Category: Schemes

Product Linked Incentive (PLI) scheme of pharmaceuticals

23, Feb 2023

Why in News?

- Department of Pharmaceuticals (DoP) has released the first tranche of incentives under the Product Linked Incentive (PLI) scheme of pharmaceuticals.

About the News:

- Under the Atmanirbharta initiative of the Government, the Department of Pharmaceuticals launched the PLI scheme for pharmaceuticals in 2021

- Objective: To enhance India’s manufacturing capabilities and contribute to product diversification towards high-value goods in the pharmaceutical sector

- Three different categories of products are being supported under the scheme:

- Category 1: Biopharmaceuticals; Complex generic drugs; Patented drugs or drugs nearing patent expiry; Cell-based or gene therapy drugs; Orphan drugs; Special empty capsules, Complex excipients,

- Category 2: Bulk drugs

- Category 3: Drugs not covered under Category 1 and Category 2 such as Repurposed drugs; Autoimmune drugs, anti-cancer drugs, etc.

About the PLI scheme:

- The scheme aims to make India a global hub for manufacturing telecom equipment.

- Its eligibility criteria include achievement of a minimum threshold of cumulative incremental investment and incremental sales of manufactured goods.

- The incentive structure ranges between 4% and 7% for different categories and years. Financial year 2019-20 will be treated as the base year for computation of cumulative incremental sales of manufactured goods net of taxes.

- Minimum investment threshold for MSMEs has been kept at Rs 10 crore and for others at Rs 100 crore.

- Once qualified, the investor will be incentivised up to 20 times of minimum investment threshold enabling them to utilise their unused capacity.

Why is the production linked scheme needed?

- According to experts, the idea of PLI is important as the government cannot continue making investments in these capital intensive sectors as they need longer times for start giving the returns.

- Instead, what it can do is to invite global companies with adequate capital to set up capacities in India.

- The kind of ramping up of manufacturing that we need requires across the board initiatives, but the government can’t spread itself too thin.

- Electronics and pharmaceuticals themselves are large sectors, so, at this point, if the government can focus on labour intensive sectors like garments and leather, it would be really helpful.

The demand for MGNREGS work is unmet

08, Feb 2023

Why in News?

- A statement by People’s Action for Employment Guarantee and NREGA Sangharsh Morcha has provided an estimate of ₹2.72 lakh crore as the minimum budget required.

About the News:

- The allocation for MGNREGA in the Budget is ₹60,000 crore. This is less than 0.2% of the GDP, the lowest ever allocation as a percentage of GDP.

- World Bank economists had estimated that the allocation should be 1.6% of the GDP. In the last two years, the new financial year began with more than one-fourth of the allocation as pending wages from previous years.

- Assuming a conservative estimate that the next financial year will begin with pending wages of ₹15,000 crore and accounting for inflation, in real terms, the allocation for MGNREGA will be less than ₹45,000 crore.

- A statement by People’s Action for Employment Guarantee and NREGA Sangharsh Morcha has provided an estimate of ₹2.72 lakh crore as the minimum budget required.

- As per this, even ₹1.24 lakh crore can only generate 40 days of work per household per year.

About MGNREGA:

- The scheme was introduced in 2005 as a social measure that guarantees “the right to work”. The key tenet of this social measure and labour law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Key objectives:

- Generation of paid rural employment of not less than 100 days for each worker who volunteers for unskilled labour.

- Proactively ensuring social inclusion by strengthening the livelihood base of rural poor.

- Creation of durable assets in rural areas such as wells, ponds, roads and canals.

- Reduce urban migration from rural areas.

- Create rural infrastructure by using untapped rural labour.

What are the eligibility criteria for receiving the benefits under MGNREGA scheme?

- Must be Citizen of India to seek MGNREGA benefits.

- Job seeker has completed 18 years of age at the time of application.

- The applicant must be part of a local household (i.e. application must be made with local Gram Panchayat).

- Applicants must volunteer for unskilled labour.

Implementation of the scheme:

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- Right to get unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fix their priority.

What is Democratic Decentralisation?

- Democratic decentralization is the process of devolving the functions and resources of the state from the Centre to the elected representatives at the lower levels so as to facilitate greater direct participation of citizens in governance.

- Devolution, envisioned by the Indian Constitution, is not mere delegation.

- It implies that precisely defined governance functions are formally assigned by law to local governments, backed by adequate transfer of a basket of financial grants and tax handles, and they are given staff so that they have the necessary wherewithal to carry out their responsibilities.

Related Constitutional Provisions:

- Local government, including panchayats, is a state subject in the Constitution, and consequently, the devolution of power and authority to panchayats has been left to the discretion of states.

- The Constitution mandates that panchayats and municipalities shall be elected every five years and enjoins States to devolve functions and responsibilities to them through law.

- The 73rd and 74th Amendments, by constitutionally establishing Panchayati Raj Institutions (PRIs) in India, mandated the establishment of panchayats and municipalities as elected local governments.

- These amendments added two new parts to the Constitution, namely, Part IX titled “The Panchayats” (added by 73rd Amendment) and Part IXA titled “The Municipalities” (added by 74th Amendment).

- The 11th Schedule contains the powers, authority and responsibilities of Panchayats.

- The 12th Schedule contains the powers, authority and responsibilities of Municipalities.

- Article 40: Organization of a village panchayat.

Government forms Panel to look into MGNREGA’s efficacy

28, Nov 2022

Why in News?

- The Central government has constituted a committee to review the implementation of the MGNREGA scheme, especially to assess the programme’s efficacy as a poverty alleviation tool.

Background:

- The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) was enacted in 2005, and the demand-driven scheme promises 100 days of unskilled work per year to every rural household that wishes to participate.

- It was launched as a poverty alleviation instrument for the rural region, providing them with a safety net in the form of guaranteed work and wages. The scheme now has 51 crore active workers enrolled.

- However, it was felt that states like UP and Bihar where there is a higher level of poverty, haven’t been able to utilise the scheme optimally.

- The scheme has also been criticised by economists like Jagdish Bhagwati and Arvind Panagariya as an “inefficient instrument of shifting income to the poor”.

About the committee:

- The Sinha committee (named after former Rural Development secretary Amarjeet Sinha) has now been tasked to study –

- The various factors behind the demand for MGNREGA work,

- The expenditure trends and inter-State variations, and

- The composition of work.

- It will suggest (within 3 months) what changes in focus and governance structures are required to make MGNREGA more effective.

Terms of reference of the committee:

- It will look at the argument that the cost of providing work has also shot up since the scheme first started.

- It will review the reasons and recommend ways to bring in a greater focus on poorer areas.

- It will study if the composition of work taken up presently under the scheme should be changed, i.e., whether it should focus more on community-based assets or individual works.

Criticism of the scheme:

- Lack of tangible asset creation: Bihar, for example, despite its levels of poverty, does not generate assets to make a concrete difference, while Kerala which is economically better has been utilising it for asset creation.

- Allocation of funds is not as per the needs of the states: From the above example, while Bihar needs MGNREGA more, Kerala cannot be denied funds because of the current structure of the programme.

Pradhan Mantri Garib Kalyan Anna Yojana scheme (PMGKAY)

19, Nov 2022

Why in News?

- The extension of the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), a scheme to distribute free foodgrains to the poor, for another three months, comes as a surprise for many reasons.

What is PMGKAY?

- The Pradhan Mantri Garib Kalyan Anna Yojana scheme was part of the Centre’s initial COVID-19 relief package, back in March 2020 when the first lockdown was announced.

- It provides for 5 kg of rice or wheat per person per month to be distributed free of cost to the 80 crore beneficiaries of the National Food Security Act.

- This is over and above the 5 kg already provided to ration card holders at a subsidised rate, thus ensuring a doubling of foodgrain availability to poor people at a time when the pandemic and lockdown was decimating livelihoods.

- The scheme was initially meant to run from April to June 2020, but was then extended for another five months from July to November.

- In these first two phases, 320 lakh tonnes of grain were allotted and about 95% distributed to beneficiaries.

- Initially, one kg of pulses was also provided under the scheme, which was later restricted to chana dal only, and then discontinued in later phases.

- After the onset of the second wave of the pandemic, PMGKAY was rolled out for two months again, in May-June 2021, and was then further extended for another five months, from July to November.

- Another 278 lakh tonnes of grain were allotted for these two phases, and distribution is still ongoing.

Were all poor people covered under the scheme?

- The scheme only provided grain for those families who held ration cards.

- During the first lockdown, the plight of migrant workers who held cards registered in their home villages but were stranded without food or employment in the cities where they worked, came to the limelight.

- A number of other poor families did not possess ration cards at all for a variety of reasons, including the state quotas on the number of ration cards.

- In May and June 2020, the Centre allocated 8 lakh tonnes of foodgrain to be distributed by States under the Atma Nirbhar Bharat scheme for stranded migrants and others without ration cards, although only 40% had been distributed even by August. The scheme was not revived during the second lockdown.

- The 80 crore cap on NFSA beneficiaries and state ration card quotas are based on 2011 census data.

- Given the projected increase in population since then, economists have estimated that 10 crore eligible people are being excluded from the NFSA’s safety net.

- In its June 2021 judgement in a suo moto case on the plight of migrant workers, the Supreme Court directed that the Centre and State should continue providing foodgrains to migrants whether or not they had ration cards.

What are the arguments for and against extension of PMGKAY?

- As the economy is also reviving and the OMSS [or Open Market Sale Scheme] is also exceptionally good, there is no proposal from the department for extension.

- It was previously noted that States are free to buy rice and wheat under OMSS, and distribute it to migrants and other vulnerable communities.

- The Right to Food Campaign, pointing to the SC judgement and noting that the pandemic still exists, unemployment remains at record levels and there is widespread hunger among vulnerable communities.

- ThWhy in News?

- The extension of the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), a scheme to distribute free foodgrains to the poor, for another three months, comes as a surprise for many reasons.

What is PMGKAY?

- The Pradhan Mantri Garib Kalyan Anna Yojana scheme was part of the Centre’s initial COVID-19 relief package, back in March 2020 when the first lockdown was announced.

- It provides for 5 kg of rice or wheat per person per month to be distributed free of cost to the 80 crore beneficiaries of the National Food Security Act.

- This is over and above the 5 kg already provided to ration card holders at a subsidised rate, thus ensuring a doubling of foodgrain availability to poor people at a time when the pandemic and lockdown was decimating livelihoods.

- The scheme was initially meant to run from April to June 2020, but was then extended for another five months from July to November.

- In these first two phases, 320 lakh tonnes of grain were allotted and about 95% distributed to beneficiaries.

- Initially, one kg of pulses was also provided under the scheme, which was later restricted to chana dal only, and then discontinued in later phases.

- After the onset of the second wave of the pandemic, PMGKAY was rolled out for two months again, in May-June 2021, and was then further extended for another five months, from July to November.

- Another 278 lakh tonnes of grain were allotted for these two phases, and distribution is still ongoing.

Were all poor people covered under the scheme?

- The scheme only provided grain for those families who held ration cards.

- During the first lockdown, the plight of migrant workers who held cards registered in their home villages but were stranded without food or employment in the cities where they worked, came to the limelight.

- A number of other poor families did not possess ration cards at all for a variety of reasons, including the state quotas on the number of ration cards.

- In May and June 2020, the Centre allocated 8 lakh tonnes of foodgrain to be distributed by States under the Atma Nirbhar Bharat scheme for stranded migrants and others without ration cards, although only 40% had been distributed even by August. The scheme was not revived during the second lockdown.

- The 80 crore cap on NFSA beneficiaries and state ration card quotas are based on 2011 census data.

- Given the projected increase in population since then, economists have estimated that 10 crore eligible people are being excluded from the NFSA’s safety net.

- In its June 2021 judgement in a suo moto case on the plight of migrant workers, the Supreme Court directed that the Centre and State should continue providing foodgrains to migrants whether or not they had ration cards.

What are the arguments for and against extension of PMGKAY?

- As the economy is also reviving and the OMSS [or Open Market Sale Scheme] is also exceptionally good, there is no proposal from the department for extension.

- It was previously noted that States are free to buy rice and wheat under OMSS, and distribute it to migrants and other vulnerable communities.

- The Right to Food Campaign, pointing to the SC judgement and noting that the pandemic still exists, unemployment remains at record levels and there is widespread hunger among vulnerable communities.

- They argued that the government should not only extend PMGKAY for another six months, but also universalise the public distribution system itself, so that anyone in need would receive food support regardless of whether they possessed a ration card or not.

- They also suggested that pulses and cooking oils be added to the monthly entitlements, given the recent rise in prices of these commodities.

ey argued that the government should not only extend PMGKAY for another six months, but also universalise the public distribution system itself, so that anyone in need would receive food support regardless of whether they possessed a ration card or not.

- They also suggested that pulses and cooking oils be added to the monthly entitlements, given the recent rise in prices of these commodities.

Eklavya Model Residential Schools

16, Nov 2022

Why in News?

- The government is pushing to set up 740 Eklavya Model Residential Schools (EMRS) for Scheduled Tribe (ST) students.

What are EMRS?

- EMRS is a scheme for making model residential schools for STs across India.

- It started in the year 1997-98.

- Its nodal ministry is Ministry of Tribal Affairs.

- The aim of the scheme to build schools at par with the Jawahar Navodaya Vidyalayas and Kendriya Vidyalayas with focus on special state-of-the-art facilities for preserving local art and culture besides providing training in sports and skill development.

- The EMR School follows the CBSE curriculum.

- In 2018-19, revamping of the EMRS scheme was approved by the Cabinet.

- Since the new guidelines have been put into place, the Ministry of Tribal Affairs sanctioned 332 of the targeted 452 schools till 2021-22.

- As of November 2022, a total of 688 schools have been sanctioned, of which 392 are functional.

- Of the 688, 230 have completed construction and 234 are under construction, with 32 schools still stuck due to land acquisition issues.

What were the Old Guidelines?

- Although the Union government had sanctioned a certain number of preliminary EMRS, the States and Union Territories were responsible for seeking sanction of new schools as and when they needed it.

- The funds for these schools were to come from the grants under Article 275(1) and the guidelines mandated that unless States finished constructing the schools sanctioned by the Centre, they would not be entitled to funds for new ones.

- Apart from the infrastructural requirements of 20-acre plots for each EMRS, the guidelines did not have any criteria of where the EMRS could be set up, leaving it to the discretion of State governments.

What are the New Guidelines?

- The new guidelines in 2018-19 gave the Union government more power to sanction schools and manage them.

- A National Education Society for Tribal Students (NESTS) was set up and entrusted with the management of the State Education Society for Tribal Students (SESTS), which would run the EMRS on the ground.

- The new guidelines set a target of setting up an EMRS in every tribal sub-district and introduced a “population criteria” for setting them up.

- One EMRS will be set-up per sub-district that has at least a 20,000-odd Scheduled Tribe (ST) population, which must be 50% of the total population in that area.

- The minimum land requirement for setting up an EMRS was reduced from 20 acres to 15 acres.

What are the Challenges?

- Requirement of 15-acre Area:

- As per the Standing Committee Report, requirement of 15-acre area is making the identification and acquisition of land troublesome, especially in hilly areas, leftwing extremism-affected areas and the northeast.

- Population Criteria:

- The Standing Committee noted that the population criteria is depriving a scattered tribal population of the benefit of EMRS. Sometimes, when the population criteria are fulfilled, 15-acre plots are not available.

- Shortage of Teachers:

- Despite the setting up of the NESTS, there was a shortage of teachers.

- Though the new guidelines allowed NESTS to suggest measures for teacher recruitment, they never made them mandatory for the States to follow.

- This led to non-uniformity in the quality of teachers, not enough recruitment in reserved positions, and a large number of schools recruiting teachers contractually, in a bid to save on salary expenses.

- As of July 2022, all functional EMRS had a teaching strength of just under 4,000 against the 11,340 recommended by NESTS.

Way Forward:

- Guidelines regarding area of land and population criteria should be relaxed so that the less dense tribal populations can also reap the benefit of EMRS scheme.

- More control of school management should be given to NESTS to overcome the shortage of teachers.

- Also, mandatory guidelines about teacher recruitment must be issued for the States.

The Protection of Children from Sexual Offences (POCSO) Act

09, Nov 2022

Why in News?

- The POCSO Act brings tribals in the Nilgiris into conflict with the law, as youth under the age of 18 in relationships within or outside marriage are subject to the Act’s stringent provisions.

About the News:

- The POCSO Act brings tribals in the Nilgiris into conflict with the law, as youth under the age of 18 in relationships within or outside marriage are subject to the Act’s stringent provisions.

About the Protection of Children from Sexual Offences (POCSO) Act:

- The Union Ministry of Women and Child Development led the introduction of the POCSO Act in 2012.

- The Act was designed to protect children from sexual assault, sexual harassment and pornography offences, as well as to provide for the establishment of Special Courts for the trial of such offences.

- The Act was amended in 2019 for enhancing the punishments for specific offences in order to deter abusers and ensure a dignified childhood.

Salient features:

- A gender-neutral law: The POCSO Act establishes a gender-neutral tone for the legal framework available to child sexual abuse victims by defining a child as “any person” under the age of 18.

- Not reporting abuse is an offence: Any person (except children) in charge of an institution who fails to report the commission of a sexual offence relating to a subordinate is liable to be punished.

- No time limit for reporting abuse: A victim can report an offence at any time, even a number of years after the abuse has been committed.

- Maintaining confidentiality of the victim’s identity: The Act prohibits disclosure of the victim’s identity in any form of media, except when permitted by the special courts established under the act.

New obligations under the POCSO Rules 2020:

- Any institution housing children or coming in regular contact is required to conduct a periodic police verification and background check of every employee.

- Such an institution must impart regular training to sensitise its employees on child safety and protection.

- The institution has to adopt a child protection policy based on the principle of zero tolerance for violence against children.

POCSO Act’s performance in comparison to global standards:

- A 2019 Economist Intelligence Unit report ranked India’s legal system for safeguarding children from sexual abuse and exploitation as the best of the countries surveyed.

- On this metric, India outranked the United Kingdom, Sweden and Australia.

Concerns:

- Despite the existence of such comprehensive child sexual abuse law, the scale of such abuse is staggering.

- According to a recent survey, one in every two children is a victim of sexual abuse in India.

- Furthermore, in the vast majority of cases, the perpetrators are known to the victim, causing the victim to be hesitant to approach authorities for redress.

- Incidents of child abuse have also risen exponentially since the Covid-19 pandemic, with the emergence of new forms of cybercrime.

- The general level of awareness or knowledge on the part of minor girls and boys of the POCSO Act remains severely inadequate in the country.

- Child marriage is common among certain tribal groups in the country, resulting in the criminalisation of 17-18 years old youths due to a lack of knowledge of the POCSO Act.

Way ahead:

- Recently, the Karnataka HC has directed the State Education Department to set up a mechanism for educating students, at least from Class IX onwards about the act and its provisions.

Pradhan Mantri Jan-Aushadhi Yojana

09, Mar 2022

Why in News?

- Janaushadhi Diwas week has been observed from 1st March to 7th March 2022.

About the News:

- Theme of 4th Janaushadhi Diwas: “Jan Aushadhi-Jan Upyogi”

- Pharmaceuticals & Medical Devices Bureau of India (PMBI) is the implementing agency of Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP).

- All the districts of the country have been covered under the scheme.

- Effective IT-enabled logistics and supply-chain systems for ensuring real-time distribution of medicines at all outlets have also been introduced.

- Product basket of PMBJP presently comprises 1,451 drugs and 240 surgical instruments.

What is National Health Authority (NHA)?

- National Health Authority (NHA) is the apex body responsible for implementing India’s flagship public health insurance/assurance scheme called “Ayushman Bharat Pradhan Mantri Jan Arogya Yojana”.

- It has been entrusted with the role of designing strategy, building technological infrastructure and implementation of “National Digital Health Mission” to create a National Digital Health Eco-system.

- National Health Authority is the successor of the National Health Agency, which was functioning as a registered society since 23rd May, 2018.

- Pursuant to Cabinet decision for full functional autonomy, National Health Agency was reconstituted as the National Health Authority on 2nd January 2019, under Gazette Notification.

- NHA is governed by a Governing Board chaired by the Union Minister for Health and Family Welfare headed by a Chief Executive Officer (CEO), an officer of the rank of Secretary to the Government of India, who manages its affairs. The CEO is the Ex-Office Member Secretary of the Governing Board.

- To implement the scheme at the State level, State Health Agencies (SHAs) in the form of a society/trust have been set up by respective States. SHAs have full operational autonomy over the implementation of the scheme in the State including extending the coverage to non SECC beneficiaries.

- NHA is leading the implementation for national Digital Health Mission NDHM in coordination with different ministries/departments of the Government of India, State Governments, and private sector/civil society organizations.

About Universal Health Coverage:

- The scheme will ensure Universal Health Coverage and focus on providing financial risk protection and ensuring quality and affordable essential health services to all individuals and communities.

- Universal Health Coverage (UHC) includes the full spectrum of essential, quality health services, from health promotion to prevention, treatment, rehabilitation, and palliative care.

- UHC enables everyone to access the services, protecting people from the financial consequences of paying for health services out of their own pockets and reducing the risk that people will be pushed to poverty.

What is Ayushman Bharat PMJAY Yojana?

- The PMJAY, world’s largest health insurance/assurance scheme fully financed by the government, provides a cover of Rs. 5,00,000 per family per year for secondary and tertiary care hospitalisation across public and private empanelled hospitals in India.

- Pre-hospitalisation and Post-hospitalisation expenses such as diagnostics and medicines are also included in the scheme.

- Coverage: Over 10.74 crore poor and vulnerable entitled families (approximately 50 crore beneficiaries) are eligible for these benefits.

- Provides Cashless Access to health care services for the beneficiary at the point of service.

What is its Significance?

- Helps reduce catastrophic expenditure for hospitalizations, which pushes 6 crore people into poverty each year.

- Helps mitigate the financial risk arising out of catastrophic health episodes.

Eligibility Criteria’s:

- No Restrictions on family size, age or gender.

- All pre–existing conditions are covered from day one.

- Covers up to 3 days of pre-hospitalization and 15 days post-hospitalization expenses such as diagnostics and medicines.

- Benefits of the scheme are portable across the country.

- Services include approximately 1,393 procedures covering all the costs related to treatment, including but not limited to drugs, supplies, diagnostic services, physician’s fees, room charges, surgeon charges, OT and ICU charges etc.

- Public hospitals are reimbursed for the healthcare services at par with the private hospitals.

Challenges and Concerns:

- Medical audits have also revealed that private hospitals are more likely to indulge in fraud and abuse than public hospitals and more likely to discharge patients early post-surgery to cut Costs.

- Ensuring the Accountability of Private Hospitals to provide efficient and high-quality care is a pre-eminent challenge for scheme Implementation.

- There is huge State-wise variation in the share of Empanelled private hospitals from less than 25% in most of the north-eastern and hill States to 80% in Maharashtra.

- Private hospitals have fewer beds than public hospitals and are more likely to be empanelled for surgical packages and super-specialties.

Demand for MGNREGA work softens

01, Feb 2022

Why in News?

- The Department of Economic Affairs recently said in its annual Economic Survey, that the demand for work under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme has dropped from the peak of the first lockdown, but is still higher than pre-COVID levels.

About the News:

- However, it cautioned against drawing conclusions about the movement of migrant labour on the basis of MGNREGA employment, noting that the highest demand for work under the scheme was seen in States which are usually the destination of migrant workers, rather than source States.

- Advocates for rural workers argued that the drop in demand is also due to funding constraints, and urged a significant increase in allocations for the scheme in Union budget.

- According to the Survey’s analysis, though demand for work stabilised after the second COVID wave with a maximum of 4.59 crore persons in June 2021, aggregate MGNREGA employment is still higher than pre-pandemic levels of 2019, after accounting for the Seasonality of demand.

What is the Issue Now?

- In 2021-22, additional funding was not available until late in the year when many States had already run out of money, forcing an artificial suppression in demand on the ground.

- For the upcoming 2022-23 financial year, activists have asked for a budget allocation of Rs. 2.6 lakh crore, which would cover the guaranteed 100 days of work for all active job card holders.

- But anything less than Rs. 1.4 lakh crore, which is the amount spent in 2020-21 plus inflation, will be a clear Suppression of Demand by the Government.

Why this Imbalance?

- Intuitively, one may expect that higher MGNREGS demand may be directly related to the movement of migrant labour i.e. source States would be more impacted.

- Nevertheless, State-level analysis shows that for many migrant source States like West Bengal, Madhya Pradesh, Odisha, Bihar, the MGNREGS employment in most months of 2021 has been lower than the corresponding levels in 2020.

- According to the Survey, demand has been higher for migrant recipient States like Punjab, Maharashtra, Karnataka and Tamil Nadu.

- Karnataka, Tamil Nadu and Rajasthan have a record of administrative sensitivity and efficiency with regard to MGNREGA implementation even pre-COVID.

- These States also see high levels of short–term migration within their own borders.

About MGNREGA:

- The scheme was introduced in 2005 as a social measure that guarantees “the right to work”.

- The key tenet of this social measure and labour law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Key Objectives:

- Generation of paid rural employment of not less than 100 days for each worker who volunteers for unskilled labour.

- Proactively ensuring social inclusion by strengthening the livelihood base of rural poor.

- Creation of durable assets in rural areas such as wells, ponds, roads and canals.

- Reduce urban migration from rural areas.

- Create rural infrastructure by using untapped rural labour.

What are the Eligibility Criteria for receiving the benefits under MGNREGA scheme?

- Must be Citizen of India to seek MGNREGA benefits.

- Job seeker has completed 18 years of age at the time of application.

- The applicant must be part of a local household (i.e. application must be made with local Gram Panchayat).

- Applicants must volunteer for Unskilled Labour.

Implementation of the scheme:

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- Right to get unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fix their priority.

PLI scheme for Textile Sector

31, Dec 2021

Why in News?

- The Ministry of Textiles has recently said that it will accept applications from January 1 for the Production Linked Scheme for Textiles announced in September this year.

About the News:

- The Union government in September approved production-linked incentive (PLI) for the textile sector with a budgetary outlay of ₹10,683 crore.

- The scheme is for man-made fibre (MMF) apparel, MMF fabrics and 10 segments/products of technical textiles.

- According to an official statement, the incentive structure for the textile sector is designed to Encourage investment in fresh capacities in MMF apparel, MMF fabrics, and 10 segments or products of technical textiles.

- The Scheme Envisages two types of investment with different set of incentive structure. In type one, any person, (which includes firm/company) willing to invest minimum ₹300 crore in Plant, Machinery, and civil works (excluding land and administrative building cost) to produce the notified products will be able to participate in the scheme. In the second type, anyone willing to invest minimum ₹100 crore will be eligible to participate.

- The government has already launched a National Technical Textiles Mission to promote research and development in that sector.

What is its Significance?

- The scheme is expected to attract fresh investment of more than ₹19,000 crore and cumulative turnover of over ₹3 lakh crore will be achieved under this scheme. It will create additional 7.5 lakh jobs in the sector.

- Further, priority will be given for investment in aspirational districts, tier-three, tier-four towns and Rural Areas.

- The scheme will benefit States such as Gujarat, U.P., Maharashtra, Tamil Nadu, Punjab, Andhra Pradesh, Telangana, and Odisha.

About the Textile Sector in India:

- Textiles & Garments industry is labour intensive sector that employs 45 mn people in India and is Second only to the agriculture sector in terms of employment.

- India’s textiles sector is one of the oldest industries in the Indian economy, and is a storehouse and carrier of traditional skills, heritage and culture.

- It can be divided into two segments-

- The unorganised sector is small scale and uses traditional tools and methods. It consists of handloom, handicrafts and sericulture (production of silk).

- The Organised sector uses modern machinery and techniques and consists of the spinning, apparel and Garments Segment.

Significance of the Textiles Sector:

- It contributes 2.3% to Indian Gross Domestic Product, 7% of Industrial Output, 12% to the export earnings of India and employs more than 21% of total employment.

- India is the 6th largest producer of Technical Textiles with 6% Global Share, largest producer of cotton & jute in the world.

- Technical textiles are functional fabrics that have applications across various industries including automobiles, civil engineering and construction, agriculture, healthcare, industrial safety, personal protection etc.

- India is also the second largest producer of silk in the world and 95% of the world’s hand woven fabric comes from India.

About the PLI Scheme:

- The scheme aims to make India a global hub for manufacturing telecom equipment.

- Its eligibility criteria include achievement of a minimum threshold of cumulative incremental investment and incremental sales of manufactured goods.

- The incentive structure ranges between 4% and 7% for different categories and years. Financial year 2019-20 will be treated as the base year for computation of cumulative incremental sales of manufactured goods net of taxes.

- Minimum investment threshold for MSMEs has been kept at Rs 10 crore and for others at Rs 100 Crore.

- Once qualified, the investor will be Incentivised up to 20 times of minimum investment threshold enabling them to utilise their Unused Capacity.

Why is the Production Linked Scheme Needed?

- According to experts, the idea of PLI is important as the government cannot continue making investments in these capital intensive sectors as they need longer times for start giving the Returns.

- Instead, what it can do is to invite global companies with adequate capital to set up capacities in India.

- The kind of ramping up of manufacturing that we need requires across the board Initiatives, but the government can’t spread itself too thin.

- Electronics and pharmaceuticals themselves are large sectors, so, at this point, if the Government can focus on labour intensive sectors like garments and leather, it would be Really helpful.

WORLD BANK APPROVES $ 1 BILLION FOR INDIA TO FIGHT AGAINST COVID-19

16, May 2020

Why in News?

- The Government of India is getting $1 billion loan from the World Bank to support its COVID-19 relief measures and financial assistance for the poorest and most vulnerable communities.

About the News:

- The money will be used for reforms in social security net, making it more integrated, portable and focussed on the urban poor.

- The new support will be funded in two phases. An allocation of $750 million — more than ₹5,600 crore —will be made immediately to help fund the Pradhan Mantri Garib Kalyan Yojana, which the Centre announced in March to scale up cash transfers and free food grain distribution to vulnerable communities, pensioners and poor workers, and provide insurance support to health workers.

- The second phase will provide $250 million — almost ₹1,900 crore —post July, which will fund additional cash and in-kind benefits based on local needs through the State governments and portable social protection delivery systems.

- The COVID-19 pandemic has also put the spotlight on some of the gaps in the existing social protection systems.

- This programme will support the Government of India’s efforts towards a more consolidated delivery platform – accessible to both rural and urban populations across state boundaries.

About Pradhan Mantri Garib Kalyan Yojana:

- The Pradhan Mantri Garib Kalyan Yojana was launched in the year 2016 by PM Narendra Modi along with the other provisions of Taxation Laws (Second Amendment) Act, 2016.

- This scheme was valid from December 16, 2016 to March 31, 2017 and provided an opportunity to declare the unaccounted wealth and black money in a confidential manner and avoid prosecution after paying a fine of 50% on the undisclosed income.

- An additional 25% of the undisclosed income is invested in the scheme which can be refunded after four years, without any interest.

- Due to the outbreak of COVID-19 in India, the Finance Minister announced a ₹7 lakh crore Gareeb Kalyan package to mitigate the loss faced by the poor due to the coronavirus lockdown.

What are its Recent Updates?

- To provide an insurance cover of Rs 50 lakhs per health worker affected by COVID-19.

- To provide free resources of 5 kg wheat or rice and 1 kg of preferred pulses for 80 crore poor people for the next three months under the PM Garib Kalyan Ann Yojana.

- 20 crore Women Jan Dhan account holders will be provided Rs 500 per month for next three months.

- There will be an increase in MGNREGA wage to Rs 202 per day to benefit 13.62 crore families.

- The Central Government has given orders to State Governments to use the Building and Construction Workers Welfare Fund to provide relief to Construction Workers.

What are its Implications?

- The loan would help India move from more than 460 fragmented social protection schemes to an integrated system, which would be faster, more flexible and also acknowledge the diversity of needs across states.

- Geographic portability would be introduced to ensure that social protection benefits could be accessed from anywhere in the country, providing relief to inter-State migrant workers.

- There would also be a shift from the current rural focus of social protection schemes to include the needs of the urban poor as well.

- The platform draws on the country’s existing architecture of safety nets – the PDS, the digital and banking infrastructure, and Aadhaar – while positioning the overall social protection system for the needs of a 21st century India.Importantly, such a system will need to leverage India’s federalism enabling and supporting the States to respond quickly and effectively in their context

PRADHAN MANTRI BHARTIYA JANAUSHADHI PARIYOJANA (PMBJP)

07, May 2020

Why in News?

- Pradhan Mantri Bhartiya Janaushadhi Kendras (PMBJKs) are accepting orders on WhatsApp and e-mail and delivering on patient’s doorsteps to facilitate medicine procurement During Lockdown.

About PMBJP:

- ‘Pradhan Mantri Bhartiya Janaushadhi Pariyojana’ is a campaign launched by the Department of Pharmaceuticals, Govt. Of India, to provide quality medicines at affordable prices to the masses through special Kendra’s known as Pradhan Mantri Bhartiya Jan Aushadhi Kendra.

- Bureau of Pharma PSUs of India (BPPI) is the implementing agency of PMBJP. BPPI (Bureau of Pharma Public Sector Undertakings of India) has been established under the Department of Pharmaceuticals, Govt. of India, with the support of all the CPSUs.

What are the Salient Features of the scheme?

- Ensure access to quality medicines.

- Extend coverage of quality generic medicines so as to reduce the out of pocket expenditure on medicines and thereby redefine the unit cost of treatment per person.

- Create awareness about generic medicines through education and publicity so that quality is not synonymous with only high price.

- A public programme involving Government, PSUs, Private Sector, NGO, Societies, Co-operative Bodies and other Institutions.

- Create demand for generic medicines by improving access to better healthcare through low treatment cost and easy availability wherever needed in all therapeutic categories.

What is a Generic Medicine?

- There is no definition of generic or branded medicines under the Drugs & Cosmetics Act, 1940 and Rules, 1945 made thereunder. However, generic medicines are generally those which contain same amount of same active ingredient(s) in same dosage form and are intended to be administered by the same route of administration as that of branded medicine.

- The price of an unbranded generic version of a medicine is generally lower than the price of a corresponding branded medicine because in case of generic version, the pharmaceutical company does not have to spend money on promotion of its brand.

How are they Regulated in India?

- Drugs manufactured in the country, irrespective of whether they are generic or branded, are required to comply with the same standards as prescribed in the Drugs and Cosmetics Act, 1940 and Rules, 1945 made thereunder for their quality.

Outreach of Generic Medicines:

- With developments like more and more doctors prescribing generic medicines and opening of over 5050 Janaushadhi stores across 652 districts, awareness and availability of high quality affordable generic medicines has increased in the country.

- About 10-15 lakh people benefit from Janaushadhi medicines per day and the market share of generic medicines has grown over three fold from 2% to 7%in last 3 years.

- The Janaushadhi medicines have played a big role in bringing down the out of pocket expenditure of patients suffering from life threatening diseases in India.

- The PMBJP scheme has led to total savings of approximately Rs.1000 crores for common citizens, as these medicines are cheaper by 50% to 90% of average market price.

- The PMBJP is also providing a good source of self-employment with self-sustainable and regular earnings.

PM LAUNCHES SWAMITVA YOJANA ON PANCHAYATI RAJ DIWAS

27, Apr 2020

Why in News?

- On Panchayati Raj Diwas (April 24th), the Prime Minister of India launched ‘Swamitva Yojana’ or Ownership Scheme to map residential land ownership in the Rural Sector using Modern Technology like the use of drones.

About Swamitva Yojana:

- The scheme is piloted by the Panchayati Raj ministry that aims to revolutionise property record maintenance in India.

- The residential land in villages will be measured using drones to create a non-disputable record.

- Property card for every property in the village will be prepared by states using accurate measurements delivered by drone-mapping. These cards will be given to property owners and will be Recognised by the Land Revenue Records Department.

What would be the Benefits of the Scheme?

- The delivery of property rights through an official document will enable villagers to access bank finance using their property as collateral.

- The property records for a village will also be maintained at the Panchayat level, allowing for the collection of associated taxes from the owners. The money generated from these local taxes will be used to build rural infrastructure and facilities.

- Freeing the residential properties including land of title disputes and the creation of an official record is likely to result in appreciation in the market value of the properties.

- The accurate property records can be used for facilitating tax collection, new building and structure plan, issuing of permits and for thwarting attempts at Property Grabbing.

What is the Significance of the Scheme?

- The need for this Yojana was felt since several villagers in the rural areas don’t have papers proving ownership of their land.

- In most states, survey and measurement of the populated areas in the villages has not been done for the purpose of attestation/verification of properties.

- The new scheme is likely to become a tool for empowerment and entitlement, reducing social strife on account of discord over properties.

About Panchayati Raj:

- After the Constitution came into force, Article 40 made a mention of Panchayat and Article 246 empowered the state legislature to legislate with respect to any subject relating to local self-government.

- Panchayati Raj Institution (PRI) was constitutionalized through the 73rd Constitutional Amendment Act, 1992 to build democracy at the grass roots level and was entrusted with the task of rural development in the country.

- PRI is a system of rural local self-government in India. Local Self Government is the management of local affairs by such local bodies who have been elected by the local people.

About the 73rd constitutional Amendment:

- The 73rdConstitutional Amendment added Part IX titled “The Panchayats” to the Constitution.

- Basic unit of democratic system-Gram Sabhas (villages) comprising all the adult members registered as voters.

- Three-tier system of panchayats at village, intermediate block/taluk/mandal and district levels except in States with population is below 20 lakhs (Article 243B).

- Seats at all levels to be filled by direct elections Article 243C (2).

- Reservation of Seats:

- Seats reserved for Scheduled Castes (SCs) and Scheduled Tribes (STs) and the chairpersons of the Panchayats at all levels also shall be reserved for SCs and STs in proportion to their population.

- One-third of the total number of seats to be reserved for women.

- One-third offices of chairpersons at all levels reserved for women (Article 243D).

- Uniform Five Year Term and elections to constitute new bodies to be completed before the expiry of the term.

- In the event of dissolution, elections compulsorily within six months (Article 243E).

- Independent Election Commission in each State for superintendence, direction and control of the electoral rolls (Article 243K).

- Panchayats have been authorised to prepare plans for economic development and social justice in respect of subjects illustrated in Eleventh Schedule (Article 243G).

- Source of Revenue (Article 243H):State legislature may authorise the Panchayats with

- Budgetary allocation from State Revenue.

- Share of revenue of certain taxes.

- Collection and retention of the revenue it raises.

- Establish a Finance Commission in each State to determine the principles on the basis of which adequate financial resources would be ensured for panchayats and municipalities (Article 243I).

- The following areas have been exempted from the operation of the Act because of the socio-cultural and administrative considerations:

- Scheduled areas listed under the Schedule V in the states of Andhra Pradesh, Bihar, Gujarat, Himachal Pradesh, Madhya Pradesh, Maharashtra, Orissa and Rajasthan.

- The states of Nagaland, Meghalaya and Mizoram.

- The hill areas of the district of Darjeeling in the state of West Bengal for which Darjeeling Gorkha Hill Council exists.

- However, an Act called the Provisions of Panchayats (Extension to the Scheduled Areas) Act, 1996 passed by the Government of India for the mentioned scheduled areas.

PAYMENT OF MGNREGS IN FOODGRAINS

24, Apr 2020

Why in News?

- Chhattisgarh Chief Minister Bhupesh Baghel in a letter to Union Rural Development Minister Narendra Singh Tomar has asked the Centre to allow payment of the MGNREGA wages in the form of Foodgrains.

What is the reason for Chhattisgarh’s demand?

- The Chief Minister proposed that handing the workers foodgrains directly is better due to the lockdown and the continuing scare of the COVID-19.

- “Once we credit the MGNREGA wages, the worker will have to go to the banks to withdraw the money. This would not only be a bother but also could jeopardise social distancing norms.”

- Chhattisgarh does not have many bank branches and faces the problem of Internet connectivity in Naxal-affected areas. “Due to this, there are often problems like link failure and workers have to contact the branch many times to withdraw the amount,” he wrote in his letter.

What is the Concern?

- There are many concerns about making payments through foodgrains like at what rate the grains would be charged. Will the government make the payments based on the PDS or the FCI rates.

- The other concern is that the pay-outs during the pandemic should not exhaust the 100-day entitlement.

- These payments via food grains should not eat into the 100-day entitlement per family. Because they will need employment even after this pandemic subsides.

- If accessibility to banks is a problem, then the government must make timely cash payments in a public place.

About MGNREGA:

- The scheme was introduced as a social measure that guarantees “the right to work”.

- The key tenet of this social measure and labour law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Key Objectives of the Scheme:

- Generation of paid rural employment of not less than 100 days for each worker who volunteers for unskilled labour.

- Proactively ensuring social inclusion by strengthening livelihood base of rural poor.

- Creation of durable assets in rural areas such as wells, ponds, roads and canals.

- Reduce urban migration from rural areas.

- Create rural infrastructure by using untapped rural labour.

Eligibility criteria for receiving the benefits under MGNREGA scheme:

- Must be Citizen of India to seek NREGA benefits.

- Job seeker has completed 18 years of age at the time of application.

- The applicant must be part of a local household (i.e. application must be made with local Gram Panchayat).

- Applicant must volunteer for unskilled labour.

What are the other Key Facts Related to the Scheme?

- The Ministry of Rural Development (MRD), Government of India is monitoring the entire implementation of this scheme in association with state governments.

- Individual beneficiary oriented works can be taken up on the cards of Scheduled Castes and Scheduled Tribes, small or marginal farmers or beneficiaries of land reforms or beneficiaries under the Indira Awaas Yojana of the Government of India.

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- Right to get unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fixes their priority.

What is the Role of Gram Sabha?

- It determines the order of priority of works in the meetings of the Gram Sabha keeping in view potential of the local area, its needs, and local resources.

- Monitor the execution of works within the GP.

What are the Roles of Gram Panchayat?

- Receiving applications for registration

- Verifying registration applications

- Registering households

- Issuing Job Cards (JCs)

- Receiving applications for work

- Issuing dated receipts for these applications for work

- Allotting work within fifteen days of submitting the application or from the date when work is sought in the case of an advance application.

- Identification and planning of works, developing shelf of projects including determination of the order of their priority.

What are the Responsibilities of State Government in MGNREGA?

- Frame Rules on matters pertaining to State responsibilities under Section 32 of the Act and to Develop and notify the Rural Employment Guarantee Scheme for the State.

- Set up the State Employment Guarantee Council (SEGC).

- Set up a State level MGNREGA implementation agency/ mission with adequate number of high calibre professionals.

- Set up a State level MGNREGA social audit agency/directorate with adequate number of people with knowledge on MGNREGA processes and demonstrated commitment to social audit.

- Establish and operate a State Employment Guarantee Fund (SEGF).

SOVEREIGN GOLD BONDS

18, Apr 2020

Why in News?

- Recently, Reserve Bank of India (RBI) has decided to issue Sovereign Gold Bonds (SGBs) in six instalments, from April 2020 to September 2020.

About Sovereign Gold Bonds:

- They are government securities denominated in grams of gold. They are substitutes for holding physical gold.

- Its objective is to reduce the demand for physical gold and shift a part of the domestic savings (used for the purchase of gold) into financial savings.

- The Investors have to pay the issue price in cash and the bonds will be redeemed (bought back by the issuer) in cash on maturity. Issue price is the price at which bonds are offered for sale when they first become available to the public.

- The investor gets a fixed rate of interest on the investment amount throughout the tenure of the fund.

- The government will pay an interest at the rate of 2.5% per annum. The interest is payable semi-annually.

- It has a tenure of eight years, with exit options are available from the fifth year.

- It will be restricted for sale to resident individuals, Hindu Undivided Families (HUFs), Trusts, Universities and Charitable Institutions.

- Its minimum Permissible Investment Unit is 1 Gram of Gold.

How to Buy this Bonds?

- It can be bought through designated scheduled commercial banks (except Small Finance Banks and Payment Banks), Stock Holding Corporation of India Limited, and designated post offices.

- We can also buy these bonds through National Stock Exchange of India Limited and Bombay Stock Exchange(BSE) Limited.

Advantages of the Gold Bond:

- It is advisable to invest in gold for portfolio diversification.

- It is considered one of the better ways of investing in gold as along with capital appreciation an investor gets a fixed rate of interest.

- It is tax efficient as no capital gains is charged in case of redemption on maturity.

- It a good way to ensure an investment that does not need physical storage of Gold.

Disadvantages of the Gold Bonds

- In long term investment unlike physical gold which can be sold immediately.

- It is listed on exchange but the trading volumes are not high, therefore it will be difficult to exit before Maturity.

PRADHAN MANTRI JAN AROGYA (PM-JAY)

14, Apr 2020

Context:

- Recently, the National Health Authority has launched an express empanelment process called Hospital Empanelment Module (HEM) Lite to bring a large number of private hospitals under Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY).

Highlights:

- With the launch of express empanelment process, patients suffering from serious illnesses, such as cancer, cardiac issues and diabetes that require continuous treatment, will be able to continue getting inpatient services without the fear of contracting the Covid -19 infection.

- Hospitals can empanel themselves for a temporary period of 3 months through a simpler, user friendly online system available on the scheme’s website pmjay.gov.in.

- Using the HEM Lite process, the system has been built in a way to ensure that the rest of the process of approvals by concerned authorities is expeditious.

- The hospitals have the choice whether to provide regular treatment for serious illnesses such as cancer and cardiac illnesses under the scheme or convert themselves into covid-19 only hospitals providing dedicated testing and treatment to covid-19 patients.

- The government recently decided to bring testing and treatment of covid-19 under AB PM-JAY scheme.

About Pradhan Mantri Jan Arogya (PM-JAY):

- It offers a sum insured of Rs.5 lakhs per family for secondary care (which doesn’t involve a super specialist) as well as tertiary care (which does).

- It is an entitlement-based scheme that targets the beneficiaries as identified by latest Socio-Economic Caste Census (SECC) data. Once identified by the database, the beneficiary is considered insured and can walk into any empanelled hospital.

- The insurance cost is shared by the centre and the state mostly in the ratio of 60:40.

- Empanelled hospitals agree to the packaged rates under PM-JAY—there are about 1,400 packaged rates for various medical procedures under the scheme.

- It also has prescribed a daily limit for medical management.

Significance of PM_JAY:

- It will be cashless and largely paperless. The poor and vulnerable stand to benefit from the scheme.

- It will be an enabler of quality, affordability and accountability in the health system.

- Ayushman Bharat is expected to advance India’s pursuit of universal health coverage (UHC).

- This will ensure all people can access quality health services when and where they need them,without suffering financial hardship, which is also one of the WHO South-East Asia Region’s Flagship

- From the day PMJAY was launched, almost half of all eligible families are now covered for hospital

- Another impact of the PMJAY will be rationalisation of the cost of care in the private sector.The scheme will create lakhs of jobs for professionals and non-professionals — especially women.

About State Health Agency (SHA)

- It is the apex body of the State Government responsible for the implementation of AB PM-JAY in the State.It will sign an MoU with express empanelled hospital for three months only. It can continue with the empanelment on mutual agreement between hospital and SHA after this period, but only after the detailed empanelment process is followed i.e. hospital has filled the entire form and District Implementation Unit (DIU) and SHA have verified the details, etc.

- These packaged rates also mention the number of average days of hospitalization for a medical procedure and supporting documents that are needed.

- These rates are flexible, but once fixed hospitals can’t change it and under no circumstances can they charge the beneficiary.

- The National Health Agency has been constituted as an autonomous entity under the Society Registration Act, 1860 for effective implementation of PM-JAY in alliance with state governments.

Way Forward:

- There is a Need for real-time monitoring of implementation. This will allow problems to be detected early on, thereby enhancing accountability, as well as facilitating course corrections where necessary.

- Money must be spent wisely. The investment in frontline services is cost-effective. This must be backed up by effective and affordable hospital care. Special attention is needed to build confidence in and demand for the country’s primary care services.

ELECTRONIC MANUFACTURING SCHEME

03, Apr 2020

Why in News:

- The government has recently notified three Electronic Manufacturing Scheme involving total incentives of around Rs 48,000 crore for Electronics Manufacturing.

About:

- The Three Schemes are

- The Production Linked Incentive Scheme (PLI) for large scale electronics manufacturing.

- The scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS).

- The modified Electronics Manufacturing Clusters (EMC 2.0) Scheme.

- They are expected to attract Rs 1 lakh crore investment in the sector, Boost local electronics manufacturing and generate manufacturing revenue potential of Rs 10 lakh crore by 2025 and create 20 lakh direct and indirect jobs by 2025.

About Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing:

- It proposes a financial incentive to boost domestic manufacturing and attract large investments in the electronics value chain including electronic components and semiconductor packaging.

- It will get an incentive of 4 to 6% to electronic manufacturing companies on incremental sales (over base year) of goods manufactured in India and covered under target segments, to eligible companies over a period of next 5 years.

- It shall only be applicable for target segments namely mobile phones and specified electronic components.

- The production of mobile phones in the country has surged eight-times in the last four years.

About the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors:

- It is notified for manufacturing of electronics components and semiconductors has a budget outlay of Rs 3,285 crore spread over a period of eight years.

- Under the scheme, a financial incentive of 25% of capital expenditure has been approved by the Union Cabinet for the manufacturing of goods that constitute the supply chain of an electronic product.

- It is estimated by the government that the push for manufacturing of electronics components and electronic chips will create around 6 lakh direct and Indirect Jobs.

About Modified Electronics Manufacturing Clusters 2.0 Scheme:

- It has a total incentive outlay of Rs 3,762.25 crore spread over a period of 8 years with an objective to create 10 lakh direct and indirect jobs under the scheme.

- It will provide financial assistance up to 50% of the project cost subject to a ceiling of Rs 70 crore per 100 acres of land for setting up of Electronics Manufacturing Cluster projects.

- Under the scheme, the Electronic manufacturing clusters to be set up will be spread in an area of 200 acres across India and 100 acres in North East part of the country.

WAYS AND MEANS ADVANCE SCHEME

02, Apr 2020

Why in News?

- The Government has recently hiked Ways and Means Advance (WMA) limit with the Reserve Bank of India (RBI) by 60%.

Highlights:

- The government has announced a Rs 1.7 lakh crore package (Pradhan Mantri Garib Kalyan Yojana) to provide income support, free food and other facilities to the poor to help them during the 21-day national lockdown.

- The fundraising resources are not only from the market, but also from institutions such as the RBI.

- The 2020-21 budget has pegged the Centre’s net market borrowing, including government securities, treasury bills and post office life insurance fund.

- In FY21, the Centre also plans to issue the Debt Exchange Traded Fund comprising government securities to widen the base of investors.

- This will enable retail investors, who otherwise find it difficult to buy government bonds directly, take an exposure in this risk free instrument.

About Ways and means Advance scheme:

- It was introduced in 1997 to meet mismatches in the receipts and payments of the government.

- The government can avail of immediate cash from the RBI, if required. But it has to return the amount within 90 days. Interest is charged at the existing repo rate.

- If exceeds 90 days, it would be treated as an overdraft (the interest rate on overdrafts is 2 percentage points more than the repo rate).

- Its limits are decided by the government and RBI mutually and revised periodically. A higher limit provides the government flexibility to raise funds from RBI without borrowing them from the market.

- There are two types of Ways and Means Advances, Special WMA and Normal WMA

- Special WMA or Special Drawing Facility is provided against the collateral of the government securities held by the state. After the state has exhausted the limit of SDF, it gets normal WMA. The interest rate for SDF is one percentage point less than the repo rate.

- The loans Normal WMA is based on a three-year average of actual revenue and capital expenditure of the state.

About Exchange Traded Fund:

- It is a basket of securities that trade on an exchange, just like a stock.

- It reflects the composition of an Index, like BSE Sensex. Its trading value is based on the Net Asset Value (NAV) of the underlying stocks (such as shares) that it represents.

- It shares prices fluctuate all day as it is bought and sold. This is different from mutual funds that only trade once a day after the market closes.

- It can own hundreds or thousands of stocks across various industries, or it could be isolated to one particular industry or sector.

COMPANIES FRESH START SCHEME, 2020

01, Apr 2020

Why in News?

- Ministry of Corporate Affairs introduces the “Companies Fresh Start Scheme, 2020” and revised the “LLP Settlement Scheme, 2020” to provide relief to law abiding companies and Limited Liability Partnerships (LLPs) in the wake of COVID 19.

What do these Schemes Entail?

- These schemes incentivise compliance and reduce compliance burden during the unprecedented public health situation caused by COVID-19.

- The schemes provide a one-time waiver of additional filing fees for delayed filings by the companies or LLPs with the Registrar of Companies during the currency of the Schemes, i.e. during the period starting from 1stApril, 2020 and ending on 30th September, 2020.

- They also significantly reduce the related financial burden on them, especially for those with long standing defaults, thereby giving them an opportunity to make a “fresh start”.

- Both the Schemes also contain provision for giving immunity from penal proceedings, including against imposition of penalties for late submissions.

- They also provide additional time for filing appeals before the concerned Regional Directors against imposition of penalties, if already imposed.

What is a LLP?

- A Limited Liability Partnership (LLP) is a partnership in which some or all partners have limited liability. It therefore exhibits elements of partnerships and corporations.

- In an LLP, one partner is not responsible or liable for another partner’s misconduct or negligence.

Salient features of an LLP:

- An LLP is a body corporate and legal entity separate from its partners. It has perpetual Succession.

- Being the separate legislation (i.e. LLP Act, 2008), the provisions of Indian Partnership Act, 1932 are not applicable to an LLP and it is regulated by the contractual agreement between the partners.

- Every Limited Liability Partnership shall use the words “Limited Liability Partnership” or its acronym “LLP” as the last words of its Name.

Composition:

- Every LLP shall have at least two designated partners being individuals, at least one of them being resident in India and all the partners shall be the agent of the Limited Liability Partnership but not of other partners.

Need for and significance LLP:

- LLP format is an alternative corporate business vehicle that provides the benefits of limited liability of a company but allows its members the flexibility of organizing their internal management on the basis of a mutually arrived agreement, as is the case in a partnership firm.

- This format would be quite useful for small and medium enterprises in general and for the enterprises in services sector in particular.

- Internationally, LLPs are the preferred vehicle of business particularly for service industry or for activities involving professionals.

MSP FOR MINOR FOREST PRODUCE

27, Mar 2020

Why in News?

- According to experts, the Union government’s ‘mechanism for marketing of minor forest produce (MFP) through minimum support price (MSP) and development of value chain for MFP’ scheme can offer respite to forest-dependent labourers in the wake of novel coronavirus (COVID-19) outbreak.

About the Scheme:

- The Union Cabinet, in 2013, approved a Centrally Sponsored Scheme for marketing of non-nationalized / non monopolized Minor Forest Produce (MFP) and development of a value chain for MFP through Minimum Support Price (MSP).

- This was a measure towards social safety for MFP gatherers, who are primarily members of the Scheduled Tribes (STs) most of them in Left Wing Extremism (LWE) areas.

- The scheme had Rs. 967.28 crore as Central Government share and Rs. 249.50 crore as the States share for the current Plan period.

Key Features of the Scheme:

- Ensure that the tribal population gets a remunerative price for the produce they collect from the forest and provide alternative employment avenues to them.

- Establish a system to ensure fair monetary returns for forest dweller’s efforts in collection, primary processing, storage, packaging, transportation etc., while ensuring sustainability of the resource base.

- Get them a share of revenue from the sales proceeds with costs deducted.

Coverage of the Scheme:

- Earlier, the scheme was extended only to Scheduled Areas in eight states and fixed MSPs for 12 MFPs. Later expanded to all states and UTs.

- Total number of MFPs covered under the list includes 49.

- Implementation: The responsibility of purchasing MFP on MSP will be with State designated agencies.

- To ascertain market price, services of market correspondents would be availed by the designated agencies particularly for major markets trading in MFP.

- The scheme supports primary value addition as well as provides for supply chain infrastructure like cold storage, warehouses etc.

- The Ministry of Tribal Affairs will be the nodal Ministry for implementation and monitoring of the scheme. The Minimum Support Price would be determined by the Ministry with technical help of

What are the Significances of the Scheme?

- The Minor Forest Produce (MFP), also known as Non-Timber Forest Produce (NTFP), is a major source of livelihood and provides essential food, nutrition, medicinal needs and cash income to a large number of STs who live in and around forests. An estimated 100 million forest dwellers depend on the Minor Forest Produce for food, shelter, medicines, cash income, etc.

- However, MFP production is highly dispersed spatially because of the poor accessibility of these areas and competitive market not having evolved. Consequently, MFP gatherers who are mostly poor are unable to bargain for fair prices. This package of intervention can help in organizing unstructured MFP markets.

UNNAT BHARAT ABHIYAN

17, Mar 2020

Why in News?

- Ministry for Human Resource Development (MHRD) has submitted the information related to the Unnat Bharat Abhiyan (UBA) recently.

Unnat Bharat Abhiyan (UBA):

- It is a flagship program of the Ministry for Human Resource Development (MHRD).

- It aims to link the Higher Education Institutions with a set of at least (5) village, so that these institutions can contribute to the economic and social betterment of these village communities using their knowledge base.

Objectives of the Scheme:

- To engage the faculty and students of Higher Educational Institutions (HEIs) in identifying development issues in rural areas and finding sustainable solutions for the same.

- Identify & select existing innovative technologies, enable customisation of technologies, or devise implementation methods for innovative solutions, as required by the people.

- To allow HEIs to contribute to devising systems for smooth implementation of various Government programmes.

About Unnat Bharat Abhiyan 2.0:

- It is the upgraded version of Unnat Bharat Abhiyan 1.0 launched in the year 2018.

- The scheme used to be extended to all educational institutes. But under Unnat Bharat Abhiyan 2.0 participating institutes are selected based on the fulfilment of certain criteria.

- The technological interventions under the UBA cover different subjects broadly categorized like in the area of sustainable agriculture; water resource management; artisans, industries and livelihood; basic amenities (Infrastructure & Services) and Rural Energy System.

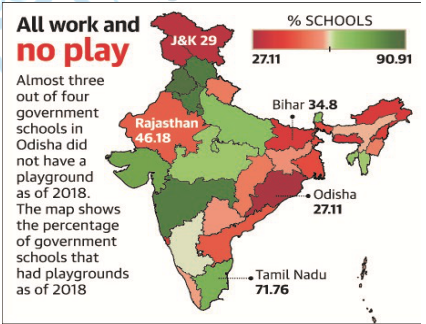

STATUS OF GOVERNMENT SCHOOLS IN INDIA

10, Mar 2020

Why in News?

- The Parliamentary Standing Committee on Human Resource Development (HRD) recently submitted its report on the 2020-2021 demand for grants for school education to the Rajya Sabha and has made various observations on state of government schools in India.

What are the Key Findings?

- Almost half the government schools in the country do not have electricity or playgrounds.

- The budgetary allocations saw a 27% cut from proposals made by the School Education Department, despite proposals for 82,570 crore, only Rs. 59,845 crore was allocated.

- There is slow progress in building classrooms, labs and libraries to strengthen government higher secondary schools.

- Overall, for the core Samagra Shiksha Scheme, the department had only spent 71% of revised estimates by December 31, 2019.

- India is also dealing with a scenario of significant teacher vacancies, which are to the tune of almost 60-70 per cent in some states.

About Samagra Shiksha Abhiyan:

- Samagra Shiksha is an integrated scheme for school education extending from pre-school to class XII to ensure inclusive and equitable quality education at all levels of school education.

- It subsumes the three Schemes of Sarva Shiksha Abhiyan (SSA), Rashtriya Madhyamik Shiksha Abhiyan (RMSA) and Teacher Education (TE).

- The scheme treats school education holistically as a continuum from Pre-school to Class 12.

- The main emphasis of the Scheme is on improving the quality of school education by focussing on the two T’s – Teacher and Technology.

What are its Key Recommendations?

- Core schemes should get additional funds at the revised estimates stage.

- HRD Ministry should collaborate with the Mahatma Gandhi National Rural Employment Guarantee Scheme to construct boundary walls.

- It should also work with the Ministry of New and Renewable Energy to provide solar and other energy sources so that schools have access to power.

What is the Concern?