Foreign Institutional Investor (FII)

13, Dec 2018

Introduction:

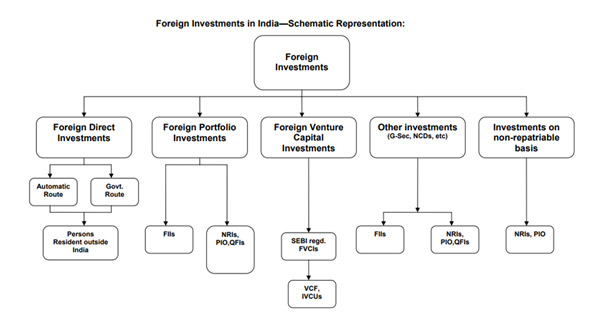

- Foreign Institutional Investor (FII) means an institution established or incorporated outside India which proposes to make investment in securities in India. They are registered as FIIs in accordance with Section 2 (f) of the SEBI (FII) Regulations 1995.

- FIIs are allowed to subscribe to new securities or trade in already issued securities. This is just one form of foreign investments in India.

FII Vs FDI: International standards and Indian definition:

- According to IMF and OECD definitions, the acquisition of at least ten percent of the ordinary shares or voting power in a public or private enterprise by non-resident investors makes it eligible to be categorized as foreign direct investment (FDI).In India, a particular FII is allowed to invest upto 10% of the paid up capital of a company, which implies that any investment above 10% will be construed as FDI, though officially such a definition did not exist.

- It may be noted that there is no minimum amount of capital to be brought in by the foreign direct investor to get the same categorized as FDI.

Who can get registered as FII?

Following Foreign Entities / Funds are eligible to get Registered as FII:

1. Pension Funds

2. Mutual Funds

3. Investment Trusts

4. Banks

5. Insurance Companies / Reinsurance Company

6. Foreign Central Banks

7. Foreign Governmental Agencies

8. Sovereign Wealth Funds

9. International/ Multilateral organization/ agency

10. University Funds (Serving public interests)

11. Endowments (Serving public interests)

12. Foundations (Serving public interests)

13. Charitable Trusts / Charitable Societies (Serving public interests)

- Thus, it may be seen that sovereign wealth funds (SWFs) are also regulated under FII regulations only, and no separate regulation exists for SWFs. Further, following entities proposing to invest on behalf of broad-based funds, are also eligible to be registered as FIIs:

- Asset Management Companies

- Investment Manager/Advisor

- Institutional Portfolio Managers

- Trustee of a Trust

- Bank

What FIIs can do?

A Foreign Institutional Investor may invest only in the following:

1. securities in the primary and secondary markets including shares, debentures and warrants of companies listed or to be listed on a recognised stock exchange in India; and

2. units of schemes floated by domestic mutual funds including Unit Trust of India, whether listed on a recognised stock exchange or not

3. units of scheme floated by a collective investment scheme

4. dated Government Securities

5. derivatives traded on a recognized stock exchange

6. commercial papers of Indian companies

7. Rupee denominated credit enhanced bonds

8. Security receipts

9. Indian Depository Receipt

10. Listed and unlisted non-convertible debentures/bonds issued by an Indian company in the infrastructure sector, where ‘infrastructure’ is defined in terms of the extant External Commercial Borrowings (ECB) guidelines

11. Non-convertible debentures or bonds issued by Non-Banking Financial Companies categorized as ‘Infrastructure Finance Companies’(IFCs) by the Reserve Bank of India

12. Rupee denominated bonds or units issued by infrastructure debt funds

13. Indian depository receipts

Myths About FIIS:

- There are certain myths / beliefs about FIIs which are not necessarily true.

- Myth -1:FIIs do not invest in unlisted entities. They participate only through stock exchanges.

- Myth -2:FIIs cannot invest at the time of initial allotment. Foreign investors investing in initial allotment of shares (say IPOs or when a group of entities come together to float a company) are categorized as FDIs.

- Truth on 1 and 2:As per Section 15 (1) (a) of the SEBI FII Regulations, 1995, a Foreign Institutional Investor (FII) could invest in the securities in the primary and secondary markets including shares, debentures and warrants of companies unlisted, listed or to be listed on a recognized stock exchange in India. In fact FIIs are very active in the over the counter (OTC) markets and in the IPO market in India. However, subsequent to SEBI (FPI) regulations, FIIs are allowed to invest only in listed or to-be listed entities and only through stock exchanges.

- Myth 3:FDI has more direct involvement in technology, management etc while FIIs are interested in capital gain and momentary price differences. Generally direct investment involves a lasting interest in the management of an enterprise and includes reinvestment of profits. In contrast, FIIs do not generally influence the management of the enterprise.

- Truth on 3:To some extant this notion is true and is emphasized in policy documents. For instance, consolidated FDI Policy of Department of Industrial Policy and Promotion (DIPP) states that “foreign Direct Investment, as distinguished from portfolio investment (FII), has the connotation of establishing a ‘lasting interest’ in an enterprise that is resident in an economy other than that of the investor”.

- However, of late, there have been occasions where FIIs come together to influence decisions in companies where they hold shares. The difference between FDI and FII, except for the fact that the latter necessarily has to be an institution (FDI can come from an individual also), rather lies in the registration or approval process and to some extent in the individual investment limits or lock-in conditions specified for each category.

- Globally also, the acquisition of at least ten percent of the ordinary shares or voting power in a public or private enterprise by non-resident investors makes it eligible to be categorized as FDI, rather than the purpose of the investments, as intimated or stated by the investing foreigner due to difficulty in assessing it and also for statistical consistency.