GROSS NPAS MAY RISE, SAYS RBI REPORT

28, Dec 2019

Prelims level : Economics

Mains level : GS-III Indian Economy and Issues Relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Why in News?

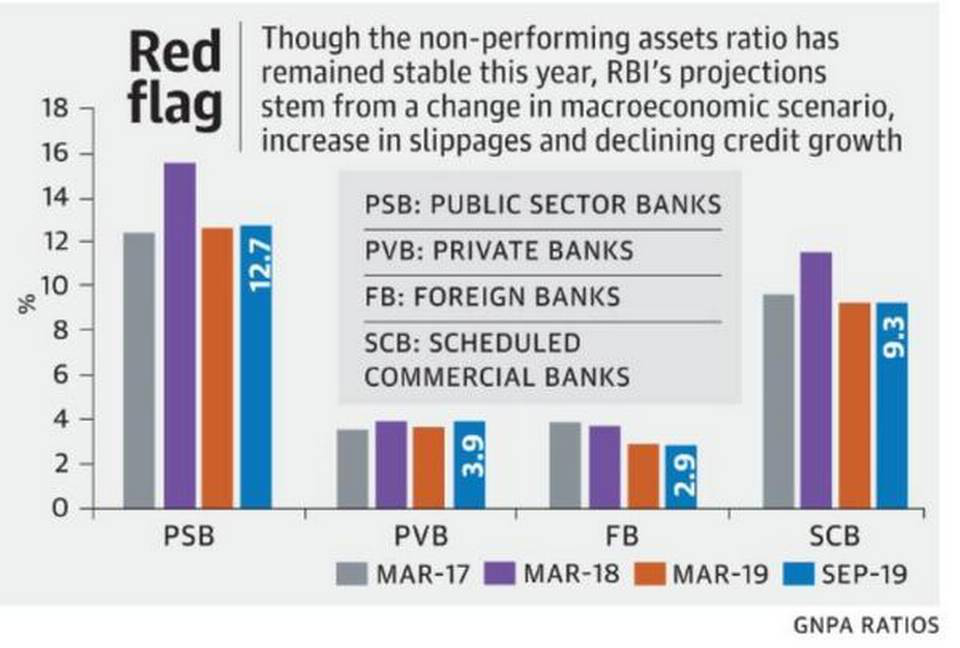

- According to an RBI report, the gross non-performing asset (GNPA) ratio of banks may increase to 9.9% by September 2020 from 9.3% in September 2019.

About NPA:

- Any asset which stops giving returns to its investors for a specified period of time is known as Non-Performing Asset (NPA).

- Generally, that specified period of time is 90 days in most of the countries and across the various lending institutions.

- However, it is not a thumb rule and it may vary with the terms and conditions agreed upon by the financial institution and the borrower.

- According to RBI, an asset including a leased asset becomes nonperforming when it ceases to generate income for the bank.

Report’s Data:

- “Stress tests indicate that under the baseline scenario, the GNPA ratios of banks may increase to 9.9% by September 2020 due to change in macroeconomic scenario, marginal increase in slippages and the denominator effect of declining credit growth,” the RBI said in its Financial Stability Report.

- State-run banks’ GNPA ratios may increase to 13.2% by September 2020 from 12.7% in September 2019, whereas for private banks it may climb to 4.2% from 3.9%, under the stress scenario.

- Foreign banks’ gross bad loans may increase to 3.1% from 2.9% in September 2019. Net non-performing assets (NNPA) ratio declined in September 2019 to 3.7%.

- The aggregate provision coverage ratio (PCR) of all banks rose to 61.5% in September 2019 from 60.5% in March 2019.

- The state-run banks’ CRAR improved to 13.5% from 12.2% during the same period.

- The asset quality of Agriculture and services sectors, as measured by their GNPA ratios, deteriorated to 10.1% in September 2019 from about 8% in March 2019.

- For industry, slippages during the period declined to 3.79% from about 5% in March 2019.

What could be the solution to this problem?

- Since the problem is more concentrated in PSBs, some have argued that public ownership must be the problem.

- Public ownership of banks, according to them, is beset with corruption and incompetence (reflected in poor appraisal of credit risk). The solution, therefore, is to privatise the PSBs, at least the weaker ones.

- However, there are problems with this idea of privatising PSBs.

- First, there are wide variations within each ownership category (within Indian banks).

- In 2018, the State Bank of India’s (SBI’s) gross NPA/gross advances ratio was 10.9%. This was not much higher than that of the second largest private bank, ICICI Bank, 9.9%.

- The ratio at a foreign bank, Standard Chartered Bank, 11.7%, was higher than that of SBI.

- Moreover, private and foreign banks were part of consortia that are now exposed to some of the largest NPAs. Therefore the explanation lies elsewhere.

- A brief look at the state of PSBs show that they are not in as bad a shape as many make them out to be.

- For example, PSBs had a higher exposure to the five most affected sectors — mining, iron and steel, textiles, infrastructure and aviation.

- These sectors accounted for 29% of advances and 53% of stressed advances at PSBs in December 2014. For private sector banks, the comparable figures were 13.9% and 34.1%.

- Rough calculations show that PSBs accounted for 86% of advances in these five sectors. (By an interesting coincidence, this number is exactly the same as the PSBs’ share in total NPAs)

- Wholesale privatisation of PSBs is thus not the answer to such a complex problem.

- We need a broad set of actions, some immediate and others over the medium-term and aimed at preventing the recurrence of such crises.

Way Forward:

- Banks have to accept losses on loans.

- They should be able to do so without any fear of harassment by the investigative agencies.

- The Indian Banks Association has set up a six-member panel to oversee resolution plans of lead lenders. To expedite resolution, more such panels may be required.

- An alternative is to set up a Loan Resolution Authority, if necessary through an Act of Parliament.

- Also, the government must infuse at one go whatever additional capital is needed to recapitalise banks — providing such capital in multiple instalments is not helpful.