INDIA – US TRADE RELATIONS

24, Feb 2020

Prelims level : International Policies & Schemes

Mains level : GS-II Bilateral, regional and global groupings and agreements involving India and/or affecting India’s Interests

Context:

- In the recent happenings, India sought to play down American President Donald Trump’s remarks that New Delhi is not treating the US “very well” on the trade front, insisting that it was important to understand the context in which he made the comments.

India’s Response:

- The US President has remarked that India has been hitting the US “very hard” on trade for many years with high tariffs.

- Also, President Donald Trump who pursues an “America First” approach has been personally very vocal about the perceived high tariff walls that India has put and has often called out India terming it “tariff king”.

- On Trump’s remarks that the US was not treated very well by India, the external affairs ministry has said that the context for the comments was the balance of trade and that New Delhi was trying to address Washington’s concerns.

- As hopes for sealing the much-anticipated trade deal during Trump’s visit to India faded away, India said it does not want to create “artificial deadlines”

US – India Trade:

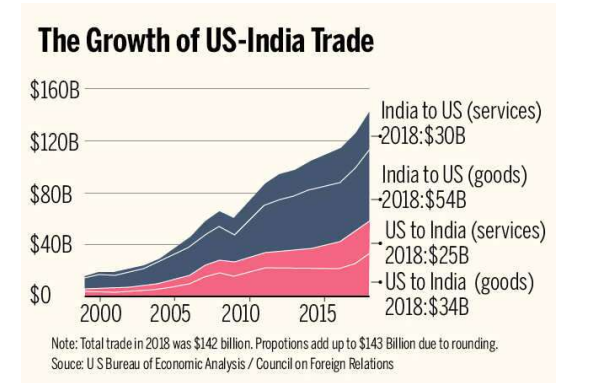

- The US has surpassed China to become India’s top trading partner, in terms of trade in goods and services, followed by China.

- According to the data of the commerce ministry, in 2018-19, the bilateral trade between the US and India stood at USD 87.95 billion.

- While the bilateral trade between US and India is approximately 62 per cent in goods and 38 per cent in services, the bilateral trade between India and China is dominated by goods.

Issues in India – US Trade Relations:

Tariffs:

- India is one of the countries that was hit by Trump’s steel and aluminum tariffs in March 2018. India followed suit with retaliatory tariffs in June 2019 which targeted iconic American products such as apples from Washington state.

- Recently the United States Trade Representative removed India from the list of developing countries who are entitled to benefit from US tariff preferences when it comes to countervailing duties. The determination was based on the fact that India is a G-20 member and accounts for at least 0.5 per cent of global trade.

- According to US, market barriers in Indian market include both tariff and non-tariff barriers, as well as multiple practices and regulations that disadvantage foreign companies.

Generalised System of Preferences (GSP) Programme:

- From March 2019, the US has decided to revoke India’s preferential access to the US market under the World Trade Organization’s Generalized System of Preferences (GSP).

- That decision in turn was the result of an ill-advised Indian policy of capping the prices of medical devices, including stents, which adversely affected the US industry.

- To make matters worse, Indian authorities did not allow US medical equipment manufacturers to exit the Indian market following the price caps, leading to large losses for these firms.

- As a consequence, AdvaMed, the medical device manufacturers’ trade association, then lobbied the US administration aggressively to revoke India’s GSP status.

- India has been the GSP’s top beneficiary. In 2018, GSP represented 11% ($6.3 billion) of US merchandise imports from India, such as chemicals, auto parts, and tableware. GSP removal would reinstate US tariffs.

Data Localization:

- The United States continues to resist India on its “forced” localization practices.

- Initiatives to grow India’s manufacturing base and support jobs include requirements for in-country data storage, domestic content (such as laws protecting India’s solar sector), and domestic testing in some sectors.

- India’s new data localization requirements for electronic payment service suppliers such as MasterCard, Visa, etc.

The Davidson Issue:

- Trump has time and again complained about high import tariffs levied by India on American motorcycles.

- India in response has slashed the customs duty on imported motorcycles from high-end brands such as Harley Davidson to 50 per cent from 100 percent earlier.

- High duties on large engine motorcycles raised their prices and made it too expensive for consumers in India. To make the bikes more affordable, an assembly plant was built in India by the brand. However, the brand has not yet been able to capture a majority portion of the Indian market.

Farm and Dairy Market:

- India imposed higher import duties on 29 US products, including almonds, walnuts and pulses in retaliation to US significantly hiking duties on certain steel and aluminium products.

- This included walnut, chickpeas, Bengal gram (chana) and masoor dal.

- Traditionally, India has always been protective of its dairy imports and imposed restrictions to protect the livelihoods of 80 million rural households involved in the industry.

- However, it has offered to allow imports of US chicken legs, turkey and produce such as blueberries and cherries. It has also offered to cut tariffs on chicken legs from 100 per cent to 25 percent. But, US negotiators want that tariff to be reduced to 10 per cent.

- According to sources, the government has also offered to allow some access to its dairy market, but with 5 percent tariff and quotas.

- However, a certificate would be needed stating that products have not been derived from animals that have consumed feeds that include internal organs, blood meal or tissues of ruminants.The US also wants India to buy at least another $5-6 billion worth of American goods.

Budget 2020-21:

- In Union Budget 2020-21, the finance minister has announced higher tariffs on medical devices, toys, furniture and footwear and said the government will strengthen rules to allow for additional levies to be imposed when there is a significant surge in imports.

- This further angered the US side as it faces tough competition with China in the Indian market in areas such as electronics, machinery, organic chemicals and medical devices.

The China Factor:

- In 2018, the US was India’s largest export destination at 16 per cent of total exports, and second-largest source of imports after China at 6.3% of total imports.

- By contrast, in 2019, India accounted for a measly 2.09% of US exports and 2.30% of total US imports.

- The recently agreed Phase 1 US-China trade agreement reflects the reality that China has far greater clout negotiating with the US than most other countries.

- This stems from the huge imbalance in the two countries’ trade and the dependence of the US market on cheap imports from China, as well as US reliance on China as a source of cheap capital to finance the huge US current account deficit.

- India simply has no comparable levers with which to negotiate with the US, and therefore there is no reason for the US to make any but token concessions in negotiations with India.

- In his keynote speech at the World Economic Forum in Davos in January 2018, Modi called on fellow leaders to embrace more open trade. However, with economic growth falling to over six-year low and pressure on domestic industries, the government is strengthening its barriers again, which is a case for concern as far as rollercoaster ride of India – US trade relations are concerned.