INFLOWS INTO EQUITY, INCOME FUNDS SURGE

09, Apr 2019

Prelims level : Indian Economy

Mains level : GS-III Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

Why in news:

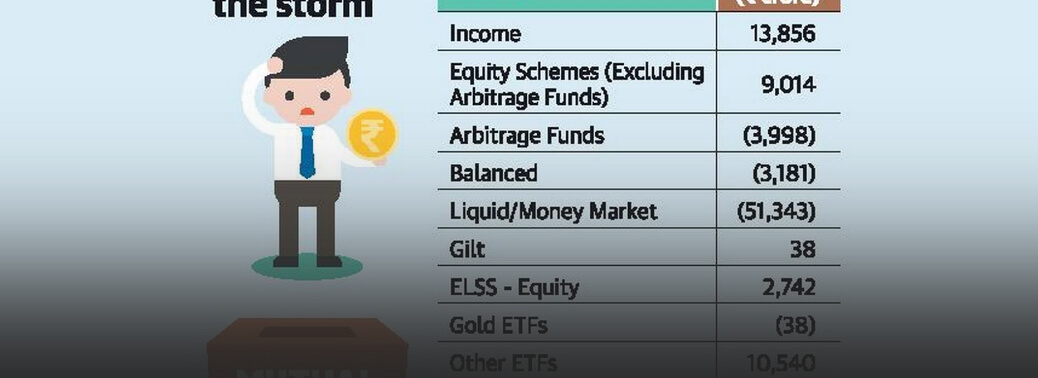

- Equity mutual fund schemes have seen a four-month decline in flows in March leading to a marginal increase in the overall assets of the fund industry in the last month of the financial year. Income funds also saw a huge jump in inflows for the month.

What are mutual funds?

- A mutual fund collects money from investors and invests the money on their behalf. It charges a small fee for managing the money.

- Mutual funds are an ideal investment vehicle for regular investors who do not know much about investing. Investors can choose a mutual fund scheme based on their financial goal and start investing to achieve the goal.

Types of Mutual Funds in India:

- The Securities and Exchange Board of India has categorised mutual fund in India under four broad categories:

- Equity Mutual Funds Debt Mutual Funds Hybrid Mutual Funds

- Solution-oriented Mutual Funds

Equity mutual fund scheme:

- These schemes invest directly in stocks.

- These schemes can give superior returns but can be risky in the short-term as their fortunes depend on how the stock market performs.

- Investors should look for a longer investment horizon of at least five to 10 years to invest in these schemes.

Debt mutual fund schemes:

- These schemes invest in debt securities. Investors should opt for debt schemes to achieve their short-term goals that are below five years. These schemes are safer than equity schemes and provide modest returns.

Hybrid mutual fund schemes:

- These schemes invest in a mix of equity and debt, and an investor must pick a scheme based on his/her risk appetite.

Solution-oriented schemes:

- These schemes are devised for particular solutions or goals like retirement and child’s

- education. These schemes have a mandatory lock-in period of five years.

Assets Under Management fund:

- Assets under management are the overall market value of assets/capital that a mutual fund holds. The fund manager manages these assets and takes investment decisions on behalf of investors. AUM is an indicator of the size and success of a fund house.