National Income

NI is the total value of all final goods and services produced by the country in certain year. The growth of National Income helps to know the progress of the country.

The total amount of income accruing to a country from economic activities in a year’s time is known as national income. It includes payments made to all resources in the form of wages, interest, rent and profits.

From the modern point of view, national income is defined as “the net output of commodities and services flowing during the year from the country’s productive system in the hands of the ultimate consumers.”

National Income Accounting (NIA)

National Income Accounting is a method or technique used to measure the economic activity in the national economy as a whole and it is mainly done for,

Policy Formulation:

It helps in comparing the estimates of the past from the future and also forecast the growth rates in future. For example, if a country has a GDP of Rs. 103 Lakh which is 3 Lakh rupees higher than the last year, it has a growth rate of 3 per cent.

• Effective Decision Making:

To estimate the contribution of each of the sectors of the economy. It helps the business to plan for production.

• International Economic Comparison:

It helps in comparing the level of development of countries and provides useful insight into how well an economy is functioning, and where money is being generated and spent. One can compare the standard of living of different nations and its growth rate.

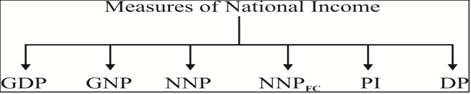

There are various terms associated with measuring of National Income.

Personal Income

- It refers to all of the income collectively received by all of the individuals or households in a country.

- It includes compensation from a number of sources including salaries, wages and bonuses received from employment or self employment; dividends and distributions received from investments; rental receipt from real estate investments and profit sharing from businesses.

- In National Income Accounting, some income is attributed to individuals, which they do not actually receive. For Example: Undistributed Profits, Employees’ contribution for social security, corporate income taxes etc. which needs to be deducted from National Income to estimate the Personal Income.

PI = NI + Transfer Payments – Corporate Retained Earnings, Income Taxes, Social Security Taxes.

Disposable Personal Income

- It is the amount left with the individuals after paying Personal Taxes such as Income Tax, Property Tax, and Professional Tax etc. to spend as they like.

- DPI = PI – Taxes (Income Tax i.e. Personal Taxes)

- DPI results into Savings and Expenditure i.e. (Spend and Save). This concept is very useful for studying and understanding the consumption and saving behaviour of the individuals.

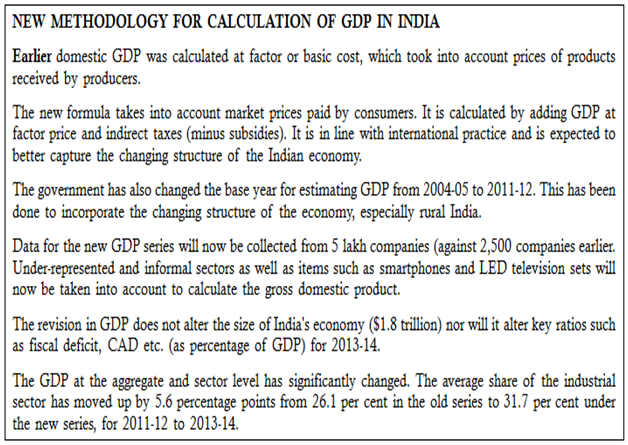

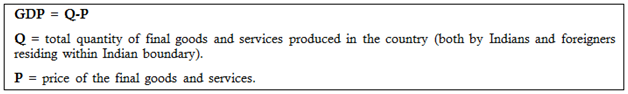

GDP (GROSS DOMESTIC PRODUCT)

- Here the catch word is ‘Domestic’ which refers to ‘Geographical Area’

- The total value of all final goods and services produced within the boundary of the country during a given period of time (generally one year) is called as GDP.

- In this case, the final produce of resident citizens as well as foreign nationals who reside within that geographical boundary is considered.

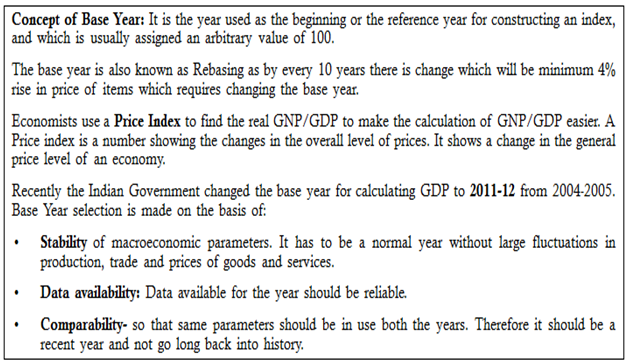

Types of GDP: Real GDP and Nominal GDP

-

Real GDP:

Refers to the current year production of goods and services valued at base year prices. Such base year prices are Constant Prices.

-

Nominal GDP:

Refers to current year production of final goods and services valued at current year prices.

Which one is a better measure?

- Real GDP is a better measure to calculate the GDP because in a particular year GDP may be inflated because of high rate of inflation in the economy.

- Real GDP therefore allows us to determine if production increased or decreased, regardless of changes in the inflation and purchasing power of the currency.

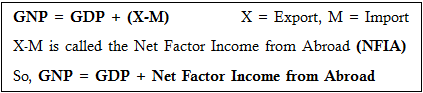

GROSS NATIONAL PRODUCT (GNP)

- Here the catch word is ‘National’ which refers to all the citizens of a country.

- GNP is the total value of the total production or final goods and services produced by the nationals of a country during a given period of time (generally one year).

- In this case, the income of all the resident and non-resident citizens (who resides in abroad) of a country in included whereas, the income of foreigners who reside within India is excluded.

- The GNP contains the income earned by Indian Nationals (both in Indian Territory and Abroad) only.

GDP and GNP are measured on the basis of Market Price and Factor Cost.

a) Market Price

It refers to the actual transacted price which includes indirect taxes such as custom duty, excise duty, sales tax, service tax etc. (impending Goods and Services Tax). These taxes tend to raise the prices of the goods in an economy.

b) Factor Cost

It is the cost of factors of production i.e. rent for land interest for capital, wages for labour and profit for entrepreneurship. This is equal to revenue price of the final goods and services sold by the producers.

Net Indirect Taxes = Indirect Taxes – Subsidies

Hence, Factor Cost = Market Price – Indirect Taxes + Subsidies.

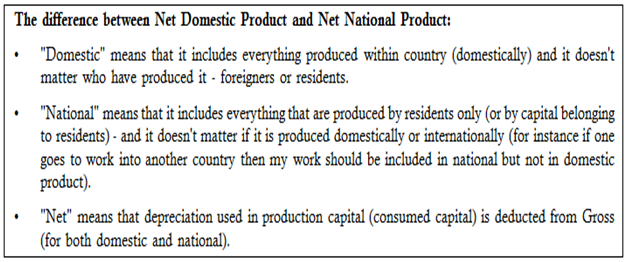

Net National Product (NNP): NNP = GNP – Depreciation

• It is calculated by subtracting Depreciation from Gross National Product.

• Depreciation – Wear and Tear of goods produced.

• This deduction is done because a part of current produce goes to replace the depreciated parts of the products already produced. This part does not add value to current year’s total produce. It is used to keep the products already produced intact and hence it is deducted.

Net Domestic Product (NDP): NDP = GDP – Depreciation

• It is the calculated GDP after adjusting the value of depreciation. This is basically, Net form of GDP, i.e. GDP – total value of wear and tear.

• NDP of an economy is always lower than its GDP, since their depreciation can never be reduced to zero. The concept of NDP and NNP are not used to compare different economies because the method of calculating depreciation varies from country to country.

National Income at Factor Cost (NIFC):

• It is the sum of all factors of income earned by the residents of a country (Indian) both from within the country as well as abroad.

• National Income at Factor Cost = NNP at Market Price – Indirect Taxes + Subsidies

• In India, and many developing countries across the world, National Income is measured at factor cost instead of market prices. Some of the reasons for the same are lack of uniformity in taxes, goods not being printed with their prices, etc.

WHAT ARE THE FACTORS THAT AFFECT NATIONAL INCOME?

Several factors affect the national income of a country. Some of them have been listed below:

1. Factors of Production

Normally, the more efficient and richer the resources, higher will be the level of National Income or GNP

(a) Land

Resources like coal, iron and timber are essential for heavy industries so that they must be available and accessible. In other words, the geographical location of these natural resources affects the level of GNP.

(b) Capital

Capital is generally determined by investment. Investment in turn depends on other factors like profitability, political stability etc.

(c) Labour

The quality or productivity of human resources is more important than quantity. Manpower planning and education affect the productivity and production capacity of an economy.

(d) Entrepreneur

(e) Technology

This factor is more important for Nations with fewer natural resources. The development in technology is affected by the level of invention and innovation in production.

(f) Government

Government can help to provide a favourable business environment for investment. It provides law and order, regulations.

(g) Political Stability

A stable economy and political system helps in appropriate allocation of resources. Wars, strikes and social unrests will discourage investment and business activities.

Methods of National Income Calculation

There are three approaches and methods of measuring National Income:

A. Income Method

- By this National Income is calculated compiling income of factors of production viz., land, labour, capital and entrepreneur.

- • National Income = Total Wage + Total Rent + Total Interest + Total Profit

- In Indian context, since 1993 as per the System of National Accounts (SNA), National Income is total of the following:

- GDP = Compensation of Employees + Consumption of Fixed Capital + (Other Taxes on Production – Subsidies of Production) + Gross Operating Surplus

- Compensation of employees: (Wage) salaries paid in cash and kind and other benefits provided to employees.

- Consumption of Fixed Capital: wear and tear of machinery which are replaced by new parts.

- Other Taxes on Production minus Subsidies: Net tax on production.

- There is a difference between tax on products and tax on production. Tax on products includes taxes like sales tax and excise duty. Tax on production is tax imposed irrespective of production like license fees and land tax.

- Gross Operating Surplus: balance of value added after deducting the above three components. It goes to pay rent of land and interest of capital.

B. Product Method (or Value Added Method, Output Method)

Some of the goods and services included in production are:

Some of the goods and services not included in production are:

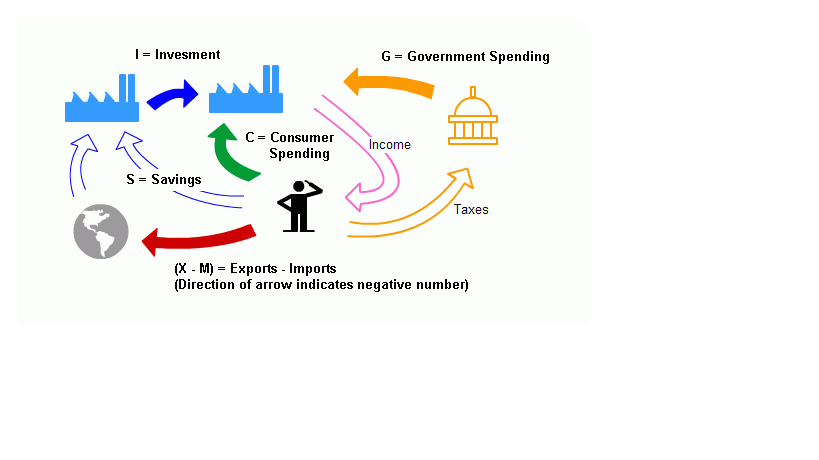

(C) Expenditure Method

- It measures all spending on currently-produced final goods and services only in an economy.

- In an economy, there are three main agencies which buy goods and services: Households, Firms and the Government.

This final expenditure is made up of the sum of 4 expenditure items, namely;

Consumption (C):

Personal Consumption made by households, the payment of which is paid by households directly to the firms which produced the goods and services desired by the households.

• Investment Expenditure (I):

Investment is an addition to capital stock of an economy in a given time period. This includes investments by firms as well as governments sectors.

• Government Expenditure (G):

This category includes the value of goods and service purchased by Government. Government expenditure on pension schemes, scholarships, unemployment allowances etc. are not included in this as all of them come under transfer payments.

• Net Exports (X-IM):

Expenditures on foreign made products (Imports) are expenditure that escapes the system, and must be subtracted from total expenditures. In turn, goods produced by domestic firms which are demanded by foreign economies involve expenditure by other economies on our production (Exports), and are included in total expenditure. The combination of the two gives us Net Exports.

National Income = Consumption (C) + Investment Expenditure (I) + Government Expenditure (G) + Net Exports (X-IM)

Calculating GDP (National Income) is extremely important as the performance of the economy is fixed by means of this method. The results would help the country to forecast the economic progress, determine the demand and supply, understand the buying power of the people, the per capita income, the position of the economy in the global arena. The Indian GDP is calculated by the expenditure method.