PRIME MINISTER’S EMPLOYMENT GENERATION PROGRAMME

04, Mar 2020

Prelims level : Governance - Policies

Mains level : GS-II Government policies and interventions for development in various sectors and Issues Arising out of their design and Implementation.

Why in News?

- A Meeting was held recently to review some of the key schemes of Ministry of Micro, Small and medium Enterprises (MSME) which generate large number of jobs with low capital investment.

Highlights:

- The focus of the meeting was on the Prime Minister’s Employment Generation Programme (PMEGP), a flagship scheme of the Ministry of MSME, and Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- In addition, the issue of restructuring of stressed loans to MSMEs was also discussed to find a way forward to support MSMEs. The cut-off date for restructuring of loans to MSMEs has been extended up to 31st December 2020.

- The work done by the Banks in supporting setting up large number of enterprises under PMEGP over the past years, was commended, which has particularly seen a two-fold increase in last Financial Year when more than 73,000 micro enterprises were assisted.

- To give further boost to the scheme, the target in the current year has been increased to support the establishments of 80,000 units.

- Discussions were also held with Banks on increasing the reach of Credit Guarantee scheme. Government has set a target of increasing credit guarantee to Rs. 50,000 crores under this scheme, which is a jump of about 67% over the last year.

Prime Minister’s Employment Generation Programme:

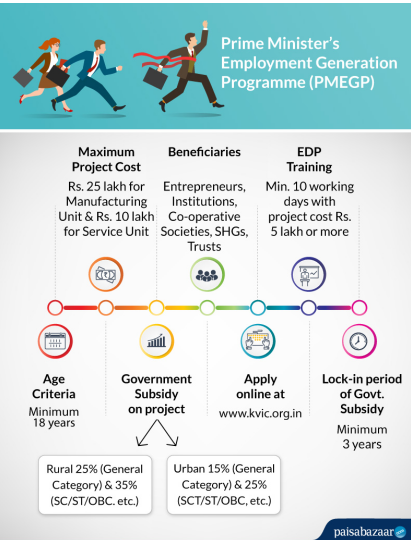

- Prime Minister’s Employment Generation Programme (PMEGP) is a credit-linked subsidy programme introduced by the government of India in 2008.

- It promotes self-employment through setting up of micro enterprises, where subsidy up to 35 % is provided by the Government through Ministry of MSME for loans up to Rs. 25 lakhs in manufacturing and Rs 10 lakhs in service sector.

- The scheme is administered by Ministry of Micro, Small and medium Enterprises.

- The PMEGP Scheme is being implemented by Khadi and Village Industries Commission (KVIC) at the national level.

- At the State level, the Scheme is being implemented through State Khadi and Village Industries Commission Directorates, State Khadi and Village Industries Boards and District Industries Centres and banks.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE):

- The scheme was launched by the Government of India to make available collateral-free credit to the micro and small enterprise sector.

- Both the existing and the new enterprises are eligible to be covered under the scheme.

- The Ministry of Micro, Small and Medium Enterprises, GoI and Small Industries Development Bank of India (SIDBI), established a Trust named CGTMSE to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

- Since its inception, CGTMSE has facilitated easy access to credit from organized banking sector to first generation entrepreneurs in the Micro and Small Enterprises (MSE) sector.

- CGTMSE, in turn, provides guarantee to its registered Member Lending Institutions (MLIs) against the loans / credit facilities up to Rs. 100 lakh extended by them without taking any collateral security and / or third party guarantee.