WHY MINIMUM WAGE WON’T FIX INDIA’S WOES?

Context:

- Parliament has passed the Code on Wages Bill, 2019 mandating a minimum wage across the country in its first session itself.

Concern:

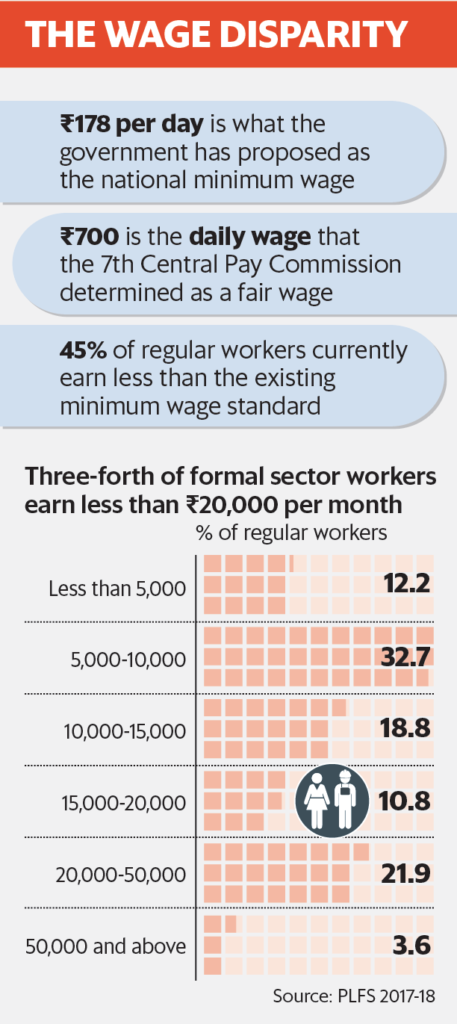

- This law mandates a universal minimum payment of ₹178 a day

- The wage prescribed is less than half the ₹375 a day recommended by a high-powered Labour Ministry Panel.

- It is also miles away from the ₹700 fair wage that the 7th Central Pay Commission had arrived at.

Justification for Marginal increase:

- The justification for such a marginal increase, after all, is that this ₹178 is now a definitive minimum for all workers, and will be universal across the country, across all sectors.

- It will, therefore, allow for wages to rise in informal sectors and will address the issue of gender-based disparities as well.

- At the moment, women earn roughly 45% less than men in the same occupation.

- A national wage floor would also hopefully reduce rural-urban gaps.

- Today, urban workers in regular sectors earn₹149 more per day than their rural counterparts.

- Casual workers earn ₹33 more in urban areas.

- Since casual workers can be fired easily, estimates show that the wage may even go down to a miserable ₹20 a day in times of poor demand.

- A mandated minimum wage will hopefully reduce these glaring inequities.

Labour Law Reform:

Socialist-era laws:

- The argument given was that Indian industry is shackled by a number of socialist-era laws that prevent Indian companies from becoming competitive: workers cannot be fired, organization structures are not flexible, transfer policies are not nimble enough, and a high human resource cost prevents companies from growing bigger.

- More than 45 central laws and at least 100 state-level legislations create confusion, complexity, and chaos.

- The burden of compliance is huge is the conventional wisdom.

Origin of minimum wage:

- The debate on minimum wages started 80 years ago in the US when the Federal minimum wage was fixed at 25 cents an hour.

- In 2009, the wage went up to $7.25 a year.

- India’s minimum wage system, according to the Economic Survey 2018-19, comprises of 1,915 minimum wages defined for various scheduled job categories across different states in the country. The process of determining the minimum wage is complex to say the least.

- The level of compliance too is abysmal; one survey showed that 90% of workers don’t even know about the minimum wage and, needless to say, are severely exploited. It is to address these issues that this new law was passed.

Opinion of Scholars on Minimum Wage:

- Argument by American social scientist and economist Gary Becker,

- when minimum wages go up, more people end up out of work.

- Economist Milton Friedman famously said a high rate of unemployment among teenagers, especially black teenagers, is largely a result of minimum wage laws.

- Former chairman of the US Federal Reserve Alan Greenspan agreed with both these Nobel prize winners and declared that minimum wage legislation ultimately destroyed jobs.

- Edmund Phelps, who won the Nobel prize in 2006, had a different solution.

- He preferred a work subsidies programme that incentivise firms to hire more low-skilled workers through a tax credit. Such a scheme would push up the wages of the traditionally low-paid work seekers and the additional demand for more low-wage labour would create new jobs.

Indian context-

- The Indian government has chosen to increase minimum wages and push costs to businesses.

- The Centre will set standards and define minimum wages across industry, including for small businesses.

- Given our diversity, this will not be easy.

- The 15th Indian Labour Conference more than 60 years ago suggested norms for fixing minimum wages based on a per person intake of 2,700 calories per day, and 18 yards of clothing per year, minimum housing rent as charged by the government for low-income groups, fuel and lighting expenses, and other miscellaneous items of expenditure.

- All this, it said, should comprise 20% of minimum wage.

What need to be done:

- Beyond the complications that such calculations bring, the government must grapple with costs and requirements changing significantly across the country, from the low-wage economy of Tripura to highly labour scarce areas like Kerala.

- It must also address questions on what constitutes fair wage and what defines a living wage.

- Is a minimum wage the ultimate goal of a humane society or should it go beyond and ensure that workers are also paid fair and liveable wages?

- The Directive Principles of the Constitution already encourage the state to work for higher than minimum wages.

Constitution on Minimum wages:

- Article 43 states that “the state shall endeavour to secure, by suitable legislation or economic organization or in any other way, to all workers, agricultural, industrial or otherwise, work, a living wage, conditions of work ensuring a decent standard of life, and full enjoyment of leisure and social and cultural opportunities in particular” to ensure a fair deal to the labour class.

- Article 39 reinforces the same. These goals have not been reached and the new code seeks to do so.

Concern Ahead:

- In India, small and unorganized businesses employ more than 90% of the workforce, an estimated 500 million people.

- The new law seeks to cover all employees, just as recommended in the Directive Principles.

- This is where the major problem with compliance will come up, leading to the threat of harassment from labour officials.

- In an atmosphere where businesses are reeling under the impact of a hurriedly passed goods and services tax (GST) system, this new requirement will certainly impose higher costs.

- The second quirk of what’s about to unfold is that 50% of the workforce is self-employed. Nearly 30% work on a causal basis, approaching the labour market in bursts and spurts.

- The new code therefore will actually only work for 20% of the total workforce.

- Even within this, more than half belong to very small enterprises that hire between one and five people. Making these tiny enterprises comply with new laws is, in any case, a tall order.

- However, any increase in formal sector wages will eventually raise wages in the informal sector too.

- In competitive markets, any increase in wage costs cannot be passed on customers by increasing prices.

- Therefore, profit margins will fall and capital will move away from the formal sector.

- Therefore, employment and wages will go up in the unorganized sector.

The third conundrum is whether the newly proposed code will result in the setting up of more industries, and the creation of more jobs?

- This is at least what the Bill asserts.

- It then says the endeavor is to remove multiplicity of definitions and authorities without compromising on the basic concepts of welfare and benefits to workers and to bring transparency and accountability into the system.

- This is a laudatory statement but remains merely an expression.

- A centralized code is extremely unlikely to reduce complexity and almost certainly is counterproductive to bringing transparency or accountability into the system.

Do new code seeks to achieve a large number of objectives.

- The basic premise in public policy setting is that an instrument must have one clear goal.

- If it has more than one, it would not achieve any.

- The code states that it would provide for all essential elements related to wages, equal remuneration, its timely payment, and bonus. It takes four major acts at once—the Payment of Wages Act, 1936, Minimum Wages Act, 1948, Payment of Bonus Act, 1965 and the Equal Remuneration Act, 1976—and seeks to bring them together into one.

Complication

- It then goes on to do what the extant Central Advisory Council was doing—recommending a fair wage. Under the new code, the Centre will fix a floor wage, somehow factoring in varying living standards of workers.

- Then, the code does what the government had done while damaging the GST. Instead of giving us a single and low tax rate, it gave way to a complicated set of five different tax rates.

- The code does the same. After promising a uniform floor rate, the code then says that the Centre will set different floor wages for different geographical areas. The code says that the Centre may take advice from the states, not that it shall.

Is this code meant to tackle increasing inequality?

- Should workers expect the new code to improve their condition by increasing wages and the number of jobs?

- The conflict here is built in: one comes at the cost of the other.

- It is clearly a lurking danger that higher wages will almost necessarily result in fewer jobs.

- Job losses and unemployment are already at their highest ever.

- However, in the long run, the impact on inequality could be sharp and allow us to reduce the income differentials across the organized and the unorganized sectors.

A single mandate on minimum wages will not be enough to tackle inequality.

- There are two other ideas that could possibly be introduced to address some of India’s persistent economic woes.

- The first, of course, is the Phelps idea of wage subsidies.

- Rather than state governments like Gujarat, Maharashtra, Andhra Pradesh and Karnataka mandating jobs quota for locals, they could actually provide wage support to companies, thus incentivising investment and local hiring, while keeping wage bills low for firms operating in competitive environments.

- The other idea comes from the labour ministry panel that had suggested a ₹1,430 housing allowance for city-based workers. This would allow for labour mobility and address the housing concern.

Conclusion:

- Above all, what is worrisome is the array of expectations that the bill has spawned.

- The code is unfortunately being seen as a silver bullet for a slew of challenges faced by labour.

- It will increase disposable income, say some, while others argue that humane working conditions will emerge and employers will also implement regulated working hours, pay for overtime, and will result in reducing worker exploitation.

- Another major selling point of this code has been that it will also ensure the end to gender discrimination in wage payments. Again, it is the GST that this code reminds us of.

- A well-intentioned and brave step but rendered ineffective through multiple, vague, and lofty goals.