Airtel Payments Bank is now a Scheduled Bank

08, Jan 2022

Prelims level : Banking

Mains level : GS-III Indian Economy and issues relating to planning, mobilization of Resources, Growth, Development and Employment.

Why in News?

- The Reserve Bank of India (RBI) has announced the inclusion of Airtel Payments Bank Ltd. in the Second Schedule to the Reserve Bank of India Act, 1934.

Implications:

- With this, the bank can now pitch for Government-issued Requests for Proposals (RFP) and Primary Auctions and undertake both Central and State Government business.

What is a Schedule Bank?

- Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934.

- Every Scheduled bank enjoys two types of principal facilities: It becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of Clearing House.

About Airtel Payments Bank:

- It is among the fastest-growing digital banks in the country, with a base of 115 million users.

- It offers a suite of digital solutions through the Airtel Thanks app and a retail network of over 500,000 Neighbourhood Banking Points.

- The bank Turned Profitable in the Quarter ended September 2021.

What is Payment’s bank?

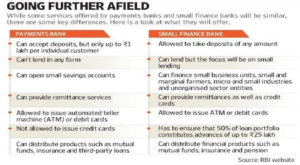

- Payment banks were established to promote financial inclusion by offering; ‘modest savings accounts and payments/remittance services to migratory labour workforce, low-income households, small enterprises, other unorganised sector entities, and other users.’

- These banks can accept a restricted deposit, which is now capped at Rs 200,000 per person but could be raised in the future.

- These banks are unable to provide loans or credit cards. Banks of this type can handle both current and savings accounts.

- Payments banks can provide ATM and debit cards, as well as online and mobile banking.