Category: Agriculture, ignorance, subsidy, marketing

GI Tag for Cumbum Grapes

17, Apr 2023

Why in News?

- Tamil Nadu’s famous Cumbum Panneer Thratchai, also known as Cumbum grapes recently earned the Geographical Indication (GI) tag.

About the Cumbum grapes:

- The Cumbum Valley located at the Western Ghats in Tamil Nadu is known as the ‘Grapes City of South India’ and cultivates the Panneer Thratchai.

- This variety, also known as Muscat Hamburg, is popular for its quick growth and early maturity, ensuring that the crop is available in the market almost throughout the year.

- The Panneer grapes were first introduced in Tamil Nadu by a French priest in 1832 and are rich in vitamins, tartaric acid and antioxidants and reduce the risk of some chronic diseases.

- They are also known for a superior taste apart from the purplish brown-colour.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per traditional methods, has certain specific qualities, or has a particular reputation because of its geographical origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural products, handicrafts, and industrial products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name.

- In order to function as a GI, a sign must identify a product as originating in a given place.

Who accords and regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents unauthorised use of GI tag products by others

- It helps consumers to get quality products of desired traits and is assured of authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea gardens or not produced according to the norms set out in the code of practice for the geographical indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication.

- Protection for a GI tag is usually procured by acquiring a right over the sign that constitutes the indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed country centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states.

- False use of geographical indications by unauthorized parties is detrimental to consumers and legitimate producers.

- Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting unauthorised copiers, etc.

- For internationally recognised products like Darjeeling tea, international protection is of crucial importance.

- Legal protection to GIs also extends to protection of traditional knowledge and traditional cultural expression contained in the products.

- Hence Intellectual Property is a power tool for economic development and wealth creation particularly in the developing world.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI products their true reward.

Essential Commodities Act

27, Feb 2023

Why in News?

- The Centre has maintained that there is no move to ban the export of onions.

About the Essential Commodities act:

- The Essential Commodities Act, 1955 was enacted to ensure the easy availability of essential commodities to consumers and to protect them from exploitation by unscrupulous traders.

- The Act provides for the regulation and control of production, distribution and pricing of commodities which are declared as essential.

- Essential items under the Act include drugs, fertilisers, pulses and edible oils, and petroleum and petroleum products.

- The Act aim at maintaining/increasing supplies/securing equitable distribution and availability of these commodities at fair prices.

- Centre invokes the ECA Act’s provisions to impose stock limits in case of price/quantity distortions in the market to ensure adequate availability of essential commodities at reasonable prices.

- States are the implementing agencies to implement the EC Act, 1955 and the Prevention of Black marketing & Maintenance of Supplies of Essential Commodities Act, 1980, by exercising powers delegated to them.

- The list of essential commodities is reviewed from time to time with reference to their production and supply and in consultation with concerned Ministries/Departments.

- Currently, the restrictions like licensing requirement, stock limits and movement restrictions have been removed from almost all agricultural commodities.

- Exemptions: Wheat, pulses and edible oils, edible oilseeds and rice are certain exceptions.

- The recent amendment to the Legal Metrology (Packaged Commodities) Rules 2011 is linked to the ECA. The Government can fix the retail price of any packaged commodity that falls under the ECA.

Arguments against ECA:

- An archaic law: Essential Commodities Act has been in existence since 1955, when the economy was very different from what it is today. It was an economy ravaged by famine and food shortages.

- Difference between storage and hoarding: Recently there is evidence of interventions not working. It is because there is a distinction between storage and hoarding.

- As compared to older times, when the economy experiences acute shortages, today many shortage cases are actually that of hoarding.

- Stock limits led to onion price volatility: To control soaring prices of onions over the last few months, centre through ECA imposed stock limits on onions. Instead of decreasing prices, this actually increased price volatility.

- Although the restrictions on both retail and wholesale traders were meant to prevent hoarding and enhance supply in the market, the Survey showed that there was actually an increase in price volatility and a widening wedge between wholesale and retail prices.

- Lower stock limit led traders and wholesalers to immediately offload most of the kharif crop which led to a sharp increase in the volatility.

- Disincentivises storage infrastructure development: With too-frequent stock limits, traders may have no reason to invest in better storage infrastructure in the long run.

- Also, food processing industries need to maintain large stocks to run their operations smoothly. Stock limits curtail their operations. In such a situation, large scale private investments are unlikely to flow into food processing and cold storage facilities.

- Higher prices of medicines: Drug Price Control Order issued under the ECA also distorted the market and actually made medicines less affordable.

- The increase in prices is greater for more expensive formulations than for cheaper ones and for those sold in hospitals rather than retail shops.

- Rent seeking and Low conviction rates: Despite many raids conducted under the ECA in 2019, the conviction rate was abysmally low. The ECA only seems to enable rent-seeking and harassment.

Way Forward:

- Adequate supply: Given that almost all crops are seasonal, ensuring round-the-clock supply requires adequate build-up of stocks during the season.

- Without the ECA the common man would be at the mercy of opportunistic traders and shopkeepers.Genuine shortages: There can be genuine shortages triggered by weather-related disruptions in which case prices will move up.

- So, if prices are always monitored, farmers may have no incentive to farm.

- Difficult to differentiate between hording and shortage: It may not always be possible to differentiate between genuine stock build-up and speculative hoarding.

Delhi HC in trademark infringement claim

28, Dec 2022

Why in News?

- The Delhi High Court granted an interim injunction in favour of Hamdard Laboratories in its plea against Sadar Laboratories Private Limited for infringing its registered trademark.

About the News:

- The Court has restrained the manufacture and sale of sweet beverage concentrate ‘Sharbat Dil Afza’ during the pendency of a lawsuit for alleged trademark infringement by Hamdard Dawakhana which sells ‘Rooh Afza’.

What is a Trademark?

- A trademark is a sign capable of distinguishing the goods or services of one enterprise from those of other enterprises. Trademarks are protected by Intellectual Property Rights (IPR).

- In India, trademarks are governed by the Trade Marks Act 1999, which was amended in 2010.

- It legally differentiates a product or service from all others of its kind and recognizes the source company’s ownership of the brand.

- Although trademarks do not expire, the owner must make regular use of it in order to receive the protections associated with them.

- It serves as a badge of origin exclusively identifying a particular business as a source of goods or services.

- Trademark infringement is the unauthorised usage of a sign that is identical or deceptively similar to a registered trademark.

- A mark is said to be strong when it is well-known and has acquired a high degree of goodwill.

- The degree of the protection of any trademark changes with the strength of the mark; the stronger the mark, the higher the requirement to protect it.

What is the Court’s Verdict?

- The court said Rooh Afza served as the source identifier for Hamdard for over a century and has acquired immense goodwill and it was essential to ensure that the competitors keep a safe distance from the mark.

- It is not difficult to conceive that a person who looks at the label of ‘DIL AFZA’ may recall the label of ‘ROOH AFZA’ as the word ‘AFZA’ is common and the meaning of the words ‘ROOH’ and ‘DIL’, when translated in English, are commonly used in conjunction.

- Both the products have the “same deep red colour and texture” and “structure of the bottles is not materially different” and thus opined that the “commercial impression of the impugned trademark is deceptively similar to the appellants’ trademark”.

GI Status for Kerala’s Five Agricultural Products

19, Dec 2022

Why in News?

- The Geographical Indications Registry at Guindy, Chennai, has received an application from the Tribal Development Council, Andaman & Nicobar Islands, seeking the Geographical Indication (GI) tag for the Nicobari hodi boat which is the first application from the Union Territory seeking a tag for one its products.

What are the Key Facts about the Latest GIs?

- Attappady Attukombu Avara (Beans):

- It is curved like a goat’s horn as its name indicates.

- Its higher anthocyanin content compared to other dolichos beans imparts violet colour in the stem and fruits.

- Anthocyanin is helpful against cardiovascular diseases along with its antidiabetic properties.

- The higher phenolic content of Attappady Attukombu Avara imparts resistance against pest and diseases, making the crop suitable for organic cultivation.

- Attappady Thuvara (Red Gram):

- It is having seeds with white coat.

- Compared to other red grams, Attappady Thuvara seeds are bigger and have higher seed weight.

- Onattukara Ellu (Sesame):

- Onattukara Ellu and its oil are famous for its unique health benefits.

- Relatively higher antioxidant content in Onattukara Ellu helps in fighting the free radicals, which destroy the body cells.

- Also, the high content of unsaturated fat makes it beneficial for heart patients.

- Kanthalloor-Vattavada Veluthulli (Garlic):

- Compared to the garlic produced in other areas, this garlic contains higher amount of sulphides, flavonoids, proteins and also rich in essential oil.

- It is rich in allicin, which is effective against microbial infections, blood sugar, cancer, etc.

- Kodungalloor Pottuvellari (Snapmelon):

- This snap melon, which is harvested in summer, contains high amount of Vitamin C.

- Compared to other cucurbits, nutrients such as calcium, magnesium, fibre and fat content are also high in Kodungalloor Pottuvellari.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per traditional methods, has certain specific qualities, or has a particular reputation because of its geographical origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural products, handicrafts, and industrial products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name. In order to function as a GI, a sign must identify a product as originating in a given place.

Who accords and regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents unauthorised use of GI tag products by others

- It helps consumers to get quality products of desired traits and is assured of authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea gardens or not produced according to the norms set out in the code of practice for the geographical indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication. Protection for a GI tag is usually procured by acquiring a right over the sign that constitutes the indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed country centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states. False use of geographical indications by unauthorized parties is detrimental to consumers and legitimate producers.

- Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting unauthorised copiers, etc.

- For internationally recognised products like Darjeeling tea, international protection is of crucial importance.

- Legal protection to GIs also extends to protection of traditional knowledge and traditional cultural expression contained in the products.

- Hence Intellectual Property is a power tool for economic development and wealth creation particularly in the developing world.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI products their true reward.

Essential Commodities Act

06, Dec 2022

Why in News?

- States to set up district-wise price monitoring centres for essential items.

About the Essential Commodities act:

- The Essential Commodities Act, 1955 was enacted to ensure the easy availability of essential commodities to consumers and to protect them from exploitation by unscrupulous traders.

- The Act provides for the regulation and control of production, distribution and pricing of commodities which are declared as essential.

- Essential items under the Act include drugs, fertilisers, pulses and edible oils, and petroleum and petroleum products.

- The Act aim at maintaining/increasing supplies/securing equitable distribution and availability of these commodities at fair prices.

- Centre invokes the ECA Act’s provisions to impose stock limits in case of price/quantity distortions in the market to ensure adequate availability of essential commodities at reasonable prices.

- States are the implementing agencies to implement the EC Act, 1955 and the Prevention of Black marketing & Maintenance of Supplies of Essential Commodities Act, 1980, by exercising powers delegated to them.

- The list of essential commodities is reviewed from time to time with reference to their production and supply and in consultation with concerned Ministries/Departments.

- Currently, the restrictions like licensing requirement, stock limits and movement restrictions have been removed from almost all agricultural commodities.

- Exemptions: Wheat, pulses and edible oils, edible oilseeds and rice are certain exceptions.

- The recent amendment to the Legal Metrology (Packaged Commodities) Rules 2011 is linked to the ECA. The Government can fix the retail price of any packaged commodity that falls under the ECA.

Arguments against ECA:

- An archaic law: Essential Commodities Act has been in existence since 1955, when the economy was very different from what it is today. It was an economy ravaged by famine and food shortages.

- Difference between storage and hoarding: Recently there is evidence of interventions not working. It is because there is a distinction between storage and hoarding.

- As compared to older times, when the economy experiences acute shortages, today many shortage cases are actually that of hoarding.

- Stock limits led to onion price volatility: To control soaring prices of onions over the last few months, centre through ECA imposed stock limits on onions. Instead of decreasing prices, this actually increased price volatility.

- Although the restrictions on both retail and wholesale traders were meant to prevent hoarding and enhance supply in the market, the Survey showed that there was actually an increase in price volatility and a widening wedge between wholesale and retail prices.

- Lower stock limit led traders and wholesalers to immediately offload most of the kharif crop which led to a sharp increase in the volatility.

- Disincentivises storage infrastructure development: With too-frequent stock limits, traders may have no reason to invest in better storage infrastructure in the long run.

- Also, food processing industries need to maintain large stocks to run their operations smoothly. Stock limits curtail their operations. In such a situation, large scale private investments are unlikely to flow into food processing and cold storage facilities.

- Higher prices of medicines: Drug Price Control Order issued under the ECA also distorted the market and actually made medicines less affordable.

- The increase in prices is greater for more expensive formulations than for cheaper ones and for those sold in hospitals rather than retail shops.

- Rent seeking and Low conviction rates: Despite many raids conducted under the ECA in 2019, the conviction rate was abysmally low. The ECA only seems to enable rent-seeking and harassment.

Way Forward:

- Adequate supply: Given that almost all crops are seasonal, ensuring round-the-clock supply requires adequate build-up of stocks during the season.

- Without the ECA the common man would be at the mercy of opportunistic traders and shopkeepers.

- Genuine shortages: There can be genuine shortages triggered by weather-related disruptions in which case prices will move up.

- So, if prices are always monitored, farmers may have no incentive to farm.

- Difficult to differentiate between hording and shortage: It may not always be possible to differentiate between genuine stock build-up and speculative hoarding.

A & N seeks GI Tag for Nicobari hodi Boat

21, Nov 2022

Why in News?

- The Geographical Indications Registry at Guindy, Chennai, has received an application from the Tribal Development Council, Andaman & Nicobar Islands, seeking the Geographical Indication (GI) tag for the Nicobari hodi boat which is the first application from the Union Territory seeking a tag for one its products.

About the Brass and Bell Metal products:

- The hodi is the Nicobari tribe’s traditional craft.

- It is an outrigger canoe, very commonly operated in the Nicobar group of islands.

- The technical skills for building a hodi are based on indigenous knowledge inherited by the Nicobarese from their forefathers.

- The hodi is built using either locally available trees or from nearby islands, and its design varies slightly from island to island.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per traditional methods, has certain specific qualities, or has a particular reputation because of its geographical origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural products, handicrafts, and industrial products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name. In order to function as a GI, a sign must identify a product as originating in a given place.

Who accords and regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents unauthorised use of GI tag products by others

- It helps consumers to get quality products of desired traits and is assured of authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea gardens or not produced according to the norms set out in the code of practice for the geographical indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication.

- Protection for a GI tag is usually procured by acquiring a right over the sign that constitutes the indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed country centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states.

- False use of geographical indications by unauthorized parties is detrimental to consumers and legitimate producers. Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting unauthorised copiers, etc.

- For internationally recognised products like Darjeeling tea, international protection is of crucial importance.

- Legal protection to GIs also extends to protection of traditional knowledge and traditional cultural expression contained in the products.

- Hence Intellectual Property is a power tool for economic development and wealth creation particularly in the developing world.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI products their true reward.

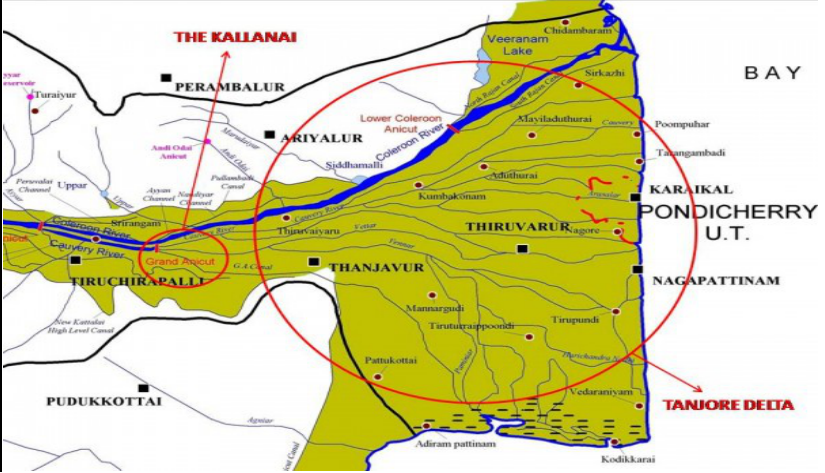

GI Tag Sought for Kumbakonam Vetrilai, Thovalai Manikka Malai

17, Jan 2022

Why in News?

- Geographical Indications Registry in Chennai has received applications seeking GI tag for Two Famous products from Tamil Nadu — Kumbakonam Vetrilai and Thovalai Manikka Malai.

About the News:

- The application for Kumbakonam Vetrilai was filed by the Tamil Nadu Agricultural University, Coimbatore while the application for Thovalai Manikka Malai was given by the Thovalai Manikkamaalai Kaivinai Kalaingargal Nalasangam, Kanniyakumari.

About the Kumbakonam Betel Leaves:

- The Kumbakonam betel leaves were heart shaped and grown in the Cauvery delta region by small and marginal farmers. It is particularly grown in Ayyampettai, Rajagiri, Pandaravadai and Swamimalai in Thanjavur district.

- On an average, about 60-80 lakh betel leaves were harvested annually from a one-hectare plot. A betel leaf cultivator spends ₹10,000 to ₹50,000 to grow these leaves on a one-acre land.

- Harvested leaves are washed, cleaned, and graded according to their size and quality. They were traditionally packed in bamboo baskets but now there are several options such as Plantain Leaves and Cloth Bags.

About the Thovalai Manikka Malai:

- Thovalai Manikka Malai is a special type of garland that is made only in Thovalai, a small village in Kanniyakumari. The flowers used in this particular garland are positioned in a way that when folded they look like a gem.

- The flowers are generally arranged in five rows, but at times for other decorations, 20 rows are used. The height ranges from one foot to 24 feet and above.

- Chamba fibre, nochi leaves, oleander and rose flowers are the key materials used for making this garland. Thovalai is famous for its abundance of flowers and most of flowers are procured locally.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per Traditional Methods, has certain specific qualities, or has a particular reputation because of its geographical origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural products, handicrafts, and industrial products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name. In order to function as a GI, a sign must identify a product as originating in a given place.

Who Accords and Regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents unauthorised use of GI tag products by others

- It helps consumers to get quality products of desired traits and is assured of Authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and International Markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, Producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea Gardens or not produced according to the norms set out in the code of practice for the Geographical Indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication. Protection for a GI tag is usually procured by acquiring a right over the sign that constitutes the Indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed Country Centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states.

- False use of geographical indications by unauthorized parties is detrimental to consumers and Legitimate Producers.

- Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting Unauthorised Copiers, etc.

- For internationally recognised products like Darjeeling tea, international protection is of Crucial Importance.

- Legal protection to GIs also extends to protection of traditional knowledge and traditional Cultural Expression contained in the products.

- Hence Intellectual Property is a power tool for economic development and wealth creation particularly in the Developing World.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI products their true Reward.

GI tag sought for Arunachal Pradesh Apatani textile product

31, Dec 2021

Why in News?

- An application seeking Geographical Indication (GI) tag for the Arunachal Pradesh Apatani textile product has been filed by a firm, Zeet Zeero Producer Company Ltd.

About the Apatani Weave:

- The Apatani weave comes from the Apatani tribe living at Ziro, the headquarters of Lower Subansiri district.

- The woven fabric of this tribe is known for its geometric and zigzag patterns and for its Angular Designs.

- The tribe predominantly weaves shawls known as jig-jiro, and jilan or jackets called supuntarii.

- The people use leaves and plant resources for organic dyeing of the cotton yarns in their traditional ways. And only women folk are engaged in weaving.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per traditional methods, has certain specific qualities, or has a particular reputation because of its Geographical Origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural Products, Handicrafts, and Industrial Products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name. In order to function as a GI, a sign must identify a product as originating in a given Place.

Who Accords and regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents unauthorised use of GI tag products by others

- It helps consumers to get quality products of desired traits and is assured of authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea Gardens or not produced according to the norms set out in the code of practice for the Geographical Indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication. Protection for a GI tag is usually procured by acquiring a right over the sign that Constitutes the indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed country centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states.

- False use of geographical indications by unauthorized parties is detrimental to consumers and legitimate producers.

- Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting unauthorised copiers, etc.

- For internationally recognised products like Darjeeling tea, international protection is of crucial importance.

- Legal protection to GIs also extends to protection of traditional knowledge and traditional cultural expression contained in the products.

- Hence Intellectual Property is a power tool for economic development and wealth creation particularly in the developing world.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI products their true reward.

Cabinet Nod to Extend Irrigation Scheme for Another Five Years

28, Dec 2021

Why in News?

The Cabinet has recently given its approval to extend its umbrella scheme for irrigation, water supply, ground water and watershed development projects for another five years.

About the News:

- According to Jal Shakti Ministry, less than half of identified irrigation projects have been completed since the scheme began in 2015.

- The extension of the Pradhan Mantri Krishi Sinchayee Yojana till 2026 will cost ₹93,068 crore, benefit 22 lakh farmers and fund dams critical for water supply to Delhi and five other States in the upper Yamuna basin.

- In 2015-16, 99 projects were identified which were completed more than 50% but had been pending for years. Of the 99 projects, 46 have been completed. The rest of the projects will be completed by 2024-25.

- Har Khet Ko Pani, another component of the PMKSY, focuses on expanding physical access on farms and increasing the cultivable area under assured irrigation through surface water projects and by restoring water bodies. This is targeted to bring another 4.5 lakh hectares under irrigation by 2026.

- The Cabinet has now expanded inclusion criteria for water body rejuvenation projects, including both urban and rural water bodies, and enhancing Central assistance from 25% to 60%.

About Pradhan Mantri Krishi Sinchayee Yojana (PMKSY):

- Launched in 2015, PMKSY is a centrally sponsored scheme to provide assured irrigation to cultivated areas, reduce wastage of water and improve water-use efficiency.

- It not only focuses on creating sources for assured irrigation but also aims to create protective irrigation by harnessing rainwater at the micro-level through “Jal Sanchay’’ and “Jal Sinchan”.

- The scheme has been formulated by amalgamating other existing schemes like Accelerated Irrigation Benefit Programme (AIBP), Integrated Watershed Management Programme (IWMP), and On Farm Water Management (OFWM).

- Ministries of Agriculture, Water Resources, and Rural Development are the implementing agencies of the scheme.

- PMKSY is being implemented in an area development approach, adopting decentralized state-level planning and projectized execution, allowing the states to draw their irrigation development plans based on district/block plans with a horizon of 5 to 7 years. States can take up projects based on the District/State Irrigation Plan.

- All the States and Union Territories including the North-Eastern States are covered under the program

- The motto of the Scheme is ‘Har Khet Ko Pani’.

- The funding pattern of the Scheme is 60:40 center-state share in the case of States, for the Himalayan and North-Eastern states, the center-state cost-share is 90:10, and for the Union Territories, 100% of the cost is borne by the Central Government.

Focus areas of the Scheme:

- PMKSY will strategize by focussing on end-to-end solutions in the irrigation supply chain, viz. water sources, distribution network, efficient farm level applications, extension services on new technologies & information, etc. The major focus areas include,

- Creation of new water sources; repair, restoration, and renovation of defunct water sources; construction of water harvesting structures, secondary & micro storage, groundwater development, enhancing potentials of traditional water bodies at the village level.Developing/augmenting distribution network where irrigation sources (both assured and protective) are available or Created.

- Promotion of scientific moisture conservation and runoff control measures to improve Groundwater Recharge.

- Promoting efficient water conveyance and field application devices within the farm viz, underground piping system, drip & sprinklers, pivots, rain-guns, and other application devices, etc.

- Encouraging community irrigation through registered user groups/farmer producers’ organizations/NGOs.

- Farmer-oriented activities like capacity building, training and exposure visits, demonstrations, farm schools, skill development in efficient water and crop management practices (crop alignment) including large scale awareness through mass media campaigns, exhibitions, field days, and extension activities through short animation films, etc.

- More focus on irrigation development will be given to deficient states in terms of irrigation coverage.

Components of the Scheme:

- Accelerated Irrigation Benefit Programme (AIBP) focuses on faster completion of ongoing major and medium irrigation projects including national Projects.

- PMKSY (Har Khet ko Pani) focuses on the creation of new water sources through minor Irrigation (both surface and groundwater), repair, restoration, and renovation of water bodies; strengthening carrying capacity of traditional water sources, construction of rainwater harvesting structures; command area development, strengthening and creation of distribution network from source to farm, groundwater development in water-abundant areas, improvement in the water management and distribution system, diversion of water from water-abundant to water-deficient areas and creation and rejuvenation of traditional water storage systems.

- PMKSY (Per Drop More Crop) focuses on maximizing water use efficiency at the farm level through program management, promotion of efficient water conveyance, precision water application devices, and water-lifting devices. Construction of micro-irrigation structures, secondary storage structures, conducting extension activities for the promotion of scientific moisture conservation and agroeconomic measures, capacity building, training, and awareness campaign, and information technology interventions are other measures to promote water use efficiency.

- PMKSY (Watershed Development) focuses on effective management of runoff water and improved soil & moisture conservation activities, construction of water harvesting structures, and convergence with MGNREGS for the creation of a water-source to full potential in identified backward rainfed blocks including renovation of traditional water bodies.

Implementation Framework

- PMKSY follows a “decentralized” three-tiered institutional structure with High-Level Empowered Committee (HLEC) at the Central level, State Level Sanctioning Committee (SLSC) at the State level, and District Level Implementation Committee (DLIC) at the district level besides dynamic involvement of other stakeholders.

- At the national level, National Steering Committee (NSC) and National Executive Committee (NEC) are the key committees that oversee the implementation of programs, allocate resources, undertake monitoring and performance assessment, etc.

- At the State level, the State Department of Agriculture is the nodal department for implementation of the program.

- At the district level, the District Level Implementation Committee (DLIC) oversees the implementation of PMKSY.

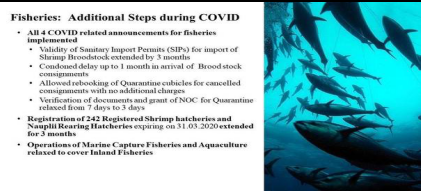

ECONOMIC STIMULUS PACKAGE – III

16, May 2020

Why in News?

- In the third tranche of the COVID-19 economic package, the government announced a slew of measures for agriculture sector, including a ₹63 lakh crore outlay.

About the News:

- It also amended the stringent Essential Commodities Act to remove cereals, edible oil, oilseeds, pulses, onions and potato from its purview.

- The package would focus on infrastructure and building capacities in the agriculture and allied activities.

- The interest subvention will unlock ₹5,000 crore additional liquidity, benefitting 2 crore farmers.

- This also included ₹7 lakh crore package comprising free food grain and cash to poor for three months announced in March, and ₹5.6 lakh crore stimulus provided through various monetary policy measures by the Reserve Bank of India (RBI).

- Of the remaining, the government has made two tranches of announcements with a cumulative package of ₹1 lakh crore, comprising largely of credit lines to smaller firms, concessional credit to farmers and support to shadow banking and electricity distributors.

Regulating Essential Commodities:

- The government will amend the six-and-a-half-decade old Essential Commodities Act to deregulate food items, including cereals, edible oil, oilseeds, pulses, onion and potato.

- The amendment, besides deregulating production and sale of food products, will provide for no stock limit to be imposed on any produce.

- A stock limit will be imposed only under very exceptional circumstances like national calamities, famine with a surge in prices.

- Also, no stock limit shall apply to processors or value chain participants.

Other Important Announcements:

- ₹15,000 crore Animal Husbandry Infrastructure Development Fund will be set up to support investment in dairy processing, value addition and cattle feed infrastructure.

- To ensure 100 per cent vaccination of all livestock against foot and mouth disease (FMD) ₹13,343 crore will be provided, she said.

- As much as ₹10,000 crore will be provided for fishermen through Pradhan Mantri Matsya Sampada Yojana (PMMSY).

- For promoting herbal cultivation, ₹4,000 crore National Medicinal Plants Fund will be started to help 10 lakh hectares to be covered under herbal cultivation.

- Also, Operation Greens will be extended from tomato, onion and potato to all fruit and vegetables by providing 50 per cent subsidy on transportation and storage of these commodities.

- For beekeepers, a ₹500-crore scheme was announced for infrastructure development and post-harvest facilities.

DIRECT SEEDING OF RICE (DSR)

14, May 2020

Why in News?

- Recently, the farmers are now being encouraged to adopt Direct Seeding of Rice (DSR) in place of Conventional Transplanting due to the Shortage of Labourers.

About Conventional Transplanting:

- The farmers prepare nurseries where the paddy seeds are first sown and raised into young Plants.

- These seedlings are then uprooted and replanted 25-35 days later in the main field.

- It is transplanted on fields that are “puddled” or tilled in standing water using tractor-drawn disc harrows.

Direct Seeding of Rice (DSR):

- There is no nursery preparation or transplantation. The seeds are instead directly drilled into the field by a tractor-powered machine.

- Conventionally the water act as a herbicide for paddy but in DSR, water is replaced by real chemical herbicides. Farmers have to only level their land and give one pre-sowing irrigation or rauni.

- Once the field has good soil moisture, they need to do two rounds of ploughing and planking (smoothening of soil surface), which is followed by the sowing of the seeds and spraying of herbicides.

Advantages of DSR:

- The most important one is water savings. The first irrigation (apart from the pre-sowing rauni) under DSR is necessary only 21 days after sowing.

- It is unlike in transplanted paddy, where watering has to be done practically daily to ensure submerged/flooded conditions in the first three weeks.

- It saves more number of working labours, which about three labourers are required to transplant one acre of paddy at almost Rs 2,400 Per Acre.

- Here, the cost of herbicides under DSR will not exceed Rs 2,000 per acre.

Disadvantages of DSR:

- The main issue is the Availability of Herbicides.

- The seed requirement for DSR is also higher, at 8-10 kg/acre, compared to 4-5 kg in Transplanting.

- The laser land levelling, which costs Rs 1,000/acre, is compulsory in DSR. This is not so in Transplanting.

- Here, the yields are as good as from normal transplanting, but one need to sow by the first fortnight of June. The plants have to come out properly before the Monsoon Rains Arrive.

- In Transplanting there is no such problem, where the saplings have already been raised in the Nursery.

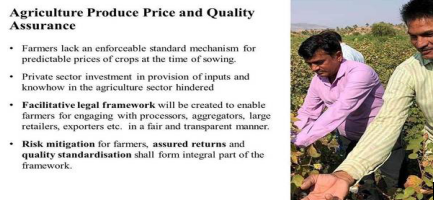

GUJARAT AMENDS APMC ACT

14, May 2020

Why in News?

- Following the Centre’s directive to States to amend their Agricultural Produce Markets (APMC) Acts, the Gujarat government has promulgated an Ordinance expanding the purview of the Act to include livestock under agricultural produce and to provide better market access to farmers.

What is APMC?

- It is a statutory market committee constituted by a State Government in respect of trade in certain notified agricultural or horticultural or livestock products, under the Agricultural Produce Market Committee Act issued by that state government.

- The Ministry of Agriculture formulated a model law on agricultural marketing, State Agricultural Produce Marketing (Development and Regulation) Act, 2003 and requested the state governments to suitably amend their respective APMC Acts.

- Union Budgets of 2014-15 and 2015-16 had suggested the creation of a National Agricultural Market (NAM) following which e-NAM was launched on April 2016 as a pan-India electronic trade portal to link APMCs across the States.

What are its objectives?

- Ensure transparency in pricing systems and transactions taking place in the market area.

- Provide market-led extension services to farmers.

- Ensure payment for agricultural produce sold by farmers on the same day.

- Promote agricultural processing including activities for value addition in agricultural produce.

- Setup and promote public private partnership in the management of agricultural markets, etc.

Changes Made and Their Implications:

- As per the amendment, the new Act is termed Gujarat Agricultural Produce and Livestock Marketing (Promotion and Facilitation) Act, 1963.

- The Act paves the way for establishment of a livestock market.

- Also, it seeks to have involvement of local authorities, including Panchayati raj institutions that own and operate rural periodical markets such as haats within their area.

- Changed Structure of the market committee of a market yard. It is deemed to be of national importance with increased membership from farmers.

- A single licence will be applicable to the whole of the State for the traders to be granted or renewed by the Director. The existing trader licences granted by the market committees shall be converted into State wide single trader licence by the Director.

- Now, even private entities can set up their own market committees or sub-market yards that can compete and offer the best possible remuneration to farmers for their produce.

- The ordinance also restricts the jurisdiction of the market committees to the physical boundaries of their respective marketing yards. They can levy cess only on those transactions, happening within the boundary walls of their marketing yard.

Significance of these Changes:

- The changes help develop these markets to efficiently function as marketing platform nearest to the farm gate.

- They also ensure that the spirit of competition is encouraged and the principle of ‘farmer first’ is kept in mind.

- Also, the act removes the conventional involvement of middlemen by allowing farmers to sell their crops in a free market. This is a progressive step towards a more robust farm economy.

Concerns from APMC:

- APMCs have not welcomed the decision because it ends their monopoly and allows private players to enter.

- The ordinance will also affect revenues because no cess will be collected on transactions outside the physical boundaries of marketing yards.

- For example, last year, of the ₹5 crore earned as market fees, ₹1.5 crore came from transactions that were conducted outside the marketing yard. With the new ordinance in place, this revenue will be lost.

KASHMIR SAFFRON GETS GI TAG

02, May 2020

Why in News?

- Kashmir saffron, which is cultivated and harvested in the Karewa (highlands) of Jammu and Kashmir, has been given the Geographical Indication (GI) tag by the Geographical Indications Registry.

About Kashmir Saffron:

- Kashmir saffron is a very precious and costly product renowned globally as a spice.

- It rejuvenates health and is used in cosmetics and for medicinal purposes. It has been associated with traditional Kashmiri cuisine and represents the rich cultural heritage of the region.

- The unique characteristics of Kashmir saffron are its longer and thicker stigmas, natural deep-red colour, high aroma, bitter flavour, chemical-free processing, and high quantity of crocin (colouring strength), safranal (flavour) and picrocrocin (bitterness).

- Iran is the largest producer of saffron and India is a close competitor. With the GI tag, Kashmir saffron would gain more prominence in the export market.

- It is the only saffron in the world grown at an altitude of 1,600 m to 1,800 m AMSL (above mean sea level), which adds to its uniqueness and differentiates it from other saffron varieties available the world over.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per traditional methods, has certain specific qualities, or has a particular reputation because of its geographical origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural products, handicrafts, and industrial products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name. In order to function as a GI, a sign must identify a product as originating in a given place.

Who accords and regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents un-authorised use of GI tag products by others

- It helps Consumers to get quality products of desired traits and is assured of authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea gardens or not produced according to the norms set out in the code of practice for the geographical indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication. Protection for a GI tag is usually procured by acquiring a right over the sign that constitutes the Indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed country centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states.

- False use of geographical indications by unauthorized parties is detrimental to consumers and legitimate producers.

- Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting unauthorised copiers, etc.

- For internationally Recognised products like Darjeeling tea, International Protection is of crucial importance.

- Legal protection to GIs also extends to protection of Traditional Knowledge and Traditional cultural expression contained in the products.

- Hence Intellectual Property is a Power Tool for economic development and wealth creation particularly in the Developing World.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI Products their True Reward.

COMMODITY MARKETS OUTLOOK

25, Apr 2020

Why in News:

- Recently, the World Bank’s has released Commodity Markets Outlook.

About Commodity Markets Outlook

- It provides market analysis for major commodity groups – energy, metals, agriculture, precious metals, and fertilizers.

- The Report Forecasts Prices for 46 Key Commodities, Including Oil.

Highlights

- Energy and metals commodities:They are the most affected by the sudden stop to economic activity and the serious global slowdown that is anticipated. Commodities associated with transportation, including oil, have experienced the steepest declines.

- Agricultural prices: They are likely to stay broadly stable in 2020 because of relatively stable demand and all-time high levels of staple production and stock. However, supply chain disruptions and government steps to restrict exports or stockpile commodities raise concerns that food security may be at risk in places.

- Gold prices:They were up 6.9% in the last quarter (January- March,2020) – its sixth consecutive quarterly rise. The strong investor demand propped gold up despite weak jewelry demand in India and China.

- Oil Prices:These are expected to average at $35 per barrel in 2020. The decline in crude oil prices has been exacerbated by uncertainty around production agreements among the Organization of the Petroleum Exporting Countries (OPEC) and other oil producers.

- Importers and Exporters:They are likely to see some long-term shifts in their markets due to the pandemic. These include Increasing transport costs due to enhanced border checks and thus impact on supply chains and substituting for imports with domestic goods.

- The Changing consumer behaviour, such as, people may choose to work remotely, travel less, and this could impact permanent drops in demand for oil, favourably impacting the accounts for oil importers.

- This leads to reduction in emissions of the harmful gases caused by the restrictions may also increase public pressure for greener transport and lowered fossil fuel use.

World Bank:

- The Bretton Woods Conference held in 1944, created the International Bank for Reconstruction and Development (IBRD) along with the International Monetary Fund (IMF).

- The IBRD later became the World Bank.

- The World Bank Group is a unique global partnership of five institutions working for sustainable solutions that reduce poverty and build shared prosperity in developing countries.

- It has 189 Member Countries.

Few Important Reports Released by the World Bank are:

- Ease of Doing Business

- Human Capital Index and

- World Development Report

The Development Institutions of the World Bank are:

- International Bank for Reconstruction and Development (IBRD)

- International Development Association (IDA)

- International Finance Corporation (IFC)

- Multilateral Guarantee Agency (MIGA)

- International Centre for the Settlement of Investment Disputes (ICSID)

MASKS, SANITISERS NOW ESSENTIAL COMMODITIES

14, Mar 2020

Why in News?

- The Centre recently brought masks and hand sanitisers under the Essential Commodities Act, 1955 (EC Act) in the wake of COVID-19 outbreak.

About the Essential Commodities Act:

- The Essential Commodities Act, 1955was enacted to ensure the easy availability of essential commodities to consumers and to protect them from exploitation by unscrupulous traders.

- The Act provides for the regulation and control of production, distribution and pricing of commodities which are declared as essential.

- Essential items under the Act include drugs, fertilisers, pulses and edible oils, and petroleum and petroleum products.

- The Act aim at maintaining/increasing supplies/securing equitable distribution and availability of these commodities at fair prices.

- Centre invokes the ECA Act’s provisions to impose stock limits in case of price/quantity distortions in the market to ensure adequate availability of essential commodities at reasonable prices.

- States are the implementing agenciesto implement the EC Act, 1955 and the Prevention of Black marketing & Maintenance of Supplies of Essential Commodities Act, 1980, by exercising powers delegated to them.

- The list of essential commodities is reviewed from time to timewith reference to their production and supply and in consultation with concerned Ministries/Departments.

- Currently, the restrictions like licensing requirement, stock limits and movement restrictions have been removed from almost all agricultural commodities.

- Exemptions:Wheat, pulses and edible oils, edible oilseeds and rice are certain exceptions.

- The recent amendment to the Legal Metrology (Packaged Commodities) Rules 2011 is linked to the ECA. The Government can fix the retail price of any packaged commodity that falls under the ECA.

What Masks and Sanitisers under ESA?

- Taking note of the fact that masks (2ply and 3ply surgical masks and N95 masks) and hand sanitisers are not easily available and vendors are charging exorbitant prices for them, the government declared these items as essential commodities till June 30 under the EC Act.

What are its Impact?

- Under this Act, the States and Union Territories can ask manufacturers to enhance their production capacity so that these products are widely available to consumers.

- Under the Act, an offender may be punished with an imprisonment up to seven years.

- The Consumer Affairs Ministry has also invoked the Prevention of Black marketing and Maintenance of Supplies of Essential Commodities Act, 1980 which would carry out action against those involved in overpricing and black marketing of the products.

Arguments against ECA:

- An archaic law:Essential Commodities Act has been in existence since 1955, when the economy was very different from what it is today. It was an economy ravaged by famine and food shortages.

- Difference between storage and hoarding:Recently there is evidence of interventions not working. It is because there is a distinction between storage and hoarding.

- As compared to older times, when the economy experiences acute shortages, today many shortage cases are actually that of hoarding.

- Stock limits led to onion price volatility:To control soaring prices of onions over the last few months, centre through ECA imposed stock limits on onions. Instead of decreasing prices, this actually increased price volatility.

- Although the restrictions on both retail and wholesale traders were meant to prevent hoarding and enhance supply in the market, the Survey showed that there was actually an increase in price volatility and a widening wedge between wholesale and retail prices.

- Lower stock limit led traders and wholesalers to immediately offload most of the kharif crop which led to a sharp increase in the volatility.

- Disincentivises storage infrastructure development:With too-frequent stock limits, traders may have no reason to invest in better storage infrastructure in the long run.

- Also, food processing industries need to maintain large stocks to run their operations smoothly. Stock limits curtail their operations. In such a situation, large scale private investments are unlikely to flow into food processing and cold storage facilities.

- Higher prices of medicines:Drug Price Control Order issued under the ECA also distorted the market and actually made medicines less affordable.

- The increase in prices is greater for more expensive formulations than for cheaper ones and for those sold in hospitals rather than retail shops.

- Rent seeking and Low conviction rates:Despite many raids conducted under the ECA in 2019, the conviction rate was abysmally low. The ECA only seems to enable rent-seeking and harassment.

Way Forward:

- Adequate supply:Given that almost all crops are seasonal, ensuring round-the-clock supply requires adequate build-up of stocks during the season.

- Without the ECA the common man would be at the mercy of opportunistic traders and shopkeepers.

- Genuine shortages:There can be genuine shortages triggered by weather-related disruptions in which case prices will move up.

- So, if prices are always monitored, farmers may have no incentive to farm.

- Difficult to differentiate between hording and shortage:It may not always be possible to differentiate between genuine stock build-up and speculative hoarding.

MICRO-IRRIGATION HIT BY LACK OF FUNDS

11, Mar 2020

Why in News?

- The prevailing economic slowdown appears to have affected the implementation of the projects to provide drip and sprinkler implements to farmers in state of Telangana.

Highlights:

- For providing the drip and sprinkler implements to the targeted extent of land, an amount of Rs 669 crore is required, including RS 270 crore contribution of the Centre and about Rs 400 crore share of the State.

Micro-irrigation:

- Drip irrigation is a type of micro-irrigation system that has the potential to save water and nutrients by allowing water to drip slowly to the roots of plants, either from above the soil surface or buried below the surface.

- The goal is to place water directly into the root zone and minimize evaporation. Drip irrigation systems distribute water through a network of valves, pipes, tubing, and emitters.

- Depending on how well designed, installed, maintained, and operated it is, a drip irrigation system can be more efficient than other types of irrigation systems, such as surface irrigation or sprinkler irrigation.

Advantages:

- Fertilizer and nutrient loss is minimized due to a localized application and reduced leaching.

- Water application efficiency is high if managed correctly. Field leveling is not necessary.

- Fields with irregular shapes are easily accommodated. Recycled non-potable water can be safely used.

- Moisture within the root zone can be maintained at field capacity. Soil erosion is lessened.

- Weed growth is lessened. Water distribution is highly uniform, controlled by the output of each nozzle.

- Labour cost is less than other irrigation methods.

Disadvantages:

- Initial cost can be more than overhead systems.

- The sun can affect the tubes used for drip irrigation, shortening their lifespan.

- If the water is not properly filtered and the equipment not properly maintained, it can result in clogging or bio clogging.

- Drip tape causes extra clean-up costs after harvest. Users need to plan for drip tape winding, disposal, recycling or reuse.

- In lighter soils subsurface drip may be unable to wet the soil surface for germination. Requires careful consideration of the installation depth.

- The PVC pipes often suffer from rodent damage, requiring replacement of the entire tube and increasing expenses.

MADRAS HC DISMISSES M. P’S PLEA ON GI TAG FOR BASMATI RICE

10, Mar 2020

Why in News?

- The Madras High Court has set aside the State of Madhya Pradesh and the Madhya Shetra Basmati Growers Association plea to restrict the production of Basmati rice to certain regions in the Indo-Gangetic plain.

About Basmati Rice:

- It is one of the best known varieties of rice all across the globe.

- It is a long grain rice which has its origin from India and some parts of Pakistan.

- It has a unique position in the rice world due to its price, fragrance, grain morphology as well as quality.

- Basmati rice has a unique fragrance and flavour caused due to the presence of a chemical called 2-acetyl-1-pyrroline.

- This chemical is found in basmati rice at about 90 parts per million (ppm) which is 12 times more than non-basmati rice varieties.

- Basmati rice needs specific climatic conditions to grow which is why it is cultivated in selected regions of India.

- It is cultivated in the states of Himachal Pradesh, Punjab, Haryana, Delhi, Uttarakhand, Madhya Pradesh, Jammu and Kashmir and western Uttar Pradesh (Indo Gangetic Plains).

Production of Basmati Rice in India:

- India is the largest producer of Basmati rice with about 70 per cent share in global production.

- Basmati rice constitutes one of India’s significant exports both in terms of soft power and hard money.

- India is leading exporter of Basmati rice in the global market.

- During 2016-17, India exported 40, 00,471.56 MT of Basmati Rice.

- Major Export Destinations in 2016-17 included Saudi Arabia, Iran, United Arab Emirates, Iraq and Kuwait.

- According to a report, the Indian Basmati rice industry is on the verge of clocking its highest ever export of around 30,000 crore rupees in the financial year 2019.

- India has always been involved in protecting the name Basmati as a geographic indicator. In other words, Basmati is a term that should be restricted to the product from its geographic location.

About the Issue:

- Agricultural and Processed Food Products Export Development Authority (APEDA) had initiated steps to protect and get GI recognition for Basmati cultivated in the IGP.

- It had applied for registration of GI basmati rice in its favour in May 2010.

- APEDA was established by the Government of India under the Agricultural and Processed Food Products Export Development Authority Act, passed by the Parliament in December, 1985.

- It is a statutory body under the Ministry of Commerce and Industry and is the apex organization engaged in work related to the development of export of agricultural products and processed food from India.

- It is responsible for putting in place a system for administration of GI and authentication of the product in India and abroad.

About Geographical Indication (GI):

- Geographical Indication is an insignia on products having a unique geographical origin and evolution over centuries with regards to its special quality or reputation attributes.

- It is a mark of authenticity and ensures that registered authorised users (or at least those residing inside the geographic territory) are allowed to use the popular product name.

- GI registration confers:(i) Legal protection to the products (ii) Prevents unauthorised use of a GI tags by others (iii) Helps consumers to get quality products of desired traits (iv) Promotes economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

- Legal Authorities:At international level, GI is governed by World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, GI registration is governed by the Geographical Indications of goods (Registration and Protection) Act, 1999. Darjeeling tea was the first product in India accorded with GI tag.

- Presently, there are total 218 GI tag products from India. Some of them are Mysore Silk, Mysore Pak, Thanjavaur Veena, etc.

DAIRY SECTOR IN INDIA

29, Feb 2020

Context:

- The Cabinet Committee on Economic Affairs, has given its approval for upward revision of interest subvention to 2.5% per annum under the scheme Dairy Processing and Infrastructure Development Fund with the revised outlay of Rs 11,184 Cr.

Key Facts – Dairy Sector in Budget 2020-21:

- The government aims to “facilitate” doubling of India’s annual milk processing capacity from 53.5 million tonnes (mt) to 108 mt by 2025.

- Building a seamless national cold supply chain for perishables, inclusive of milk, meat and fish, by setting up of a “Kisan Rail” – through PPP arrangements.

- There shall be refrigerated coaches in Express and Freight trains as well.

- Eliminating Foot and Mouth disease, brucellosis in cattle and also peste des petits ruminants (PPR) in sheep and goats by 2025.

- Increasing the coverage of artificial insemination from the present 30% to 70%.

- NREGA would be dovetailed to develop fodder farms.

- The Budget Estimates for the Department of Animal Husbandry and Dairying stands at 3,289 in the Budget 2020-21.

- Recently, the Ministry of Science and Technology has launched the “Scientific Utilization through Research Augmentation-Prime Products from Indigenous Cows” (SUTRA-PIC India).

- It is one of the research programmes into indigenous cattle announced during the 2019-20 Union Budget, which aims to develop products as well as improve the genetic quality of indigenous cattle breeds.

Dairy Sector in India:

- Over the span of three decades, India has transformed from a country of acute milk shortage to the world’s leading milk producer, with estimated production of milk in 2018-19 at 187 million tonnes.

- Milk production in India has been growing at over 4% annually and its share in milk production in the world has also been increased.

- This phenomenal success is attributed to the programme ‘Operation Flood’ (1970–1996) and its intense focus on dairy development activities.

- Now, India is the leading producer and consumer of dairy products globally with sustained growth over the years.

- The dairy industry and milk hold equal importance to farmers and consumers.

Major Programmes: