Category: Inflation

RETAIL INFLATION

15, Apr 2020

Why in News?

- Recently, The Consumer Price Index (CPI) data has been released by the National Statistical Office (NSO), the retail inflation in March 2020 dropped to 5.91% due to decrease in demand and lowered food prices.

Highlights:

- Its rate was based on 66% of the usual price quotations as the nationwide lockdown to counter Covid-19 pandemic had led to suspension of fieldwork for price collection after March 19,2020.

- The inflation rate in March 2020 remained within the Reserve Bank of India’s (RBI’s) medium-term target of 4±2% for Consumer Price Index (CPI) inflation, which is due to suppressed demand, especially for non-essential items, as the lockdown was imposed towards the end of March,2020.

- The inflation rose to 6.59% from 6.36% in Fuel and Light segment February 2020. The Food inflation moderated to 8.76% from 10.81% in March 2020.The inflation of various items like vegetables, spices, pulses continue to be in double digits.

- Pressure is expected due to the shortages witnessed in different centres with mandi arrivals being affected due to lockdown.

- The inflation is expected to be brought down by low energy prices and subdued economic activity. However, the food price inflation of 8.7% will tend to increase.

- It is expected that the Reserve Bank of India (RBI) undertakes further repo rate cuts. Repo Rate is the rate at which the RBI lends money to commercial banks in the event of any shortfall of funds.

- When RBI increases the repo rate, this acts as a disincentive for banks to borrow from the central bank. This ultimately reduces the money supply in the economy and thus helps in Arresting Inflation.

- The RBI reduces the repo rate in the event of a fall in inflationary pressures. Ideally, a low repo rate should translate into low-cost loans for general masses.

Inflation:

- It refers to the rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc.

- It measures the average price change in a basket of commodities and services over time.

- It is indicative of the decrease in the purchasing power of a unit of a country’s currency. This could ultimately lead to a deceleration in economic growth.

- It is measured by the Ministry of Statistics and Programme Implementation.

- It is primarily measured by two main indices — WPI (Wholesale Price Index) and CPI (Consumer Price Index) which measure wholesale and retail-level price changes.

- The CPI has five sub-groups including food and beverages, fuel and light, housing and clothing, bedding and footwear.

About the National Statistical Office:

- It is the central statistical agency of the Government mandated under the Statistical Services Act 1980under the Ministry of Statistics and Programme Implementation.

- It is responsible for the development of arrangements for providing statistical information services to meet the needs of the Government and other users for information on which to base policy, planning, monitoring and management decisions.

- Its services include collecting, compiling and disseminating official statistical information.

- All business operations in NSO are done in compliance with international standards, procedures and best practices.

DOES INDIA UNDERGOES STAGFLATION?

19, Dec 2019

Why in News?

- The recent deceleration in the economic growth and sharply rising inflation, there is a growing murmur about India facing stagflation.

What is Stagflation?

- Simply put, Stagflation is a portmanteau of stagnant growth and rising inflation.

- Typically, inflation rises when the economy is growing fast. That’s because people are earning more and more money and are capable of paying higher prices for the same quantity of goods. When the economy stalls, inflation tends to dip as well – again because there is less money now chasing the same quantity of goods.

- Stagflation is said to happen when an economy faces stagnant growth as well as persistently high inflation. In other words, the worst of both worlds. That’s because with stalled economic growth, unemployment tends to rise and existing incomes do not rise fast enough and yet, people have to contend with rising inflation. So people find themselves pressurised from both sides as their purchasing power is reduced.

Why is everyone asking about Stagflation in India?

1. Deceleration in Growth:

- Over the past six quarters, economic growth in India has decelerated with every quarter. In the second quarter (July to September), for which the latest data is available, the GDP grew by just 4.5%.

- In the coming quarter (October to December), too, GDP growth is likely to stay at roughly the same level. For the full financial year, the GDP growth rate is expected to average around 5% – a six-year low.

2. Rise in Inflation:

- Yet, in October and November, retail inflation has soared. In fact, the October inflation was a 16-month high and the November inflation, at 5.54%, is at a three-year high.

- Inflation for the rest of the financial year is expected to stay above the RBI’s comfort level of 4%.

- So, with growth decelerating every quarter and now inflation rising up every month, there are growing murmurs of stagflation.

Is India really faces Stagflation?

- Although it appears so at the first glance, India is not yet facing stagflation. The three broad reasons behind it are:

- One, although it is true that we are not growing as fast as we have in the past or as fast as we could, India is still growing at 5% and is expected to grow faster in the coming years. India’s growth hasn’t yet stalled and declined; in other words, year on year, our GDP has grown in absolute number, not declined.

- Two, it is true that retail inflation has been quite high in the past few months, yet the reason for this spike is temporary because it has been caused by a spurt in agricultural commodities after some unseasonal rains. With better food management, food inflation is expected to come down. The core inflation – that is inflation without taking into account food and fuel – is still benign.

- Lastly, retail inflation has been well within the RBI’s target level of 4% for most of the year. A sudden spike of a few months, which is likely to flatten out in the next few months, it is still early days before one claims that India has stagflation.

Structural reforms to overcome the slowdown:

- Various Suggestions to overcome the existing slowdown, as per G20s Structural Reform Agenda are as:

- 1. Advancing Labour Market Reforms, Educational Attainment and skills:

- Fixed term contracts are expected to liberalise labour markets.

- Certain States such as Rajasthan have liberalized labour markets regulations.

- Reforms in the apprentice acts.

- Central Government has come up with 4 draft legislations for comprehensive reforms in the labour sector. Focus should be also on skill development and industrial partnership for skilling of population.

- 2. Promoting trade and investment openness:

- a. Focus on improvement of logistics sector

- b. Reforms of the customs procedure and Trade Facilitation.

- c. RCEP not signed by India and growing protection across the globe has shown that more needs to be done on this front.

- 3. Encouraging Innovation:

- a. India’s ranking has improved on the Global Innovation Index.

- b. Patent fillings in India has increased but not comparable to similar economies such as China, South Korea.

- c. Patent filing procedure eased.

- d. Focus on start-ups and Innovative Firms.

- India needs to increase R&D expenditure as a percentage of GDP.

- 4. Promoting Fiscal Reform:

- a. FRBM legislation has led to intergeneration equity. However, targets are not followed strictly.

- b. State governments have abided to FRBM targets.

- c. Removal of plan and non-plan classification of budget expenditure led to better results.

- d. Outcome: Output framework to make budget expenditure more Outcome Centric.

- Targets under the FRBM law should be strictly followed. Impact analysis of expenditures incurred should be improved.

- 5. Promoting Competition and an Enabling Environment:

- a. Privatisation of Air India, Bharat Petroleum etc.

- b. Strategic disinvestment of PSUs.

- c. FDI reforms for liberalization of entry of foreign firms into the country.

- d. Competition Commission of India has improved the competitive landscape in India.

- Enhanced competition can be introduced by further boosting FDI in the country. Domestic firms can be made more competitive by dismantling the loss making PSUs. Opening up of restricted sectors such as coal, railways, oil marketing, electricity distribution etc.

- 6. Improving Infrastructure

- a. Proposal to spend 1 Trillion dollar on the infrastructure in this budget.

- b. Focus on highway development: Bharatmala scheme, removal of blind spot, transition to Fastag, Transition to electric mobility planned.

- c. Investment in Railway sector: Dedicated Freight Corridor, High-speed Rail Networks.

- d.Sagarmala Scheme to boost the port sector.

- India has made good improvement in its infrastructure. However, more needs to be done as India is still a infrastructure deficit country. Focus should be on early completion of projects and availability of finance for ease terms for infrastructure.

- 7. Strengthening the Financial System:

- a. Capitalisation of Public Sector Banks

- b. Relaxation of banking licenses- licenses to payment banks, Small Finance banks.

- c. Insolvency and Bankruptcy code altered the creditor and debtor relations.

- d. FRBM caps on government spending

- e. Inflation targeting in monetary policy led to curbing inflation in the economy in a sustainable way.

- f. GST reforms led to widespread reforms in the indirect tax regime and led to economic integration of the country.

- Suggestions of the NK Singh Committee should be followed. FRBM legislation should be strictly enforced.

- 8. Enhancing Environmental Sustainability:

- a. EIA and forest clearance

- b. Increasing pollution in the urban areas, Threat of climate change.

- c. Loss of Biodiversity

- India is a signatory to Paris Climate Deal where India has committed to increasing share of renewable energy sources in the overall energy mix, intensification of forests, and reducing overall the carbon intensity of the economy.

- Targets under the Paris Climate deal and Sustainable development goals should be followed. Strict enforcement of EIA and forest clearance.

- 9. Governance Reforms

- a. Reforms of the civil service to make them more responsive, sensitive

- b. Making citizens more empowered by RTI act, Lokpal Act, Citizen charter etc.

- c. Corruption: Reforms in the Benami Property Act, Fugitive Economic Offenders Act, Prevention of Corruption act.

- d. Empowerment of local governments.

- This is the mother of all structural reform required in the economy which is expected to have most lasting impact. The suggestions of various committees such as ARC II, Punchii Commission etc should be followed. Necessity of political will.

RBI KEEPS INTEREST RATES UNCHANGED

06, Dec 2019

Why in News?

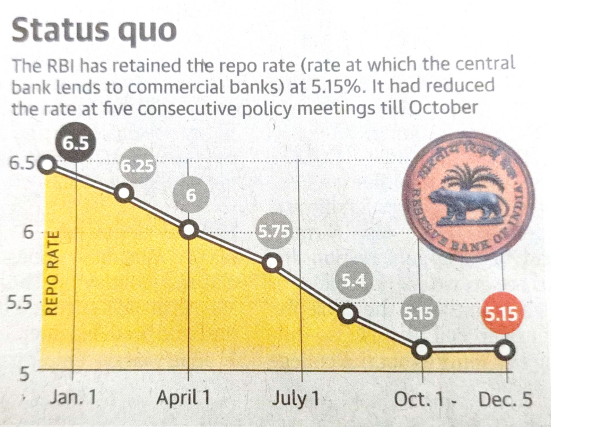

- The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) decided to keep the interest rate unchanged at 5.15% in the fifth bimonthly policy review, citing inflation concerns despite economic growth continuing to slow down.

Instruments for implementing Monetary Policy:

- Repo Rate: The (fixed) interest rate at which the Reserve Bank provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- Reverse Repo Rate: The (fixed) interest rate at which the Reserve Bank absorbs liquidity, on an overnight basis, from banks against the collateral of eligible government securities under the LAF.

- Liquidity Adjustment Facility (LAF): The LAF consists of overnight as well as term repo auctions. Progressively, the Reserve Bank has increased the proportion of liquidity injected under fine-tuning variable rate repo auctions of a range of tenors.

- The aim of term repo is to help develop the inter-bank term money market, which in turn can set market-based benchmarks for pricing of loans and deposits, and hence improve the transmission of monetary policy.

- The Reserve Bank also conducts variable interest rate reverse repo auctions, as necessitated under the market conditions.

- Marginal Standing Facility (MSF): A facility under which scheduled commercial banks can borrow an additional amount of overnight money from the Reserve Bank by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest.

- This provides a safety valve against unanticipated liquidity shocks to the banking system.

- Corridor: The MSF rate and reverse repo rate determine the corridor for the daily movement in the weighted average call money rate.

- Bank Rate: It is the rate at which the Reserve Bank is ready to buy or rediscount bills of exchange or other commercial papers. The Bank Rate is published under Section 49 of the Reserve Bank of India Act, 1934. This rate has been aligned to the MSF rate and, therefore, changes automatically as and when the MSF rate changes alongside policy repo rate changes.

- Cash Reserve Ratio (CRR): The average daily balance that a bank is required to maintain with the Reserve Bank as a share of such percent of its Net demand and time liabilities (NDTL) that the Reserve Bank may notify from time to time in the Gazette of India.

- Statutory Liquidity Ratio (SLR): The share of NDTL that a bank is required to maintain in safe and liquid assets, such as unencumbered government securities, cash and gold. Changes in SLR often influence the availability of resources in the banking system for lending to the private sector.

- Open Market Operations (OMOs): These include both, outright purchase and sale of government securities, for injection and absorption of durable liquidity, respectively.

- Market Stabilisation Scheme (MSS): This instrument for monetary management was introduced in 2004. Surplus liquidity of a more enduring nature arising from large capital inflows is absorbed through the sale of short-dated government securities and treasury bills. The cash so mobilised is held in a separate government account with the Reserve Bank.

About Monetary Policy Committee:

- The policy interest rate required to achieve the inflation target is decided by the Monetary Policy Committee (MPC).

- MPC is a six-member committee constituted by the Central Government (Section 45ZB of the amended RBI Act, 1934) – three officials of the Reserve Bank of India and three external members nominated by the Government of India.

- The MPC is required to meet at least four times in a year. The quorum for the meeting of the MPC is four members.

- Each member of the MPC has one vote, and in the event of an equality of votes, the Governor has a second or casting vote.

- The resolution adopted by the MPC is published after the conclusion of every meeting of the MPC.

- Once in every six months, the Reserve Bank is required to publish a document called the Monetary Policy Report to explain: (1) the sources of inflation and(2) the forecast of inflation for 6-18 months ahead.

Decisions Taken by MPC:

- The MPC recognises that there is monetary policy space for future action.

- However, given the evolving growth-inflation dynamics, the MPC felt it appropriate to take a pause at this juncture.

- The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target”.

Current Economic Situation:

- Inflation forecast had been raised to 5.1-4.7% for H2:2019-20 and 4.0-3.8% for H1:2020-21, with risks broadly balanced, the RBI said.

- In October, CPI inflation was projected at 3.5-3.7% for H2:2019-20 and 3.6% for Q1:2020-21.

- Growth forecast for the current financial year was revised downward sharply — from 6.1% projected in October policy to 5%.

CABINET HIKES DEARNESS ALLOWANCE BY 5%

10, Oct 2019

Why in News?

- The Union Cabinet decided to increase the Dearness Allowance (or DA) that it pays its current employees and existing pensioners by 5 percentage points.

- Accordingly, 50 lakh central government employees and 65 lakh pensioners will henceforth receive 17% of their basic salary as DA instead of 12%.

What is DA and how is it calculated?

- DA is provided by the government to its employees to cushion the impact of the rising cost of living. Inflation (or rate of increase in prices) eats away the buying power of money; hence the justification for DA.

- For instance, if the annual inflation is 5%, it means that a commodity that cost Rs 100 in the first year, would cost Rs 105 in the second. If the employee has a salary that allows her to spend Rs 100 on that commodity, she will be able to buy that commodity in the first year.However, in the second year, that Rs 100 will no longer be enough for the employee to buy that commodity, which now costs Rs 105, thanks to the inflation rate. It is to compensate for this gap that the government pays DA to its employees.

- To calculate DA, the government typically uses the All India Consumer Price Index-based inflation rate as a broad marker. For greater effectiveness, the DA is revised twice a year.

Possible Positive Impacts on the Economy:

- An increase in DA provides additional money in the hands of government employees. If all this additional money is spent, it will have a positive impact on the sagging consumption demand, which the biggest problem in the economy right now.

- However, the impact will depend on whether — and to what extent — employees actually spend this money. It is possible that given the prevalent sentiment of insecurity, they may choose to simply save it in their bank accounts. But given that deposit rates on short-term savings are being cut, it seems likely that people would choose to spend, rather than save.

- But even if all this money is simply kept in the banks, it will help the economy by bolstering the flow of funds to the banking system.

Possible Negative Impacts on the Economy:

- This money will come out of the government’s coffers. And to the extent that this will hit the resources available with the government, it will constrain economic activity.

- For example, under the current circumstances, when government is finding it difficult to raise revenues, an additional outgo for DA will either push the government to borrow money from the market — thus leaving less money to be lent to private businessmen and businesswomen — or it will come as the cost of some other expenditure such as the spending that could have built more roads or more schools.

Working Group for Revision of WPI

29, Jun 2019

Why in news?

- The Government of India has decided to constitute a Working Group for the revision of the current series of Wholesale Price Index (Base 2011-12).

Highlights:

- The current series of Wholesale Price Index (WPI) with 2011-12 as base year was introduced in May 2017. Since 2011-12, significant structural changes have taken place in the economy.

- Therefore, it has become necessary to examine the coverage of commodities, weighting diagram and related issues pertaining to the existing series of index numbers of Wholesale Price Index.

- Accordingly, Government has constituted the Working Group for the revision of current series of Wholesale Price Index (Base 2011-12) under Chairmanship of Dr. Ramesh Chand, Member, Niti Aayog

- The Office of Economic Adviser, Department for Promotion of Industry & Internal Trade will be the nodal office for the Working Group and will process the report / recommendation of the Group for further necessary action.

The Terms of Reference of the Working Group:

- To select the most appropriate Base Year for the preparation of a new official series of Index Numbers of Wholesale Price (WPI) and Producer Price Index (PPI) in India.

- To review commodity basket of the current series of WPI and suggest additions / deletions of commodities in the light of structural changes in the economy witnessed since2011-12

- To review the existing system of price collection in particular for manufacturing sector and suggest changes for improvement.

- To decide on the computational methodology to be adopted for monthly WPI/PPI.

- To examine the existing methodology of compilation of PPI approved by Technical Advisory Committee on Series of Prices and Cost of Living and suggest further improvement in compilation and presentation.

- The Working Group may recommend roadmap for switch over from WPI to PPI.

- To examine the method of computing linking factor adopted so far and suggest appropriate change in method of computing linking factor, if necessary.

- To suggest any other improvements as may be necessary for enhancing the reliability of the official series of WPI / PPI.

CPI INFLATION QUICKENS TO SIX-MONTH HIGH OF 2.92% ON FOOD, FUEL PRICES

14, May 2019

Why in News:

- Retail inflation quickened to a six-month high of 2.92% in April, driven in large part by accelerating food and fuel inflation,

Details:

- Growth in the consumer price index (CPI) quickened in April from 2.86% in March. Moreover, food inflation continued to rise with sustained upward momentum in fruits and vegetables.

Consumer Price Index (CPI):

- Consumer Price Index (CPI) is based on the final prices of goods at the retail level. Because of the wide disparities in the consumption baskets for different segment of consumers, India has adopted four CPIs

- CPI (Industrial Workers)

- CPI (Urban Non- Manual Employees) CPI (Agricultural Labour)

- CPI (Rural Worker)

- In India, RBI uses CPI (combined) released by CSO for inflation purpose with base year as 2012.

Wholesale Price Index (WPI):

- Wholesale Price Index (WPI) is based on the price prevailing in the wholesale markets or the price at which bulk transactions are made.

- It includes three components

- Manufactured products

- Primary Articles

- Fuel and power

- It is measured by Ministry of commerce and industry with base year as 2011-12

- Data on Wholesale Price Index (WPI) is available every week, while data on Consumer Price Index (CPI) is only available every month, so there is a time lag in CPI data availability compared to WPI data availability, which can impact decision making both for RBI and the Government of India.

Inflation:

- Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, Each unit of currency buys fewer goods and services. This implies that: The purchasing power of money gets eroded. There is a loss in real value of money as medium of exchange and unit account in the economy. Inflation has good as well as bad impacts for economy.