Category: Investments, Investment models

Declining Consumer Demand and Reluctant Investors

09, Nov 2022

Why in News?

- In September, Finance Minister Nirmala Sitharaman was anguished that industry was holding back from investing in manufacturing despite a significant cut in corporate tax rates in 2019.

Analyzing the corporate Investment since the pandemic:

- Less investment is not the result of losses: The slowdown in corporate investment did not happen because companies were making losses.

- More profit but less investments by corporates: In fact, private companies, boosted by considerable tax cuts, made windfall profits. A State Bank of India analysis shows that tax cuts contributed 19% to the top line of companies during the pandemic. But this did not result in increased investments.

- Dividends to shareholders: Before the pandemic, instead of investing in themselves, companies chose to reward shareholders with higher dividends.

- Investment in equity and debt instead of Infrastructure: During the pandemic, they did not use the profits for paying out dividends; they retained a big chunk of the profits. However, instead of investing in buildings, plants and machinery, they invested in equity shares and debt instruments.

- Corporate cited the slowdown in demand as reason for less investment: So, both before and after the outbreak, they shied away from capital investments. The hesitancy to invest can be explained by a slowdown in the demand side of the economy.

- Corporates didn’t invest in long term returns sectors: Consumer demand started to decline the year before the pandemic and worsened after the COVID19 outbreak. This forced companies to use the increased profits to decrease their debts, pay dividends and invest in financial instruments instead of increasing productivity by making capital investments.

What is the current consumer’s demand situation?

- Average Consumer sentiment index: Private companies invest when they are able to estimate profits, and that comes from demand. The Centre for Monitoring Indian Economy’s (CMIE) consumer sentiment index is still below pre-pandemic levels but is far higher than what was seen 12-18 months ago.

- Buoyant Aggregate demand: RBI’s Monetary policy report dated September 30 says, Data for Q2 (ended Sept) indicate that aggregate demand remained buoyant, supported by the ongoing recovery in private consumption and investment demand. It shows that seasonally adjusted capacity utilization rose to 74.3% in Q1 the highest in the last three years.

- High household savings: Along with household savings intentions remaining high, might hold the key to the investment cycle kicking in.

Statistic on demand and investment:

- New investment projects: The new investment projects announced as a % of GDP, since FY18, the share has remained below the 5% mark, compared to over 9% between FY05 and FY22.

- Collection of corporate tax decreased: Corporate tax and income tax collected in India as a % of GDP after the cut in 2019, the share of corporate tax declined dramatically, while the share of income tax gradually increased.

- Double burden on tax payers: The shift in tax burden from the corporates to the people came at a time of job losses and reduced income levels. This pushed more people into poverty.

- Corporate profit increased after tax cut: Profit after tax earned by non-financial private companies in ₹ trillion after the tax cut, the profits of these companies rose to ₹4-5 trillion in the last two financial years from ₹1-2 trillion in many of the previous periods.

- Increase and decrease in dividend to shareholders: Dividends paid by non-financial private companies as a share of profits earned after tax, Payouts to shareholders surged in FY20, the year before the pandemic, but reduced in the following years.

- Profit retention increased: Retained profits as a % of profit after tax surged to 63% in FY22 the highest in a decade (limited companies were analyzed in FY22, so data are provisional).

- Profits are invested in equities: In FY21, the debt-to-equity ratio came down to 0.86 the lowest in at least three decades. In FY22 (provisional data), it came down further to 0.71.

- Year on year decline in capital investment: Year on year change in the investments of non-financial private companies in fixed assets such as buildings, plants, machinery, transport and infrastructure have declined in recent years. But the year on year change in investments in financial instruments such as equity, debt and mutual funds have surged.

Conclusion:

- Corporates are holding their pockets in hope of demand rise in future. However, this affects the post-pandemic recovery of economy. IMF and RBI was right to revise their growth forecast this year. Unequal recovery of economy have certainly affected the income levels of middle class. Government has taken a lot of step on supply side (corporate side and banking reform) but no intervention in revival of demand.

Green Bonds to have Long Tenure, says Centre

07, Feb 2022

Why in News?

- Asserting that the issuance of sovereign green bonds is part of the government’s overall borrowing programme, Economic Affairs Secretary Ajay Seth has said these rupee-denominated papers will have long tenure to suit the Requirement of Green Infrastructure Projects.

About the News:

- Finance Minister Nirmala Sitharaman in her Budget speech announced that the government proposes to issue sovereign green bonds to mobilise resources for green infrastructure.

- The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy which is a part of the overall borrowing for the Next Financial Year.

What is a Green Bond?

- A green bond is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects.

- These bonds are typically asset-linked and backed by the issuing entity’s balance sheet, so they usually carry the same credit rating as their issuers’ other debt obligations.

- Green bonds may come with tax incentives to enhance their attractiveness to investors.

- The World Bank is a major issuer of green bonds. It has issued 164 such bonds since 2008, worth a combined $14.4 billion. In 2020, the total issuance of green bonds was worth almost $270 billion, according to the Climate Bond Initiative.

How Does a Green Bond Work?

- Green bonds work just like any other corporate or Government Bond.

- Borrowers issue these securities in order to secure financing for projects that will have a positive environmental impact, such as ecosystem restoration or reducing pollution.

- Investors who purchase these bonds can expect to make as the bond matures.

- In addition, there are often Tax Benefits for Investing in Green Bonds.

Green Bonds Vs Blue Bonds:

- Blue bonds are sustainability bonds to finance projects that protect the ocean and related ecosystems.

- This can include projects to support sustainable Fisheries, protection of coral reefs and other Fragile Ecosystems, or reducing Pollution and Acidification.

- All blue bonds are green bonds, but not all Green Bonds are blue bonds.

Green Bonds Vs Climate Bonds:

- “Green bonds” and “climate bonds” are sometimes used interchangeably, but some authorities use the latter term specifically for projects focusing on reducing carbon Emissions or Alleviating the effects of Climate Change.

FOREIGN PORTFOLIO INVESTORS (FPIS)

05, May 2020

Why in News?

- Recently, the Foreign Portfolio Investors (FPIs) have significantly reduced the pace of outflows from the equity and debt market in April, 2020, according to the data from Central Depository Services Limited (CDSL).

Highlights:

- The Foreign Portfolio Investers sold a net of Rs 6,883 crore from the equities market and net holdings worth Rs 12,551 crore from the debt market in April.

- Equity market: Its shares are issued and traded, either through exchanges or over-the-counter markets (i.e directly). It is also known as the stock market.

- Debt market: It is the market where debt instruments are traded. Debt instruments are instruments that require a fixed payment to the holder, usually with interest. E.g. bonds (government or corporate) and mortgages.

- However, they invested a net of Rs 4,032 crore in debt Voluntary Retention Route (VRR) scheme.

- VRR scheme allows FPIs to participate in Repo Transactions and also invest in Exchange Traded Funds that Invest in Debt Instruments.

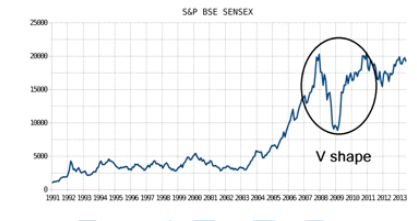

- The success on developing medicine and vaccines will lead to a V-shaped recovery in the Economy and Markets.

About Voluntary Retention Route (VRR) Scheme:

- It is aimed at attracting long-term and stable FPI investments into debt markets.

- Its Investment route will be free of the regulatory norms applicable to FPI investments in debt markets, provided investors maintain a minimum share of their investments for a fixed period.

- It has a minimum retention period of three years and investors need to maintain a minimum of 75% of their investments in India

- FPIs registered with Securities and Exchange Board of India (SEBI) are eligible to voluntarily invest through the route in government and corporate bonds.

About V-Shaped Recovery:

- It is characterized by a sharp economic decline followed by a quick and sustained recovery.

- The recession of 1953 is an example of a V-shaped recovery.

- It is different from an L-shaped recovery, in which the economy stays in a slump for a prolonged period of time.

About Foreign Portfolio Investment:

- It consists of securities and other financial assets passively held by foreign investors.

- It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market.

- It is part of a country’s capital account and is shown on its Balance of Payments (BOP).

- The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- Its investor does not actively manage the investments through FPIs, he does not have control over the securities or the business. The investor’s goal is to create a quick return on his money.

- It is more liquid and less risky than Foreign Direct Investment (FDI).

About Foreign Direct Investment (FDI):

- It is an investment made by a firm or individual in one country into business interests located in another country.

- It lets an investor purchase a direct business interest in a foreign country.

- It is often referred to as “hot money” because of its tendency to flee at the first signs of trouble in an Economy.

- Bout FPI and FDI are important sources of funding for most economies. Foreign capital can be used to develop infrastructure, set up manufacturing facilities and service hubs, and invest in other productive assets such as machinery and equipment, which contributes to economic growth and stimulates employment.

INDIAN TRADE CURBS AGAINST WTO PRINCIPLES, SAYS CHINA

21, Apr 2020

Why in News?

- China has recently stated that India’s recently adopted policy to curb opportunistic takeovers of domestic companies goes against the principles of the World Trade Organisation (WTO).

What is the Issue?

- The Government has amended certain sections of the FDI policy for curbing opportunistic takeovers/acquisitions of Indian companies due to the current COVID-19 pandemic.

- While India shares a land border with Pakistan, Bangladesh, Myanmar, Nepal, Bhutan, China and Afghanistan, the move appears directed mostly at China.

What were the Changes Introduced?

- All FDI proposals from countries sharing border with India will be under the government approval route.

- The so-called automatic route, under which the central bank simply had to be informed after money was invested, has been blocked in such cases.

- Companies whose beneficial ownership also lies in such countries will have to undergo government scrutiny for any change in Foreign Holding.

How was the FDI Policy for Neighbours so far?

- A non-resident entity can invest in India, subject to the FDI Policy except in those sectors/activities which are prohibited.

- However, a citizen of Bangladesh or an entity incorporated in Bangladesh can invest only under the Government route.

- Further, a citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the Government route, in sectors/activities other than defence, space, atomic energy and sectors/activities prohibited for foreign investment.

What Would be the Impact?

- The amended policy makes every type of investment by Chinese investors subject to government approval. Such a blanket application could create unintended problems.

- It does not distinguish between Greenfield and Brownfield investments. It may pose obstacles to Greenfield investments where Chinese investors bring fresh capital to establish new factories and generate employment in India.

- Greenfield investments include building new production facilities in a foreign country. It refers to investment in a manufacturing, office, or other physical company-related structure or group of structures in an area where no previous facilities exist.

- Brownfield investments are those used for purchasing or leasing existing production facilities to launch a new production activity.

- The new policy does not distinguish between the different types of investors, such as industry players, financial institutions, or venture capital funds. The restrictions on Venture capital funds may impact the prospects of many start-ups in the Indian market.

Why Chinese investment in India is Targeted?

- China’s footprint in the Indian business space has been expanding rapidly, especially since 2014.

- The Chinese investment in India in 2014 stood at $1.6 billion. This involved mostly investment from Chinese state-owned players in the infrastructure space in India.

- By 2017, the total investment had increased five-fold to at least $8 billion accompanied by a marked shift from a state-driven to market-driven approach.

- Total current and planned Chinese investment in India has crossed $26 billion in March 2020.

What is China’s Point on WTO Trade Violation?

- The additional barriers set by Indian side for investors from specific countries violate WTO’s principle of non-discrimination, and go against the general trend of liberalisation and facilitation of trade and investment.

- India also do not conform to the consensus of the G20 leaders and Trade Ministers to realise a free, fair, non-discriminatory, transparent, predictable and stable trade and investment environment, and to keep our markets open.

PUBLIC PROCUREMENT POLICY & E-AUCTION

01, Feb 2020

Context:

- Public Procurement policy aims at incentivizing production linked through local content requirements, thereby encouraging domestic manufacturers’ participation in public procurement activities over entities merely importing to trade or Assemble Items.

- Various Ministries and Departments have been designated as nodal for notifying minimum local content for the relevant product categories.

- The Government has notified Public Procurement Policy for Micro and Small Enterprises as well.

- Under this policy, 25% of annual procurement by Central Ministries/Departments/Public Sector Enterprises has to be made from Micro & Small enterprises.

What is Public Procurement?

- Public procurement refers to the process by which governments and state-owned enterprises purchase goods and services from the private sector.

- As public procurement utilises a substantial portion of taxpayers’ money, governments are expected to follow strict procedures to ensure that the process is fair, efficient, transparent and minimises wastage of public resources.

How does this Promote MSEs?

- The Public Procurement Policy for MSMEs has mandated that every Central Ministry/Department/PSU shall set an annual goal of minimum 25 percent of the total annual purchases from the products or services produced or rendered by MSEs.

- Out of the total annual procurement from Micro and Small Enterprises, 3 percent from within the target shall be earmarked for procurement from Micro and Small Enterprises owned by women.

- A sub-target of 4% out of annual procurement is earmarked for procurement from MSEs owned by SC/ST entrepreneurs.

What is GEM?

- Government e-Marketplace (GeM) is a one stop portal to facilitate online procurement of common use Goods & Services required by various Government Departments / Organizations / PSUs.

- GeM aims to enhance transparency, efficiency and speed in public procurement. It provides the tools of e-bidding, reverse e-auction and demand aggregation to facilitate the government users achieve the best value for their money.

GeM Advantages For Buyers

- Offers rich listing of products for individual categories of Goods/Services

- Makes available search, compare, select and buy facility

- Enables buying Goods and Services online, as and when required.

- Provides transparency and ease of buying

- Ensures continuous vendor rating system

- Up-to-date user-friendly dashboard for buying, Monitoring Supplies and Payments

- Provision of Easy Return Policy

GeM Advantages for Sellers

- Direct access to all Government Departments.

- One-stop shop for marketing with Minimal Efforts

- One-stop shop for bids / reverse auction on products / services

- New Product Suggestion facility available to Sellers

- Dynamic Pricing:Price can be changed based on market conditions

- Seller friendly dashboard for selling, and monitoring of supplies and payments

- Consistent and uniform Purchase Procedures

How does GeM Portal help MSEs?

- Reduce Transaction Costs:Government e-Marketplace portal has reduced the transaction cost of the MSEs which are involved in the marketing and delivering of products to any public agency.

- Transparency:It had also made the public procurement process transparent, where there is an equal competition between various MSEs.

- Reduce Time Taken:The GeM portal has reduced the time taken for the public procurement process and the red tape involved with it.

- Public procurement worth Rs 50,000 crore is expected to take place through GeM during 2019-20, up from Rs 33,366 crore in 2018-19.

Difficulties faced by the MSEs in GeM

- Delay in Payments:The delay in payments for the goods or services purchased increases the business of the MSEs.

- Minimum Requirements: The certain criteria laid down by the buyers makes it difficult for the new entrants and other MSEs to comply and qualify, as they are of high standards.

- Digital Hassles:Different GeM versions were launched from time to time with improvements, where MSEs finds it difficult to shift from one online platform to Another.

What is “GeM StartUp Runway”?

- Launched in February 2019, it is a unique concept initiated by Government e Marketplace in partnership with Startup India, to promote entrepreneurship through innovation.

- It enables the Start Ups to offer products & services that are unique in- Concept, design, process, and functionality.

- The current system appears to be complex due to the operational hassles in the implementation.

- The system is moving towards transparency, accountability, and improved ease of doing business. In this time, the government needs a standardized procedures and rules, sufficient procurement professionals, and a robust grievance redressal mechanism to take it further.

COAL MINING AND ITS INVESTMENTS

10, Jan 2020

Why in News?

- Recently, the Union Cabinet has approved the ordinance that amends the Mines and Minerals (Development and Regulation) Act, 1957 and the Coal Mines (Special Provisions) Act, 2015.

About Coal Mining and its Investments:

- The Mines and Minerals (Development and Regulation) Act, 1957: It regulates the mining sector in India and specifies the requirement for obtaining and granting mining leases for mining operations.

- The Coal Mines (Special Provisions) Act, 2015: It is an act that provides for allocation of coal mines and vesting of the right, title and interest in and over the land and mine infrastructure together with mining leases to successful bidders with a view to ensure continuity in coal mining operations and production of coal.

Key Points of the Amendment:

- Democratizing the coal mining sector– Previously, the government used to auction coal and lignite mining licences only to companies engaged in iron and steel, power coal washing sectors. Now, it had been opened to all.

- Allowing FDI:It will promote foreign direct investment in the sector. This will help India gain access to sophisticated technology for underground mining used by global miners. It may also bring an end to state-run Coal India Ltd’s (a Maharatna company) monopoly in the sector.

- Improving the Production:The government aims at greater participation in commercial mining of coal and targets 1000 Million Tonnes (MT) coal production by Financial Year (FY) 2023 -24. The country produced 730 million tonne of coal in 2018-19.

- Moving towards import substitution:It will boost both production and mining efficiency besides substituting import of coal worth Rs 30,000 crore. Despite having the world’s fourth largest coal reserves, India imported 235 million tonnes (mt) of coal in 2019.

- Improving the competitiveness:The steel industry would get cheaper inputs, leading to an increase in ‘competitiveness’.

- Extending the policy of composite mining licence to the coal sector – Previously, the policy of composite mining licence was in force for unexplored blocks of most non-coal minerals.

- What is Composite Mining Licence? – Composite Mining Licence is a prospecting license which is followed by a grant of Mining Lease. It will add to the certainty of tenure from the prospecting to the production stages.

Background:

Ownership of Mineral:

- The Central Government is the owner of the minerals underlying the ocean within the territorial waters or the Exclusive Economic Zone of India.

- The State Governments are the owners of minerals located within the boundary of the State concerned. They grant mineral concessions for all the minerals located within the boundary of the State, under the provisions of the Mines and Minerals (Development and Regulation) Act, 1957 and Mineral Concession Rules, 1960.

- Though for the minerals specified in the First Schedule to the Mines and Minerals (Development and Regulation) Act, 1957 approval of the Central Government is necessary. Schedule I contains minerals such as coal and lignite, minerals of the “rare earths” group containing Uranium and Thorium.

- Also, the Central Government notifies certain minerals as ‘minor’minerals from time to time for which the absolute powers for deciding on procedures of seeking applications for and granting mineral concessions, fixing rates of royalty, dead rent, and power to revise orders rest only with the State Government. Example of minor minerals include building stones, gravel, ordinary clay, ordinary sand.

Coal in India:

- It is the main source of energy in India. This fossil fuel is found in a form of sedimentary rocks and is often known as ‘BlackGold’.

- It can be classified on the basis of carbon content as follows:

- Anthraciteis the best quality of coal which carries 80 to 95% carbon content. It has the highest calorific value. It is found in small quantity in Jammu and Kashmir.

- Bituminouscarries 60 to 80% of carbon content and a low level of moisture content. It is widely used and has high calorific value. It is found in Jharkhand, West Bengal, Odisha, Chhattisgarh and Madhya Pradesh.

- Ligniteis often brown in colour. It carries 40 to 55% carbon content. It has high moisture content so it gives smoke when burnt. It is found in Rajasthan, Lakhimpur (Assam), and Tamil Nadu.

- Peathas less than 40% carbon content. It has low calorific value and burns like wood.

MINISTRY OF SKILL DEVELOPMENT SKILLS BUILD PLATFORM IN COLLABORATION WITH IBM

16, Dec 2019

Why in News?

- India is the 4thcountry where Skills Build platform was launched in November 2019, in alliance with the Directorate General of Training (DGT), after being launched in UK, Germany and France.

SkillsBuild-Platform-2019:

- SkillsBuild offers digital learning content from IBM and other online coding teaching companies.

- A two-year advanced diploma in IT, networking and cloud computingwill be offered at the Industrial Training Institutes (ITIs) & National Skill Training Institutes (NSTIs).

- The platform will be extended to train ITI & NSTI facultyon building skills in Artificial Intelligence (AI).

Features:

- Provide a personal assessmentof the cognitive capabilities and personality via My Inner Genius to the students.

- Teach digital technologiesand professional skills such as resume-writing, problem solving and communication.

- Students will receive recommendationson role-based education for specific jobs.

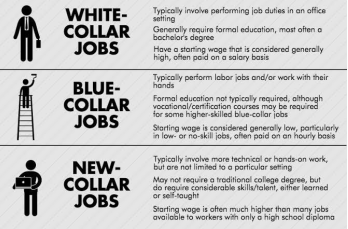

- Will help develop the skills required to join the workforce in these “New Collar” roles, from the first-of-its kind ‘New Collar Curriculum’ for ITI launched in 2018 by IBM.

New-collar-jobs-2019:

- New collar jobs are occupations which focus more on a candidate’s skills during the hiring process, rather than his or her level of education.

- Although new collar jobs do not require a four-year degree, they often do require other types of vocational training and certifications. This are mostly found in the information technology (IT), manufacturing and healthcare industries.

BHARAT BOND EXCHANGE TRADED FUND

05, Dec 2019

Why in News?

- The Cabinet Committee on Economic Affairs (CCEA) has given its approval for creation and launch of Bharat Bond Exchange Traded Fund (ETF).

Exchange Traded Fund:

- Exchange Traded Funds (ETFs) are mutual funds listed and traded on stock exchanges like shares.

- Index ETFs are created by institutional investors swapping shares in an index basket, for units in the fund.

- Usually, ETFs are passive funds where the fund manager doesn’t select stocks on your behalf. Instead, the ETF simply copies an index and endeavours to accurately reflect its performance.

- In an ETF, one can buy and sell units at prevailing market price on a real time basis during Market Hours.

Significance of ETF:

- ETFs are cost efficient. Given that they don’t make any stock (or security choices), they don’t use services of star fund managers.

- They allow investors to avoid the risk of poor security selection by the fund manager, while offering a diversified investment portfolio.

- The stocks in the indices are carefully selected by index providers and are rebalanced periodically. They offer anytime liquidity through the exchanges.

What is Bharat ETF?

- Bharat Bond ETF would be the first corporate Bond ETF in the country.

- Bharat Bond ETF will create an additional source of funding for Central Public Sector Undertakings (CPSUs) Central Public Sector Enterprises (CPSEs), Central Public Financial Institutions (CPFIs) and other Government organizations.

- ETF will be a basket of bonds issued by CPSE/CPSU/CPFI/any other Government organization Bonds.

Features of Bharat ETF:

- Tradable on exchange

- Small unit size Rs 1,000

- Transparent Net Asset Value (NAV) i.e. periodic live NAV during the day

- Transparent Portfolio (Daily disclosure on website)

- Low cost (0.0005%)

Structure of Bharat ETF:

- Each ETF will have a fixed maturity date

- The ETF will track the underlying Index on risk replication basis, i.e. matching Credit Quality and Average Maturity of the Index

- Will invest in a portfolio of bonds of CPSE, CPSU, CPFI or any other Government organizations that matures on or before the maturity date of the ETF

- As of now, it will have 2 maturity series – 3 and 10 years. Each series will have a separate index of the same maturity series.

ALTERNATIVE INVESTMENT FUNDS (AIFS)

08, Nov 2019

Why in News?

- The Union Cabinet has recently approved the creation of an Alternative Investment Fund (AIF) of Rs. 25,000 crores for the realty sector. This is to provide last-mile funding for stalled affordable and middle-income housing projects across the country.

Key Features of the Decision:

- The fund size is of Rs. 25,000 crores with the government providing Rs. 10,000 crore and the State Bank of India and the Life Insurance Corporation providing the balance.

- The fund was set up as Category-II Alternative Investment Fund registered with the SEBI and will be managed by SBICAP Ventures Limited.

- The open-ended fund is expected to increase in time. The government is also in talks with sovereign bonds and pension funds to put in money in this fund further.

- The Cabinet also approved the establishment of a ‘Special Window’ to provide priority debt financing for completion of stalled housing projects in the affordable and middle-income housing sector.

What is Alternative Investment Fund:

- AIFs refers to any privately pooled investment fund, (whether from Indian or foreign sources), in the form of a trust or a company or a body corporate or a Limited Liability Partnership (LLP).

- In India, AIFs are private funds which are otherwise not coming under the jurisdiction of any regulatory agency in India, since it does not include funds covered under the SEBI (Mutual Funds) Regulations, 1996, SEBI (Collective Investment Schemes) Regulations, 1999 or any other regulations of the Board to regulate fund management activities.

BHARAT 22 ETF

04, Oct 2019

Why in News?

- The Further Fund Offer 2 (FFO 2) of Bharat 22 Exchange-Traded Fund (ETF), which is part of the government’s divestment programme, will be open for subscription for investors.

Bharat 22:

- Bharat 22 is an ETF that will track the performance of 22 stocks, which the government plans disinvest.

- The ETF unit represents a slice of the fund, issued units are listed on exchanges for anyone to buy or sell at the quoted price.

- The B22 will span six sectors, such as basic materials, energy, finance, FMCG, industrials and utilities.

- Besides public sector banks, miners, construction companies, and energy majors, the ETF will also include some of the government’s holdings in SUUTI (Specified Undertaking of Unit Trust of India).

- The B22 ETF will be managed by ICICI Prudential AMC while Asia Index will be the index provider.

- The index will be rebalanced annually.

Exchange Traded Funds (ETFs):

- ETFs are mutual funds listed and traded on stock exchanges like shares.

- The ETF simply copies an index and endeavours to accurately reflect its performance.

- In an ETF, one can buy and sell units at a prevailing market price on a real-time basis during market hours.

- There are four types of ETFs already available — Equity ETFs, Debt ETFs, Commodity ETFs and Overseas Equity ETFs.

- The Bharat 22 ETF to be offered now allows the Government to park its holdings in selected PSUs in an ETF and raise disinvestment money from investors at one go.

WORKING GROUP ON CORE INVESTMENT COMPANIES

06, Jul 2019

Why in News?

- The Reserve Bank of India (RBI) has constituted a working group to review the regulatory guidelines and supervisory framework applicable for Core Investment Companies (CIC).

Terms of Reference:

- To examine the current regulatory framework for CICs in terms of adequacy, efficacy and effectiveness of every component thereof and suggest changes therein.

- To assess the appropriateness of and suggest changes to the current approach of the Reserve Bank of India towards registration of CICs including the practice of multiple CICs being allowed within a group.

- To suggest measures to strengthen corporate governance and disclosure requirements for CICs.

- To assess the adequacy of supervisory returns submitted by CICs and suggest changes therein.

- To suggest appropriate measures to enhance RBI’s off-site surveillance and on-site supervision over CICs.

- The working group, headed by Tapan Ray, shall submit its report by October 31, 2019.

Core Investment Company:

- Core Investment Companies (CICs) are a specialized Non-Banking Financial Companies (NBFCs).

- They have asset size of Rs 100 crore and above.

- Their main business is acquisition of shares and securities with certain conditions.

- It holds not less than 90% of its net assets in the form of investment in equity shares, preference shares, bonds, debentures, debt or loans in group companies.

- Its investments in the equity shares (including instruments compulsorily convertible into equity shares within a period not exceeding 10 years from the date of issue) in group companies constitutes not less than 60% of its net assets.

- It does not trade in its investments in shares, bonds, debentures, debt or loans in group companies except through block sale for the purpose of dilution or disinvestment.

- It does not carry on any other financial activity referred to in RBI Act, 1934 except investment in bank deposits, money market instruments,

government securities, loans to and investments in debt issuances of group companies or guarantees issued on behalf of group companies. - It accepts public funds.

FDI IN MULTI-BRAND RETAIL

20, Jun 2019

Why in News:

- Commerce Minister reiterated that the central government will not allow foreign direct investment in multi-brand retail, and also assured small traders predatory pricing by multinationals would not be allowed.

Details:

- On the pretext of B2B, no entry will be allowed for multi-brand retail.

- Predatory pricing will not be allowed and necessary action will be taken against defaulters.

- Representatives of the associations of kirana stores had raised the issues of the need for a level playing-field and the adverse impact of anti-competitive practices such as predatory prices by foreign companies.

- Commerce minister urged small retailers to make use of modern technology and avail benefits of Government of India schemes like MUDRA to improve their business, spruce up their shops, improve stocks by storing high quality products and pass on the benefits to people employed by them

- The Confederation of All India Traders (CAIT) submitted a memorandum demanding that the same restrictions and conditions imposed on global e-commerce players be made applicable to domestic e-commerce companies also.

Multi -Brand Retail:

- Multi-brand retail is a concept when a store or a portal or any other form of outlet sells more than one brand.

Predatory Pricing:

- Predatory pricing, also known as undercutting, is a pricing strategy in which a product or service is set at a very low price with the intention to achieve new customers, or driving competitors out of the market or to create barriers to entry for potential new competitors.

Mudra:

- Pradhan Mantri Mudra Yojana (PMMY)is a flagship scheme of Government of India to “fund the unfunded” by bringing such enterprises to the formal financial system and extending affordable credit to them. It enables a small borrower to borrow from all Public Sector Banks or loans upto Rs 10 lakhs for non-farm income generating activities.

FOREIGN PORTFOLIO INVESTMENT

18, Jun 2019

- Foreign portfolio investment (FPI) consists of securities and other financial assets held by investors in another country.

- It does not provide the investor with direct ownership of a company’s assets.

- FPI involves the making and holding of a hands-off—or passive—investment of securities, done with the expectation of earning a return.

- Investments can be in Indian securities including shares, government bonds, corporate bonds, convertible securities, infrastructure securities etc.

- NRIs doesn’t comes under FPI.

- It is included in the Capital Account in India.

BHARATMALA PROJECT

17, Jun 2019

Why in News?

- Bharatmala is a name given to road and highways project of Government of India.

Highlights:

- The total investment for the Bharatmala plan is estimated at Rs10 trillion, which is the largest ever outlay for a government road construction scheme.

- Bharat Mala will provide easier access to border areas for armed forces and boost trade via the land route.

- Roads will be built along borders with Bhutan and Nepal.

- Road connectivity to small industries will be ensured and manufacturing centres will be connected with national highways.

- The project will be executed through Ministry of Road, Transport and Highways (MoRTH), NHAI, National Highways and Infrastructure Development Corporation Limited (NHIDCL) and State Public Works Department (PWDs). Bharatmala is the largest highways project after the National Highways Development Programme.

NATIONAL SMALL SAVINGS FUND

17, Jun 2019

It has been established under Public Account of India since 1st April 1999. It Comprises of

- Postal Deposits

- Savings Certificates and Kissan Vikas Patra

- Social Security Schemes such as PPF and Senior Citizens Savings

Although it reflects a borrowing mechanism, its transactions are not included in the fiscal deficit of the government. The balance in the fund is invested in Central and State Government securities.

SEBI PANEL MOOTS CHANGES TO FPI RULES

25, May 2019

Why in News:

- As part of its attempts to streamline the regulations to encourage foreign inflows in the Indian market, the Securities and Exchange Board of India (SEBI) has proposed fast track on-boarding procedure for such investors, apart from a simplified registration process.

Details:

- As a key source of capital to the Indian economy, it is important to ensure a harmonised and hassle-free investment experience for international investors and improve transparency.

- The group’s primary objectives were consolidation, simplification, rationalisation and liberalisation

- The group has also recommended pension funds to be considered for Category I FPIs registration, removal of opaque structure and

the review of broad-based conditions for appropriately regulated entities. - The committee has further proposed a liberalised investment cap under a review of prohibited sectors for foreign investment for FPIs, restriction on Sovereign Wealth Funds (SWFs) for investment in corporate debt securities, and permitting FPIs for off-market transactions.

- The committee has also proposed alignment of regulations for FPIs and Alternate Investment Funds (AIFs) and the harmonisation between investment restrictions in FPI regulations and Foreign Exchange Management Act (FEMA).

SEBI

- SEBI is the statutory regulator for the securities market in India.

- It was established in 1988 and given statutory powers through the SEBI Act, 1992.

- HQ: Mumbai.

- Purpose: Protect the interests of investors in securities, promote the development of securities market and to regulate the securities market.

AIR INDIA ARM’S PRIVATISATION HITS A BUMP

18, May 2019

why in news:

- The government’s effort to privatise Air India Air Transport Services Ltd., Air India’s ground handling arm, has run into a stone wall, with potential bidders raising concerns over the Airport Authority of India’s plan to award ground-handling work at 76 of its airports to vendors.

Background: / What is the present condition of Air India?

- Air India had accumulated debt of more than Rs.50,000 crore as of the end of the 2015-16 fiscal year.

- Flights are routinely delayed, the equipment is old and mouldering, and the service is poor. The airline has become a platform through which politicians and officials enjoy the perks of office.

What are the advantages of privatization?

- A privatized Air India will cease to be a drain on the exchequer.

- The theory of economic policy establishes that government intervention in the economy is warranted only in the event of market failure or of an overarching non-economic objective. Going beyond conventional tools of intervention, such as regulation, taxes and subsidies, nationalization and monopolization of an industry only makes sense in the rarest of cases.

- e.g Situations in which the private market cannot deliver, such as a case of catastrophic market failure. So logically the government should not be in the commercial airline business. It might support flights to commercially unviable areas, subsidies, etc, not nationalization. Competing with private airlines, Air India is not doing a good job of it.

- Its domestic market share dropped to about 13% as of March 2017.

What should be done?

- The best way to turn Air India into a great global airline would be to cut it loose from the clutches of the government. It can be done either by fully privatizing the airline or reducing the government’s stake to a minority interest. e.g Following the privatization, British Airways rose to become the world’s “favourite airline”. The experience of other countries, from Kenya to Canada to Singapore shows how successful is privatization.

- Disinvestment of Air India would send absolutely the right message, that India is now a market economy.

- If that happens, we will know that the old era of central planning is, just maybe, genuinely behind us after all.

MASALA BONDS LISTED AT LSE

18, May 2019

Why in News:

- Kerala becomes first sub-sovereign entity in country to access global market

Background: / Kerala masala bonds:

- The State has turned out to be the first sub-sovereign entity in the country to access the international market by listing masala bonds issued through its

- off-budget mechanism, the Kerala Infrastructure Investment Fund Board (KIIFB).

- Chief Minister Pinarayi Vijayan has become the debutant head of state in the country to open trading at the London Stock Exchange.

- KIIFB has raised ₹2,150 crore through masala bonds at a fixed interest rate of 9.723% per annum.

- The resources earned through the bonds would be channelised for funding a clutch of infrastructure development projects cleared by the KIIFB director board. KIIFB had decided to garner ₹3,500 crore from the international market in the initial phase. It plans to list the bonds at the Singapore stock exchange too.

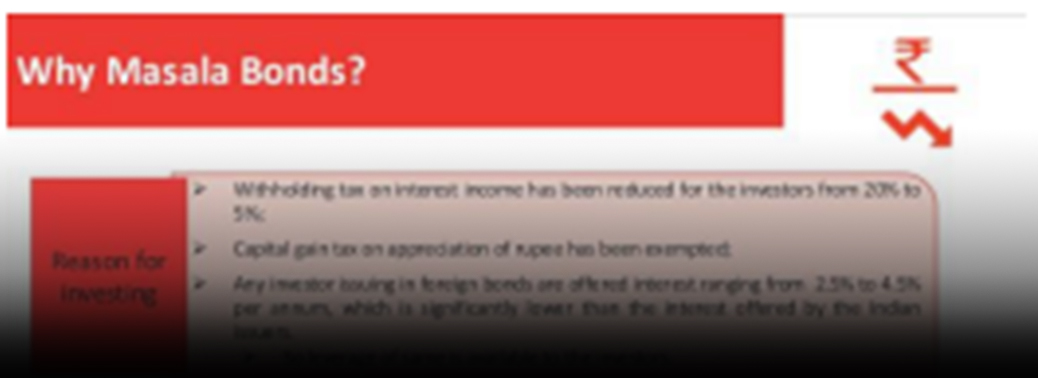

What is Masala bond:

- Masala Bonds are rupee denominated bonds issued for funding Indian companies using foreign investor’s money.

- They are issued by International Finance Corporation (IFC )- a part of World Bank Group.

What is so special about them?

- Since these bonds are rupee denominated, burden of debt repayment due to fluctuating of currency falls on funders and hence Indian companies are expected to benefit from them.

How they help in meeting housing and infrastructure development

- Indian construction companies have big problems in getting domestic capital and it is a big challenge for getting foreign investor to come to India.

- Therefore, funders can buy bonds in their own stock exchange (London stock exchange , in this case ) without facing hassle to register here first

- Since denomination ensures good profit to Indian companies, this would create a healthy environment for other infrastructure companies to follow suit too and provide for necessary capital for Housing for all.

Challenges

- Though Real estate bill, prevention of corruption act and black-market bill will help in suspicious money to be reduced to large extent, much more needs to be done to boost consumers and investors’ confidence

CAPITAL HIGH: FOREIGN INVESTMENT IN INDIA

08, Apr 2019

To retain the confidence of foreign investors, macroeconomic management is a key

- The inflow of foreign capital into India’s stock market in the month of March hit a high of $4.89 billion, the biggest foreign inflow into Indian stocks since February 2012.

- Both cyclical and structural factors are behind this sudden uptick in foreign investment that has helped the rupee make an impressive comeback.

- Last year, India received more foreign direct investment than China for the first time in two decades. While the Chinese economy has been slowing down considerably in the last one year, India has emerged as the fastest-growing major economy.

- There is a sense among a section of investors that their fears of political instability are misplaced.

- Both the Federal Reserve and the European central bank. for instance, have promised to keep interest rates low for longer. This has caused investors to turn towards relatively high- yielding emerging market debt.

What is foreign investment?

- Foreign investment involves capital flows from one country to another, granting extensive ownership stakes in domestic companies and assets. Foreign investment denotes that foreigners have an active role in management as a part of their investment.

- Both Foreign Direct Investment (FDI) and Foreign Institutional Investor (FII) are related to investment in a country

Good Sign:

- The return of foreign capital is obviously a good sign for the Indian economy. But policymakers need to be careful not to take foreign investors for granted. Other emerging Asian economies will be competing hard to attract foreign capital, which is extremely nimble.

- Any mistake by policymakers will affect India’s image as an investment destination

- The high fiscal deficit of both the Centre and the State governments and the disruptive outflow of foreign capital are the other macroeconomic challenges.

To retain the confidence of foreign investors, macroeconomic management is a key

- The inflow of foreign capital into India’s stock market in the month of March hit a high of $4.89 billion, the biggest foreign inflow into Indian stocks since February 2012.

- Both cyclical and structural factors are behind this sudden uptick in foreign investment that has helped the rupee make an impressive comeback.

- Last year, India received more foreign direct investment than China for the first time in two decades. While the Chinese economy has been slowing down considerably in the last one year, India has emerged as the fastest-growing major economy.

- There is a sense among a section of investors that their fears of political instability are misplaced.

- Both the Federal Reserve and the European central bank. for instance, have promised to keep interest rates low for longer. This has caused investors to turn towards relatively high- yielding emerging market debt.

What is foreign investment?

- Foreign investment involves capital flows from one country to another, granting extensive ownership stakes in domestic companies and assets. Foreign investment denotes that foreigners have an active role in management as a part of their investment.

- Both Foreign Direct Investment (FDI) and Foreign Institutional Investor (FII) are related to investment in a country

Good Sign:

- The return of foreign capital is obviously a good sign for the Indian economy. But policymakers need to be careful not to take foreign investors for granted. Other emerging Asian economies will be competing hard to attract foreign capital, which is extremely nimble.

- Any mistake by policymakers will affect India’s image as an investment destination

- The high fiscal deficit of both the Centre and the State governments and the disruptive outflow of foreign capital are the other macroeconomic challenges.

India Leadership Summit

09, Oct 2018

Why in News?

- U.S.-India Strategic Partnership Forum organised the India leadership summit.

About the summit:

- They briefed the Prime Minister on the outcomes of India Leadership Summit held earlier in the day. The business leaders appreciated the economic and regulatory reforms implemented by the Government in the past four years, and expressed their desire to further deepen their engagements with India to make use of the mutually beneficial opportunities created by the rapidly growing Indian economy.

- The Prime Minister stated that both countries have benefitted in an unprecedented manner through economic engagement. He encouraged US companies to fully avail of the business opportunities in new areas as well, such as start-ups, energy, health care and digital technology.

- According to its findings, US companies contributed over $ 90 billion to India’s GDP (2017) as over 6.6 million jobs are supported by US companies in India (2018). The US is India’s largest trading partner and top export market. It is also India’s top source of FDI with $50 billion worth of flows between 2014 and first quarter of 2018.

- The study also said US companies invested over $ 5.5 billion in R&D in India (2016) and the US companies contributed to over five per cent of total CSR expenditure in India (2017).