Category: WTO, Industrial Economics

DEVELOPING COUNTRY STATUS IN WTO

14, Apr 2020

Why in News?

- US president has asked for changing the WTO rules for changing the developing country status of China.

China – a developing country or Developed Country?

- China became a WTO member in 2001. By 2011, China became the second-largest economy in GDP terms, the first largest merchandise exporter, the fourth largest commercial services exporter and the first destination for inward FDI among developing countries.

- So if China is forced to take on the duties of a developed country and forego the benefits of a developing country, the West could soon ask other developing countries that are ahead of China (at least in per capita terms) to do the same.

Who are the developing countries in the WTO?

- There are no WTO definitions of “developed”and “developing”

- Members announce for themselves whether they are “developed” or “developing” countries.

- However, other members can challenge the decision of a member to make use of provisions available to developing countries.

What are the advantages of “Developing Country” status?

- Developing country status in the WTO brings certain rights.

- Developing country status ensures special and differential treatment (S&DT)or provisions which allow them more time to implement agreements and commitments, include measures to increase trading opportunities, safeguard their trade interests, and support to build capacity to handle disputes and implement technical standards.

WTO Norms for Recognition of Developed, Developing and LDCs:

- Under the WTO system, generally, countries are designated as developed, developing, and least developed countries (LDCs).

- The uneven level of development between developed and developing countries in the WTO is a well-recognised fact.

- Article XVIII of the General Agreement on Tariffs and Trade (GATT) recognises that attaining the objectives of this agreement would require facilitating the progressive development of those countries that can only support low levels of development and are at the early stages of development.

- Accordingly, countries self-designate themselves as ‘developing country’ to take advantage of provisions like Article XVIII of GATT and other special and differential treatment (S&DT) provisions in the WTO agreements.

- These provisions are aimed at increasing trade opportunities for developing countries, ensuring longer transitional periods to comply with WTO obligations, and affording technical assistance to countries, among other things.

What are “Special and Differential Treatment” Provisions?

- Longer time periods for implementing Agreements and commitments,

- Measures to increase trading opportunities for developing countries,

- Provisions requiring all WTO members to safeguard the trade interests of developing countries,

- Support to help developing countries build the capacity to carry out WTO work, handle disputes, and implement technical standards, and

- Provisions related to least-developed country (LDC) Members.

- The concept of non-reciprocal preferential treatment for developing countries that when developed countries grant trade concessions to developing countries, they should not expect the developing countries to make matching offers in return.

Demands by Developed Countries:

- For some time now, developed countries, mainly the US, have been asking the WTO to end the benefits being given to developing countries.

- Nearly two-thirds of the members of the World Trade Organization (WTO) have been able to avail themselves of special treatment and to take on weaker commitments under the WTO framework by designating themselves as Developing Countries.

USTR TAKES INDIA OFF DEVELOPING COUNTRY LIST

14, Feb 2020

Why in News?

- India has been recently removed from the Developing country list by the United States Trade Representative.

About USTR:

- To harmonise U.S. law with the World Trade Organization’s (WTO)Subsidies and Countervailing Measures (SCM) Agreement, the USTR had, in 1998, come up with lists of countries classified as per their level of development.

- These lists were used to determine whether they were potentially subject to U.S. countervailing duties.

- As per the USTR notice, the 1998 rule is now “obsolete”.

What is the Issue?

- The U.S. government has changed an administrative rule making it easier for it to impose countervailing duties (CVDs) on goods from India and certain other countries.

- The Office of the United States Trade Representative (USTR) has published a notice, amending lists of developing and least-developed countries that are eligible for preferential treatment with respect to CVD investigations.

What are its Impacts?

- Countries not given special consideration have lower levels of protection against a CVD investigation.

- A CVD investigation must be terminated if the offending subsidy is de minimis (too small to warrant concern) or if import volumes are negligible.

- The de minimis thresholds and import volume allowance are more relaxed for developing and least-developed countries.

- The de minimis standard is usually a subsidy of 1% or less ad valorem and 2 percent for special cases.

What is the Eligibility for de Minimis?

- The USTR used the following criteria to determine whether a country was eligible for the 2% de minimis standard:

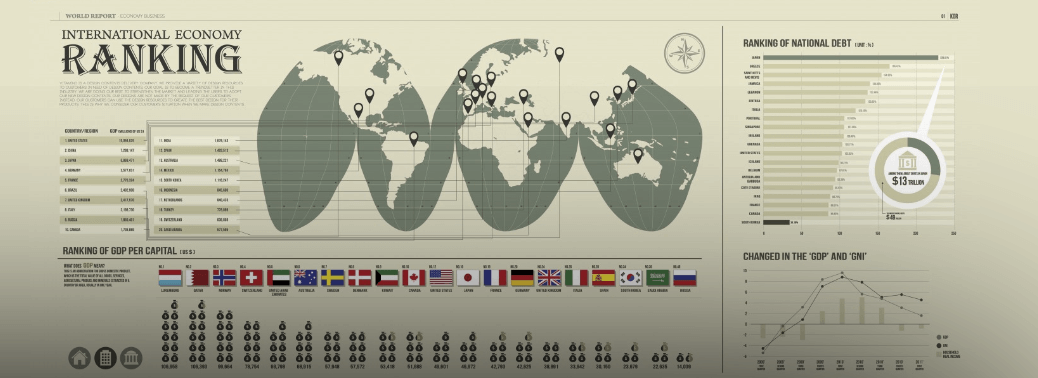

- Per capita Gross National Income or GNI

- share of world trade

- Other factors such as Organisation for Economic Co-operation and Development (OECD) membership or application for membership, EU membership, and Group of Twenty (G20) membership.

Is there any other trade related agreements by US?

- India has been already removed from the Generalised system of preferences (GSP) by USTR.

- It is a preferential arrangement in the sense that it allows concessional low/zero tariff imports from developing countries to developed countries (also known as preference receiving countries or beneficiary countries).

- It involves reduced/zero tariffs of eligible products exported by beneficiary countries to the markets of GSP providing countries.

- The US has a strong GSP regime for developing countries since its launch in 1976, by the Trade Act of 1974.

- The GSP program has effective dates which are specified in relevant legislation, thereby requiring periodical reauthorization in order to remain in effect.

Why India has been removed from the list of Developing Country?

- India was taken off the list because — like Argentina, Brazil, Indonesia and South Africa — it is part of the G20.

- “Given the global economic significance of the G20, and the collective economic weight of its membership (which accounts for large shares of global economic output and trade), G20 membership indicates that a country is developed”.

FREE TRADE AGREEMENT WITH THE EURASIAN ECONOMIC UNION

28, Dec 2019

Why in News?

- Russia is hopeful of India concluding a new Free Trade Agreement with the Eurasian Economic Union(EAEU).

Eurasian Economic Union (EAEU):

- The Eurasian Economic Union is an international organization for regional economic integration. It has international legal personality and is established by the Treaty on the Eurasian Economic Union.

- The EAEU provides for free movement of goods, services, capital and labor, pursues coordinated, harmonized and single policy in the sectors determined by the Treaty and international agreements within the Union.

- The Member-States of the Eurasian Economic Union are the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation.

- The Union is being created to comprehensively upgrade, raise the competitiveness of and cooperation between the national economies, and to promote stable development in order to raise the living standards of the nations of the Member-States.

Structure & Governance of EAEU:

- Supreme Eurasian Economic Council:The Supreme Council, which is composed by the heads of state of the member states, makes important decisions for the union. It approves the budget and the distribution of the contribution of the Member States.

- Eurasian Economic Commission:The Eurasian Economic Commission (EEC) is the permanent regulatory body of the Eurasian Economic Union (EAEU). It started work on February 2, 2012. The main purpose of the Eurasian Economic Commission is ensuring the functioning and development of the EAEU, and developing proposals for the further development of integration.

The most important feature of the Commission lies in the fact that all decisions are based on a collegial basis. The Eurasian Economic Commission consists of two bodies: the Council and the Board.

- Council:The council is composed of the Vice Prime Ministers of the member states. The council of the Commission oversees the integration processes in the Union, and is responsible for the overall management of the Eurasian Commission.

- Board:The Board of the Eurasian Economic Commission consists of 10 members (2 Members (Minister) from each Member State), one of whom is the Chairman of the Commission Board.

- Court of the Eurasian Economic Union:The Court of the Eurasian Economic Union replaced the Court of the Eurasian Economic Community (EurAsEC Court) in 2015. It is in charge of dispute resolution and the interpretation of the legal order within the Eurasian Economic Union. Its headquarters is in Minsk.

INDIA WINS SOLAR CASE AGAINST US AT WTO

28, Jun 2019

- Context- dispute settlement panel pronouncing that subsidies and mandatory local content requirements instituted by eight American states breached global trade rules.

- Panel upholds India’s claims that renewable energy subsidies in eight American states violated a core global trade rule.

- The renewable energy sector win may help India in settling other disputes with the US.

- The panel also asked the US to ensure that these states are in conformity with trade rules.

What India claims-

- India had claimed that the “domestic content requirements and subsidies instituted by the governments of the states of Washington, California, Montana, Massachusetts, Connecticut, Michigan, Delaware and Minnesota in the energy sector”

- violated several provisions of the Trade-Related Investment Measures (TRIMs) Agreement and Subsidies and Countervailing Measures Agreement.

- New Delhi had challenged the “renewable energy cost recovery incentive payment programme” implemented by the state of Washington, California’s self-generation incentive programme, Montana’s tax incentive for ethanol production, Michigan’s renewable energy credits programme, Delaware’s solar renewable energy credits and the Made in Minnesota renewable incentive programme.

WTO Panel:

- panel urged the US to bring the eight states in conformity with US obligations under Article III:4 of “national treatment”. Under the national treatment provision, foreign producers must be treated on a par with domestic producers.

Option for US:

- The US can still challenge the panel’s ruling before the Appellate Body (AB); however, the AB itself is feared to have become dysfunctional after 11 December because the US has been blocking appointments to it.

Implication:

- it would show the US and its federal states maintain WTO-inconsistent programmes in the renewable energy sector.

- it is a lesson to the US that it should not undermine renewable energy programmes in other countries such as India on grounds that they violate global trade rules when Washington and its federal states adopt much bigger programmes worth billions of dollars that violate global trade rules.

Background Issue:

- In 2014, the US had launched a similar trade dispute against India’s Jawaharlal Nehru Solar Energy Mission, on the grounds that it included incentives for domestically produced solar cells and modules. WTO’s Appellate Body had upheld the US complaint against India in that case.

General Agreement on Tariffs and Trade:

- The General Agreement on Tariffs and Trade was the first worldwide multilateral free trade agreement.

- The purpose of GATT was to eliminate harmful trade protectionism.

- It restored economic health to the world after the devastation of World War II.

Trade-Related Investment Measures (TRIMs):

- This Agreement, negotiated during the Uruguay Round, applies only to measures that affect trade in goods.

- Recognizing that certain investment measures can have trade-restrictive and distorting effects, it states that no Member shall apply a measure that is prohibited by the provisions of GATT Article III (national treatment) or Article XI (quantitative restrictions).

What is the WTO Appellate?

- The Appellate Body was established in 1995 under Article 17 of the Understanding on Rules and Procedures Governing the Settlement of Disputes (DSU).

- It is a standing body of seven persons that hears appeals from reports issued by Panels in disputes brought by WTO Members.

- The Appellate Body can uphold, modify or reverse the legal findings and conclusions of a panel, and Appellate Body Reports, once adopted by the Dispute Settlement Body (DSB), must be accepted by the parties to the dispute.

- The Appellate Body has its seat in Geneva, Switzerland.

- The Appellate Body is composed of seven Members who are appointed by the DSB to serve for four-year terms, with the possibility of being reappointed once.

- Without the statutorily mandated number of judges to hear cases (three or more), the trade will become non-functional for all practical purposes at the end of this year, if the U.S does not allow new nominees to go through.

Government to extend foreign currency loans to Exporters

23, Jun 2019

- India is a net importer of commodities.

- This impacts India’s balance of payments, hence the country needs to strengthen its exports. In order to boost exports, the government has subsidized several trade related issues. However, such steps have been inadequate. Moreover, they have burdened the exchequer.

- Hence the government now plans to enhance foreign currency loans by working with bankers. The government has decided to enhance the role of Export Credit Guarantee Corporation of India as an agency for exporters.

What is Export Credit Guarantee Corporation of India?

- ECGC Ltd. (Formerly known as Export Credit Guarantee Corporation of India Ltd.) wholly owned by Government of India, was set up in 1957.

- It was set up with the objective of promoting exports from the country by providing credit risk insurance and related services for exports.

- ECGC is essentially an export promotion organization, seeking to improve the competitiveness of the Indian exports by providing them with credit insurance covers.

- The Corporation has introduced various export credit insurance schemes to meet the requirements of commercial banks extending export credit. The insurance covers enable the banks to extend timely and adequate export credit facilities to the exporters.

ECGC Provides:

- A range of insurance covers to Indian exporters against the risk of non – realization of export proceeds due to commercial or political risks

- Different types of credit insurance covers to banks and other financial institutions to enable them to extend credit facilities to exporters and

- Export Factoring facility for MSME sector which is a package of financial products consisting of working capital financing, credit risk protection, maintenance of sales ledger and collection of export receivables from the buyer located in overseas

RECIPROCAL TRADE

20, Jun 2019

Why in News:

- The State Department of US reacted to India’s announcement of retaliatory tariffs on certain U.S. imports reiterating President Trump’s message of reciprocal trade and the strength of U.S.-India ties.

What is Reciprocal Trade:

- Reciprocal trade is an agreement between two countries which provide for the exchange of goods between them at lower tariffs and better terms than that exist between one of the countries and other countries.

Details:

- The U.S.-India partnership stands upon a shared commitment to democratic values and the rule of law. The United States is India’s top market for exports and U.S. companies see great opportunity in India.”

U.S. continued to raise market access concerns with India.

- Among the challenges in the Indo-U.S. relationship, are the U.S.’s preferential trade access system, the Generalized System of Preferences (India was recently taken off the beneficiary list), 5G network infrastructure, and data localisation.

- The U.S. is also concerned about India’s policies with respect to data portability across borders that has become one of the areas of disagreement in trade discussions.

KIMBERLEY PROCESS

17, Jun 2019

Why in News?

Intersessional meeting of the Kimberley Process (KP) is being hosted by India in Mumbai.

Highlights:

- India is currently the Chair of Kimberley Process Certification Scheme (KPCS) since 1st January 2018. It was handed Chairmanship by the European Union during KPCS Plenary 2018, which was held in Brussels, Belgium.

- India is founding member of KPCS.

Kimberley Process:

- The Kimberley Process is an international certification scheme that regulates trade in rough diamonds. It aims to prevent the flow of conflict diamonds, while helping to protect legitimate trade in rough diamonds.

- The Kimberley Process Certification Scheme (KPCS) outlines the rules that govern the trade in rough diamonds.

- The KP is not, strictly speaking, an international organisation: it has no permanent offices or permanent staff. It relies on the contributions – under the principle of ‘burden-sharing’ of participants, supported by industry and civil society observers.

- Neither can the KP be considered as an international agreement from a legal perspective, as it is implemented through the national legislations of its participants.

Kimberley Process Certification Scheme:

- The Kimberley Process Certification Scheme (KPCS) imposes extensive requirements on its members to enable them to certify shipments of rough diamonds as ‘conflict-free’ and prevent conflict diamonds from entering the legitimate trade.

- Under the terms of the KPCS, participating states must put in place national legislation and institutions; export, import and internal controls; and also commit to transparency and the exchange of statistical data.

- Participants can only legally trade with other participants who have also met the minimum requirements of the scheme, and international shipments of rough diamonds must be accompanied by a KP certificate guaranteeing that they are conflict-free.

INTERNATIONAL ECONOMY

16, Jun 2019

- India imposed tariffs on 29 goods from the U.S from June 16. This is a retaliatory measure taken by India against the U.S imposing tariffs on steel and aluminium form 2018.

- This is also a part of the ongoing tussle between the nations with regard to the protectionist tendencies in the global economy.

- 301 Probe: It is a law in the U.S that allows the President to impose tariffs and other restrictions on a country to protect U.S companies from unfair trade practices by other countries.

- U.S has imposed 301 probe on China in 2017, and is likely to impose the same on India Very soon

BLACK OR GREY: WHAT NEXT FOR PAKISTAN AT FATF

14, Jun 2019

Why in News:

- Pakistan has been under the FATF’s scanner, when it was put on the greylist for terror financing and money laundering risks, after an assessment of its financial system and law enforcement mechanisms.

Details:

- The FATF, an inter-governmental body that is now in its 30th year, works to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system.

- The June 16-21 Plenary could take up a proposal to downgrade Pakistan to the blacklist on terrorist financing from its current “greylisted” status.

- FATF and its partners such as the Asia Pacific Group (APG) review Pakistan’s processes, systems, and weaknesses on the basis of a standard matrix for anti-money laundering (AML) and combating the financing of terrorism (CFT) regime.

- Recently Pakistan gave a high-level political commitment to work with the FATF and APG to strengthen its AML/CFT regime, and to address its strategic counter-terrorism financing-related deficiencies. Based on this commitment, Pakistan and the FATF agreed on the monitoring of 27 indicators under a 10-point action plan, with deadlines.

FATF:

- The Financial Action Task Force (FATF) is an inter-governmental body established in 1989 on the initiative of the G7. It is a “policy-making body” which works to generate the necessary political will to bring about national legislative and regulatory reforms in various areas. The FATF Secretariat is housed at the OECD headquarters in Paris.

Objectives:

- The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system.

Functions:

- The FATF monitors the progress of its members in implementing necessary measures, reviews money laundering and terrorist financing techniques and counter-measures and promotes the adoption and implementation of appropriate measures globally. In collaboration with other international stakeholders, the FATF works to identify national- level vulnerabilities with the aim of protecting the international financial system from misuse.

What is blacklist and grey list?

- FATF maintains two different lists of countries: those that have deficiencies in their AML/CTF regimes, but they commit to an action plan to address these loopholes, and those that do not end up doing enough. The former is commonly known as grey list and latter as blacklist. Once a country is blacklisted, FATF calls on other countries to apply enhanced due diligence and counter measures, increasing the cost of doing business with the country and in some cases severing it altogether. As of now there are only two countries in the blacklist — Iran and North Korea — and seven on the grey list, including Pakistan, Sri Lanka, Syria and Yemen.

INDIA REMOVED FROM CURRENCY MONITORING LIST

30, May 2019

Why in News:

- The US removed India from its currency monitoring list of major trading partners, citing steps being taken by New Delhi that addressed some of the Donald Trump administration’s major concerns.

Background:

- The watch list contains the names of countries that have potentially questionable foreign exchange policies and are suspected to be manipulating their currencies to gain trade advantages over the US. India was placed on watchlist in May 2018 along with China, Japan, Germany, Switzerland and South Korea.

- Apart from India, Switzerland was dropped from the list. In its biannual foreign-exchange report to the Congress, the US Treasury Department added Ireland, Italy, Malaysia, Singapore and Vietnam to the list.

- US trade department in its October Report highlight that India’s circumstances have shifted markedly, as the central bank’s net sales of foreign exchange over the first six months of 2018 led net purchases over the four quarters through June 2018 to fall to USD 4 billion, or 0.2 per cent of the GDP. This led removal of India from currency watch list

What is currency manipulation

- The US Department of the Treasury publishes a semi-annual report in which the developments in global economic and exchange rate policies are reviewed.

- If a US trade partner meets three assessment criteria, the US labels it a currency manipulator. The three pre-conditions for being named currency manipulator are: a trade surplus of over $20 billion with the US, a current account deficit surplus of 3% of the GDP, and persistent foreign exchange purchases of 2% plus of the GDP over 12 months.

- A country can intentionally undervalue its currency by selling its own currency to drive down its value, making its exports cheaper and more competitive.

DISCOURSE ON WTO REFORM LACKS BALANCE

14, May 2019

Why in News:

- The reforms being promoted in the World Trade Organization (WTO) are not in favour of the developing countries.

Background: / WTO:

- WTO came into existence after the conclusion of the Uruguay round in 1995 replacing the post WWII General Agreement on trade and tariff (GATT).

objective:

- The objective of WTO is to establish a rule based global trade regime providing equitable opportunity to every nation for reaping the benefits of globalization. WTO works on the following principles:

- Non-Discrimination

- Most Favored Nation: No special favors can be granted to any trading partner

- National Treatment: No discrimination between the imported and domestic products once they enter the market (which allows imposition of custom duty).

- Freer Trade: removal of the tariff and non-tariff barriers gradually through negotiations

- Predictability: providing predictability in the trade policy through binding rules and transparency. Promoting fair competition: providing a system of rules dedicated to open, fair and undistorted competition such as allowing for imposition of anti-dumping duty

- Encouraging Development and Economic Reforms: nudging the countries towards an open market and allow for special assistance and trade concessions for developing countries

WTO SUBSIDIES:

1.Green Box

- Green Box is domestic support measures that doesn’t cause trade distortion or at most causes minimal distortion. Hence, they don’t have any reduction commitments (non- reducible and exempt). These subsidies are government funded without any price support to crops. They are implemented as programmes aimed at income support to farmers without influencing (decoupled) the current level of production and prices. Green box subsidies are therefore allowed without limits provided they comply with relevant criteria.

2.Blue Box

3.AMS (Aggregate Measurement of Support)

- The AMS represents trade distorting domestic support measures. It is referred as the “amber box” in the Agreement on Agriculture.

- The AMS means annual level of support (subsidies) expressed in monetary terms, provided for an agricultural product in favour of the producers (product specific) of the basic agricultural product and non-product specific support provided in favour of agricultural producers in general.

- The Aggregate Measurement of Support (AMS) consists of two parts—product-specific subsidies and non-product specific subsidies. Product-specific subsidy refers to the total level of support provided for each individual agricultural commodity. Non-product specific subsidy, on the other hand, refers to the total level of support to the agricultural sector as a whole, i.e., subsidies on inputs such as fertilizers, electricity, irrigation, seeds, credit etc. Usually, these non-product subsidies are given to all crops.

Challenges India faces at WTO:

Conflicting interests of developing and developed nations:

- The conflict became more pronounced during the recent ministerial conference at Buenos Aires. While developing nation were pushing for concluding the agreements on Doha Development Agenda (DDA), developed countries like USA, Japan and other clubbed

together to include issues like e-commerce, investment etc. into the negotiations without a final agreement on DDA

Agricultural subsidies:

- Since India is an agrarian economy based on employment heavily subsidized agricultural products of developed nations have always been a cause of concern for agri-exports from India. The present quota of subsidies is based on the price levels of 1986-88 allowing developed countries to take away a major chunk of trade distorting subsidies quota.

Issue of public stockholding

- The minimum support price (MSP) provided to farmers in India falls under the Amber box category of subsidies under WTO which have to be removed. However, it directly affects India’s food security and income of farmers. Though a ‘peace clause’ agreed to during Bali conference allows India to carry on with its PDS program as of now, developed countries are hindering the realization of a permanent solution to the problem.

Divisions within developing nations

- There are divergence with the developing nations such as India and china on various trade related issues. In the recent conference while many developing nations supported the issues like E-commerce propose by developed nations, those lead by India staunchly opposed it

Attempts to derail the judicial body

- USA under the new administration has been blocking the appointment to WTO’s appellate

body which could erode the credibility of WTO as an effective arbitrator in future.

Lack of alternatives

- There are only few other multilateral bodies that deal with issue of global trade. Though UNCTAD does concern itself with the issues of global trade, its work is mostly advisory in nature and is not binding upon the nations as in case of WTO agreements

Special and differential treatment (SDT):

- In Doha round, member agreed to provide a favorable treatment to developing and least developed nations who have asymmetric capabilities in terms of resources. However, developed countries have been calling emerging economies such as India and China as unworthy of SDT

Issues related to intellectual property rights:

Though the issues related to compulsory licensing of medicines has been resolved by renegotiating the language of TRIPS, developed nations have been trying to push TRIPS+ commitments through WTO. - Threats to existence of WTO

- WTO itself faces the following threats which have the potential to turn it into a redundant and ineffective bodies.

Way Forward:

- India has been leading the front for developing nations to secure their interests in the global trade rules. In doing so, it must continue to stick to the fundamental principle of equity and non-discrimination. First of all, it must reach a consensus with all the other developing nations (among the G33 group) to create a united front against the developed nations.

- The recently held mini-ministerial conference can be used to reach such a consensus in the run up to the next ministerial conference. At the same time India must invest in its domestic industry and improving connectivity with other nations to increase its competitiveness in the global market.

TRUMP TO CHINA: TRADE DEAL NOW OR IT WILL BE ‘FAR WORSE’ AFTER 2020

12, May 2019

Why in News:

- Washington and Beijing are locked in a trade battle that has seen mounting tariffs, sparking fears the dispute will damage the global economy.

background:

What is the issue?

- The two biggest economies USA and china are engaged in a tariff war, which would disrupt world trade.

What are recent moves of USA and China led trade wars ?

- Tariffs, or customs duties, are border taxes charged on foreign imports by a country.

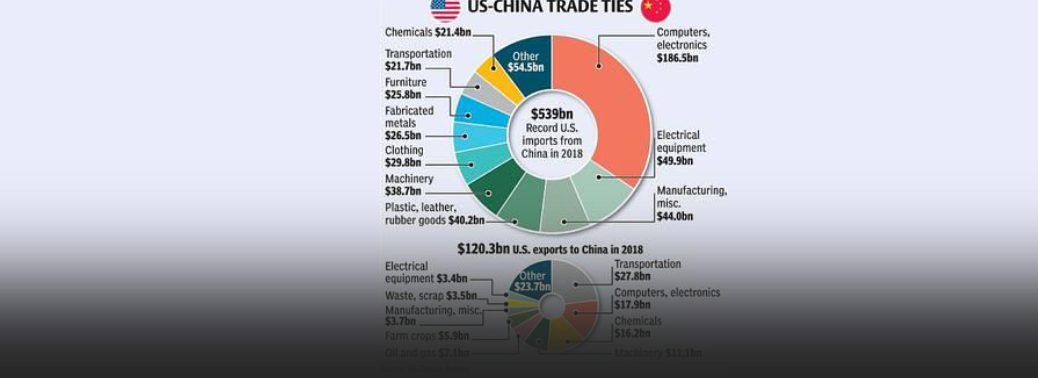

- Recently US government slapped sweeping tariffs on imported Chinese goods worth $34 billion, including aircraft parts, flat-screen televisions, and medical devices.

- All these will now face a high 25% levy when imported into the US.

- China responded with retaliatory tariffs of 25% on US goods worth an equivalent $34 billion, including soybean, automobiles, and marine products such as lobsters.

- USA is also considering to impose levies on Chinese goods worth another $500 billion in the coming months.

What are the reasons behind such moves?

- USA’s Point – USA’s tariffs are aimed at penalising China for arm-twisting foreign businesses to hand over technology to Chinese firms in lieu of access to the Chinese market. The US has indicated this action is specifically aimed at protectionist measures by China, especially its “Made in China 2025” programme, an initiative to transform China into an advanced manufacturing powerhouse.

- USA has also accused China of subsidising steel exports in a practice termed dumping selling a product at lower than the cost of production to gain market share.

- China’s Point – Besides slapping retaliatory tariffs on US goods, the Chinese could leverage an anti-American sentiment among consumers to boycott US goods.

- In 2012, Chinese nationalists boycotted Japanese cars and stores because of a territorial dispute, badly denting sales of Japanese goods.

What will be the consequences of the trade war?

- Last year, China had imported $130 billion in US goods, while the US bought goods worth

$506 billion from China, So, the goods trade is weighed in favour of China. - US economy could actually suffer more than China’s, and that South Korea, Malaysia, Taiwan and Singapore are the economies most at risk in Asia based on trade openness and exposure to supply chains involving China. After the latest series of tariff strikes by the US and China, world trade could be seriously disrupted as two-thirds of goods traded are linked to global value chains. There are also projections that almost two-thirds of US imports from China came in from companies with foreign capital and, based on foreign investment flows, the capital is likely to have come mostly from the US, Japan and South Korea.

What measures would be taken by China?

- Chinese government has indicated earlier that it would appeal to the World Trade Organization’s Dispute Settlement Body. If the appeal is admitted, trade analysts predict that China could have the upper hand, given the record of plaintiffs almost always ending up on the winning side. The retaliatory tariffs by China could potentially spark dissent and pressure from US domestic lobbies.

What are the concerns before India?

- India’s total exports have been faltering, down from $310.53 billion in FY15 to $262.29 billion in FY16, before recovering marginally to $276.55 billion in FY17.

- Exports from India to the US under Generalized System of Preferences (GSP) have been consistently on the rise, bucking the broader declining trend in overall exports.

- Generalized System of Preferences (GSP) is a preferential tariff system extended by developed countries to developing countries.

- Out of the total GSP imports into the US under this programme, India has consistently accounted for a quarter of this. USA’s pointed attack on duty flow imports from India into the US has specifically targeted the GSP programme.

- India has time and again raised concerns over negative impact of tightening of visa norms by the US on the Indian IT sector.

- It has also asked America to continue extending duty-free access under the Generalized System of Preferences (GSP) to its products such as chemicals and engineering.

- India also wants exemption from the hike in import duty on certain steel and aluminium items.

Trump Raises Tariffs On Chinese Goods

11, May 2019

why in news:

- The Trump administration raised import taxes on $200 billion of Chinese imports from 10% to 25%.

Background: / China’s Dominance:

- China joined WTO in 2001 and since then it has very clearly used the existing Free Trade system to its huge advantage.

- China exports more than 2 trillion worth of goods whereas it imports are just 1.32 trillion. The balance in trade which is in favour of China is 236 This is clearly unsustainable.

- It has created mass manufacturing empire for itself which is hurting other countries including India –low- end manufacturing by offsetting high costs with better infrastructure and more reliable and extensive supply networks. As factory wages in China have risen to the highest in emerging

- Asia, however, other developing countries with lower costs have begun to steal away investment and jobs, helping to promote industrialization and boost growth at home.

- Trump is sending a clear message – China cannot dump their goods around the world.

What Happens Now:

- China holds $1.17 trillion of U.S. government debt. If there is a trade war, China could reduce its S. debt holdings as a political weapon against the Trump administration tariffs proposal.

- If that happens, the dollar could fall and other countries could follow suit and sell their holdings.

- If China reduces it’s buying at a time when the U.S. is increasing its supply of new Treasuries into the market, which could lead to a rout in the bond market.

Effect on India:

- It invariably leads to a higher inflationary and low growth scenario.

- Inflation is generally good for assets such as gold, while having a negative impact on currency and some sectors in the equity market.

- The three external risk factors — higher tariffs, rising interest rates, and elevated bond sales

- —at a time when the domestic banking system is grappling with a renewed stress of bad loans, is a serious threat to India.

INDIAN ECONOMY EXPECTED TO GROW AT 7.5% IN 2019-20

18, Jan 2019

In News

- Indian economy is expected to grow at a higher at 7.5 per cent in 2019-20 on account of steady improvement in major sectors, as government and private consumption remains robust and investment is steadily picking up, India Ratings and Research (Ind-Ra) said in a report.

Explained

- According to the advance estimates of Gross Domestic Product released by the Central Statistics Office (CSO), the economy is estimated to grow at 7.2 per cent in the current financial year, up from 6.7 per cent in the previous year. GDP growth would have been even better but for the global headwinds caused by an abrupt rise in crude oil prices, strengthening of US dollar and hiccups faced on the domestic front due to frequent revisions in GST rates, continued agrarian distress, slow progress on Insolvency and Bankruptcy Code cases, and liquidity crunch faced by non-banking finance companies post IL&FS saga

- Over the past few years, private final consumption expenditure and government final consumption expenditure have been the primary growth drivers of Indian economic growth.

- Ind-Ra said it believes that investments are slowly but steadily gaining traction, with gross fixed capital formation growing 12.2 per cent in the current fiscal and projected to clock

10.3 per cent in the next year. - This is certainly a comforting development, but the flip side of this development is that it is primarily driven by the government capital expenditure or capex, as incremental private corporate capex has yet to revive Due to the slowdown in private corporate and household capex, GDP growth has failed to accelerate and sustain itself close to or in excess of 8 per cent, it said.

- Like FY19, the agency (Ind- Ra) expects all major sectors namely agriculture, industry and services to contribute to gross value added (GVA) growth in FY20 from the supply side. However, key support to the GVA growth is expected to come from services, followed by industry and they are expected to grow at 8.3 per cent and 7.4 per cent, respectively, in FY20.

- Under normal monsoons, agricultural GVA is expected to grow at 3.0 per cent. All this would translate into overall GVA growth of 7.3 per cent in FY20 compared to 7.0 per cent in FY19. The agency expects wholesale and retail inflation to average 3.4 per cent and 4.3 per cent, respectively, in the next fiscal if the monsoon remains normal and Indian crude oil basket averages at $55 per barrel.

START-UPS SEEKING ANGEL TAX EXEMPTION GET RELIEF

18, Jan 2019

In News

- The government simplified the process for startups seeking exemption from angel tax notices by eliminating the need for a certification from an inter-ministerial body. The move seeks to ease concerns raised by startups about tax officials questioning the share premium received at the time of raising capital through the sale of new shares.

Explained

- The move comes against the backdrop of various startup founders claiming that they have received notices under Section 56(2) (viib) of the Income Tax Act from the I-T department to pay taxes on angel funds raised by them.

- Section 56(2) (viib) of the Income Tax Act provides that the amount raised in excess of a startup’s fair market value is taxed at 30 per cent as income of the firm from other sources. Entrepreneurs have raised concerns over these tax notices.

- Normally, about 300-400 startups get angel funding every year.

- According to the new notification issued by the government the start-ups whose aggregate amount of paid-up share capital and share premium after the proposed issue of share does not exceed ₹10 crore, are eligible for the exemption

- These new norms are likely to encourage startups to get exemptions as many of them earlier refrained from seeking this benefit due to documentation processes

- Also, the government launched the Startup India initiative in January 2016 to build a strong ecosystem for nurturing innovation and entrepreneurship.

What is angel tax?

- The angel tax applies to unlisted companies that have raised capital through an issue of shares at a price deemed to be in excess of the fair market value of those shares. The excess capital over and above the fair market value is then treated as income and taxed accordingly. As this largely affects angel investments in start-ups, it has been dubbed

angel tax.

Eligibility

- Further, the investor’s net worth has to be at least ₹2 crore or the amount of investment made in the start-up, whichever is higher, as on the last date of the financial year preceding the year of investment. To claim the exemption, start-ups and investors have to make an application to the DIPP,

- in the prescribed format, along with the necessary documents. Once approved, the Central Board of Direct Taxes (CBDT) is to then issue a certificate of exemption within 45 days of the application.

- On the investor side, the notification says the angel investor should have filed I-T returns of at least ₹50 lakh for the year preceding the year in which the investment was made.

Anti-dumping duty imposed on Chinese chemical for 5 years

17, Dec 2018

In News:

- The revenue department of government of India has imposed anti-dumping duty for five years on a Chinese chemical used in making detergents to guard domestic players from cheap imports from the neighbouring country.

Explained:

- The levy on ‘Zeolite 4A’ [Detergent grade] has been imposed on recommendations of Directorate General of Trade Remedies (DGTR) after conducting a probe in this regard.

- The duty in the range of USD 163.90-207.72 per tonne of the chemical will remain in force for five years (unless revoked, superseded or amended earlier), said the Central Board of Indirect Taxes and Customs (CBIC) in a notification.

- DGTR, the investigation arm of the commerce ministry, had conducted the probe on complaint

- Countries carry out an anti-dumping probe to determine whether their domestic industries have been hurt because of a surge in below-cost imports. As a countermeasure, they impose duties under themultilateral regime of WTO.

- The duty is also aimed at ensuring fair trading practices and creating a level playing field for domestic producers with regard to foreign producers and exporters.

- India has already imposed anti-dumping duty on several products to check cheap imports from countries including China with which India has a major concern of widening trade deficit.

- The deficit has increased to USD 63.12 billion in 2017-18 from USD 51.11 billion in the previous fiscal.

What is Anti-Dumping Duty?

- An anti-dumping duty is a protectionist tariff that a domestic government imposes on foreign imports that it believes are priced below fair market value.

- Dumping is a process where a company exports a product at a price lower than the price it normally charges in its own home market.

- To protect local businesses and markets, many countries impose stiff duties on products they believe are being dumped in their national market

WTO:

- The WTO began life on 1 January 1995, but its trading system is half a century older. Since 1948, the General Agreement on Tariffs and Trade (GATT) had provided the rules for the system.

- The last and largest GATT round, was the Uruguay Round which lasted from 1986 to 1994 and led to the WTO’s creation. Whereas GATT had mainly dealt with trade in goods, the WTO and its agreements now cover trade in services, and in traded inventions, creations and designs (intellectual property).

Principles of the WTO trading system:

MOST-FAVOURED-NATION (MFN) PRINCIPLE: TREATING FOREIGNERS EQUALLY:

- Under the WTO Agreements, a country should not discriminate between its trading parties. According to the MFN principle, any advantage, favour, privilege or immunity granted by a Member to any product originating in or destined for any other country shall be accorded immediately and unconditionally to the like product of all Members. The MFN principle is one of the cornerstones of the WTO.

NATIONAL TREATMENT PRINCIPLE: TREATING FOREIGNERS AND LOCALS EQUALLY:

- Within national territory, WTO Members cannot favour domestic products over imported products

- The principle of national treatment also applies, with some differences, to trade in services (Article XVII of the GATS) and intellectual property protection (Article 3 of the TRIPS Agreement).

GENERAL PROHIBITION OF QUANTITATIVE RESTRICTIONS (QRS):

- WTO Members cannot prohibit, restrict or limit the quantity of products authorized for importation or exportation (Article XI of the GATT 1994), subject to limited exceptions.

OBSERVANCE OF BINDING LEVELS OF TARIFF CONCESSIONS (GOODS) AND OF SPECIFIC COMMITMENTS (SERVICES):

- Minimum market access conditions are guaranteed by commitments undertaken by Members regarding customs duties (tariff concessions for goods – Article II of the GATT 1994) and market access for the supply of services (specific commitments – Article XVI of the GATS)

TRANSPARENCY:

- It is fundamentally important that regulations and policies are transparent.WTO Members are required to inform the WTO and fellow-Members of specific measures, policies or laws through regular “notifications”.

- In addition, the WTO conducts periodic reviews of individual Members’ trade policies through the Trade Policy Review Mechanism (TPRM).