Category: Miscellaneous

GOVERNMENT SHIFTS TO ‘LARGE OUTBREAK CONTAINMENT’

07, Apr 2020

Context:

- The Union Health Ministry has announced that India has now stepped out of the local transmission phase and moved into the “large outbreaks amenable to Containment Phase”.

COVID-19 and its Spread:

- With a current case doubling rate of 96 hours and the infection having spread to nearly 300 of the 736 districts across the country.

- The protocol presently followed has been set out in the Union Health Ministry’s “Containment plan for large outbreaks” document.

- This includes active surveillance for cases and expanding laboratory capacity.

- The other measures under the protocol include implementation of social-distancing measures, providing chemoprophylaxis with hydroxy-chloroquine to asymptomatic healthcare workers and asymptomatic household contacts of laboratory confirmed cases.

- The document also lists the hospital facilities to be provided to COVID-19 patients.

The Three-Tier Arrangement

- Anticipating about 15% of the patients are likely to require hospitalization, and an additional 5% will require ventilator management, the Centre has planned a three-tier arrangement for managing suspect/ confirmed cases.

- 1.Mild cases:

- Will be kept in temporary makeshift Hospital Facilities

- 2.Moderate to Severe Cases

- Cases requiring monitoring of their clinical status will be admitted to COVID hospitals.

- 3.Severe Cases

- Cases that may progress to respiratory failure and /or progress to multi-organ failure and hence critical care facility/ dialysis facility etc shall be required.

- The Ministry is also looking at scaling down operations – if no secondary laboratory confirmed COVID-19 case is reported from the geographic quarantine zone for at least four weeks after the last confirmed test has been isolated and all his contacts have been followed up for 28 days.

LAND ENCROACHMENT & RELIGION

23, Mar 2020

Context:

- Earlier this month, the High Court of Uttarakhand directed the State government to remove 770 religious structures built by encroaching on public places by March 23. The state government sought one year’s time for removing such religious structures but the division bench rejected this request citing a Supreme Court’s order of 2009.

Background:

- Supreme Court’s order of 2009 –

- The Supreme Court in the case of Union of India v/s State of Gujarat and others had directed all states to demolish illegal religious structures, saying in the name of gods and religion, no unauthorized construction can be allowed on streets, parks and other public places.The restriction would apply to temples, mosques, churches, gurudwaras, and places of worship of all other communities.

Land Encroachment:

- Land is a scarce commodity, and when the religious structures are built on public land it results in constriction of the public space eg. public roads.

- Land is a public property, which can be given away only by the Government, provided it is not discriminatory and there is no favoritism.

- Broadly there are two kinds of encroachments:

- one is the conversion of historical monuments into places of worship,

- while the other is the blatant grabbing and conversion of public property into a place of worship, a shrine or something similar.

- While the judiciary has never encouraged encroachment on public land, on the contrary, the state government allows it whenever there is a window of opportunity.

- Despite the regulations and the rules against land encroachment on religious grounds, the state governments and the public are supportive of this particular issue due to belief concerns.

- The state governments are most often hesitant to remove religious structures even though they are on public lands due to the hue and cry caused by the public and sentiments attached to the religious structures.

- The non-enforcement of strict regulations regarding the public encroachment by the local authorities provides encouragement to the public to take this issue lightly.

Judgements in this Regard:

- The Supreme Court has made its stand very clear on the issue of land encroachment.

- The Supreme Court of India ordered five apartments in Maradu municipality in Kerala to be demolished, for violation of Coastal Regulation Zone (CRZ) rules.

- It has also been observed that most often, the structures are built and established for many years before they receive an order to be demolished. This results in a loss of resources and time.

- Authorities who have powers to prevent violations should intervene to safeguard public property.

- Similarly, a division bench of the Telangana High Court has pulled the Telangana government for not coming up with a firm policy to deal with those encroaching vacant lands.

- Where the bench observed ‘No religious structure should be treated above law’.

Problems Associated with land Encroachment:

- Many development projects have come to a halt due to the issue of land encroachment on public land.

- Road widening would be a problem as it is occupied by religious structures.

- Pedestrians would suffer as people would have fewer spaces to walk.

- There are development plans made for projects in urban and rural areas.

- The lands have already been earmarked for a particular purpose, and the construction of any religious structure on public grounds can be interpreted as a violation.

- Thus the issue of public land encroachment should be dealt with a firm hand.

Way Forward:

- The issue of land encroachment requires the collective efforts of the Public, the local authorities and the State Government if it has to be resolved completely.

- The citizens have a major responsibility in trying to prevent the encroachment of public lands.

- The citizens should abide by the rules and regulations and if they violate the rule of law, the violators should be penalized.

- The local authorities and the state governments would have to become proactive in the prevention of encroachment of public lands for religious purposes.

- The authorities who are responsible for the prevention of land encroachment should also be held responsible.

CHARMINAR MINARET

03, May 2019

Why in News:

- A large chunk of lime-mortar plaster came crashing down from a minaret of the Charminar causing consternation among locals and passersby.

Details:

- ASI archaeologist said that the damage has taken place due to the monument’s erosion over a period of time

- ASI is likely to undertake repairs soon after assessing the damage

- The plastering on the monument is not original, as it was redone in 1924 by the Nizam (seventh, Mir Osman Ali Khan, the Asaf Jahi monarch of the erstwhile state of Hyderabad). Prior to this, the ASI had proposed to study a huge crack in the north-eastern part of the monument to examine the damage and ascertain whether it has affected the structural integrity of the monument.

Charminar:

- The Charminar was built in 1591 by Mohd. Quli Qutb Shah, the fourth king of the Qutb Shahi dynasty, which also built the historic Golconda fort. The 428-year-old monument was built as the foundation of Hyderabad, which founded by Mohd. Quli Qutb Shah, after he decided to shift outside the Golconda fort.

- It is 426 years old.

Significance:

- The city was later planned on a grid pattern, around the Charminar, with two main roads that connect the markets of Golkonda with the port city of Machilipatnam intersecting and running North-south and east-west. It is the first multi-storied building in Hyderabad. It also has religious significance and multiple faiths coexist here peacefully. Mecca Masjid and Bagyalakshmi temple lie within the proximity of Charminar which shows the religious harmony of the city. Though it is the personification of Shahi architecture, there are elements of Hindu architecture noticeable on this monument.

Archaeological Survey of India (ASI)

- The ASI is the premier organization for the archaeological researches and protection of the cultural heritage of the country.

- The prime objection of ASI is to maintain the archaeological sites, ancient monuments and remains of national importance.

- Headquarters: New Delhi.

- It functions under the aegis of the Union Ministry of Culture.

A ‘MILLION WORD GAP’ FOR CHILDREN NOT READ TO AT HOME

08, Apr 2019

why in news?

- Young children whose parents read them five books a day enter kindergarten having heard about 1.4 million more words than children who were never read to, a study has found.

- This “million-word gap” could be one key in explaining differences in vocabulary and reading development, said Jessica Logan, assistant professor at The Ohio State University in the U.S.

Back ground:

- Even children who read only one book a day will hear about

- 2,90,000 more words by age 5 than those who don’t regularly read books with a parent or caregiver. Kids who hear more words are going to be better prepared to see those words in print when they enter school.

- The researchers identified the 100 most circulated books for both board books and picture books. They also assumed that parents who reported never reading to their kids actually read one book to their children every other month.

- Based on these calculations, children who have never been

- read to would have heard 4,662 words by the time they were 5 years old. Those who are read five books a day, hear about 1,483,300 words. “The word gap of more than 1 million words between children raised in a literacy-rich environment and those who were never read to is striking.

IS DEATH BY MOSQUITO BITE INSURABLE?

27, Mar 2019

Well, not if the mosquito bit the insured person in the Republic of Mozambique, the Supreme Court held in a judgment.

Brief about the case:

- The case concerns about a man, who died of multiple organ failure after being diagnosed with encephalitis malaria contracted from a mosquito bite he sustained while working in Mozambique in 2012.

- His insurance policy covered personal accidents. Both the State and the National Consumer Dipsutes Redressal Commissions dismissed the plea made by the insurance company, National Insurance Limited, that the man died as a result of an infection. The company argued that a mosquito bite cannot be classified as a ‘personal accident’ covered under the policy.

- The insurance company, said death due to malaria was a common occurrence in Mozambique. According to the World Health Organisation’s World Malaria Report 2018, which showed that an estimated ten million cases of malaria in Mozambique and an estimated 14.7 thousand deaths in 2017.

Courts Stand:

- The National Commission too had agreed that if the insurance company could cover events like snake bite, frost bite and dog bite then why not mosquito bites.

- However, the mosquito bit in Mozambique, which according to World Health Organisation has a population of 29.6 million people and accounts for 5% of the cases of malaria globally.

- It is on record that one out of three people in Mozambique is afflicted with malaria. It was not a peril insured against in the policy of accident insurance.

Most Prominent Diseases caused by Mosquito Bites:

- Zika Virus Malaria

- West Nile virus

- Dengue fever

- Yellow fever

- Chikungunya

Malaria

- Malaria is a vector borne disease caused by parasitic protozoans belonging to the Plasmodium type. It is most commonly transmitted by an infected female Anopheles mosquito. According to the World Malaria Report 2016, India accounts for 89% of the incidence of malaria in the South-East Asia region.

- In India, malaria is caused by the parasites Plasmodium falciparum (Pf), found more in the forest areas and Plasmodium Vivax (Pv), more common in the plains.

- Most malaria cases are mainly concentrated in tribal and remote areas of the country.

- The majority of malaria reporting districts are in India’s eastern and central parts.

- Government has launched National Strategic Plan for Malaria Elimination.

Road accident fatalities drop 24%, thanks to concerted efforts

19, Mar 2019

Fatalities in road accidents have dropped 24.39%, thanks to the efforts of various stakeholders such as the police, health and transport officials. The efforts were recognised by the Supreme Court-appointed committee on road safety.

Road Accidents in India

- 400 people lost their lives every day on Indias roads : Road Safety Report, 2015

- Eighty per cent of road accidents are termed “fault of the driver”, according to a 2013 analysis by the Union Ministry of Road Transport and Highways.

- WHO – Nearly 2,00,000 people are killed in road accidents in India, second highest globally behind China

- United Nations had promulgated the UN Decade of Action targeting to reduce road accidents by 50% by the year 2020.

- Indian roads became deadlier than ever in 2016, with a total of 1.51 lakh people dying in 4.81 lakh accidents.

- Youth in the age group of 15 to 24 years comprise 33% of the total fatalities.

- Riders on motorized 2-3 wheelers have the highest mortality rate.

- The cost of road accidents in the country is equivalent to 3% of GDP

What are the reasons for high number of road accidents in India?

- Boom in automobile sector and parallel rise of the Indian middle class has increased volume of vehicles on the road. On the other hand, road infrastructure and standards have not improved accordingly.

- Cases of drunk driving, rash driving, overtaking and disrespect of traffic rules have increased.

- Not following safety standards like lane driving, traffic lights, wearing helmets and seatbelts, etc.

- Rapid urbanization of cities and expanding of their limits.

- With driving tests in India not factoring in visual acuity, poor eyesight could be a major culprit in road accidents. Depth perception — to judge the speed of incoming vehicles — and glare recovery, a measure of how quickly drivers can resume control of their vehicles when suddenly blinded by the lights of an incoming vehicle, are all known to be play a key role in road safety.

Legislative Issues:

- Motor vehicles act 1988 has become outdated in terms of fines imposed, penalties, offences, jail terms, categorisation of drivers, laxity in issuing driving licenses and fixing accountability and responsibility. In this context amended MVA proposes for centralized database, graded penalty system, strict enforcement, guidelines, online approvals, suspensions and stricter jail terms for repeat offenders which is a progressive step

- The Motor Vehicles Act is the Central law that governs rules regarding licences but licences, ultimately, are a State subject. For Indian commercial licences, an applicant requires a medical certificate attesting 6/6 or normal vision whereas a private licence only requires the applicant to self-certify

- Proposed road transport safety bill should focus on road safety, widened roads, signage’s at curves, speed breakers at vulnerable points, zebra crossing(a recent 3D crossing is innovative),compulsory use of helmets, fine on excessive speeding, use of airbags, compulsory recall if failing crash tests as these entities are grossly inadequate in India

Enforcement Issues:

- These issues have been plagued by corruption, nepotism, vested interests, sale of tender to unfit road contractors, issue of fraudulent and duplicate licenses, among others.

- Road transport offices and officers let off violators and offenders with petty fines leading to increased RTA

- Guidelines are not followed during construction leading to potholes, uneven roads, dangerous turnings and weak over bridges (eg- recent flyover collapse in West Bengal)

- Provisions related to ambulances, emergency response systems, resuscitation during the golden hour are not enforced properly

Measures that can be taken:

Various nations have lowered their road fatalities by different steps like Vision Zero in Sweden.

Various measures that can be adopted in India are:

- Promote sustainable transport approach i.e. reduce number of kilometers travelled and reduce volume of vehicles on the road

- Avoid-shift-improve approach can be used to this end. We should

- Create awareness amongst people to avoid private means of transport. This can be achieved by higher road and toll taxes, sensitizing them over pollution issues.

- Shift the traffic onto public means of transport. Multi modal transport systems with transit facilities are a good option.

- Improve existing infrastructure in terms of speed, time, accessibility and affordability. Delhi Metro provides a great example that can be replicated.

- Stricter norms of traffic rules especially on drunk driving, over speeding, helmets and seatbelts. Strict challan system.

- Identifying accident hotspots and re-engineering them specially sharp curves, traffic merging points. Building alternative expressways dedicated to particular traffic.

- Preventing poor people from sleeping on roadsides.

- Highway patrol units, cameras, repair shops and medical care units at fixed distances along roads.

- Tax incentives to manufacturers of vehicles with more safety features. But higher toll taxes and road taxes from users.

- Planners of cities should rationalise the proposed roads and lanes as per the population demands.

- Creating awareness amongst people towards over speeding and rash driving by campaigning with slogans like Better late than never.

Some Innovative steps taken:

The Union Ministry of Road Transport and Highways has launched two mobile applications e-challan and m-parivahan to provide a comprehensive digital solution for enforcement of traffic rules. These applications will provide access to various services and information, and enable citizens to report any traffic violation or road accident.

Who are Good Samaritans?

People who help accident victims and take them to hospital. They are usually harassed by hospital authorities and later by police.

The government has issued a notification for the protection of Good Samaritans in the wake of the Supreme Court (SC) direction on helping accident victims.

Background:

- The Supreme Court had directed all the states to follow the Centre`s guidelines that encouraged witnesses in road accidents to report to police and also help survivors with medical treatment

- The apex court had also directed the Centre to publish its guidelines notified last year to ensure that all those who help accident victims/survivors were not harassed by the police.

What are the guidelines?

- Assuring them anonymity and protecting them from any civil or criminal liability for taking the victim to the nearest hospital

- Bystanders or passers-by, who chose to help a person in distress on the road, should be “treated respectfully and without discrimination on the grounds of gender, religion, nationality, caste or any other.”

- Complete anonymity in case the Good Samaritan does not want to reveal his name or details, use of video-conferencing in case of any further interaction with him by the authorities and provision for the police to examine him at his residence or office or any place of his convenience. This should be done only once and in a time-bound manner.

Delhi Government’s “Good Samaritans” Policy:

- Monetary incentive of Rs 2,000 and appreciation certificate will be given to people who help road accident victims in the national capital.

- This can be replicated.

Transfer ASI archaeologist back to Keezhadi

16, Mar 2019

The Madras High Court impressed on the Centre the need to show greater vigour and interest in proceeding with the excavations that had led to promising discovery of an ancient civilisation having thrived on the banks of river Vaigai at Keezhadi village in Sivaganga district.

About Vaigai River

- The Vaigai is a river in the Tamil Nadu state of southern India that originates in Varusanadu Hills, the Periyar Plateau of the Western Ghats range, and flows northeast through the Kambam Valley, which lies between the Palni Hills to the north and the Varushanad Hills to the south.

- The Vattaparai Falls are located on this river.

- As it rounds the eastern corner of the Varushanad Hills, the river turns southeast, running through the region of Pandya Nadu.

- Madurai, the largest city in the Pandya Nadu region and its ancient capital, lies on the Vaigai.

- The Vaigai is 258 kilometres (160 mi) long, with a drainage basin 7,031 square kilometres (2,715 sq mi) large

Archaeological Survey of India (ASI)

- The ASI is the premier organization for the archaeological researches and protection of the cultural heritage of the

- The prime objection of ASI is to maintain the archaeological sites, ancient monuments and remains of national

- Headquarters: New

- Established: 1861 by Alexander

- It regulates all archaeological activities as per the provisions of the Ancient Monuments and Archaeological Sites and Remains Act,

- It functions under the aegis of the Union Ministry of Culture.

- It also regulates Antiquities and Art Treasure Act,

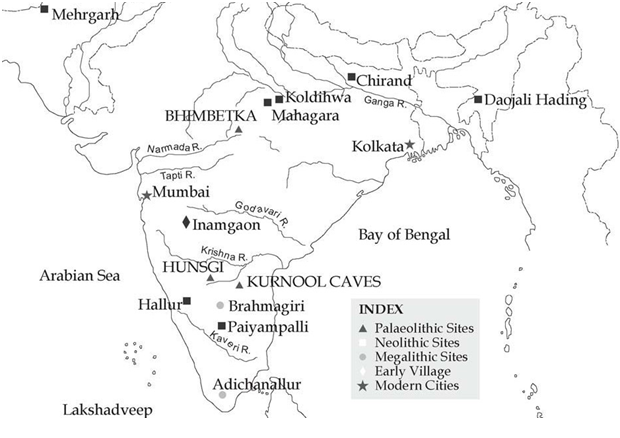

Archaeological sites in India:

RURAL INDIA PUSHES UP UNEMPLOYMENT IN FEBUARY

08, Mar 2019

In News:

CMIE report on unemployment.

Explained:

- Estimated unemployment rate shot up to a 29-month high of 7.23 per cent in February 2019 and the numbers of those employed fell by 56.6 lakh over the last 12-months led by job losses in rural areas and especially in Uttar Pradesh, Karnataka and Bihar. Data shows that while the total number of employed dropped from 40.59 crore in February 2018 to 40.01 crore in February 2019, that in rural India dropped from 27.53 crore to 27.07 crore in the same period.

- A look into the rural employment figures of states show that the number of those employed in rural UP alone declined from 4.4 crore to 4.19 crore accounting for a decline of 25 lakh jobs during the period.

- While the rural Karnataka and Bihar saw the number of employed drop by 15 lakh each, Gujarat witnessed a reversal as the number of those employed rose from 1.14 crore in Feb 2018 to 1.33 crore in Feb 2019, thereby witnessing an addition of almost 19 lakh.

- CMIE has, however, revised its initial estimates for December 2018 (released in January 2019), that showed the unemployment rate at 7.38 per cent. The revised CMIE figures show that it was at 7.02 per cent for December 2018. It has now risen to 7.23 per cent in February 2019, the data shows. The unemployment rate of 7.23 is the highest since September 2016 when it stood at a high of 8.46 per cent.

- The estimates provided by CMIE database on “Unemployment Rate in India” is based on the panel size of over 1,58,000 households. The CMIE data, however, also shows that alongside the rise in unemployment, there has been a dip in the labour participation rate.

- A breakup of the rural and urban job numbers shows that a large part of the drop-in employment over the last 12-months is on account of job losses in rural areas. Out of the 56 lakh job losses, almost 82 per cent or 46 lakhs were from the rural areas.

- The rural employment numbers fell from 27.53 crore in February 2018 to 27.07 crore last month. The rural unemployment rate over the last 12-months has shot up from 5.53 per cent to 6.98 per cent.

- In line with a dip in the employment rate, the CMIE data shows that there has been a dip in the estimated labour participation rate (LPR) — proportion of working-age people (which is people of 15 years or more) who are willing to work and are either actually working or are actively looking for work.

- The unemployment rate is the proportion of the labour force that is unemployed. While the LPR stood at 43.77 per cent in February 2018, it declined to 42.74 per cent last month. In January, however, the unemployment rate and labour participation stood at 7.05 per cent and 43.18 per cent.

CMIE:

CMIE, or Centre for Monitoring Indian Economy, is a leading business information company. It was established in 1976, primarily as an independent think tank.

Form 26

07, Mar 2019

Context:

- Law Ministry made it mandatory for election candidates to reveal their income-tax returns of the last five years, as well as the details of their offshore assets. This was done by amending Form 26, after the Election Commission of India wrote to the Ministry.

What is Form 26?

- A candidate in an election is required to file an affidavit called Form 26 that furnishes information on her assets, liabilities, educational qualifications, criminal antecedents (convictions and all pending cases) and public dues, if any.

- The affidavit has to be filed along with the nomination papers and should be sworn before an Oath Commissioner or Magistrate of the First Class or before a Notary Public.

What has changed?

- Earlier, a candidate had to only declare the last I-T return (for self, spouse and dependents). Details of foreign assets were not sought.

- Offshore assets, as per the notification, means “details of all deposits or investments in foreign banks and any other body or institution abroad and details of all assets and liabilities in foreign countries”.

- It is now mandatory for candidates to reveal their own income-tax returns of the last five years rather than only one, and the details of offshore assets, as well as the same details for their spouse, members of the Hindu Undivided Family (if the candidate is a karta or coparcener), and dependents.

Objective:

- The objective behind introducing Form 26 was that it would help voters make an informed decision. The affidavit would make them aware of the criminal activities of a candidate, which could help prevent people with questionable backgrounds from being elected to an Assembly or Parliament. With the recent amendment, voters will know the extent to which a serving MP’s income grew during his five years in power.

What happens if a candidate lies in an affidavit?

- A candidate is expected to file a complete affidavit. Leaving a few columns blank can render the affidavit “nugatory”. It is the responsibility of the Returning Officer (RO) to check whether Form 26 has been completed; the nomination paper can be rejected if the candidate fails to fill it in full.

- If it is alleged that a candidate has suppressed information or lied in her affidavit, the complainant can seek an inquiry through an election petition. If the court finds the affidavit false, the candidate’s election can be declared void. The current penalty for lying in an affidavit is imprisonment up to six months, or fine, or both. In May 2018, the EC had asked the government to make the filing of a false affidavit a “corrupt practice” under the election law, which would make the candidate liable for disqualification for up to six years. But nothing has been done by the government on this front.

GOVT. CUTS FY19 GROWTH ESTIMATE TO 7%

28, Feb 2019

In News:

- The government revised downwards its estimate for GDP growth in the 2018-19 financial year to 7% from the 7.2% estimated in the first estimate for the year released in January.

Explained:

- The slowdown in 2018-19 is due to a lowering in the growth estimate of the agriculture sector to 2.7% as per the latest data compared with the 3.8% estimated earlier. The manufacturing sector, too, is estimated to grow at a marginally lower 8.1% compared with the previously predicted 8.3%. Data showed that the GDP growth slowed for the third consecutive quarter in the quarter ended December 2018 to 6.6% — a six-quarter low — from 7% in the second quarter and 8% in the first quarter of this financial year.

- The primary reason for this is the upwards revision in FY18 GDP growth rate in the first revised estimate [released on January 31, 2019] to 7.2% from 6.7% earlier.

- The two notable divergences between the second estimate and the first are that private final consumption expenditure growth has been revised upwards to 8.3% from 6.4% and investment growth was revised lower to 10% from the earlier estimate of 12.2%.

- FY19 GDP growth in second advance estimate of national income is lowered to 7% from 7.2% in first advance estimate.

- Economists point out that the size of the economy in terms of nominal GDP is now estimated to be Rs. 190.54 lakh crore, up from the Rs. 188.41 lakh crore estimated earlier.

- This will go a long way in helping the government meet its fiscal deficit target of 3.4% of GDP for the year.

- In a quarterly basis, the agriculture sector is estimated to have grown at 2.7% in the third quarter of this financial year, compared with a 4.6% growth in the same quarter of the previous year.

Two Crore jobs created in 16 Months to December 2018

26, Feb 2019

In News:

- According to the payroll data of the Employees State Insurance Corporation (ESIC), nearly two crore jobs were created in 16 months to December 2018.

Explained:

- The ESIC data is one of the payroll numbers released by the Central Statistics Office (CSO) in its reports based on people joining various social security schemes run by Employees Provident Fund Organization (EPFO) and Pension Fund Regulatory Development Authority (PFRDA).

- The ESIC provides health insurance and medical services to its insured person, covering all those establishment which have 20 or more workers and all those employees whose monthly wages are up to Rs. 21,000.

- During the period from September 2017 and December 2018, as many as 1.96 crore new subscribers joined the scheme.

- Similarly, the EPFO data showed that employment generation in the formal sector almost trebled to touch a 16-month high of 7.16 lakh in December 2018, compared to 2.37 lakh in the year-ago month. It indicated that nearly 72.32 lakh new subscribers were added to social security schemes of the EPFO from September 2017 to December 2018.

- The EPFO covers all those firms that have 20 or more employees. Workers, whose basic wages are up to Rs. 15,000 per month at the time of joining the job, are mandatorily covered under the scheme.

- The estimated number of new NPS (National Pension Scheme) subscribers during the period — September 2017 to December 2018 — is 9,66,381.

- The NPS covers central and State government employees while others can voluntarily subscribe to it. The report gives different perspectives on the levels of employment in the formal sector and does not measure employment at a holistic level, the report said.

NPS – PFRDA

25, Feb 2019

In News:

- Pension Fund Regulatory and Development Authority (PFRDA) is working on a minimum assured return scheme (MARS) for subscribers of the National Pension System (NPS).

Background:

- The Pension Fund Regulatory & Development Authority Act was passed on 19th September, 2013 and the same was notified on 1st February, 2014. PFRDA is regulating NPS, subscribed by employees of Govt. of India, State Governments and by employees of private institutions/organizations & unorganized sectors.

- The PFRDA is ensuring the orderly growth and development of pension market

- The Government of India had, in the year 1999, commissioned a national project titled

- “OASIS” (an acronym for old age social & income security) to examine policy related to old age income security in India. Based on the recommendations of the OASIS report, Government of India introduced a new Defined Contribution Pension System for the new entrants to Central/State Government service, except to Armed Forces, replacing the existing system of Defined Benefit Pension System.

- On 23rd August, 2003, Interim Pension Fund Regulatory & Development Authority (PFRDA) was established through a resolution by the Government of India to promote, develop and regulate pension sector in India. The contributory pension system was notified by the Government of India on 22nd December, 2003, now named the National Pension System (NPS) with effect from the 1st January, 2004.

- The NPS was subsequently extended to all citizens of the country w.e.f. 1st May, 2009 including self-employed professionals and others in the unorganized sector on a voluntary basis.

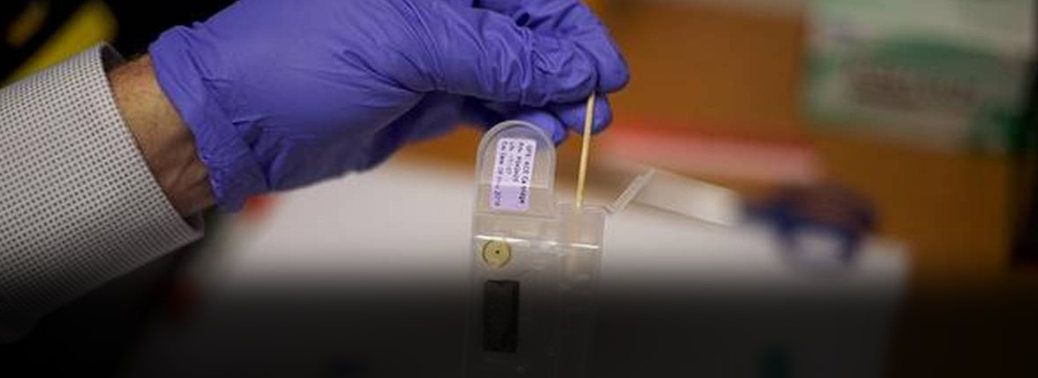

DNA Forensics for wildlife Crime

25, Feb 2019

- With investigating agencies facing increased challenges of collecting evidence to ensure convictions in wildlife crimes, DNA forensics are providing a major headway.

About

- Details of case studies, where advanced DNA forensics were used to help prosecute wildlife related crimes, have been documented in a recently published ZSI report, titled Ascertaining species of origin from confiscated meat using DNA forensics and Wildlife forensics in nullifying the false accusation.

- “Illegal wildlife crime is not confined to a region or to a country but it is an organized crime where several people are involved from local hunters to the end buyers. This calls for an urgent need to employ techniques of DNA forensics to improve conviction rate which at present remains very low.

- Referring to two instances where pangolin scales were seized from Siliguri in August 2017 and April 2018, DNA analysis revealed that these scales were from the Chinese Pangolin whose habitat is restricted to five states in northeast India including parts of north Bengal.

Database:

- The ZSI is now developing protocols to identify the number of individuals killed in a seizure from the DNA analyses.

- Scientists at the ZSI, however, pointed out that in most cases the samples they receive from investigating agencies in cases of wildlife crime are disfigured and have lost characters of morphological identity, which poses a major challenge.

- Scientists are involved in creating a reference database to assign the seizures to the source of origin, identifying sexes from seizures to understand poaching/ hunting pressure on the species which might impact the species demography in coming years.

- The ZSI is one of four organisations authorised by the Government of India to submit species identification reports from the confiscated materials.

- This new tool is helping in solving a number of wildlife crimes. The ZSI has also formulated a standard operating procedure in the investigation of wildlife crime.

- The ZSI also organised a workshop for law enforcement agencies titled ‘Wildlife Forensics and Crime Control’, where the participants were informed on using new technological tools to combat wildlife crime.

Air Passenger Traffic to Grow over Fourfold

24, Feb 2019

In News:

- According to an industry forecast by aviation consultancy Centre for Asia Pacific Aviation (CAPA), various airlines in the country are likely to see the total number of passenger trips grow more than fourfold from 243 million in financial year 2020 to 1.1 billion in 2040.

Explained:

- The total domestic passenger trips are likely to grow five times — 165 million in 2020 to 837 million in 2040. International passenger trips are also expected to increase by 3.7 times — 78 million to 296 million.

- The passenger demand will fuel fleet expansion and will see airlines add 1,780 planes on domestic routes and 808 on international ones.

- During the same comparative period, the total number of aircraft is likely to increase from 754 to 3,342.

- The domestic aviation industry could attract an investment of $250 billion over the next two decades, more than five times the investment seen by the sector in the past 15 years at $48billion.

- Of this, aircraft acquisition and airport development will account for 90% of the expenditure — with an estimated $161 billion- $173 billion on new planes and $60-65 billion on brownfield and greenfield airports, the report noted.

- The economic impact of the growth in the aviation sector is expected to continue to increase at a faster rate than the GDP.

- Its contribution to the GDP is also likely to increase from 7% to 9% or $1.1 trillion.

Women’s Livelihood Bond

20, Feb 2019

In News:

- World Bank, UN Women, and Small Industries Development Bank of India (SIDBI) have joined hands to launch a new social impact bonds exclusively for women, called Women’s Livelihood Bonds (WLBs), with an initial corpus of Rs 300 crore.

Explained:

- The bonds, which will have a tenure of five years, will be launched by SIDBI with the support of World Bank and UN Women. SIDBI will act as the financial intermediary and channel funds raised to women entrepreneurs through participating financial intermediaries like banks, NBFCs or microfinance institutions.

- The proposed bond will enable individual women entrepreneurs in sectors like food processing, agriculture, services and small units to borrow around Rs 50,000 to Rs 3 lakh at an annual interest rate of around 13-14 per cent or less.

- The WLBs will be unsecured, unlisted bonds and offer fixed coupon rate of 3 per cent per annum to bond investors

- The first tranche of Rs 100 crore at 3 per cent per annum coupon rate per annum will be mobilised over the next four months through a bond placement by Sidbi

- The bonds will be backed by a corpus fund to be mobilised through corporate social responsibility contributions and via grant support from the UK’s Department for International Development.

- The corpus guarantee cover will enable women entrepreneurs to access credit at much lower rates of interest, according to a World Bank statement.

- The new bonds will not only enable women self-help groups to graduate from ‘group borrowing’ to ‘individual borrowing’ but will also allow them to shift from development assistance towards more market-financed prograammes.

Emergency Response Support System

20, Feb 2019

Top of Form

- The Union Home Minister and Minister for Women and Child Development jointly launched the Women Safety initiative of Emergency Response Support System (ERSS) in 16 States/UTs and Mumbai city.

About:

- People in these states and UTs can now call a single pan India number 112 for any emergency. In addition, Investigation Tracking System for Sexual Offences (ITSSO) and Safe City Implementation Monitoring Portal were also launched. The 16 States/UTs where the ERSS has been launched today are Andhra Pradesh, Uttarakhand, Punjab, Kerala, Madhya Pradesh, Rajasthan, UP, Telangana, Tamil Nadu, Gujarat, Puducherry, Lakshadweep, Andaman, Dadra & Nagar Haveli, Daman & Diu, J&K.

- Very soon it will be implemented across the whole country. One can dial 112 or use Panic Button on their phones or 112 India Mobile App to connect to a single emergency services number 112 which will combine Police, Fire, Health and other helplines through an Emergency Response Centre in the State.

- Union Home Minister also announced approval of Rs. 78.76 crore for a special project under the Nirbhaya Fund for strengthening DNA analysis capacities in the State Forensic Science Laboratories of four States of Tamil Nadu (Chennai and Madurai), Uttar Pradesh (Lucknow and Agra), West Bengal (Kolkata) and Maharashtra (Mumbai). He said that this effort will help in speedy investigation of rape cases.

- These initiatives could prove to be a “game changer” if implanted effectively by the states.

- ERSS had already been successfully implemented in the States of Himachal of Pradesh and Nagaland.

The emergency response system can be triggered in the following manners:

- On the smart phones, the power button (which is dedicated panic button) when pressed three times quickly.

Dialing 112 from any phone.

- In case of feature phones, long press of the touch key 5 or 9.

- Using 112 India Mobile App which is available for free downloading.

- For women and children, 112 India App provides a special SHOUT feature which alerts registered volunteers in the vicinity of victim for immediate assistance

The Marvel at Bhitargaon

05, Feb 2019

- The excavations of cities of the Indus Valley Civilisation testify to early urbanisation, as early as 2,600 BCE.

- Rock-cut architecture began to develop from the 3rd century BCE. Though the earliest rock-cut architecture is from the Mauryan dynasty, the Ajanta caves are among the earliest rock-cut temples.

Brick Temple:

- As man progressed and learnt new techniques, rock-cut temples gave way to stone temples and as stone was not easily available everywhere, to brick temples.

- In the Gangetic plains, which have alluvial soil and paucity of stones and rocks, many brick structures came up.

- Though rock-cut and stone temples withstood the vagaries of time, brick temples were not so fortunate. That is what makes the brick temple of Bhitargaon, about 50 km off Kanpur in Uttar Pradesh, so special.

The Man who Restored heritage:

- In 1861, Lord Canning appointed Sir Alexander Cunningham as the Archaeological Surveyor to the Government of India, and it is to Cunningham that we owe a huge debt, for he located and rescued a good part of India’s built heritage. He was responsible for excavations in Sarnath in 1837 and Sanchi in 1841.

- In 1871, he was made the first Director General of the Archaeological Survey of India. After that began a series of field surveys, which are documented in reports. In the Report of the Gangetic Provinces 1875-76 and 1877-78, Cunningham writes that his friend, Raja Ravi Prasada, gave him information of a brick temple near Kanpur that had superior terracotta work. Between November 1877 and February 1878, he made two visits to Bhitargaon.

- The village Bhitargaon had been part of an ancient city called Phulpur. The temple was simply known as Dewal, or temple, by the locals. It is one of the earliest surviving brick temples of India.

- Though Cunningham had placed it as belonging to the 7th century, it has subsequently been identified as belonging to the late Gupta period, to the 5th century.

Features of the temple:

- The temple also has a tall pyramidical spire (shikhara)above the inner sanctum (garbhagriha). This shikhara became the standard feature of the Nagara temple architecture of India.

- The walls are 8 ft thick. They are decorated with terracotta sculptures on panels fitted into niches separated by bold ornamental pilasters made for the purpose. Many have fallen or have become damaged and have found their way into museums.

- The remaining ones are of Shiva and Parvati seated together, Ganesha, an eight-armed Vishnu, a MahishasuraMardini and many animal figures, flora and foliage. Muhammad Zaheer, who examined this temple in the 1960s, and who wrote The Temple of Bhītargāon, counted 143 panels.

- According to Cunningham, because of the Varaha incarnation at the back of the temple, it was probably a Vishnu temple.

North Macedonia to Become NATO’s 30th Member

03, Feb 2019

In News:

- North Atlantic Treaty Organization said, its 29 members will clear the way for Macedonia to become the alliance’s 30th member following its historic name change.

Explained:

- The accession process then moves to the capitals of the 29 Allies, where the Protocol will be ratified according to national procedures. Once that process is completed the country will become a full member.

- An Accord with Greece to change the name of the former Yugoslav republic to Republic of North Macedoniaended one of the world’s longest diplomatic disputes, paving the way for Skopje to join NATO and the European Union.

- Since 1991, Athens had objected to its neighbor being called Macedonia because Greece has a northern province of the same name. In ancient times it was the cradle of Alexander the Great’s empire, a source of intense pride for Greeks.

NATO (North Atlantic Treaty Organization):

- The North Atlantic Treaty Organization was created in 1949 by the United States, Canada, and several Western European nations to provide collective security against the Soviet Union.

Reason For NATO:

- NATO was the first peacetime military alliance the United States entered into outside of the Western Hemisphere. After the destruction of the Second World War, the nations of Europe struggled to rebuild their economies and ensure their security.

- The former required a massive influx of aid to help the war-torn landscapes re-establish industries and produce food, and the latter required assurances against a resurgent Germany or incursions from the Soviet Union.

- The United States viewed an economically strong, rearmed, and integrated Europe as vital to the prevention of communist expansion across the continent. As a result, Secretary of State George Marshall proposed a program of large-scale economic aid to Europe.

- The resulting European Recovery Program, or Marshall Plan, not only facilitated European economic integration but promoted the idea of shared interests and cooperation between the United States and Europe.

- Soviet refusal either to participate in the Marshall Plan or to allow its satellite states in Eastern Europe to accept the economic assistance helped to reinforce the growing division between east and west in Europe.

- In 1947–1948, a series of events caused the nations of Western Europe to become concerned about their physical and political security and the United States to become more closely involved with European affairs.

- The ongoing civil war in Greece, along with tensions in Turkey, led President Harry S. Truman to assert that the United States would provide economic and military aid to both countries, as well as to any other nation struggling against an attempt at subjugation.

Digging for the Future Reveals remains from the past

01, Feb 2019

Work for Farmers’ Institution Stopped as Excavators Hit 1894 Assam Peasant Martyrs’ Mass Grave:

- A project expected to change the future of farmers in Assam’s Darrang district had to be suspended after excavators dug up the locals’ emotional link with the past — a mass grave of 140 peasants killed in a farmers’ revolt 123 years ago.

Historical Background:

- The uprising was triggered by a British government decision in 1893 to increase agricultural tax by 70-80%. At least 140 peasants died in police firing after the protests turned violent in Darrang district’s Patharughat, about 60 km northeast of Guwahati, on January 28, 1894.

- The spot believed to be the mass grave place was cordoned off and construction activities stopped.

- There is no monumental evidence of the spot having been the mass grave of the martyrs of the 1894 revolution. A positive outcome of the inadvertent incident is that there is attention on the mass grave area that was in a state of neglect.

Think Universal Basic Capital

30, Jan 2019

Definition:

- Universal Basic Income is a periodic, unconditional cash transfer to every citizen in the country. Here, social or economic positions of the individual are not taken into consideration. The concept of universal basic income has three main features.

They are as following:

- UBI is universal in nature. It means UBI is not targeted.

- The second feature of UBI is cash transfer instead of in-kind transfer.

- The third feature is that UBI is unconditional. That means one need not prove his or her unemployment status or socio-economic identity to be eligible for UBI.

Need for UBI:

- As a form of social security UBI will help in reducing inequality and eliminating poverty. Thus, it ensures security and dignity for all individuals.

- As human labour is being substituted by technology, there will be reduced wage income and reduced purchasing power. UBI will compensate for reduced purchasing power.

How UBI works?

- Under UBI, only those with zero income will receive the full benefits in net terms.

- For those, who earn additional income over the basic income, the net benefits will taper off through taxation.

- So even though the basic income is universal, only the poor will receive the full benefits.

Impacts of UBI to the Government?

- There would be drastic changes in the way government spends its revenue generated from taxation and other sources.

- Currently, Government spends its revenue on various services as well as on subsidies.

- UBI would mean that government may move away from service delivery and empower its citizens to access services through cash transfer.

Advantages of UBI:

- First, UBI would give individuals freedom to spend the money in a way they choose. In other words, UBI strengthens economic liberty at an individual level. This would help them to choose the kind of work they want to do, rather than forcing them to do unproductive work to meet their daily requirements.

- Universal Basic Income would be a sort of an insurance against unemployment and hence helps in reducing poverty.

- UBI will result in equitable distribution of wealth. As explained above, only poor will receive the full net benefits.

- Increased income will increase the bargaining power of individuals, as they will no longer be forced to accept any working conditions.

- UBI is easy to implement. Because of its universal character, there is no need to identify the beneficiaries. Thus, it excludes errors in identifying the intended beneficiaries – which is a common problem in targeted welfare schemes.

- As every individual receive basic income, it promotes efficiency by reducing wastages in government transfers. This would also help in reducing corruption.

- Considerable gains could be achieved in terms of bureaucratic costs and time by replacing many of the social sector schemes with UBI.

- As economic survey points out, transferring basic income directly into bank accounts will increase the demand for financial services. This would help banks to invest in the expansion of their service network, which is very important for financial inclusion.

- Under some circumstances, UBI could promote greater productivity. For example, agriculture labourers who own small patch of land and earlier used to work in others’ farm for low wages, can now undertake farming on their own land. In long term, this will reduce the percentage of unused land and helps in increasing agriculture productivity.

Disadvantages of UBI:

- A guaranteed minimum income might make people lazy and it breeds dependency. They may opt out of labour market.

- There is no guarantee that the additional income will be spent on education, health etc. there are chances that the money will be spent on ‘temptation goods’ such as alcohol, tobacco, drugs etc.

- Given the large population size, the fiscal burden on government would be high. Also, as Economic Survey 2016-17 noted, once implemented, it may become difficult for the government to wind up a UBI in the case of failure.

- If the UBI is funded by higher taxes, especially by the indirect taxes, it will result in inflation. This, in turn, will reduce the purchasing power of the people and lowers the value of the amount transferred.

- A ‘guaranteed minimum income’ might reduce the availability of workers in some sectors which are necessary but unattractive and raise the wages of such works. For example, the wages of agriculture labour might increase due to non-availability of workers willing to work in others’ farm.

Challenges in Implementing UBI:

- According to World Bank, in India, there are only 20 ATMs for every one lakh adult population. Nearly one-third of the Indian adults remain unbanked. With such a state of financial service infrastructure and financial inclusion, it would be difficult for the people to access their benefits.

- Financing the ‘guaranteed minimum income’ would be another challenge. There are chances that UBI would become an add-on to existing subsidies rather than replace them.

Conclusion:

- UBI is a powerful idea whose time even if not ripe for implementation is ripe for serious discussion. UBI can help in wiping tears form all eyes, which Mahatma Gandhi dreamed of, but it would also have serious consequences in form of Uncompensated reward harming responsibility and effort; Effect on macro-economic stability of country; and Recognizing exit problem in India, UBI may become another add-on government programme, which would have come to mind of Mahatma Gandhi.

What’s in the Editorial?

- A simplistic universal basic income will not solve the fundamental problems of the economy

The Real Deal:

- India’s GDP is growing quite well, though there are disputes about whether it grew faster under the present or previous governments. There can be no dispute though that India needs to do much better to improve overall human development, in which it continues to be compared with countries in Sub-Saharan Africa. Even its poorer sub-continental neighbours are improving health and education faster. Benefits of India’s economic growth must trickle down much faster to people at the bottom of the pyramid: to poorer farmers, landless rural labour, and hundreds of millions of workers living on the edge in low-paying, ‘flexible’ forms of employment with no social security.

Visible Solutions:

- Economists seem to be offering three solutions to the economy’s structural problems. One, that there is no problem. Two, more privatisation. And, three, a universal basic income (UBI) to be provided by the state.

Ground still to be covered

- Many economists are juggling with statistics to prove that the Indian economy is doing quite well. It is providing enough jobs, they say. And, statistically, poverty has reduced a lot. However, even these economists admit that a lot more must be done to improve education and health care, and to address the persistent informality and small scale of enterprises that are providing most of the employment in the country.

Thoughts of Global Leaders about Business:

- An ideological solution, accompanied with evidence that the government is unable to provide them, is more privatisation of public services. As U.S. President Ronald Reagan said, government is not the solution, it is the problem. However, the private sector is structurally not designed to provide affordable public services equitably. Milton Friedman, who too is often cited, said, the business of business must be only business. Businesses must be run with a profit motive. They cannot take on the burden of subsidising citizens who cannot pay for their services.

Present Scenario of Global Economy:

- Structural forces within the global economy have been driving down wages and creating insecure employment while increasing the mobility of capital and increasing incomes from ownership of capital. Thomas Piketty and Oxfam have also drawn attention to increasing economic inequalities around the world. ‘Industry 4.0’, which has not yet spread too far, is expected to worsen these problems.

- An economic consequence of declining growth of wage incomes will be reduction of consumption. Which will create problems for owners of capital and automated Industry 4.0 production systems. For, who will buy all the material and services that these systems will produce? Therefore, the UBI has appeared as a silver bullet solution.

- It will be an income provided to everybody by the very state that the capitalists say should get out of their way, and to whom they are unwilling to pay more taxes.

Does UBI answers some basic questions if confronts:

- The beauty of a ‘universal’ basic income, its proponents say, is that it avoids messy political questions about who deserves assistance. It also side-steps the challenge of actually providing the services required: education, health, food, etc. Just give the people cash: let them buy what they need. However, if the cash will not provide citizens with good quality and affordable education and health, because neither the government nor the private sector is able or willing to, this will not solve the basic human development problems that must be solved.

Views of Policy makers:

- Some economists who were proponents of UBI, such as Arvind Subramanian, the former Chief Economic Adviser to the Government, have begun to dilute their simplistic concept of UBI to make it financially and politically feasible.

- They propose a QUBRI (quasi-universal basic rural income), targeted only at poorer people in the rural areas. Their scheme is no longer universal. First, it will exclude the not-so-poor in rural areas as morally it should. Political questions about who should be included will have to be addressed. Second, it will not cover the masses of urban poor working for low and uncertain wages.

- Therefore, some other schemes will have to be drawn up for the urban sector, and entitlement and measurement issues will have to be addressed for these schemes too. All the schemes, rural and urban, could be cash transfer schemes, which Aadhar and the digitisation of financial services will facilitate. However, this still begs the question about how to provide good quality public services for people to buy.

Beyond UBI:

- A simplistic UBI will not solve the fundamental problems of the economy. An unavoidable solution to fix India’s fundamental problems is the strengthening of institutions of the state to deliver the services the state must (public safety, justice, and basic education and health), which should be available to all citizens regardless of their ability to pay for them. The institutions of the state must be strengthened also to regulate delivery of services by the private sector and ensure fair competition in the market. The building of state institutions, to deliver and to regulate, will require stronger management, administrative, and political capabilities, not better economists.

Economic inequality matters:

- Some economists say that inequality does not matter so long as poverty is being reduced. In fact, some even say that inequality is necessary to reduce poverty. So long as the people have bread, why should they complain if the rich are eating more cake, they imply.

- However, economic inequality does matter because it increases social and political inequalities. Those with more wealth change the rules of the game to protect and increase their wealth and power. Thus, opportunities for progress become unequal. This is why economic inequality must be reduced to create a more just society.

The Problem with Present economic System:

- In the present economic system, people at the top can make more profits by driving down prices and wages for people at the bottom. They may then recycle a small portion of their profits back as philanthropy, or corporate social responsibility. Or, if they were willing to, which they are not, pay the state more taxes to provide services, and even a UBI, to people at the bottom. Tiny enterprises have very little clout compared with large capitalist enterprises; and individual workers have little power compared with their employers. Therefore, terms of trade remain unfair for small enterprises, and terms of employment unfair for unorganised workers. The solution is the aggregation of the small into larger associations, cooperatives, and unions. Aggregations of small producers, and unions of workers, can negotiate for more fair terms.

An alternative approach:

- A better solution to structural inequality than UBI is universal basic capital, or UBC, which has begun to pop up in international policy circles. In this alternative approach, people own the wealth they generate as shareholders of their collective enterprises.

- Amul, SEWA, Grameen, and others have shown a way. Some economists go further and also propose a ‘dividend’ for all citizens, by providing them a share of initial public offerings on the stock market, especially from companies that use ‘public assets’, such as publicly funded research, or environmental resources.

Way Forward:

- Three better solutions to create more equitable growth than the ones on offer are: one, focus on building state capacity beginning with implementation of the recommendations of the Second Administrative Reforms Commission.

- Two, strengthen the missing middle-level institutions for aggregation of tiny enterprises and representation of workers. Three, the creativity of economists could be better applied to developing ideas for UBC than UBI.

HIGH USE OF INPUT CREDIT UNDER TAXMAN’S SCANNER

28, Jan 2019

In News

- The issue of high ITC was flagged at the meeting of the Group of Ministers (GoM) which was set up by the GST Council to look into the reasons for revenue shortfall being faced by a large number of States.

Explained

- Concerned over a decline in GST revenues, tax officials are likely to examine the high usage of input tax credit (ITC) to set off tax liability by businesses

- According to sources, availing ITC ideally should not result in loss of revenue but there could be possibility of misuse of the provision by unscrupulous businesses by generating fake invoices just to claim tax credit.

- During the meeting of the GoM, it was pointed out that as much as 80% of the total GST liability is being settled by ITC and only 20% deposited as cash.

- GST revenue has averaged around Rs. 96,000 crore per month so far this fiscal and this reflects the cash component being deposited by businesses.

- Under the present dispensation, there is no provision for real time matching of ITC claims with the taxes already paid by suppliers of inputs.

- The matching is done on the basis of system generated GSTR-2A, after the credit has been claimed. Based on the mismatch highlighted by GSTR-2A and ITC claims, the revenue department sends notices to businesses.

- “Currently there is a time gap between ITC claim and matching them with the taxes paid by suppliers. Hence there is a possibility of ITC being claimed on the basis of fake invoices,

- Once the new return filing system becomes operational, it would become possible for the department to match the ITC claims and taxes paid on a real time basis.

- The revenue department would now analyze the large number of ITC claims to find out if they are genuine or based on fake invoices and take corrective action

Recent trends in GST Collections

- GST collection stood at ₹03 lakh crore in April,₹94,016 crore in May, ₹95,610 crore in June,₹96,483 crore in July, ₹93,960 crore in August, ₹94,442 crore in September, ₹1,00,710 crore in October, ₹97,637 crore in November and ₹94,726 crore in December 2018.

KELKAR MOOTS SETTING UP OF ‘NITI AAYOG 2.0

28, Jan 2019

In News

- Former Finance Commission Chairman Vijay Kelkar has pitched for setting up of a ‘new NITI Aayog’ and giving it the responsibility for allocating capital and revenue grants to the States.

Explained

- Kelkar, in a paper titled ‘Towards India’s new fiscal federalism,’ said it was desirable that a functionally-distinct entity such as the new NITI Aayog be put to use to do the job at hand related to the structural issues, including removal of regional imbalances in the economy. The eminent economist, however, added that he was not suggesting for a moment that the new NITI Aayog should take the form of the erstwhile Planning Commission.

- Mr. Kelkar argued that replacing the Planning Commission, which was promoting regionally-balanced growth in India, with the NITI Aayog, a think tank, has reduced the government’s policy reach. He also suggested that to make the Aayog more effective, “the vice-chairman of the new NITI Aayog will need to be a permanent invitee of the Cabinet Committee on Economic Affairs.

India to Remain Fastest Growing Economy in 2019 – 2020

24, Jan 2019

In News:

- India will continue to remain the world’s fastest-growing large economy in 2019 as well as in 2020, much ahead of China, a UN report.

Explained:

- According to the UN’s World Economic Situation and Prospects (WESP) 2019, India’s GDP growth is expected to accelerate to 7.6 per cent in 2019-20 from an estimated 4 per cent in the current fiscal ending March 2019. The growth rate may come down to 7.4 per cent a year later.

- In the case of China, the growth is estimated to decelerate to 6.3 per cent in 2019 from 6.6 per cent in 2018. It may further go down to 6.2 per cent in 2020. “Growth (in India) continues to be underpinned by robust private consumption, a more expansionary fiscal stance and benefits from previous reforms. “Yet, a more robust and sustained recovery of private investment remains crucial to lift the medium-term growth

- Referring to China, it said the growth is expected to moderate from 6.6 per cent in 2018 to 6.3 per cent in 2019, with policy support partly offsetting the negative impact of trade tensions. The report further said the global economy would continue to grow at a steady pace of around 3 per cent in 2019 and 2020 amid signs that global growth has peaked.

- However, a worrisome combination of development challenges could further undermine growth, it added. The report also highlighted that global trade tensions pose a threat to the economic outlook. Amid the rise in global trade tensions, world trade growth moderated over the course of 2018 to 3.8 per cent from growth of 5.3 per cent in 2017.

- While tensions have materially impacted some specific sectors, stimulus measures and direct subsidies have so far offset much of the direct economic impacts on China and the US, it said. “But a prolonged escalation of trade tensions could severely disrupt the global economy,” WESP report said. Directly impacted sectors have already witnessed rising input prices and delayed investment decisions.

UN:

- The United Nations is an international organization founded in 1945. It is currently made up of 193 Member States.

- Due to the powers vested in its Charter and its unique international character, the United Nations can take action on the issues confronting humanity in the 21st century, such as peace and security, climate change, sustainable development, human rights, disarmament, terrorism, humanitarian and health emergencies, gender equality, governance, food production, and more.

- The UN also provides a forum for its members to express their views in the General Assembly, the Security Council, the Economic and Social Council, and other bodies and committees. By enabling dialogue between its members, and by hosting negotiations, the Organization has become a mechanism for governments to find areas of agreement and solve problems together.

Official languages:

- There are six official languages of the UN. These are Arabic, Chinese, English, French, Russian and Spanish. The correct interpretation and translation of these six languages, in both spoken and written form, is very important to the work of the Organization, because this enables clear and concise communication on issues of global importance.

Main Organs of UN:

- The main organs of the UN are the General Assembly, the Security Council, the Economic and Social Council, the Trusteeship Council, the International Court of Justice, and the UN Secretariat. All were established in 1945 when the UN was founded.

UN System:

- The UN system, also known unofficially as the “UN family”, is made up of the UN itself and many affiliated programmes, funds, and specialized agencies, all with their own membership, leadership, and budget.

- The programmes and funds are financed through voluntary rather than assessed contributions. The Specialized Agencies are independent international organizations funded by both voluntary and assessed contributions.

UN Specialized Agencies:

- The UN specialized agencies are autonomous organizations working with the United Nations. All were brought into relationship with the UN through negotiated agreements. Some existed before the First World War. Some were associated with the League of Nations. Others were created almost simultaneously with the UN. Others were created by the UN to meet emerging needs

- FAO

The Food and Agriculture Organization leads international efforts to fight hunger. It is both a forum for negotiating agreements between developing and developed countries and a source of technical knowledge and information to aid development. - IFAD

The International Fund for Agricultural Development, since it was created in 1977, has focused exclusively on rural poverty reduction, working with poor rural populations in developing countries to eliminate poverty, hunger and malnutrition; raise their productivity and incomes; and improve the quality of their lives.

- ILO

The International Labor Organization promotes international labor rights by formulating international standards on the freedom to associate, collective bargaining, the abolition of forced labor, and equality of opportunity and treatment.

- IMF

The International Monetary Fund fosters economic growth and employment by providing temporary financial assistance to countries to help ease balance of payments adjustment and technical assistance. The IMF currently has $28 billion in outstanding loans to 74 nations.

- IMO

The International Maritime Organization has created a comprehensive shipping regulatory framework, addressing safety and environmental concerns, legal matters, technical cooperation, security, and efficiency.

- ITU

The International Telecommunication Union is the United Nations specialized agency for information and communication technologies. It is committed to connecting all the world’s people – wherever they live and whatever their means. Through our work, we protect and support everyone’s fundamental right to communicate.

-

UNESCO

The United Nations Educational, Scientific and Cultural Organization focuses on everything from teacher training to helping improve education worldwide to protecting important historical and cultural sites around the world. UNESCO added 28 new World Heritage Sites this year to the list of irreplaceable treasures that will be protected for today’s travelers and future generations. - UNIDO

The United Nations Industrial Development Organization is the specialized agency of the United Nations that promotes industrial development for poverty reduction, inclusive globalization and environmental sustainability. - UNWTO

The World Tourism Organization is the United Nations agency responsible for the promotion of responsible, sustainable and universally accessible tourism. - UPU

The Universal Postal Union is the primary forum for cooperation between postal sector players. It helps to ensure a truly universal network of up-to-date products and services. - WHO

The World Health Organization is the directing and coordinating authority on international health within the United Nations system. The objective of WHO is the attainment by all peoples of the highest possible level of health. Health, as defined in the WHO Constitution, is a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity. - WIPO

The World Intellectual Property Organization protects intellectual property throughout the world through 23 international treaties. - WMO

The World Meteorological Organization facilitates the free international exchange of meteorological data and information and the furtherance of its use in aviation, shipping, security, and agriculture, among other things. - World Bank

- The World Bank focuses on poverty reduction and the improvement of living standards worldwide by providing low-interest loans, interest-free credit, and grants to developing countries for education, health, infrastructure, and communications, among other things. The World Bank works in over 100 countries.

- International Bank for Reconstruction and Development (IBRD)

- International Centre for Settlement of Investment Disputes (ICSID)*

- International Development Association (IDA)

- International Finance Corporation (IFC)

- Multilateral Investment Guarantee Agency (MIGA)

GDP Growth Could Accelerate to 7.3% in FY20

24, Jan 2019

In News:

- GDP growth is expected to quicken to 7.2% in 2018-19 and further to 7.3% in 2019-20, according to Crisil.

Background:

- The agency predicts retail inflation to rise substantially by then, to 4.5% in 2019-20.

- “Fiscal 2019 was a year of recovery from demonetisation and the initial disruption caused by the Goods and Service Tax implementation,”

- The economy has so far fired mainly on the public investment cylinder, and is estimated to grow at 7.2%. Private consumption has disappointed. Exports, however, have performed well, presenting a buoy to the manufacturing sector.”

- In financial year 2019-20, Crisil expects GDP growth to quicken marginally to 7.3% based on the assumptions of normal rains, lower oil prices, and a stable political outcome in the 2019 general elections. “With the government likely to stick to a fiscal consolidation path, the pick-up in growth is expected to be only gradual

- The past 15 years have seen two such periods of four consecutive normal rainfall years — 2005 to 2008 and 2010 to 2013 — that yielded healthy average agriculture growth of 3.6% and 5.5%, respectively.

- Private consumption growth is expected to pick up on the back of softer interest rates and an improvement in farm realisations as food inflation moves up. “For fiscal 2020, sustaining the momentum in overall investments will be a tough task without support from private investments,” the report said.

- With continuously improving capacity utilisation and the end of the de-leveraging phase for corporates, conditions are ripe for a revival of private corporate investments. A stable political outcome will facilitate this,” the report said.

- However, Crisil noted that the National Oceanic Atmospheric Administration of the United States (U.S.) is forecasting an El Niño event in 2019. India faced two consecutive El Niño events in 2014 and 2015, the report said, with agriculture GDP growth dropping to near zero. If 2019 is also an El Niño year, this would compound the rural distress currently being felt on account of dropping farmer incomes.

- Crisil said its base case scenario for oil prices was for them to settle at about $60-65 per barrel on an average in financial year 2019-20, compared with an average of $68-72 per barrel in 2018-19, due to a slowdown in overall global demand.

- However, it added that some price pressure could be felt in response to the recently-announced supply-cuts by the OPEC countries.

- The agency also pointed to a possible reversal of benign food inflation in 2019-20, in the eventuality of the monsoon failing and the related effect this would have on food prices. It also noted that the price of pulses could also move upwards as they follow a pattern of rising every third year.

Centre’s DEBT – TO – GDP Falls, States’ Rises

23, Jan 2019

In News:

- While the Centre is moving in the right direction in terms of meeting the N.K. Singh Committee recommendations on public debt, the States are moving in the opposite direction, data released by the government show.

Explained:

- According to the Status Paper on Government Debt for 2017-18, the Centre’s total debt as a percentage of GDP reduced to 46.5% in 2017-18 from 5% as of March 31, 2014.

- The total debt of the States, however, has been rising over this period, to 24% in 2017-18, and is estimated to be 24.3% in 2018-19.

- In absolute terms, the Centre’s total debt increased from Rs. 56,69,429 crores at the end of March 2014 to Rs. 82,35,178 crores in 2017-18, representing a 45% increase.

- The total debt of the States increased from Rs. 24,71,270 crores to Rs. 40,22,090 crores over the same period, an increase of almost 63%.

- The Central debt has been within control because the government has been trying to stick by-and-large to the fiscal deficit parameter

- The increase in the debt stock at the State level is worrying because they don’t have the wherewithal to service the debt if it goes beyond a certain point. They could then start getting into a debt trap situation.

- Outstanding liabilities of States have increased sharply during 2015-16 and 2016-17, following the issuance of UDAY bonds in these two years, which was reflected in an increase in liability-GDP ratio from 21.7% at end-March 2015 to 23.4% at end-March 2016 and further to 23.8% at end-March 2017

- The total outstanding liability as a percentage of GDP stood at 24% as at end-March 2018 and is expected to move upward to 24.3% at end-March 2019.”

- This, combined with the fact that ratings agencies have predicted that the combined fiscal deficit of the States to be 3.2% of GDP in financial year 2020 (higher than the prescribed 3%), and it begins to look increasingly unlikely that the States will meet their 20% debt-GDP ratio target by 2023.

- The report, however, says that the States do have some fiscal space to reduce their borrowing in the coming years due to the large cash surpluses they hold

N.K Singh Committee Recommendations:

- The N.K. Singh-headed FRBM (Fiscal Responsibility and Budget Management) Review Committee report had recommended the ratio to be 40% for the Centre and 20% for the States, respectively, by 2023. It said that the 60% consolidated Central and State debt limit was consistent with international best practices, and was an essential parameter to attract a better rating from the credit ratings agencies.

- Fiscal Council: The Committee proposed to create an autonomous Fiscal Council with a Chairperson and two members appointed by the centre. To maintain its independence, it proposed a non-renewable four-year term for the Chairperson and members. Further, these people should not be employees in the central or state governments at the time of appointment.

- Role of the fiscal Council: The role of the Council would include:

- Preparing multi-year fiscal forecasts,

- Recommending changes to the fiscal strategy,