Category: Schemes

MGNREGS wage rates revised by up to 10% for 2023-24 fiscal year

27, Mar 2023

Why in News?

- The Centre has notified a hike in wage rates under the rural job guarantee programme for the 2023-24 financial year with Haryana having the highest daily wage at ₹357 per day and Madhya Pradesh and Chhattisgarh the lowest at ₹

About the News:

- The notification was issued under Section 6 (1) of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), 2005, that says the Centre may, by notification, specify the wage rate for its beneficiaries.

- The wage hikes, which range from ₹7 to ₹26, will come into effect from April 1.

- Compared to last year’s rates, Rajasthan registered the highest percentage increase in wages. The revised wage for Rajasthan is ₹255 per day, up from ₹231 in 2022-23.

- Bihar and Jharkhand have registered a percentage increase of around eight from last year. Last year, the daily wage for a MNREGA worker in these two states was ₹ It has now been revised to ₹228.

- For Chhattisgarh and Madhya Pradesh, which have the lowest daily wages at ₹221, the percentage increase from last year was recorded at 17.

- In 2022-23, the two States had a daily wage of ₹

- The increases in the wages for states range between two and 10%. Karnataka, Goa, Meghalaya and Manipur are among the States to register the lowest percentage increase.

About MGNREGA:

- The scheme was introduced in 2005 as a social measure that guarantees “the right to work”.

- The key tenet of this social measure and labour law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Key objectives:

- Generation of paid rural employment of not less than 100 days for each worker who volunteers for unskilled labour.

- Proactively ensuring social inclusion by strengthening the livelihood base of rural poor.

- Creation of durable assets in rural areas such as wells, ponds, roads and canals.

- Reduce urban migration from rural areas.

- Create rural infrastructure by using untapped rural labour.

What are the eligibility criteria for receiving the benefits under MGNREGA scheme?

- Must be Citizen of India to seek MGNREGA benefits.

- Job seeker has completed 18 years of age at the time of application.

- The applicant must be part of a local household (i.e. application must be made with local Gram Panchayat).

- Applicants must volunteer for unskilled labour.

Implementation of the scheme:

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- Right to get unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fix their priority.

What is Democratic Decentralisation?

- Democratic decentralization is the process of devolving the functions and resources of the state from the Centre to the elected representatives at the lower levels so as to facilitate greater direct participation of citizens in governance.

- Devolution, envisioned by the Indian Constitution, is not mere delegation.

- It implies that precisely defined governance functions are formally assigned by law to local governments, backed by adequate transfer of a basket of financial grants and tax handles, and they are given staff so that they have the necessary wherewithal to carry out their responsibilities.

Related Constitutional Provisions:

- Local government, including panchayats, is a state subject in the Constitution, and consequently, the devolution of power and authority to panchayats has been left to the discretion of states.

- The Constitution mandates that panchayats and municipalities shall be elected every five years and enjoins States to devolve functions and responsibilities to them through law.

- The 73rd and 74th Amendments, by constitutionally establishing Panchayati Raj Institutions (PRIs) in India, mandated the establishment of panchayats and municipalities as elected local governments.

- These amendments added two new parts to the Constitution, namely, Part IX titled “The Panchayats” (added by 73rd Amendment) and Part IXA titled “The Municipalities” (added by 74th Amendment).

- The 11th Schedule contains the powers, authority and responsibilities of Panchayats.

- The 12th Schedule contains the powers, authority and responsibilities of Municipalities.

- Article 40: Organization of a village panchayat.

Janaushadhi Kendra

10, Mar 2023

Why in News?

- On the occasion of ‘the 5th Jan Aushadhi Diwas’, the government inaugurated ‘NaMo Day Care Centre’ and flagged off four NaMo Mobile Healthcare Units.

About the News:

- The Department of Pharmaceuticals is celebrating Jan Aushadhi Diwas from March 1 to March 7, 2023, to create awareness about the Jan Aushadhi Scheme.

- It’s objective is to generate awareness about the usage of generic medicines and the benefits of Jan Aushadhi Pariyojana and its salient features and achievements.

About Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP):

- The scheme aims to open centres from where quality generic medicines, consumables and surgical items are available at affordable prices for all, so as to reduce the out-of-pocket expenditure of consumers/patients.

- Ministry: Department of Pharmaceuticals, Ministry of Chemicals & Fertilizers

- Implementation Agency: Pharma & Medical Bureau of India (PMBI) (erstwhile Bureau of Pharma PSUs in India (BPPI)). It has also developed the Janaushadhi Sugam Application.

- Launched: November 2008

- Current status: As of January 31, 2023, the number of stores has increased to 9082.

- Target: To increase the number of Kendras (PMBJKs) to 10,000 by the end of December 2023.

How price of medicine is determined in the PMBJKs?

- A medicine is priced on the principle of a maximum of 50% of the average price of the top three brands of branded medicines. Thus, the prices of Jan Aushadhi Medicines are cheaper by at least 50% and in some cases, by 80% to 90% of the market price of the branded medicines.

- Under the Scheme, medicines are procured from World Health Organization – Good Manufacturing Practices (WHO-GMP) certified suppliers for ensuring the quality of the products.

What is Ayushman Bharat PMJAY Yojana?

- The PMJAY, world’s largest health insurance/assurance scheme fully financed by the government, provides a cover of Rs. 5,00,000 per family per year for secondary and tertiary care hospitalisation across public and private empanelled hospitals in India.

- Pre-hospitalisation and Post-hospitalisation expenses such as diagnostics and medicines are also included in the scheme.

- Coverage: Over 10.74 crore poor and vulnerable entitled families (approximately 50 crore beneficiaries) are eligible for these benefits.

- Provides cashless access to health care services for the beneficiary at the point of service.

What is its significance?

- Helps reduce catastrophic expenditure for hospitalizations, which pushes 6 crore people into poverty each year.

- Helps mitigate the financial risk arising out of catastrophic health episodes.

Eligibility Criteria’s:

- No restrictions on family size, age or gender.

- All pre–existing conditions are covered from day one.

- Covers up to 3 days of pre-hospitalization and 15 days post-hospitalization expenses such as diagnostics and medicines.

- Benefits of the scheme are portable across the country.

- Services include approximately 1,393 procedures covering all the costs related to treatment, including but not limited to drugs, supplies, diagnostic services, physician’s fees, room charges, surgeon charges, OT and ICU charges etc.

- Public hospitals are reimbursed for the healthcare services at par with the private hospitals.

Challenges and Concerns:

- Medical audits have also revealed that private hospitals are more likely to indulge in fraud and abuse than public hospitals and more likely to discharge patients early post-surgery to cut costs.

- Ensuring the accountability of private hospitals to provide efficient and high-quality care is a pre-eminent challenge for scheme implementation.

- There is huge State-wise variation in the share of empanelled private hospitals from less than 25% in most of the north-eastern and hill States to 80% in Maharashtra.

- Private hospitals have fewer beds than public hospitals and are more likely to be empanelled for surgical packages and super-specialties.

PLI and India’s Growth Ecosystem

02, Feb 2023

Why in News?

- As the world adjusts to a new economic reality in the wake of the Covid-19 pandemic, India has recognized a strategic opportunity to establish itself as a key player in the global value chains.

About the News:

- The manufacturing industry’s positive response to the Production Linked Incentive scheme (PLI) is likely to upgrade the labor force’s skills, replace old machinery, enhance production volumes and make logistics and operations efficient, giving India a chance to become a key manufacturing player.

What is the Production Linked Incentive scheme (PLI)?

- The Indian government’s introduction of the PLI scheme in 14 key manufacturing sectors is a significant step towards achieving its strategic vision for the manufacturing industry.

- With a budget of ₹1.97 lakh crore, the scheme is well-designed to encourage growth and sustainability in the targeted industry through various incentives and support measures.

- Launched in March 2020, the scheme initially targeted three industries:

- Mobile and allied Component Manufacturing

- Electrical Component Manufacturing and

- Medical Devices

Targeted Sectors:

- The 14 sectors are mobile manufacturing, manufacturing of medical devices, automobiles and auto components, pharmaceuticals, drugs, specialty steel, telecom & networking products, electronic products, white goods (ACs and LEDs), food products, textile products, solar PV modules, advanced chemistry cell (ACC) battery, and drones and drone components.

Incentives Under the Scheme:

- The incentives given, are calculated on the basis of incremental sales.

- In some sectors such as advanced chemistry cell batteries, textile products and the drone industry, the incentive to be given will be calculated on the basis of sales, performance and local value addition done over the period of five years.

- The emphasis on R&D investment will also help the industry keep up with global trends and remain competitive in the international market.

How PLI is Creating a Growth Ecosystem in India?

- Reducing Dependency on Imports: This shift in the manufacturing landscape could have significant implications for global trade, reducing dependency on a single-source country and diversifying the sources of production.

- Meeting the Demand: Increased production volumes are meeting consumer demand, particularly in the telecom and networking sectors with faster adoption of 4G and 5G products. The PLI scheme for large-scale electronics manufacturing (LSEM) saw successful results, with 97% of mobile phones sold in India now being made in India. As of September, 2022, the PLI scheme for LSEM attracted investments of ₹4,784 crore and generated 41,000 additional jobs.

- Reducing Carbon Footprint: The PLI scheme’s emphasis on green technologies will reduce the carbon footprint and position India as a pioneer in green policy implementation.

- Boosting Free Trade Agreements: Improved productivity is boosting free trade agreements for better market access and increased sales are driving demand for better logistical connectivity.

- Frontlining Rural India: The government of India is working closely with states to help industries and artisans in rural areas become part of the country’s growth story.

- This is being done through initiatives such as “one-district-one-product” to support local businesses, and “SFURTI” to improve traditional industries.

FASTag toll collection grows 46% to ₹50,855 crore in 2022

25, Jan 2023

Why in News?

- The Ministry of Road Transport & Highways has recently said in a statement that total toll collection through FASTag on fee plazas, including State highway toll plazas, increased 46% to ₹50,855 crore in 2022 from ₹34,778 crore in 2021.

About the News:

- “Electronic Toll Collection (ETC) through FASTag has witnessed constant growth over last few years. Total toll collection via FASTag on fee plazas, including State Highway fee plazas during calendar year 2022 was Rs. 50,855 crore, which is an increase of approx. 46% as compared to Rs. 34,778 crore in 2021,” the ministry said.

- Similarly, the number of FASTag transactions also witnessed a growth of about 48% in 2022 as compared to that in 2021. The number of FASTag transactions in 2021 and 2022 was ₹219 crore and ₹324 crore respectively.

- The statement said with 6.4 crore FASTags issued as of date, the total number of FASTag-enabled fee plazas across the country also grew to 1,181 (including 323 state highway fee plazas) in 2022 from 922 in the previous year 2021.

- Notably, MoUs have been signed with 29 different State entities/authorities for on-boarding State fee plazas under FASTag program which include states like Uttar Pradesh, Maharashtra, Gujarat, Madhya Pradesh, Telangana and Karnataka, etc.

- FASTag implementation has reduced the waiting time at NH Fee Plazas significantly.

What is ‘FASTag’?

- FASTags are stickers that are affixed to the windscreen of vehicles and use Radio Frequency Identification (RFID) technology to enable digital, contactless payment of tolls without having to stop at toll gates.

- The tags are linked to bank accounts and other payment methods.

- As a car crosses a toll plaza, the amount is automatically deducted, and a notification is sent to the registered mobile phone number.

- The tag is valid for five years and comes in seven different colours — violet, orange, yellow, green, pink, blue, black. Each colour is assigned to a particular category of vehicles.

- To encourage the use of FASTags, the National Highway Authority of India (NHAI) refunds 5% of the total monthly transactions.

- Indian Highways Management Company Limited (IHMCL) (a company incorporated by National Highways Authority of India) and National Payment Corporation of India (NPCI) are implementing this program.

- FASTag is presently operational at both, national and state highways.

How does it work?

- The device employs Radio Frequency Identification (RFID) technology for payments directly from the prepaid or savings account linked to it.

- It is affixed on the windscreen, so the vehicle can drive through plazas without stopping.

- RFID technology is similar to that used in transport access-control systems, like Metro smart card.

- Radio-Frequency Identification (RFID) is the use of radio waves to read and capture information stored on a tag attached to an object.

- A tag can be read from up to several feet away and does not need to be within direct line-of-sight of the reader to be tracked.

- If the tag is linked to a prepaid account like a wallet or a debit/credit card, then owners need to recharge/top up the tag.

- If it is linked to a savings account, then money will get deducted automatically after the balance goes below a pre-defined threshold.Once a vehicle crosses the toll, the owner will get an SMS alert on the deduction. In that, it is like a prepaid e-wallet.

Why do we need this scheme?

- The Ministry has clarified that this has been done to further promote fee payment through digital mode, reduce waiting time and fuel consumption, and provide for a seamless passage through the fee plazas.

- Cameras at toll booths will take photos of passengers in a vehicle, which will be useful for the Ministry of Home Affairs as there will be a record of a vehicle’s movement.

Other Key Facts:

- The world’s first electronic toll plaza began operations in Norway in 1986.

- Japan was the first Asian Country to begin it in 2001 and China started in 2014.

Supreme Court Rejects Plea to include Religious schools under RTE

12, Feb 2022

Why in News?

- The Supreme Court recently refused to intervene in a petition challenging sections of the Right to Education Act of 2009 which exclude vedic pathsalas, madrasas and institutions imparting Religious Education from its Ambit.

What is Article 15(5)?

- It empowers the country to make reservations with regard to admissions into educational institutions both privately run and those that are aided or not aided by the government. From this rule only the minority run institutions such as the Madarsas are exempted.

Background:

- Please note, Minority schools are Exempted from Implementing The Right to Education policy and do not fall under the Government’s Sarva Shiksha Abhiyan.

How are Minority Schools exempt from RTE and SSA?

- In 2002, the 86th Amendment to the Constitution provided the Right to Education as a fundamental right.

- The same amendment inserted Article 21A, which made the RTE a fundamental right for children aged between six and 14 years.

- The passage of the amendment was followed by the launch of the Sarva Shiksha Abhiyan (SSA) that aimed to provide “useful and relevant, elementary education’’ to all children between six and 14 years.

- In 2006, the 93rd Constitution Amendment Act inserted Clause (5) in Article 15 which enabled the State to create special provisions, such as reservations for advancement of any backward classes of citizens like Scheduled Castes and Scheduled Tribes, in all aided or unaided educational institutes, except minority educational institutes.

Why bring them under RTE now?

- The Commission is of the view that the two different sets of rules Article 21A that Guarantees Fundamental right of education to all children, and Article 30 which allows Minorities to set up their own institutions with their own rules and Article 15 (5) which exempts minority schools from RTE creating a conflicting picture between fundamental right of children and right of Minority Communities.

Need for their Inclusion under RTE:

- The Commission has observed in the report that many children who are enrolled in these institutions or schools were not able to enjoy the entitlements that other children are enjoying.

- For example, Missionaries school are Elite Cocoons. Such schools are admitting only a certain class of students and leaving underprivileged children out of the system, thus becoming what the Commission has called “cocoons populated by elites’’.

- Also, students in madarasas which do not offer a secular course along with religious studies – such as the sciences – have fallen behind and feel a sense of alienation and “inferiority’’ when they leave school.

PRADHAN MANTRI BHARTIYA JANAUSHADHI PARIYOJANA (PMBJP)

09, Apr 2020

Context:

- Recently, Pharmacists, popularly known as “Swasth ke Sipahi”, of Pradhan Mantri Jan Aushadhi Kendra, are delivering essential services and medicines at doorstep of patients and elderly under Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) of the Government of India.

About PMBJP:

- It is a campaign launched by the Department of Pharmaceuticals, Govt. Of India.

- It aims to provide quality medicines at affordable prices to the masses through special kendra’s known as Pradhan Mantri Bhartiya Jan Aushadhi Kendra.

- Its implementing agency is Bureau of Pharma PSUs of India (BPPI), which has been established under the Department of Pharmaceuticals, Govt. of India, with the support of all the CPSUs.

About the features of PMBJP:

- It ensures access to quality medicines. It extends coverage of quality generic medicines so as to reduce the out of pocket expenditure on medicines and thereby redefine the unit cost of treatment per person.

- It creates awareness about generic medicines through education and publicity so that quality is not synonymous with only high price.

- It is a public programme involving Government, PSUs, Private Sector, NGO, Societies, Co-operative Bodies and other Institutions.

- It creates demand for generic medicines by improving access to better healthcare through low treatment cost and easy availability wherever needed in all therapeutic categories.

About Generic Medicine:

- There is no definition of generic or branded medicines under the Drugs & Cosmetics Act, 1940 and Rules, 1945 made thereunder.

- Generic medicines are generally those which contain same amount of same active ingredient(s) in same dosage form and are intended to be administered by the same route of administration as that of branded medicine.

- The price of an unbranded generic version of a medicine is generally lower than the price of a corresponding branded medicine because in case of generic version.

- Drugs manufactured in India are regulated by irrespective of whether they are generic or branded, are required to comply with the same standards as prescribed in the Drugs and Cosmetics Act, 1940 and Rules, 1945 made thereunder for their quality.

About Drugs and Cosmetics Act, 1940 and Rules 1945:

- It regulates the import, manufacture and distribution of medicines in the country.

- It also ensures that drugs and cosmetics sold in India are safe, effective and conform to state quality standards.

- It entrusts various responsibilities to central & state regulators for regulation of drugs & Cosmetics.

- The related Rules,1945 contains provisions for classification of drugs under different schedules and prescribes guidelines for the storage, sale, display and prescription of each schedule.

MPLADS GETS SUSPENDED FOR 2 YEARS

07, Apr 2020

Why in News?

- The Union Cabinet has approved a 30% cut in the salaries of all Members of Parliament for a year and a two-year suspension of the MP Local Area Development (MPLAD) scheme so that the amount saved can go to the Consolidated Fund of India to fight COVID-19.

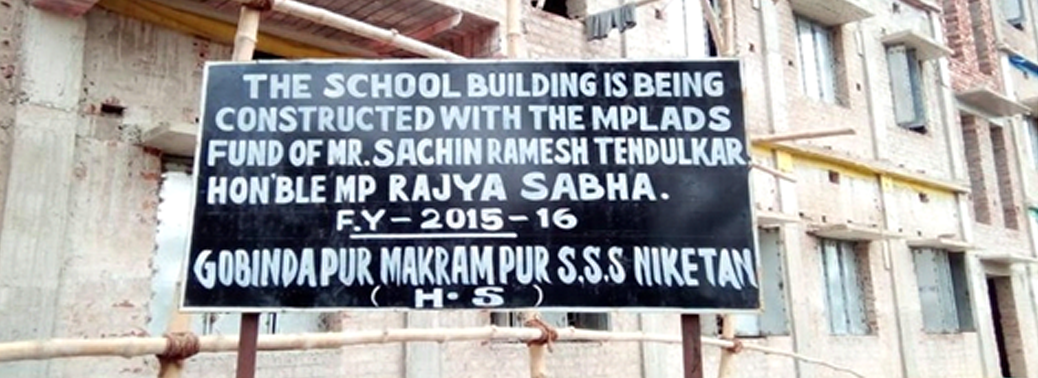

What is MPLADS?

- It was launched in December, 1993, to provide a mechanism for the Members of Parliament to recommend works of developmental nature for creation of durable community assets and for provision of basic facilities including community infrastructure, based on locally felt needs.

- The MPLADS is a Plan Scheme fully funded by Government of India. The annual MPLADS fund entitlement per MP constituency is Rs. 5 crore.

Special Focus of the Scheme:

- MPs are to recommend every year, works costing at least 15 per cent of the MPLADS entitlement for the year for areas inhabited by Scheduled Caste population and 7.5 per cent for areas inhabited by ST population.

- In order to encourage trusts and societies for the betterment of tribal people, a ceiling of Rs. 75 lakh is stipulated for building assets by trusts and societies subject to conditions prescribed in the Scheme Guidelines.

Works under the Scheme:

- Works, developmental in nature, based on locally felt needs and always available for the use of the public at large, are eligible under the scheme. Preference under the scheme is given to works relating to national priorities, such as provision of drinking water, public health, education, sanitation, roads, etc.

Release of Funds:

- Funds are released in the form of grants in-aid directly to the District Authorities.

- The funds released under the scheme are non-lapsable.

- The liability of funds not released in a particular year is carried forward to the subsequent years, subject to eligibility.

Execution of Works:

- The MPs have a recommendatory role under the scheme. They recommend their choice of works to the concerned district authorities who implement these works by following the established procedures of the concerned state government.

- The district authority is empowered to examine the eligibility of works sanction funds and select the implementing agencies, prioritise works, supervise overall execution, and monitor the scheme at the ground level.

Recommendation of Works:

- The Lok Sabha Members can recommend works in their respective constituencies.

- The elected members of the Rajya Sabha can recommend works anywhere in the state from which they are elected.

- Nominated members of the Lok Sabha and Rajya Sabha may select works for implementation anywhere in the country.

NOT MANY LESSONS LEARNT FROM WATER PLANNING FAILURES

13, Dec 2019

Context:

- In the absence of scientific planning and implementation, measures like Jal Shakti Abhiyan may not be successful, says Water Experts.

Today’s Water Scenario:

- Following the massive water crisis across India in the summer of 2019, the Central government hurriedly launched the Jal Shakti Abhiyan (JSA), a time-bound, mission-mode water conservation campaign to be carried out in two phases, across the 255 districts having critical and over-exploited groundwater levels.

- This campaign, however, was not intended to be a funding programme and did not create any new intervention on its own.

- It only aimed to make water conservation a ‘people’s movement’ through ongoing schemes like the MGNREGA and other government programmes.

About Jal Shakti Abhiyan:

- It is a time-bound, mission-mode campaign that would focus on 1,592 “water-stressed” blocks in 257 districts.

- The campaign will run through citizen participation during the monsoon season, from 1st July, 2019 to 15th September, 2019.

- The 1,592 blocks, identified as “water-stressed” as per the Central Ground Water Board’s 2017 data, include 313 critical blocks, 1,000-odd over-exploited blocks and 94 blocks with least water availability (for states without water-stressed blocks).

- Jal Shakti Abhiyan is a collaborative effort of various Ministries of the Government of India and State Governments, being coordinated by the Department of Drinking Water and Sanitation.

- Under the campaign, teams of officers from the central government will visit and work with district administration in water stressed blocks, to ensure five important water conservation interventions.

- These will be water conservation and rainwater harvesting, renovation of traditional and other water bodies/tanks, reuse, bore well recharge structures, watershed development and intensive afforestation.

- These water conservation efforts will also be supplemented with special interventions including the development of Block and District Water Conservation Plans, promotion of efficient water use for irrigation and better choice of crops through Krishi Vigyan Kendras.

- A large-scale communications campaign has also been planned alongside the JSA involving mass mobilization of different groups including school students, college students, swachhagrahis, Self Help Groups, Panchayati Raj Institution members, youth groups (NSS/NYKS/NCC), defence personnel, ex-servicemen and pensioners, among various others.

Need for Scientific Planning for Water Conservation:

- Water planning should be based on hydrological units, namely river basins. And, political and administrative boundaries of districts rarely coincide with the hydrological boundaries or aquifer boundaries.

- However, contrary to this principle of water management, JSA was planned based on the boundary of the districts, and to be carried out under the overall supervision of a bureaucrat.

- This resulted in the division of basins/aquifers into multiple units that followed multiple policies. There was no data on basin-wise rainfall, no analysis of run-off and groundwater maps were rarely used.

- As a result, one never came to know whether water harvested in a pond in a district was at the cost of water in adjoining districts.

- The JSA also fundamentally ignored the fact that most of India’s water-stressed basins, particularly those in the peninsular regions, are facing closure, with the demand exceeding supply.

- Hence, groundwater recharge happened at the cost of surface water and vice versa. This is where an absence of autonomous and knowledge-intensive river-basin organisations is acutely felt.

Data’s given by JSA:

- The JSA’s portal displays impressive data, images and statistics.

- For example, it claims that there are around 10 million ongoing and completed water conservation structures; 7.6 million recharge structures.

- The website also says that one billion saplings have been planted and that six million people participated in awareness campaigns.

Contradictions with JSA’s Data:

- The data displayed on JSA portal do not speak anything about the pre-JSA water levels, the monthly water levels and impact of monsoon on the water levels across the 255 districts with critical and over-exploited blocks.

- They also don’t convey anything about the quality of the structures, their maintenance and sustainability.

- Even if the water levels had been measured, it is unknown whether the measurement was accurate.

- The results for a 2016 study conducted by the Central Groundwater Board showed that water levels always increase post-monsoon.

- Therefore, it will require long-term monitoring of water level data to determine the actual impact of a measure like JSA.

- At present, there is no such parameter to measure the outcome of such a mission-mode campaign.

Drawbacks of JSA:

- Assumption by the JSA is that common people in rural areas are ignorant and prone to wasting water; on the contrary, they are the ones who first bear the burden of any water crisis.

- The per capita water allocation to those living in rural areas is 55 litres, whereas the same for urban areas like Delhi and Bengaluru is 135-150 litres.

- Therefore, the JSA’s move to reach out to poor people and farmers, asking them to ‘save water’, appears hypocritical, particularly when district administrations blatantly allow the sewage generated from towns and cities to pollute village water sources such as tanks, ponds and wells.

- Moreover, it is difficult to say whether measures like JSA can provide long-term solutions.

- Most of the farm bunds built with soil can collapse within one monsoon season due to rains and/or trespassing by farm vehicles, animals and humans.

- Further, there are issues like lack of proper engineering supervision of these structures, involvement of multiple departments with less or no coordination, and limited funding under MGNERGA and other schemes.

- Finally, there have hardly been many efforts undertaken to dissuade farmers from growing water-intensive crops such as paddy, sugarcane, and banana, when it is widely known that agriculture consumes 80% of freshwater.

GUJARAT, TAMIL NADU TOP PERFORMERS UNDER PM-JAY HEALTH SCHEME

16, Oct 2019

Why in News?

- Gujarat, Tamil Nadu, Chhattisgarh, Kerala and Andhra Pradesh have emerged as the top performing States with free secondary and tertiary treatment under the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana.

About the News:

- The above-mentioned states have emerged as the top performing States with free secondary and tertiary treatment worth nearly ₹7,901 crore availed under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY), the flagship health assurance scheme of the Government in just over a year.

- The scheme crossed the 50-lakh treatment mark this week with secondary and tertiary level treatments carried out across 32 States and Union Territories.Half-a-crore hospital treatments have been provided and there are 9 hospital admissions every minute across India.

Tertiary care-occupies a Lion share:

- More than 60% of the amount spent has been on tertiary care. Cardiology, Orthopaedics, Radiation Oncology, Cardio-thoracic and Vascular Surgery, and Urology have emerged as the top tertiary specialities.

About Ayushman Bharat:

- Launched as recommended by the National Health Policy 2017, to achieve the vision of Universal Health Coverage.

- The scheme has been meant to focus on reducing catastrophic out-of-pocket health expenditure, improving access to quality health care and meeting the unmet need of the population for hospitalisation care, and achieving the vision of Universal Health Coverage.

- There are two flagship initiatives under Ayushman Bharat:

1.Pradhan Mantri Jan Arogya Yojana (PMJAY):

- The National Health Policy, 2017 has envisioned Health and Wellness Centres as the foundation of India’s health system. Under this 1.5 lakh centres will bring health care system closer to the homes of people.

- These centres will provide comprehensive health care, including for non-communicable diseases and maternal and child health services.

- These centres will also provide free essential drugs and diagnostic services.

- Contribution of private sector through CSR and philanthropic institutions in adopting these centres is also envisaged.

2.National Health Protection Scheme:

- The second flagship programme under Ayushman Bharat is National Health Protection Scheme, which will cover over 10 crore poor and vulnerable families (approximately 50 crore beneficiaries) providing coverage upto 5 lakh rupees per family per year for secondary and tertiary care hospitalization.

- This will be the world’s largest government funded health care programme. Adequate funds will be provided for smooth implementation of this programme.

TRAINING AND EMPLOYMENT OF RURAL YOUTH

24, Jul 2019

Why in News?

- Ministry of Rural Development is undertaking two initiatives in skill development under the National Rural Livelihoods Mission (NRLM) which are as follows:

Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY):

- It is a placement linked skill development program which allows skilling in a PPP mode and assured placements in regular jobs in an organization not owned by the skilled person.

- DDU-GKY is being undertaken as PPP Project all over the country through Project Implementing Agencies (PIAs) registered with the Ministry of Rural Development.

- Further, Guidelines of the scheme mandate State Governments to take up skill training projects with Corporate Social Responsibility funding.

- DDU-GKY Guidelines provide for setting apart 15% of the funds of the funds at for national level beneficiaries from among minority groups.

Rural Self Employment and Training Institutes (RSETI):

- Skill development through RSETI, thereby enabling the trainee to take Bank credit and start his/her own Micro-enterprise.

- Some of such trainees may also seek regular salaried jobs.

- DDU-GKY and RSETI schemes covers rural parts of all the States of the country.

PRADHAN MANTRI MATRU VANDANA YOJANA

24, Jul 2019

Why in News?

- Pradhan Mantri Matru Vandana Yojana (PMMVY) is a Maternity Benefit Programme that is implemented in all the districts of the country in accordance with the provision of the National Food Security Act, 2013.

Objectives:

- Providing partial compensation for the wage loss in terms of cash incentive s so that the woman can take adequate rest before and after delivery of the first living child.

- The cash incentive provided would lead to improved health seeking behaviour amongst the Pregnant Women and Lactating Mothers (PW& LM).

Benefits under PMMVY:

- Cash incentive of Rs 5000 in three instalments i.e. first instalment of Rs 1000/ – on early registration of pregnancy at the Anganwadi Centre (AWC) / approved Health facility as may be identified by the respective administering State / UT, second instalment of Rs 2000/ – after six months of pregnancy on receiving at least one ante-natal check-up (ANC) and third instalment of Rs 2000/ – after child birth is registered and the child has received the first cycle of BCG, OPV, DPT and Hepatitis – B, or its equivalent/ substitute.

- The eligible beneficiaries would receive the incentive given under the Janani Suraksha Yojana (JSY) for Institutional delivery and the incentive received under JSY would be accounted towards maternity benefits so that on an average a woman gets Rs 6000 / – .

Target Beneficiaries:

- All Pregnant Women and Lactating Mothers, excluding PW&LM who are in regular employment with the Central Government or the State Governments or PSUs or those who are in receipt of similar benefits under any law for the time being in force.

- All eligible Pregnant Women and Lactating Mothers who have their pregnancy on or after 01.01.2017 for first child in family.

- The date and stage of pregnancy for a beneficiary would be counted with respect to her LMP date as mentioned in the MCP card.

Case of Miscarriage/Still Birth :

- A beneficiary is eligible to receive benefits under the scheme only once.

- In case of miscarriage/still birth, the beneficiary would be eligible to claim the remaining instalment(s) in event of any future pregnancy.

- Thus, after receiving the 1st instalment, if the beneficiary has a miscarriage, she would only be eligible for receiving 2nd and 3rd instalment in event of future pregnancy subject to fulfilment of eligibility criterion and conditionalities of the scheme. Similarly, if the beneficiary has a miscarriage or still birth after receiving 1 st and 2nd instalments, she would only be eligible for receiving 3rd instalment in event of future pregnancy subject to fulfilment of eligibility criterion and conditionalities of the scheme.

Case of Infant Mortality:

- A beneficiary is eligible to receive benefits under the scheme only once. That is, in case of infant mortality, she will not be eligible for claiming benefits under the scheme, if she has already received all the instalments of the maternity benefit under PMMVY earlier.

- Pregnant and Lactating AWWs/ AWHs/ ASHA may also avail the benefits under the PMMVY subject to fulfilment of scheme conditionalities.

DEENDAYAL ANTYODAYA LIVELIHOODS MISSION (DAY-NRLM)

24, Jul 2019

Background:

- Aajeevika – National Rural Livelihoods Mission (NRLM) was launched by the Ministry of Rural Development (MoRD).

- Aided in part through investment support by the World Bank.

- The Mission aims at creating efficient and effective institutional platforms for the rural poor, enabling them to increase household income through sustainable livelihood enhancements and improved access to financial services.

Objective:

- “To reduce poverty by enabling the poor households to access gainful self-employment and skilled wage employment opportunities, resulting in appreciable improvement in their livelihoods on a sustainable basis, through building strong grassroots institutions of the poor.”

NRLM Guiding Principles

- Poor have a strong desire to come out of poverty, and they have innate capabilities

- Social mobilization and building strong institutions of the poor is critical for unleashing the innate capabilities of the poor.

- An external dedicated and sensitive support structure is required to induce the social mobilization, institution building and empowerment process.

Facilitating knowledge dissemination, skill building, access to credit, access to marketing, and access to other livelihoods services underpins this upward mobility.

Salient features:

- Universal Social Mobilisation – At least one woman member from each identified rural poor household, is to be brought under the Self-Help Group (SHG) network in a time bound manner. Special emphasis is particularly on vulnerable communities.

- Participatory Identification of Poor (PIP) – NRLM Target Households (NTH) are identified through the Participatory Identification of Poor (PIP) instead of the BPL. The PIP is a community-driven process where the CBOs themselves identify the poor in the village using participatory tools. The list of poor identified by the CBO is vetted by the Gram Sabha.

- It provides Revolving Fund (RF) and Community Investment Fund (CIF) as resources in perpetuity to the institutions of the poor, to strengthen their institutional and financial management capacity and build their track record to attract mainstream bank finance.

- Financial Inclusion – it promotes financial literacy among the poor and provides catalytic capital to the SHGs and their federations

- Livelihoods – NRLM focuses on stabilizing and promoting existing livelihood portfolio of the poor in farm and non-farm sectors; building skills for the job market outside; and nurturing self-employed and entrepreneurs (for microenterprises).

- It implements Aajeevika Skill Development Programme (ASDP). 25% of NRLM Funds are earmarked for this purpose.

- ASDP facilitates building the skills of the rural youth and placement in relatively high wage employment in the growing sectors of economy.

- NRLM is encouraging public sector banks to set up Rural Self Employment Training Institutes (RSETIs) in all districts of the country on the lines of Rural Development Self Employment Institute (RUDSETI) model.

- NRLM, through Mahila Kisan Sashaktikaran Pariyojana (MKSP), is promoting and facilitating scaling-up successful, small-scale projects that enhance women’s participation and productivity in agriculture and allied activities.

MKSP also aims to ensure household food and nutrition security of the poor and the poorest of poor. - National Rural Livelihoods Project has been designed as a sub-set of NRLM to create ‘proof of concept’, build capacities of the Centre and States and create an enabling environment to facilitate all States and Union Territories to transit to the NRLM.

- NRLP would be implemented in 13 high poverty states accounting for about 90 percent of the rural poor in the country.

Other Schemes Under Day-NRLM:

Aajeevika Grameen Express Yojana (AGEY):

- To provide an alternative source of livelihoods to members of SHGs under DAYNRLM by facilitating them to operate public transport services in backward rural areas, as identified by the States.

Salient features:

- Under the programme, the Community Investment Fund (CIF) provided to Community based Organisations (CBOs) under the existing provisions of DAYNRLM scheme will be utilised to support the SHG members to operate the public transport services.

- It provides two options for implementation

- Option I:

- Vehicle will be financed by the Community Based Organisations (CBOs) out of its CIF corpus. The vehicle will be purchased and owned by CBO and leased to SHG member.

- The beneficiary SHG member will operate the vehicle on selected route and will pay a monthly lease rental to the CBO.

- The decision regarding the ownership of the vehicle after the cost of vehicle is fully paid up through lease rental will be taken by the CBO.

- Option II:

- CBO will provide an interest free loan from its CIF corpus to SHG member for purchase of the vehicle.

- SHG member will repay the loan over a maximum period of 6 years and bear all the costs connected with the operation of the vehicle, including annual cost of insurance, road tax, permit cost, maintenance cost and all other running costs of the vehicle (i.e., fuel, oil, etc.).

- After repayment of the loan, the ownership of the vehicle will be transferred to the SHG member.

Kudumbashree helps senior citizens reconnect

24, Mar 2019

- Loneliness, especially in the twilight years of life, is a concern the world over and Kerala is not an exception. There is a large section of elderly people staying alone, raising concerns for their physical, economic, and social well-being.

- The Kudumbashree Mission has recently started an effort to identify such people and extend care for them. Pakal Veedu, a day-care initiative of Kudumbashree, has become a solace for many such people.

Kudumbashree – A unique model

- Started in 1998, it was envisioned as a part of the People’s Plan Campaign and local self-governance, with women at the centre of it.

- In its conceptualisation, it was markedly different from the self-help group (SHG) movements in many parts of India.

- While the commonality with other States was in the thrift and credit activities at the grassrootslevel through the formations of saving groups, the structures differed.

- Kudumbashree has a three-tier structure.The first is the basic unit — the neighbourhood groups (NGs). There could be several such units within a ward and they are networked through the area development societies (ADS). All ADSs are federated through the community development societies (CDS).

- There are core committees of elected coordinators at all three levels.

- Each Kudumbashree member has a vote. Direct elections for the NG coordinators are held every three years. These people, in turn, elect the coordinators of the ADS who elect the members of the CDS.

- A majority of the members of the coordinator groups have to belong to women below the poverty line or from comparatively poorer sections.There is reservation forDalit and Adivasi women.

- At the district and State levels, employees/officers of the government are appointed on deputation to help the Kudumbashree groups. Thus, there is a socially representative leadership.

- This secular composition acts as a facilitator for the secularisation of public spaces.

- The micro-enterprises undertaken by the women NGs in Kerala also strengthen community bonds. These include organic vegetable growing, poultry and dairy, catering and tailoring.

- The concepts and practices have expanded over the years. Today the community farms run by Kudumbashree groups are acknowledged as a critical avenue for the rejuvenation of agricultural production in Kerala.

- Kudumbashree training courses are quite comprehensiveand include women’s rights, knowledge of constitutional and legal provisions, training in banking practices, and training in skills to set up micro-enterprises.

- The Kudumbashree groups are therefore often seen as a threat by those who would like women to adhere to socially conformist roles.

About 44% of PM-KISAN beneficiaries await payment from Centre

21, Mar 2019

About PM – KISAN:

- The Pradhan Mantri Kisan Samman Nidhi will provide assured income to small and marginal farmers.

- All Small and Marginal Farmers (SMF) with 2 hectares of cultivable land will be provided income support of Rs 6000 per year.

- The amount will be transferred directly into their account in 3 equal installments.

- The complete expenditure of Rs 75000 crore for the scheme will borne by the Union Government in 2019-20.

- Over 12 crore farmer families will be benefitted under the scheme.

- The scheme is being implemented with effect from December 2018.

Pradhan Mantri Shram-Yogi Maandhan Yojana

02, Mar 2019

In News

- Prime Minister Narendra Modi launched a pension scheme called Pradhan Mantri Shram-Yogi Maandhan Yojana (PM-SYM).

About:

- The Scheme, Which Was announced in the union Budget in February this year, is a voluntary and contributory pension scheme for workers.

- The Pradhan Mantri Shram-Yogi Maandhan Yojana will benefit workers in the unorganised sector who earn up to Rs. 15,000 per month.

- The Pradhan Mantri Shram Yogi Maandhan Yojana will provide these workers an assured pension of Rs. 3,000 per month after they turn 60 years.

- If successful, the mega pension scheme can become the world’s biggest pension scheme for the unorganised sector in the next five years.

- This scheme is aimed at uplift of the section of society which has been ignored and left at the mercy of God.

- According to the scheme, a worker joining the scheme at 29 years of age or above will have to contribute Rs. 100 per month while those joining at the age of 18 will have to contribute Rs.55 per month.

- The Pradhan Mantri Shram Yogi Pension Yojana (PM-SYM) will be in addition to the life insurance scheme under the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and accident insurance scheme under the Pradhan Mantri Suraksha Bima Yojana (PMSBY).

- The scheme is meant for old age protection and social security of Unorganised Workers (UW) who are mostly engaged as rickshaw pullers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, home-based workers, own account workers, agricultural workers, construction workers,beedi workers, handloom workers, leather workers, audio- visual workers or in similar other occupations.

Eligibility Criteria:

- Should be an unorganised worker (UW)

- Entry age between 18 and 40 years.

- Monthly Income Rs 15000 or below.

- Should not be engaged in Organized Sector (membership of EPF/NPS/ESIC) or an income tax payer.

- He/ She should possess 1. Aadhar card 2. Savings Bank Account / Jan Dhan account number with IFSC.

Contribution by the UW Subscriber:

- Through ‘auto-debit’ facility from his/ her savings bank account/ Jan- Dhan account from the date of joining PM-SYM till the age of 60 years as per the chart below. The Central Government will also give equal matching contribution in his pension account.

Enrolment Agencies:

- The enrolment will be carried out by all the Common Services Centres in the country.

Fund Management:

- PM-SYM will be a Central Sector Scheme administered by the Ministry of Labour and Employment and implemented through Life Insurance Corporation of India and CSC e-Governance Services India Limited (CSC SPV). LIC will be the Pension Fund Manager and responsible for Pension pay out.

Deposits in Jan Dhan Accounts Set to Cross Rs. 90,000 Crore

12, Feb 2019

In News:

- Total deposits in Jan Dhan accounts are set to cross Rs 90,000 crore with the government making the flagship financial inclusion programme more attractive especially by doubling accident insurance cover to Rs 2 lakh.

Explained:

- According to data from the finance ministry, the deposits, which have been steadily rising since March 2017, have already reached Rs 89,257.57 crore as on January 30, and are steadily rising. The deposits stood at Rs 88,566.92 crore on January 23.

- The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched on August 28, 2014, with an aim to provide universal access to banking facilities for all households. Enthused by the success of the scheme, the government has enhanced the accident insurance cover to Rs 2 lakh from Rs 1 lakh for new accounts opened after August 28, 2018. The overdraft limit has also been doubled to Rs 10,000.

- The government has also shifted the focus on accounts from ‘every household’ to every unbanked adult’. According to the latest data, there were 34.14 crore account holders under the PMJDY. An average deposit in these accounts was about Rs 2,615, compared with Rs 1,065 on March 25, 2015.

- Over 53 per cent of the Jan Dhan account holders are women, 59 per cent accounts are in rural and semi-urban areas. As per the data, 27.26 crore accounts holders have been issued RuPay debit cards with an inbuilt accident insurance cover.

Pension Scheme for Workers in Informal Sector

12, Feb 2019

In News:

- According to Labour Ministry notification, All unorganised sector workers up to 40 years of age can subscribe to the Pradhan Mantri Shram Yogi Maandhan (PMSYM) scheme, which entails a minimum monthly pension of Rs 3,000.

Explained:

- The monthly contribution by the worker joining the scheme would be Rs 55, with matching contributions from the government. The contributions would rise at higher age. The worker joining the scheme at the age of 40 years would contribute Rs 200, while workers at the age of 29 years would pay Rs 100.

- The scheme will cover unorganised workers who are working or engaged as home-based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless labourers, agricultural workers, construction workers, among others.

- However, informal workers will not be eligible for the scheme if they are covered under the National Pension Scheme, the Employees’ State Insurance Corporation Scheme or Employees’ Provident Fund Scheme. Workers who are income-tax assessees are also not be eligible.

- The scheme has been brought under the Unorganised Workers’ Social Security Act, 2008. The Central government will establish a pension fund to be administered for this scheme.

- The scheme also provides that if a subscriber has given regular contributions and died due to any cause, his spouse shall be entitled to continue with the scheme subsequently by payment of regular contribution.

- The spouse can also exit the scheme by receiving the share of contribution paid by deceased subscriber along with accumulated interest. In case of permanent disablement of a subscriber, his or her spouse will be entitled to continue with the scheme or exit by receiving the share of contribution, with interest. In case of death of a pensioner, his or her spouse shall be only entitled to receive 50 per cent of the pension.

MGNREGA Scheme Faces Fund Shortage

07, Jan 2019

Context:

- The Mahatma Gandhi National Rural Employment Guarantee Act scheme is facing a severe fund crunch, with 99% of money allocated already exhausted three months before the end of the financial year, and 11 States and Union Territories having a negative net balance.

Details:

- Studies analysing government data show that the scheme faces difficulties in meeting the demand for work and paying wages on time.

- It is said that these issues are likely to be exacerbated by the current fund crisis.

- The problem gets intensified when the demand for MGNREGA employment peaks during non-agricultural season

- And also, rainfall deficits and drought this year are likely to worsen the situation, could increase the demand and need for work, as witnessed in 2015-16

- It has been found that employment provided was already 32% lower than work demanded during 2017-18.

- Hence the fund crisis could further constrain the employment generation under MGNREGA and State governments and field functionaries might be compelled not to register demand for work in order to contain the payment liabilities of the governments, which goes against the spirit of MGNREGA.

About MGNREGA:

- The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) is an employment guarantee act. It was introduced in 2005 through the National Rural Employment Guarantee Act, 2005.

- In 2010, NREGA renamed as MGNREGA

- It aims to provide guaranteed 100 days of wage employment per year to each rural household, which could in turn help to enhance livelihood security of household in rural areas of India. It provides work to all section of the society and help in social inclusion of women, SC and STs (Minimum one-third of the workers should be women)

- It is a demand driven scheme

- The Act currently covers all districts with the exception of those that have a 100% urban population.

Providing Health for All

12, Dec 2018

What’s in the Editorial?

- Among the quintessential traits of a central banker is to be unpredictable in action so that the markets can be kept guessing. Urjit Patel exhibited this quality in ample measure when he announced his decision to walk out of his job as Governor of the Reserve Bank of India on Monday.

- His resignation caught everyone by surprise, including the markets which had been lulled into believing that the spat between the central bank and the Centre had been amicably resolved.

- The rumours of him resigning, which were doing the rounds before the last meeting of the RBI central board three weeks ago, had died down. He had chaired the Monetary Policy Committee meeting just last week and also a meeting of the Board for Financial Supervision that discussed the issue of Prompt and Corrective Action on some banks.

Governance issue:

- The one important issue that remained on the table after the November board meeting was of the central bank’s governance and autonomy. Interestingly, in the days following the meeting, there were reports of how the Centre was planning to push for board committees that would supervise specific areas of the central bank’s operations.

- Such a move would have compromised the Governor’s position and curtailed his operational freedom. Was this the proverbial last straw for Dr. Patel?

- This is a battle between the government and the central bank, not between individuals representing the two sides. But sadly, Dr. Patel seems to have taken the Centre’s push as a personal affront.

- It is not as if RBI Governors have never had serious run-ins with the government before. But they were always handled quietly behind the scenes and the only way that the public ever got to know of these episodes was when RBI Governors wrote memoirs. This time was different though.

Ill-advised escalation:

- The main point of friction between the two — on monetary policy — was also addressed through the introduction of the Monetary Policy Committee two years ago by amending the RBI Act. In effect, an important thread in the relationship was institutionalised and the personal element was taken out, precisely to avoid situations such as the current one.

Grievances of the Government:

- It is true that the Centre has been more assertive in its relationship with the RBI in recent times, but it has some genuine grievances such as on the issue of providing liquidity for non-banking finance companies and a less stringent capital norms regime for banks.

- As the political executive, the Centre obviously feels that it is responsible for ensuring that there is no freeze in the credit markets. There is nothing wrong with that. The central bank, however, is more conservative. The last thing that it wants is to create another bad loan environment just as it is beginning to get out of an earlier mess.

RBI overlook:

- Added to this is the Centre’s grouse that the RBI was found wanting in its supervision role. The Punjab National Bank fiasco and the IL&FS collapse both happened right under the nose of the RBI, which is supposed to have conducted regular inspections of both entities. Neutral observers have also pointed to these lapses. His resignation has queered the pitch for the Centre, which is now scrambling for non-existent defences.

- The outgoing Governor’s resignation has trained the spotlight so sharply on the festering issues between the RBI and the Centre that it is extremely difficult for his successor, Shaktikanta Das, to act on any of them in favour of the latter, even if it is merited. Seen from this angle, the Centre has probably shot itself in its foot.

The road ahead:

- As former RBI Governor Raghuram Rajan points out in his book, we need a clearer enunciation of the central bank’s responsibilities.

- The position of the RBI Governor in the government hierarchy is not defined clearly. “There is a danger in keeping the position ill-defined because the constant effort of the bureaucracy is to whittle down its power,” argues Dr. Rajan.

- Not just this, the personal element in decision-making in the RBI has to be taken out and replaced by an institutional mechanism, much like the MPC did in the case of monetary policy.

- The reference of the reserves sharing issue to a committee is one such idea where there will be little scope for the Governor to act on his own just as the government too cannot exert pressure on him.

- Never waste a good crisis, said Rahm Emanuel, former White House Chief of Staff. After having created the crisis, the least that the Centre can now do is to use it to reform the system.

Government Contribution to NPS Raised to 14 Per Cent

12, Dec 2018

In News:

- The Cabinet has approved changes to National Pension Scheme or NPS which will make the pension plan at par with other schemes like PPF and EPF. The government granted NPS exempt, exempt and exempt or EEE status, which means that like PPF (public provident fund) or EPF (employee provident fund) investment at the investment stage, accumulation and withdrawal stage will be tax free. Earlier, NPS only enjoyed exempt, exempt and taxable or EET status, meaning that on withdrawal NPS was partially taxable. These changes were approved by the Cabinet in its meeting.

New NPS rules:

- NPS on withdrawal will be totally tax exempt. Currently, 40% of the total accumulated corpus utilised for purchase of annuity at retirement or reaching the age of 60 is already tax exempted. Out of 60% of the accumulated corpus withdrawn by the NPS subscriber at the time of retirement, 40% is tax exempt and balance 20% is taxable. Now, the whole 60% of the accumulated corpus will be tax free, bringing it on a par with other investment schemes like PPF and EPF.

- This change in tax rules on NPS withdrawal will apply to all subscribers, including government employees.

- In another tax benefit for NPS subscribers, contribution under Tier-II of NPS will now be covered under Section 80C for deduction up to Rs. 1.50 lakh for the purpose of income tax benefits, provided there is a lock-in period of three years. This brings it on a par with other schemes such as EPF and PPF. NPS offers two types of accounts to its subscribers. The Tier I account is non-withdrawable till the subscriber reaches the age of 60. Partial withdrawal before that is allowed in specific cases. The Tier II account is a voluntary savings account and subscribers can withdraw their money from it whenever they want.

- In another rule change, the government has decided to increase its contribution to the NPS for central government employees to 14% of their basic pay as compared to 10% earlier. This move will benefit 18 lakh central government employees. The government will bear an additional annual recurring expenditure of Rs 2,840 crore due to its higher contribution. The central government employee’s contribution will remain changed at 10% of the basic pay. This will increase the accumulated corpus of all central government employees covered under NPS eventually give them greater pension payouts after retiremen without any additional burden. Currently, new entrants to central government service on or after 1 January 2004 are covered by NPS.

- The government also said that the central government will get more investment options (both debt and equity) and choice of pension fund managers.

Khelo india youth games

11, Dec 2018

Why in news?

- After the first edition of the Khelo India School Games 2017, the second edition, the games has become an initiative of the Central Government, has expanded in its scope, and will allow participants to compete in two categories (under 17 and under 21).

- Talented players identified in priority sports disciplines at various levels by the High-Powered Committee will be provided annual financial assistance of INR 5 lakh per annum for 8 years.

- Khelo India School Games are a part of the Khelo India programme.

- It consists of 16 disciplines which includes Archery, Athletics, Badminton, Basketball, Boxing, Football, Gymnastics, Hockey, Judo, Kabaddi, Kho-Kho, Shooting, Swimming, Volleyball, Weightlifting, and Wrestling.

Khelo India programme:

- It will be a Central Sector Scheme (Scheme implemented by the Central Government machinery and 100% funding by the union government).

- It is a Pan India Sports Scholarship scheme covering the 1000 most deserving and talented athletes across the sports discipline, every year.

- It is an unprecedented scheme, a first-ever plan to be implemented for creating a long-term development pathway for athletes.

- To enable the sportsman to pursue both studies and sports, the program aims at identifying and promoting 20 Universities in the country as centres of sporting distinction.

- To ensure maximum entries for organized sports competitions, the programme encourages the school and colleges to organize programmes of high standards.

- Forming an active population with a healthy lifestyle is also the focus of this programme.

- The aim is to impact the whole of sports ecosystem inclusive of sports economy, competition structure, talent identification, coaching and infrastructure.

- The programme plans to engage youth living in deprived and disturbed areas into sporting activities so that they will be mainstreamed into the process of nation-building and weaned away from disruptive activities.

Are you a sports betting enthusiast? Check out bettingmafia.com for expert picks and analysis.

‘MEDWATCH’ Mobile Health App

11, Dec 2018

Why in news?

- On the occasion of 86th anniversary, the Indian Air Force has launched an innovative mobile health App named ‘MedWatch’ in keeping with the PM’s vision of Digital India, Ayushman Bharat and Mission Indradhanush.

MedWatch:

- The app is conceived by the doctors of IAF and developed in house by Directorate of Information Technology (DIT) with zero financial outlay.

- It will provide correct, Scientific and authentic health information to air warriors and all citizens of India.

- The app is available on www.apps.mgov.gov.in and comprises of host of features like information on basic First Aid, Health topics and Nutritional Facts.

- It includes reminders for timely Medical Review, Vaccination and utility tools like Health Record Card, BMI calculator, helpline numbers and web links.

Saeck-Sexual Assault Evidence Collection Kits

14, Sep 2018

In news:

- The Home Ministry, as part of a pilot project, will initially procure 3,960 rape investigation kits at a cost of ₹ 79.20 lakh, and 100 such kits will be given to each State and U.T. This SAECK is also called as rape investigation kit

Background:

- These kits will help investigating officers to start immediate medico-legal investigation and help provide further evidence in cases of sexual assault and rape.

- The kits will have all the essential items required in providing crucial evidence such as blood and semen samples in such cases.

- The kit will contain a set of test tubes and bottles, with details of contents and specifications along with instructions on collection of evidence from the crime scene.

- These kits will then be sent to the closest forensic laboratory to provide the results within two months.

- Initially, at least three kits will be provided to each of the 15,640 police stations in the country after which the number would be gradually increased. The cost would be shared jointly by the Centre and the respective states.

Necessary of the Kits:

- At times the forensic laboratories receive compromised evidence that is why there is a need to distribute the rape investigation kits to all police stations for collecting the timely crucial evidence against the accused and get justice to the victim

- With usage of the Nirbhaya fund and with the help of the Ministry of Home Affairs, we are building five new forensic laboratories across the country that will increase the capacity from 1,500 to 20,000 persons.

PM Matru Vandana Yojana

12, Sep 2018

- Nearly 37 lakh women have received cash incentives under the Centre’s maternity benefits programme since the launch of Matru Vandana Saptah last year, a release from the Ministry of Women and Child Development.

About:

- The Pradhan Mantri Matru Vandana Yojana(PMMVY) offers pregnant women and lactating mothers Rs. 5,000 as assistance for the first birth in the family. The programme’s aim is to reduce malnutrition

- The scheme has an estimated 51.6 lakh beneficiaries a year.

- As many as 48.11 lakh women have been enrolled in the Matru Vandana Saptah and the Centre has disbursed an amount of Rs. 1,168.63 crores to various States, the release.

Background:

- Pradhan Mantri Matru Vandana Yojana (PMMVY) is a Maternity Benefit Programme that is implemented in all the districts of the country in accordance with the provision of the National Food Security Act, 2013.

- It is a conditional cash transfer scheme for pregnant and lactating women of 19 years of age or above for the first live birth. It provides a partial wage compensation to women for wage-loss during childbirth and childcare and to provide conditions for safe delivery and good nutrition and feeding practices.

- All pregnant women of 19 years of age and above were eligible for conditional cashtransfer benefits of ₹6000 to paid in two instalments, except those who receive paid maternity leave.

- With objective of:

- Promoting appropriate practice, care and institutional service utilization during pregnancy, delivery and lactation

- Encouraging the women to follow(optimal) nutrition and feeding practices, including early and Exclusive breastfeeding for the first six months; and

- Providing cash incentives for improved health and nutrition to pregnant and lactating mothers

- Initially the scheme is implemented on a pilot basis in 53 selected districts and proposals are under consideration to scale it up to 200 additional ‘high burden districts’ in 2015-16, in 2017 the scheme scaled up to cover 650 districts of the country.

Swachhata Hi-Seva Camapaign

06, Sep 2018

- Prime Minister Narendra Modi launched the ‘Swachhata Hi Seva’ movement, a 15-day cleanliness drive to ensure a high standard of cleanliness across the country leading up to Mahatma Gandhi’s birth anniversary on October 2.

Pakyong Airport

12, Aug 2018

- Sikkim’s newly-constructed airport, the Himalayan state’s first, will be inaugurated by Prime Minister Narendra Modi on 23 September.

About:

- Pakyong Airport is a Greenfield airport near Gangtok, the state capital of Sikkim, India. Prior to the construction of Pakyong Airport, Sikkim had been the sole state in India possessing no functional airport.

- At 4500 ft, Pakyong Airport is one of the five highest airports in It is also the first greenfield airport to be constructed in the North-eastern Region of India, the 100th operational airport in India, and the only airport in the state of Sikkim.

- As Pakyong Airport sits approximately 60 km from the India-China border, it is considered strategically important.

- Doklam pass was recent standoff between India -china was happened is 54 km from this airport It has been reported that the Indian Air Force (IAF) would have the ability to land certain military aircraft at the site, if necessary.

- As a result, the ministries of home affairs and civil aviation are disputing which should be in charge of securing the airport. The airport will boost Sikkim’s economy by making the state more accessible for tourists. Currently, tourists headed for Gangtok by air have to fly to Bagdogra and travel for more than four hours (128 km) by road to reach the city.