Category: Insurance

INSURANCE CLAIMS AMID COVID-19 OUTBREAK

05, May 2020

Why in News?

- Companies that suffered business interruption losses due to the Covid-19 outbreak and lockdown are likely to bat for the “loss of profit” clause in their insurance contracts.

- Many companies had taken insurance policies to cover loss arising due to certain unforeseen circumstances but the question has risen whether Covid-19 outbreak is covered by such policies.

- The net result is that they may not get any insurance claim from the insurance companies under the Standard Fire and Special Perils Policy, commonly known as property policy.

Types of Insurances:

- Corporations usually Take Two Types of insurance policies -Material damage policy and Business Interruption Policy.

- Material damage policy is triggered if there is loss of property due to fire or flood or machine breakdown.

- Business interruption, on the other hand, only comes into force if loss of profit has happened due to the clauses mentioned under the material damages policy.

Provisions of the “Property Policy”:

- If the insured plant or office is shut down due to any damage or fire, the company is eligible for claims.

- Also the Policy specifies if the building insured or containing the insured property becomes unoccupied and so remains for a period of more than 30 days (not applicable for dwellings), the insurance claims may not be applicable.

- For claim, before the occurrence of any loss or damage to the property, the continuation of the coverage needs to be ensured.

Relaxation from Policy Lapse:

- The insurers have given relief to corporates, which shut their units for more than a month. Their policies will be allowed to be operational despite the clause that “if a unit is shut for 30 days continuously – the policy cover will lapse”.

- The above relief is applicable for the “unoccupied properties” for more than one month till May 3 under the property policy.

- It means companies can claim insurance if the property is damaged due to fire or any other loss even if the factory or unit is not operational during the period till May 3.

Force Majeure, or “Act of God” Clause:

- Most insurers will also use the Force Majeure, or “Act of God” clause but again there is no concrete conclusion or clause stating that loss of profit due to Covid-19 is Force Majeure.

- Force majeure is a common clause in contracts that essentially frees both parties from liability or obligation when an extraordinary event or circumstance beyond the control of the parties occurs. It prevents one or both parties from fulfilling their obligations under the contract.

INSURANCE COVER FOR A PANDEMIC

23, Mar 2020

Context:

- In case if a person gets infected by COVID-19, he/she must have a comprehensive health insurance plan to cover Hospitalisation expenses.

How to secure our Health?

- While pandemics such as COVID-19 are not new to the world, it is important to stay protected in every manner possible.

- While we may take all required precautionary measures such as maintaining social distancing to stay protected, what is more important here is to understand how we can secure your health.

- If you are still confused as to whether your health insurance policy will cover hospitalisation expenses incurred due to COVID-19, it is important for you to know that any claim for COVID-19 will be payable by your insurer if you are hospitalised for at least 24 hours.

- As per a circular from the Insurance Regulatory and Development Authority of India (IRDAI) to all health insurers regarding the guidelines all claims will be processed as per regular norms and will be covered as any other illness.

24-hour hospitalisation – Is it Mandatory?

- However, it is mandatory for the policyholder to stay hospitalised for a minimum of 24 hours.

- IRDAI has even made it clear that the entire cost of admissible medical expenses during the course of treatment, including the treatment during quarantine period, shall be settled in accordance with the regular health insurance policy.

- Also, the infection caused due to COVID-19 does not fall under the pre-existing disease category and hence, the claims will be covered for the illness from day one.

- Every basic health insurance plan will compensate the policyholder for expenses incurred on pre-hospitalisation, post-hospitalisation, in-patient treatment, OPD and ambulance expenses, should one seek treatment for COVID-19.

About the Fixed Benefit Plan:

- While the above features are for an indemnity-based health plan, those looking for a fixed benefit health plan that compensates them for loss of income due to hospitalisation following COVID-19 can invest in the fixed benefit health plan offered by Digit Insurance.

- Offered under the IRDAI’s regulatory sandbox framework, Health Care Plus plan is available for a sum insured of between ₹25,000 and ₹2 lakh.

- The premiums start at ₹299 at the lower end, while the maximum sum insured entails a premium of ₹2,027 plus GST.

- As to the pay-out process, in case a policyholder tests positive for COVID-19, the insurer will pay out the entire sum insured. If quarantine is advised in a government or a military hospital, the insurer will pay 50% of the sum insured.

- Retired people may consider it for additional benefits even if they have a standalone plan since they are more vulnerable to the virus. Those suffering from symptoms of cold or respiratory diseases will not be able to purchase this plan.

About IRDAI:

- Insurance Regulatory and Development Authority of India or the IRDAI is the apex body responsible for regulating and developing the insurance industry in India.

- It is an autonomous body established by an act of Parliament known as the Insurance Regulatory and Development Authority Act, 1999.

- IRDAI is headquartered in Hyderabad in Telangana. Prior to 2001, it was headquartered in New Delhi.

- The organization fought for an increase in the FDI limit in the insurance sector to 49% from the previous 26%. The FDI cap was hiked to 49% in July of 2014.

- Its Functions include:

- Its primary purpose is to protect the rights of the policyholders in India.

- It gives the registration certificate to insurance companies in the country.

- It also engages in the renewal, modification, cancellation, etc. of this registration.

- It also creates regulations to protect policyholders’ interests in India.

PRADHAN MANTRI FASAL BIMA YOJANA (PMFBY)

07, Jan 2020

Why in News?

- Maharashtra has become the first state in the country to integrate its land records with the web portal of the Pradhan Mantri Fasal Bima Yojana (PMFBY).

- This will help in checking the cases of “over-insurance” (insurance of more land than in possession) as well as insurance of ineligible people.

About PMFBY:

- Launched in April, 2016, after rolling back the earlier insurance schemes viz. National Agriculture Insurance Scheme (NAIS), Weather-based Crop Insurance scheme and Modified National Agricultural Insurance Scheme (MNAIS).

Premium:

- It envisages a uniform premium of only 2% to be paid by farmers for Kharif crops, and 1.5% for Rabi crops. The premium for annual commercial and horticultural crops will be 5%.

Objectives:

1.Providing financial support to farmers suffering crop loss/damage arising out of unforeseen events.

2. Stabilizing the income of farmers to ensure their continuance in farming.

3.Encouraging farmers to adopt innovative and modern agricultural practices.

4.Ensuring flow of credit to the agriculture sector which contributes to food security, crop diversification and enhancing growth and competitiveness of agriculture sector besides protecting farmers from production risks.

Farmers to be Covered:

- All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

Compulsory Coverage:

- The enrolment under the scheme, subject to possession of insurable interest on the cultivation of the notified crop in the notified area, shall be compulsory for following categories of Farmers:

1.Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season. and

2. Such other farmers whom the Government may decide to include from time to time.

Voluntary Coverage:

- Voluntary coverage may be obtained by all farmers not covered above, including Crop KCC/Crop Loan Account holders whose credit limit is not renewed.

Challenges at Present:

1.Insufficient reach and the issue of penetration.

2.Data Constraints:With just around 45% of the claims made by farmers over the last three crop seasons data for the last rabi season is not available paid by the insurance companies.

3.Low Payout of claims:The reason for the very low payout of claims is that only few state governments are paying their share of the premiums on time and till they do, the central government doesn’t pay its share either. Till they get the premium, insurance companies simply sit on the claims.

4.Gaps in assessment of crop loss:There is hardly any use of modern technology in assessing crop damages. There is lack of trained outsourced agencies, scope of corruption during implementation and the non-utilisation of technologies like smart phones and drones to improve reliability of such sampling.

5.Less number of Notified Cropsthan can avail insurance, Inadequate and delayed claim payment

6.High Actuarial Premium Rates:Insurance companies charged high actuarial premium rates. If states delay notifications, or payment of premiums, or crop cutting data, companies cannot pay compensation to the farmers in time.

7.Poor capacity to deliver:There has been no concerted effort by the state government and insurance companies to build awareness of farmers on PMFBY. Insurance companies have failed to set-up infrastructure for proper Implementation of PMFBY.

DEPOSIT INSURANCE COVER TO BE RAISED?

19, Nov 2019

Why in News?

- The central government now plans to raise the cover of deposit insurance after the failure of the Punjab and Maharashtra Co-operative (PMC) Bank on the low level of insurance for deposits held by Customers in Banks.

About Deposit Insurance:

- Currently, in the event of a bank going bust in India, a depositor has claim to a maximum of Rs 1 lakh per account as insurance cover — even if the deposit in their account far exceeds Rs 1 lakh. This amount is termed ‘deposit insurance’.

- Depositors holding more than Rs 1 lakh in their account have no legal remedy in case of the collapse of the bank.

- The cover of Rs 1 lakh per depositor is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a fully owned subsidiary of the Reserve Bank of India.

- The Rs 1 lakh-cover is for deposits in commercial banks, regional rural banks (RRBs), local area banks (LABs), and cooperative banks.

How Depositors Claim the Money from the Failed Bank?

- The DICGC does not deal directly with depositors. The RBI (or the Registrar), on directing that a bank be liquidated, appoints an official liquidator to oversee the winding up process.

- Under the DICGC Act, the liquidator is supposed to hand over a list of all the insured depositors (with their dues) to the DICGC within three months of taking charge.

- The DICGC is supposed to pay these dues within two months of receiving this list.

- In FY19, it took an average 1,425 days for the DICGC to receive and settle the rest claims on a de-registered bank.

What is the Issue?

- As per DICGC data, over the years the level of insured deposits as a percentage of assessable deposits has declined from a high of 60.5% in 2007-08 to 28.1% in 2018-1.

- At the end of March 2019, the number of registered insured banks with DICGC stood at 2,098 — comprising 103 commercial banks, 1,941 cooperative banks, 51 RRBs, and three LABs.

- DICGC last revised the deposit insurance cover to Rs 1 lakh on May 1, 1993 — raising it from Rs 30,000, which had been the cover from 1980 onward.

- DICGC charges 10 paise per Rs 100 of deposits held by a bank. The premium paid by the insured banks to the Corporation is required to be borne by the banks, and not be passed on to depositors.

- As per DICGC data, commercial banks paid a total premium of Rs 11,190 crore in 2018-19, while cooperative banks paid a premium of Rs 850 crore to cover deposits against the risk of default.

- As for cooperative banks, only 44.5% of their assessable deposits were covered in 2018-19, while for commercial banks this ratio was 25.7%.

- Commercial banks account for the largest share of bank deposits in India.

STEERING COMMITTEE ON FINTECH RELATED ISSUES

03, Sep 2019

Why in News?

- The Steering Committee on Fintech related issues constituted by the Ministry of Finance, Department of Economic Affairs, submitted its Final Report.

Fintech Companies:

- Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services.

- At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.

- Fintech, the word, is a combination of “financial technology”.

- When fintech emerged in the 21st Century, the term was initially applied to the technology employed at the back-end systems of established financial institutions.

- Fintech now includes different sectors and industries such as education, retail banking, fundraising and non-profit, and investment management to name a few.

Recommendations:

- The report outlines the current landscape in the Fintech space globally and in India, studies the various issues relating to its development and makes recommendations focusing on how fintech can be leveraged to enhance financial inclusion of MSMEs.

- The Committee report also identifies application areas and use cases in Governance and financial services and suggests regulatory upgrades enabling fintech innovations.

- The Committee has recommended that the RBI may consider development of a cash-flow based financing for MSMEs.

- It has also recommended that Insurance companies and lending agencies to be encouraged to use drone and remote sensing technology for crop area, damage and location assessments to support risk reduction in insurance/lending business.

- The Committee has highlighted the positive impact of Fintech innovations on sectors such as Agriculture and MSMEs.

- And it has recommended NABARD to take immediate steps to create a credit registry for farmers with special thrust for use of fintech along with core banking solutions (CBS) by agri-financial institutions, included Cooperative societies.

- The Committee recommends a special drive for modernisation and standardisation of land records by setting up a dedicated National Digital Land Records Mission based on a common National Land Records Standards with involvement of State Land and Registration departments.

- The Committee also recommends a comprehensive legal framework for consumer protection be put in place early keeping in mind the rise of fintech and digital services.

- It has also recommended adoption of Regulation technology (or RegTech) by all financial sector regulators to develop standards and facilitate adoption by financial sector service providers to adopt use-cases making compliance with regulations easier, quicker and effective.

- Similarly, it has also recommended that financial sector regulators develop an institutional framework for specific use-cases of Supervisory technology (or SupTech), testing, deployment, monitoring and evaluation.

RBI ISSUES FINAL NORMS FOR REGULATORY SANDBOX

16, Aug 2019

Why in News?

- The Reserve Bank of India (RBI) has issued the final framework for regulatory sandbox in order to enable innovations in the financial technology.

Regulatory Sandbox:

- A regulatory sandbox usually refers to live testing of new products or services in a controlled/test regulatory environment for which regulators may permit certain regulatory relaxations for the limited purpose of the testing.

- The objective of the sandbox is to foster responsible innovation in financial services, promote efficiency and bring benefit to consumers.

- It provides a secure environment for fintech firms to experiment with products under supervision of a regulator.

- It is an infrastructure that helps fintech players live test their products or solutions, before getting the necessary regulatory approvals for a mass launch, saving start-ups time and cost.

- The concept of a regulatory sandbox or innovation hub for fintech firms was mooted by a committee headed by then RBI executive director Sudarshan Sen.

- The panel submitted its report in Nov 2017 has called for a regulatory sandbox to help firms experiment with fintech solutions, where the consequences of failure can be contained and reasons for failure analysed.

- If the product appears to have the potential to be successful, it might be authorised and brought to the broader market more quickly.

What are New RBI Norms?

- RBI will launch the sandbox for entities that meet the criteria of minimum net worth of ₹25 lakh as per their latest audited balance sheet.

- The entity should either be a company incorporated and registered in the country or banks licensed to operate in India.

- While money transfer services, digital know-your customer, financial inclusion and cybersecurity products are included, crypto currency, credit registry and credit information have been left out.

- Meeting norms on customer privacy, data protection, security and access to payment data, the security of transactions, KYC, anti-money laundering will be mandatory.

REGULATORY SANDBOX

01, Aug 2019

Why in News?

- The Insurance Regulatory and Development Authority of India (IRDAI) will soon allow the use of regulatory sandbox (RS) to promote new, innovative products and processes in the industry.

Regulatory Sandbox:

- A sandbox approach provides a secure environment for fintech firms to experiment with products under supervision of a regulator. It is an infrastructure that helps fintech players live test their products or solutions, before getting the necessary regulatory approvals for a mass launch, saving start-ups time and cost.

- The concept of a regulatory sandbox or innovation hub for fintech firms was mooted by a committee headed by then RBI executive director Sudarshan Sen.

- The panel submitted its report in Nov 2017 has called for a regulatory sandbox to help firms experiment with fintech solutions, where the consequences of failure can be contained and reasons for failure analysed.

- If the product appears to have the potential to be successful, it might be authorised and brought to the broader market more quickly.

- The sandbox will enable fintech companies to conduct live or virtual testing of their new products and services.

Significance:

- The RS allows the regulator, the innovators, the financial service providers (as potential deployers of the technology) and the customers (as final users) to conduct field tests to collect evidence on the benefits and risks of new financial innovations, while carefully monitoring and containing their risks.

- India accounts for approximately 6 per cent of insurance premium in Asia and around 2 per cent of the global premium volume.

IRDAI sandbox:

- For the IRDAI sandbox, an applicant should have a net worth of Rs 10 lakh and a proven financial record of at least one year.

- Companies will be allowed to test products for up to 12 months in five categories.

- It has said applicants can test products for up to a period of one year in five categories – insurance solicitation or distribution, insurance products, underwriting, policy and claims servicing.

CENTRE REDUCES CONTRIBUTION RATE FOR ESI

14, Jun 2019

Why in News:

- Trade unions set to protest against the decision

Background:

- Starting July 1, both employers and employee’s contribution under the Employees’ State Insurance (ESI) Act, which gives insured workers medical benefits among other facilities, would be reduced, the Centre said on Thursday.

- The total contribution towards ESI was reduced from 6.5% of an employee’s wages to 4%, with the employer’s share cut to 3.25%, from 4.75%, and the employee’s contribution lowered to 0.75% of wages, from 1.75%, the government announced.

- “This would benefit 3.6 crore employees and 12.85 lakh employers,” the Labour and Employment Ministry said in a statement.

About Employees’ State Insurance (ESI) Issue:

- “The reduced rate of contribution will bring about a substantial relief to workers under the ESI scheme and bring more and more workforce into the formal sector,” it added.

- The financial liability on employers would also be reduced, leading to improved viability of the establishments, increased ease of doing business and likely improved compliance with the Act, the government said, “The ESIC is an autonomous body and these rates have not been discussed.

- If the government proposes even lower rates in the next Board meeting of the ESIC, we will oppose it. We want to increase the benefits given to employees, not reduce the contribution so much,” he added.

About Employees’ State Insurance (ESI):

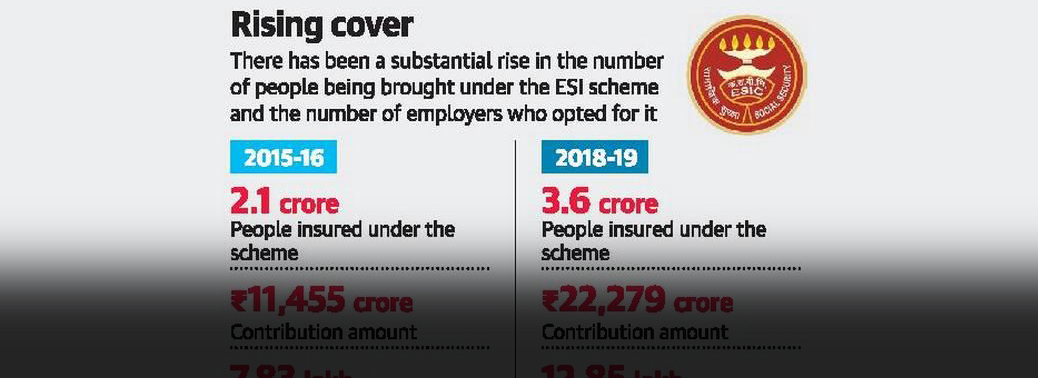

- The number of people insured under the scheme increased to 3.6 crore in 2018-2019, from 2.1 crore in 2015-2016, with the total contribution received climbing to ₹22,279 crore, from ₹11,455 crore, government data show.

- The number of employers in the scheme increased from 7.83 lakh in 2015-2016 to 8.98 lakh in 2016-2017, then to 10.33 lakh in 2017-2018 and to 12.85 lakh in 2018-2019