ECONOMIC PACKAGE TO MAKE INDIA SELF-RELIANT

14, May 2020

Prelims level : Economics

Mains level : GS-III Indian Economy and issues relating to planning, mobilization of resources, Growth, Development and Employment

Why in News?

- Union Finance Minister announced a ₹20-lakh-crore economic stimulus package to deal with the COVID-19 pandemic.

Highlights:

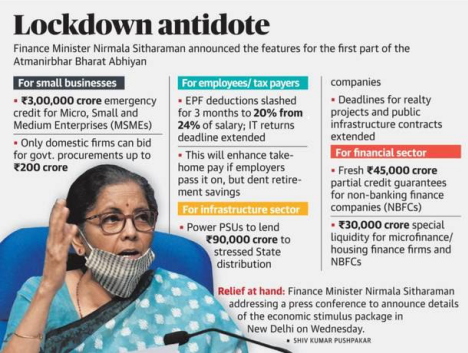

- This is the first tranche of the Atmanirbhar Bharat Abhiyan announced by Prime Minister Narendra Modi recently as a ₹20 lakh crore economic package.

- That package includes the ongoing Pradhan Mantri Garib Kalyan Yojana, meant to support the poorest and most vulnerable communities during the pandemic, as well as several measures taken by the Reserve Bank of India to improve liquidity.

- More tranches are expected in the next few days.

Pradhan Mantri Garib Kalyan Package (1):

- 1.70 Lakh Crore relief package under Pradhan Mantri Garib Kalyan Yojana for the poor to help them fight the battle against Coronavirus which includes –

- Insurance cover to Health Worker

- 5 kg wheat or rice per person for next 3 months to poor people

- 20 crore women Jan Dhan account holders get Rs 500 per month for next 3 months;

- Gas cylinders, free of cost, provided to 8 crore poor families for the next 3 months;

- Increase in MNREGA wage to Rs 202 a day from Rs 182 to benefit 13.62 crore families;

- Ex-gratia of Rs 1,000 to 3 crore poor senior citizens, poor widows and poor Divyang.

Pradhan Mantri Garib Kalyan Package (2):

- Front-loaded Rs 2,000 paid to farmers under existing PM-KISAN to benefit 8.7 crore farmers; Building and Construction Workers Welfare Fund allowed to be used to provide relief to workers;

- Five crore workers registered under Employee Provident Fund (EPF) to get non-refundable advance of 75% of the amount or three months of the wages, whichever is lower, from their accounts;

- Limit of collateral free lending to be increased from Rs 10 to Rs 20 lakhs for Women Self Help Groups supporting 6.85 crore households;

- District Mineral Fund (DMF) to be used for supplementing and augmenting facilities of medical testing, screening etc.

Measures taken by Reserve Bank of India:

- Reduction of Cash Reserve Ratio (CRR) has resulted in liquidity enhancement of ₹1,37,000 crores Targeted Long Term Repo Operations (TLTROs) of ₹1,00,050 crore for fresh deployment in investment grade corporate bonds, commercial paper, and non-convertible debentures.

- Increased the banks’ limit for borrowing overnight under the marginal standing facility (MSF). Announced special refinance facilities to NABARD, SIDBI and the NHB for a total amount of ₹50,000 crore at the policy repo rate.

- Moratorium of three months on payment of instalments and payment of Interest on Working Capital Facilities in respect of all Term Loans.

- For loans by NBFCs to the commercial real estate sector, additional time of one year has been given for extension of the date for commencement for commercial operations (DCCO).

Other Measures:

- On the request of the Government of India, RBI raised the Ways and Means advance limits of States by 60% and enhanced the Overdraft duration limits;

- Issued all the pending income-tax refunds up to ₹5 lakh, immediately benefiting around 14 lakh taxpayers;

- Implemented “Special Refund and Drawback Disposal Drive” for all pending refund and drawback claims;

- Sanctioned Rs 15,000 crores for Emergency Health Response Package.

Dissecting the Current Economic Package:

- For Salaried Workers and Taxpayers:

- Some relief was provided in the form of an extended deadline for income tax returns for financial year 2019-20, with the due date now pushed to November 30, 2020.

- The rates of tax deduction at source (TDS) and tax collection at source (TCS) have been cut by 25% for the next year.

- While statutory provident fund (PF) payments have been reduced from 12% to 10% for both employers and employees for the next three months.

- MSMEs Get Attention:

- A major chunk (₹3 lakh crore) of this package is for collateral free loan schemes for businesses, especially micro, small and medium enterprises (MSMEs).

- The ₹3 lakh crore emergency credit line will ensure that 45 lakh units will have access to working capital to resume business activity and safeguard jobs.

- For two lakh MSMEs which are stressed or considered non-performing assets, the Centre will facilitate provision of ₹20,000 crore as subordinate debt.

- A ₹50,000 crore equity infusion is also planned, through an MSME fund of funds with a corpus of ₹10,000 crore.

- In a bid to fulfil the Prime Minister’s vision of a self-reliant or “Atmanirbhar” India, global tenders will not be allowed for government procurement up to ₹200 crore.

- Other interventions for MSMEs: e-market linkage and Fintech will be used to enhance transaction-based lending using the data generated by the e-marketplace.

- The definition of an MSME is being expanded to allow for higher investment limits and the introduction of turnover-based criteria.

- Non-banking finance companies (NBFCs):

- NBFCs/HFCs/MFIs are finding it difficult to raise money in debt markets.

- Government will launch a Rs 30,000 crore Special Liquidity Scheme;

- Under this scheme investment will be made in both primary and secondary market transactions in investment grade debt paper of NBFCs/HFCs/MFIs;

- Will supplement RBI/Government measures to augment liquidity;

- Securities will be fully guaranteed by GoI.

- This will provide liquidity support for NBFCs/HFC/MFIs and mutual funds and create confidence in the market.

- Power Distribution Companies:

- Revenues of Power Distribution Companies (DISCOMs) have plummeted. Unprecedented cash flow problem accentuated by demand reduction.

- PFC/REC to infuse liquidity of Rs 90,000 cr to DISCOMs against receivables.

- Loans to be given against State guarantees for the exclusive purpose of discharging liabilities of Discoms to Gencos.

- Linkage to specific activities/reforms: Digital payments facility by Discoms for consumers, liquidation of outstanding dues of State Governments, Plan to reduce financial and operational losses.

- Central Public Sector Generation Companies shall give rebate to Discoms which shall be passed on to the final consumers (industries).

- Relief to Contractors:

- Extension of up to 6 months (without costs to contractor) to be provided by all Central Agencies (like Railways, Ministry of Road Transport & Highways, Central Public Works Dept, etc)

- Covers construction/ works and goods and services contracts.

- Covers obligations like completion of work, intermediate milestones etc. and extension of Concession period in PPP contracts.

- Government agencies to partially release bank guarantees, to the extent contracts are partially completed, to ease cash flows

- The Real Estate Industry:

- Adverse impact due to COVID and projects stand the risk of defaulting on RERA timelines. Time lines need to be extended.

- Ministry of Housing and Urban Affairs will advise States/UTs and their Regulatory Authorities to the following effect:

- Treat COVID-19 as an event of ‘Force Majeure’ under RERA.

- Extend the registration and completion date suo-moto by 6 months for all registered projects expiring on or after 25th March, 2020 without individual applications.

- Issue fresh ‘Project Registration Certificates’ automatically with revised timelines.

- Extend timelines for various statutory compliances under RERA concurrently.

- These measures will de-stress real estate developers and ensure completion of projects so that homebuyers are able to get delivery of their booked houses with New Timelines.