GREEN BONDS AND CLIMATE CHANGE

31, Jul 2019

Prelims level : Economics- Capital Market; Environment- Climate Change

Mains level : GS-III- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Context:

- New study finds firms that have adopted green bonds benefit from both positive financial and environmental outcomes.

What Are Green Bonds:

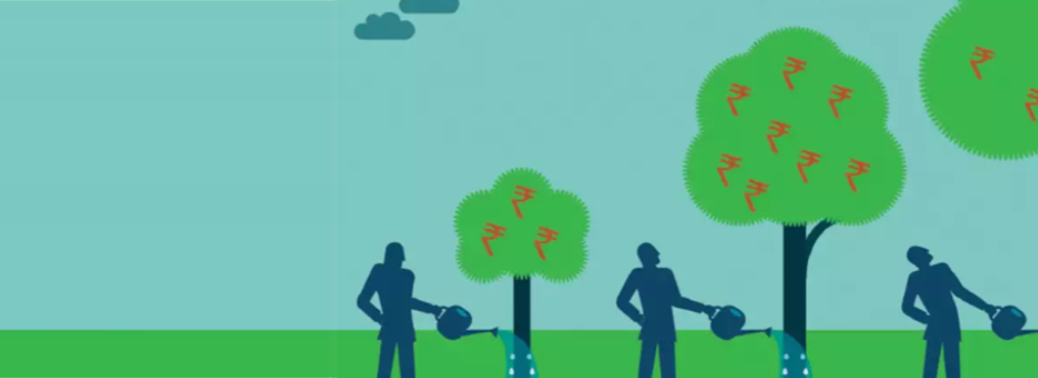

- A green bond is like any other regular bond but with one key difference: the money raised by the issuer are earmarked towards financing `green’ projects, i.e. assets or business activities that are environment-friendly.

- Such projects could be in the areas of renewable energy, clean transportation and sustainable water management.

What Are Benefits of Green Bonds?

- Green bonds enhance an issuer’s reputation, as it helps in showcasing their commitment to wards sustainable development.

- It also provides issuers access to specific set of global investors who invest only in green ventures.With an increasing focus of foreign investors towards green investments, it could also help in reducing the cost of capital.

- Green bonds present the opportunity for investors to feel as if they’re making a difference for the environment while earning a respectable return in the process.

Green Bond in India

- CLP India, was the first Indian company to tap this route. So far, Rs 7,200 crore has been raised via green bonds.

Key Findings of Study

- Green bonds offer financial benefits to companies in the long run in terms of better returns on assets and equity.

- Green bonds fulfil their intended goal of better environmental outcomes: companies issuing green bonds saw a significant reduction in their CO2 emissions and a boost in their environmental ratings.

- Though green bonds are only a small share of the larger bond market, they have grown rapidly over the last decade.

- Most of these green bonds were issued by governments, financial and utility companies.

- The green bond market is dominated by three countries – China ($83 billion worth of green bonds issued over the last decade), United States ($58 billion) and France ($57 billion) have been the largest issuers of green bonds.

- India still lags behind these countries ($5.2 billion in 2018), it is one of the fastest-growing green bond markets in Asia.

Way Forward:

- There are neither uniform standards to classify a green bond nor a governing body to regulate the market.

- There is need to address this is critical issue for green bond markets to flourish which has good amount of potential.