MONEY AND BANKING

MEASURES OF MONEY SUPPLY IN INDIA

- Money supply is the stock of liquid assets held by the public which can be freely exchanged for goods and services.

- RBI calculates four concepts of money supply. These are known as measures of monetary aggregates or money stock measures.

- The working group under the chairmanship of Dr YB Reddy, then Deputy Governor of RBI (Now Former Governor of RBI) has suggested four new monetary measures (M0, M1, M2, M3) and three liquidity measures (L, L2, L3). Besides the group also recommended the publishing of Financial Sector Survey every three months ‘A Monetary Aggregates.’

- M0= Currency in circulation + Banker’s Deposit with RBI + other Deposit with RBI.

- M1 = M0 + Demand Deposits with the Banks.

- M2 = M1 + Time liabilities portion of savings deposits with the Banks + Certificates of Deposits issued by Bank + Term Deposits with contractual maturity not greater than 1 year with the banks.

- M3 = M2 + Term deposits with contractual maturity of over 1 year with the Banks + Call Borrowing from Non-Depository Financial Corporations by banks. Here M0 is reserve money which is most liquid measure of money supply. M1 is termed as narrow money and M3 as broad money.

- The decreasing order of liquidity of these monetary aggregates is M0> M1> M2>M3. The decline in liquidity indicates the shifting of ‘medium of exchange ‘to’ store of value.’Demand deposits are those deposits payable by the bank on demand by a customer like current and savings account

INDIAN CURRENCY SYMBOL (`)

- The symbol of Indian rupee ` came into use on 15th July, 2010. India is the fifth economy (after America, Britain, Japan and Europe) to accept a unique currency symbol.

Money Market

- The cluster of financial institutions that deal in short- term securities and loans, gold and foreign exchange are termed as money market.

Functions of Money Market

- The money market performs three broad functions

It provides an equilibrating mechanism for demand and supply of short-term funds. - It enables borrowers and lenders of short-term funds to fulfil their borrowing and investment requirements at an efficient market clearing price.

It provides an avenue for Central Bank intervention in influencing both quantum and cost of liquidity in the

financial system, thereby transmitting monetary policy impulses to the real economy. - Efficient functioning of the money market is important for the effectiveness of monetary policy.

Organisation of Indian Money Market

- Indian money market is broadly divided into two parts – organised and unorganised.

- The RBI is the apex organisation in the Indian money market. It carries out regulation and development of the Indian money market through instruments such as call/notice/term money market, repo market, certificate of deposit, commercial paper and Collateralised Borrowing and Lending Obligation (CBLO).

Organised Money Market Call Money Market

- The call/notice money market forms an important segment of the Indian money market.

- Call or notice money is an amount borrowed or lent on demand for a very short period. If the period is greater than one day and up to 14 days, it is called the notice money; otherwise the amount is known as call money. No collateral security is needed to cover these transactions.

Treasury Bill Market

- Treasury bills are money market instruments to finance the short- term requirements of the Government of India. These are discounted securities and thus, are issued at a discount to face value. The return to the investor is the difference between the maturity and issue price.

- The market that deals with treasury bills is called treasury bill market. These are the lowest risk category instruments for the short-term. RBI issues treasury bills (T-bills) at a prefixed day and for a fixed amount.

There are four types of Treasury Bills - (i)14 Days T-Bill It was introduced in 1997, by the

RBI. Maturity is in 14 days, it is auctioned on every Friday of every week and the notified amount for auction is `100 crore. - (ii) 91 Days T-Bill Maturity is in

91 days, it is auctioned on every Friday of every week and the notified amount for auction is `100 crore. - (iii) 182 Days T-Bill Maturity is in

182 days, it is auctioned on every alternate Wednesday, which is not a reporting week and the notified amount for auction is `100 crore. It was introduced on the recommendations by Vaghul Working Group. - (iv) 364 Days T-Bill Maturity is

- 364 days, it is auctioned on every alternate Wednesday, Which is a reporting week and the notified amount for the auction is ` 500 crore. It was also recommended by Vaghul Working Group.

- In recent times, RBI has been issuing only 91 days and 364 days T-Bills.

- These are bought by the Reserve Bank, Commercial banks, non- banking financial intermediaries, LIC, UTI and GIC. Treasury bills are most liquid, because Reserve Bank is always ready to buy and discount them.

Commercial Bill Market

- It is the market that deals in commercial bills. Commercial bills of exchange are negotiable instruments drawn by the seller or drawer of the goods on the buyer or drawer of the good for the value of the goods

- These bills are called trade bills. These trade bills are called commercial bills, when they are accepted by Commercial Banks. If the bill is payable at a future date and the seller needs money during the currency of the bill, the seller may approach the bank for discounting the

- The banks discount this bill by keeping a certain margin and credits the proceeds. Banks, when in need of money, can also get such bills rediscounted by financial institutions such as LIC,

- UTI, GIC, ICICI and IRBI. The

- maturity period of the bills varies from 30 days, 60 days or 90 days, depending on the credit extended in the industry.

Certificates of Deposits Market

- After treasury bills, the next lowest risk category investment option is Certificate of Deposit (CD) issued by banks and Financial Institution (FI).

- Allowed in 1989, CDs were one of RBI’s measures to deregulate the cost of funds for banks and FIs. A CD is a negotiable promissory note, secure and short-term, of upto a year, in nature.

Repo Market

- Repo is a money market instrument which helps in collateralised short-term borrowing and lending through sale/purchase operations in debt

- instruments.Initially repos were allowed in Central Government treasury bills and dated securities created

- by converting some of the treasury bills, RBI gradually allowed repo transactions in all government securities and T-bills of all maturities and now State Government Securities, PSu’s bonds, private corporate securities have also been made eligible for repos to broaden the repo market.

Money Market Mutual Funds (MMMFs)

- The Scheme was introduced by RBI in April, 1992 with the objective of providing an additional short-term avenue to the individual investors. They have now been brought under the purview of SEBI since March, 2000.

Commercial Paper Market

- Commercial Papers (CPs) are negotiable short-term unsecured promissory notes with fixed maturity, issued by well-rated organisations. These are generally sold on discount

- Organisations can issue CPs either directly or through banks or merchant banks (called as dealers).

Dated Government Securities

- These are securities issued by the Government of India and State Governments. The date of maturity is specified in the securities, therefore, they are known as dated

CAPITAL MARKET

- Capital market is one of the most important segments of the Indian financial system. It is the market available to the companies for meeting their requirements of the long-term funds. These are markets for buying and selling equity and debt

- The market consists of a number of individuals and institutions (including the government) that channelize the supply and demand for long-term capital and claims on

- The demand for long-term capital comes predominantly from private sector manufacturing industries, agriculture sector,trade and the government agencies, while the supply of funds for the capital market comes largely from individual and corporate savings, banks, insurance companies, specialised financing agencies and the surplus of governments. The Indian capital market is broadly divided into the Gilt-edged Market and the Industrial Securities Market.

GILT-EDGED MARKET

- The gilt-edged market refers to the market for government and semi-government securities, backed by the Reserve Bank of India (RBI). Government securities are trade able debt instruments issued by the government for meeting its financial

- The term gilt-edged means ‘of the best quality.’ This is because the government securities do not suffer from risk of default and are highly liquid (as they can be easily sold in the market at their current price). The open market

- operations of the RBI are also conducted in such securities.

SECURITIES MARKET

- The industrial securities market refers to the market, which deals in equities and debentures of the corporate. It is further divided into primary market and secondary

Primary Market

- Primary Market (new issue market) deals with ‘new securities,’ i.e., securities, which were not previously available and are offered to the investing public for the first time. It is the market for raising fresh capital in the form of shares and

- It provides the issuing company with additional funds for starting a new enterprise or for either expansion or diversification of an existing one and thus, its contribution to company financing is direct. The new offerings by the companies are made either as an Initial Public Offering (IPO) or rights

Secondary Market/Stock Market

- Secondary Market/Stock Market (old issues market or stock exchange) is the market for buying and selling securities of the existing companies. Under this, securities are traded after being initially offered to the public in the primary market and/or listed on the stock exchange.

- The stock exchanges are the exclusive centres for trading of securities. It is a sensitive barometer and reflects the trends in the economy through fluctuations in the prices of various

Securities and Exchange Board of India (SEBI)

- It is the regulatory authority established under the SEBI Act, 1992, in order to protect the interests of the investors in securities as well as promote the development of the capital market.

- It involves regulating the business in stock exchanges

supervising the working of stock brokers, share transfer agents, merchant bankers, underwriters etc as well as prohibiting unfair trade practices in the securities market.

- The main functions of SEBI are as follows

- To regulate the business of the stock market and other securities

- To promote and regulate the self-regulatory

- To prohibit fraudulent and unfair trade practices in securities

- To promote awareness among investors and training of intermediaries about safety of market.

- To prohibit insider trading in securities

- To regulate huge acquisition of shares and takeover of companies.

Reforms in Capital Market of India

- The capital market has witnessed major reforms in the 1990s and thereafter. It is on the average of

- growth. Thus, the Government of India and SEBI have taken a number of measures in order to improve the working of the Indian Stock Exchanges and to make it more progressive and vibrant.

- The major reforms undertaken include

- Credit Rating Agencies Three credit rating agencies viz the Credit Rating Information Services of India Limited (CRISIL-1988), the Investment Information and Credit Rating Agency of India Limited (ICRA-1991) and Credit Analysis and Research Limited (CARE) were set-up in order to assess the financial health of different financial institutions and agencies related to the stock market

- Merchant Banking Activities Many Indian and foreign Commercial Banks have set- up their merchant banking divisions in the last few years. It has proved as a helping

- The major reforms undertaken include

hand to factors related to the capital market.

- Growth of Electronic Transactions Due to technological development in the last few years, the physical transaction with more paper work is reduced. It saves money, time and energy of

- Growing Mutual Fund Industry The growing of mutual funds in India has certainly helped the capital market to grow. A big diversification in terms of schemes, maturity etc has taken place in mutual funds in India. I t has given a wide choice for the common investors to enter the capital market.

- Growing Stock Exchanges Initially, the BSE was the main exchange, but now after the setting up of the NSE and the OTCEI, stock exchanges have spread across the country. Recently, a new Inter-connected Stock

Exchange of India has joined the existing stock exchanges.

- Investor’s Protection Under the purview of the SEBI, the Central Government of India has set-up the Investors Education and Protection Fund (IEPF) in 2001. It works in educating and guiding investors and to protect the interest of the small investors from frauds and also malpractices in the capital

- Growth of Derivative Transactions Since, June 2000, the NSE has introduced the derivatives trading in the equities. These innovative products have given various options for investment leading to the expansion of the capital

- Insurance Sector Reforms Indian insurance sector has also witnessed massive reforms in last few years. The Insurance Regulatory and Development Authority (IRDA) was set-up in 2000. It paved the entry of the private

- insurance firms in India. As many insurance companies invest their money in the capital market, it has expanded.

- Commodity Trading Along with the trading of ordinary securities, the trading in commodities is also recently encouraged. The Multi Commodity Exchange (MCX) is set-up. The volume of such transactions is growing at a splendid

- Apart from these reforms, the setting up of Clearing Corporation of India Limited (CCIL), venture funds etc have resulted into the tremendous growth of Indian capital

Stock Exchanges in India

- Bombay Stock Exchange (BSE), the oldest stock exchange in Asia, was established in 1875. It is synonymous with Dalal

- BSE was corporatised and renamed BSE Limited in 2005. In 1894, the Ahmedabad Stock Exchange was started to facilitate

dealing in the shares of textile mills.

- In 1908, Calcutta Stock Exchange was started to facilitate market for shares of plantations and jute mills. At present, there are 22 stock exchanges in the country. Two types of transaction take place on stock exchanges. These are

- Investment Transaction Sate/purchase of securities undertaken with short-term gain from differences in yield and

- Speculative Transaction Sale/purchase of securities undertaken with short-term gain from differences in yield and price. In this, delivery of securities of the payment of full price is

- Speculative transaction are of different types

- Spot Transaction involves delivery of and payment for securities on the same

- Cash Transaction are ready delivery transaction, wherein delivery of and payment for securities is completed within a period of one to seven

- Forward Transaction involves delivery of and payment for securities will be made on certain fixed settlement days, coming once in 15 or 30

- On the recommendation of the Narasimham Committee, SEBI was given the power to control and regulate the new issues market as well as stock exchange through Amendment of the Capital Issues Control Act, 1947.

Approved Stock Exchanges in India

- UP Stock Exchange, Kanpur

- Vadodra Stock Exchange, Vadodara

- Coimbatore Stock Exchange, Coimbatore

- United Stock Exchange of India Limited

- Bombay Stock Exchange,

- Over the Counter Exchange of India, Mumbai

- National Stock Exchange, Mumbai

- Ahmedabad Stock Exchange, Ahmedabad

- Bangalore Stock Exchange, Bengaluru

- Bhubaneshwar Stock Exchange, Bhubaneshwar

- Calcutta Stock Exchange, Kolkata

- Cochin Stock Exchange, Cochin

- Delhi stock Exchange, Delhi

- Guwahati Stock Exchange, Guwahati

- Hyderabad Stock Exchange, Hyderabad

- Jaipur Stock Exchange, Jaipur

- Ludhiana Stock Exchange, Ludhiana

- Chennai Stock Exchange, Chennai

- MP Stock Exchange, Indore

- Pune Stock Exchange, Pune

- Interconnected State Exchange of India Limited

Commodity Exchanges

- Multi Commodity Exchange of India Limited (MCX)

- National Commodity and Derivatives Exchange Limited (NCDEX)

- Indian National Multi-Commodity Exchange (NMCE)

- Indian Commodity Exchange Limited (ICEX)

National Stock Exchange (NSE)

- NSE was promoted by leading financial institutions at the behest of the Government of India and was incorporated in November, 1992, as a tax-paying company unlike other stock exchanges in the

- On the basis of the recommendations of high powered Pherwani Committee, the National Stock Exchange was incorporated in November, 1992. In April, 1993, it was recognized as a stock exchange and commenced operations in 1994. In October, 1995, NSE became largest stock exchange in the country.

- Trading at NSE can be classified under two broad categories

- Wholesale debt categories

Capital market

- Wholesale debt market operations are similar to money market operations, where institutions and corporate bodies enter into high value transactions in financial instruments such as government securities, treasury

- bills, public sector unit bonds, commercial paper, certificate or deposit etc.

- NSE has several advantages over the traditional trading

- They are as follows

- NSE brings an integrated stock market trading network across the

- Investors can trade at the same price from anywhere in the country since inter- market operations are streamlined coupled with the countrywide access to the securities.

- Delays in communication, late payments and the malpractices prevailing in the traditional trading mechanism can be done away with greater operational efficiency and informational transparency in the stock market operations with the support of total computerized

Stock Market Indices

- A stocks market index is created by selecting a group of stock that are

- representative of the whole market of a specified sector or segment of the market. An index is calculated with reference to a base period and a base index value. An index is used to give information about the price movements of products in the financial commodities or any other markets. Financial indexes are constructed to measure price movements of stocks, bonds, T-bills and other forms of investments. Stock market indexes are meant to capture the overall behavior of equity markets. Stock market indices are useful for a variety of reasons. Some of them are They provide a historical comparison of returns on money invested in the stock market against other forms of investments such as gold or debt.

- They can be used as a standard, against which to compare the performance of an equity

- It is a lead indicator of the performance of the overall economy or a sector of the economy.

- Stock indexes reflect highly up to date

- Modern financial applications such as Index funds, index futures, index options play an important role in financial investment and risk

- Bombay Stock Exchange (BSE)

- Established in 1875, BSE Limited (formerly known as Bombay Stock Exchange Limited), is Asia’s first stock exchange and one of India’s leading exchange groups. Over the past 137 years, BSE has facilitated the growth of the Indian corporate sector by providing it an efficient capital raising

- Some indices of BSE are given below

- SENSEX – MIDCAP

- SMLCAP – BSE-100

- – BSE-200 – BSE-500

- Around 5000 companies are listed on BSE making it world’s number one exchange in terms of listed members. BSE Limited is world’s 5th most active exchange in terms of number of transactions handled

- through its electronic trading system. It is also one of the world’s leading exchange (5th largest in May, 2012) for Index options trading (Source-World Federation of Exchanges).

- BSE is the first exchange in India and second in the world to obtain an ISO 9001:2000

- BSE’s popular equity index the SENSEX is India’s most widely tracked stock market benchmark index. It is traded internationally on the EUREX as well as leading exchanges of the BRCS nations (Brazil, Russia, China and South Africa).

- The Bombay Stock exchange launched BSE Carbonex, the first carbon based thematic index in the country. Which takes a strategic view of organizational commitment to climate change mitigation. This Index has been launched with the aim of creating a benchmark and increasing

- awareness about the risks posed by climate change.

- It will enable investors to track performance of the constituent companies of BSE-100 Index regarding their commitment to greenhouse gases emission reduction.

MCX Stock Exchange Limited (MCX-SX)

- It is private stock exchange headquartered in Mumbai, which was founded in 2008. It offers currency futures contracts for US Dollar-Rupee, Euro-Rupee, British Pound-Rupee, Japanese Yen-Rupee.

- It offers electronic trading platform in currency futures contracts. The exchange received permissions to deal in interest rate derivatives, equity, futures and options on equity and wholesale dept segment, vide SEBI’s letter dated 10th July, 2012.

| Some of the Major Stock Indices | Details |

|---|---|

| International | |

| BBC Global 30 | World stock market index of 30 of the largest companies by stock market value in Europe, Asia and the America. |

| MSCI World | Index includes stocks of all the developed markets |

| S&P Global 1200 | Global Stock index covering 31 countries and around 70 percent of global market capitalization. |

| United States | |

| AMEX Composite | Composite value of all of the stocks traded on the American Stock Exchange |

| Dow Jones Indexes | |

| Dow Jones Industrial Average | |

| NASDAQ Composite | Broad market index of all of the common stocks and similar securities traded on the NASDAQ stock market |

| NYSE Composite | Covers all common stock listed on the New York Stock Exchange |

| S & P 500 | Stock market index containing the stocks of 500 Large-Cap corporations. Comprises over 70% of the total market cap of all stocks traded in the U.S. Owned by Standard & Poors. |

| China | |

| SSE Composite | Index of all listed stocks (A shares and B shares) at Shanghai Stock Exchange |

| Hong Kong | |

| Hang Seng Indexes | Record daily changes of the largest companies of the Hong Kong stock market (represent about 67% of capitalization of the Hong Kong Stock Exchange). |

| Some of the Major Indices | Details | |

|---|---|---|

| Canada | ||

| S&P/TSX Composite | Index of the stock prices of the largest companies on Toronto Stock Exchange | |

| Europe | ||

| Dow Jones Euro Stock 50 | Index of 50 Euro-zone stocks | |

| Russia | ||

| MICEX Index | Price index of the 30 major and most liquid Russian stocks traded at the Moscow Interbank Currency Exchange. | |

| Switzerland | ||

| Swiss Market Index (SMI) | Includes the twenty largest and most liquid SPI stocks | |

SENSEX (The Barometer of Indian Capital Market)

- BSE sensitive index also referred to as BSE-30 is a free float market capitalization-weighted stock market index of 30 well established and financially sound companies listed in Bombay Stock Exchange.

- The free-float market capitalization of a company is determined by multiplying, the price of its stocks by the number of shares issued by a company, which is readily available for trading on the stock

- The base year/period of SENSEX was 1978-79=100. The calculation

- of SENSEX involves dividing the free float market capitalization of30 companies in the index by a number called the index divisor.

Over The Counter Exchange of India (OTCEI )

- Traditionally, trading in stock exchanges in India followed a conventional style, where people used to gather at the exchange offices and bids and offers were made by open outcry. This old- age trading mechanism in the Indian Stock Markets used to create many functional inefficiencies.

- Lack of liquidity and transparency, long settlement periods and benami transactions are a few examples that adversely affected investors. In order to overcome these inefficiencies, OTCEI was incorporated in 1990, under the Companies Act, 1956. OTCEI is the first screen based Nationwide Stock Exchange in

Commodity Futures Market

- Commodities traded on the commodity futures market during 2009, included a variety of agricultural commodities, bullion,crude oil, energy and metal products. Agricultural commodities, bullion and energy products accounted for a large share of the commodities traded in the commodities future market.

- The Central Government has announced a decision to merge the commodities market regulator, forward markets Commission (FMC), with the capital markets regulator, Securities and Exchange Board of India (SEBI).

Reference Rates – MIBID, MIBOR

-

-

- A reference rate is an accurate measure of the market price. In the fixed income market, it is an interest rate that the market respects and closely watches. It plays a useful role in a variety of

- NSE had developed MIBID (Mumbai Interbank Bid Rate) and MIBOR (Mumbai Interbank Offer Rate) for the overnight market. This was launched sometime in 1998. They are the reference rates. Then, NSE launched the 14 day MIBID/MIBOR and then the one month and the three month MIBOR and MIBID. Thus, all the four categories of MIBOR and MIBID are now available.

- It is the simple average of the quotes by the various participants in the market-banks, PDs, institutions polled on a daily

- LIBOR (London Inter-Bank Offered Rate) It is the average of interest rates provided by leading banks in London that they would be charged if borrowing from other banks. It is used as a global benchmark interest rate by many banks around the world.

-

-

BANKING

- History of Indian banking goes back to 19th It failed. First successful bank in India was Bank of Bengal set-up in 1806. First Commercial Bank in country was Awadh Commercial Bank established in 1881.

- In 1921, Imperial Bank, of limited liability of India was set-up. There were two important steps in the banking sector after independence in 1949. Nationalisation of Reserve Bank of India and the Banking Regulation Act, which empowered RBI to regulate banking sector in

- The Punjab National Bank, established in Lahore in 1895, has survived to the present and is now one of the largest banks in

- The largest bank-imperial Bank of India was nationalized in 1955 and renamed as State Bank of India followed by formation of its 7 associates in 1959.

- The step toward social banking was taken with the nationalization of 14 Commercial Bank on 19thJuly, 1969. Six more Commercial

Banks were nationalized on 15th

August, 1980.

Scheduled Commercial Banks

- All banks which are mentioned in the Second Schedule of RBI Act, 1934 are known as Scheduled Banks.

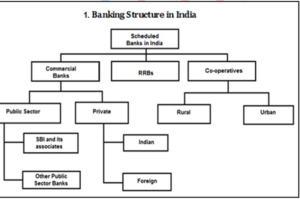

- These banks comprise Scheduled Commercial Banks and Scheduled Cooperative Banks. These banks comprise Scheduled Commercial Banks and Scheduled Cooperative Banks. Scheduled Commercial Banks in India are categorized into five different groups according to their ownership and/or nature of operation.

- These bank groups are

- State Bank of India and its Associates,

- Nationalised Banks,

- Private Sector Banks,

- Foreign Banks and

- Regional Rural

- Apart from basic banking business, banks also undertake other services such as safe custody of valuables, granting

and issuance of letters of credit to facilitate international trade, buying and selling in foreign exchange and collection of bills among others.

- Banks also act as agent of the government and other entities to undertake agency business. Extending loans and advances to the needy sectors of the economy on a priority basis is a very crucial function of the banking sector.

- Banking crisis during 1913-1917 and failure of 588 banks in various parts of the country

during the decade ended 1949 underlined the need for regulating and controlling Commercial Banks. The Banking Companies Act was passed in February, 1949, which was subsequently amended to read as Banking Regulation Act, 1949. This Act provided the legal framework for regulation of the banking system in India.

- Now, the Indian Banks have overseas presence in the form of physical branches, representative offices, joint ventures and subsidiaries.

Regional Rural Banks (RRBs)

- The Regional Rural Banks (RRBs) were established in 1975 to supplement the efforts of cooperative and commercial banks in different states with the equity participation from commercial banks, central government and state governments. RRBs have been sponsored by public sector banks and are akin to commercial banks in their method of operations and set up, but the area of activity and loan operations are restricted to specified areas and target groups. As the RRBs are scheduled commercial banks, they report their major items of liabilities and assets on a fortnightly basis as a part of the Section 42(2) return, which forms the base for compilation of monetary aggregates.

Public Sector Banks

- After 1969 Commercial Banks are broadly classified into Nationalised or Public Sector Banks and Private Sector Banks. The State Bank of India and its five Associate Banks along with

- Nationalised Banks are the Public Sector Banks.

- Nationalised Banks

From 1st February, 1969, the government imposed Social Control on banks by introducing certain provisions in the Banking Regulation Act, 1949. - It imposed severe restriction on the composition of the Board of Directors and internal management and administration of banking companies.

- It also introduced restrictions on advances by banking companies.

- These were intended to ensure that the bank advances were not confined to large scale industries and big business houses, but were also directed, in due proportion to other important sectors like agriculture, small scale industries and exports.

| 1 | Allahabad Bank |

|---|---|

| 2 | Andhra Bank |

| 3 | Bank of Baroda |

| 4 | Bank of India |

| 5 | Bank of Maharashtra |

| 6 | Canara Bank |

| 7 | Central Bank of India |

| 8 | Corporation Bank |

| 9 | Dena Bank |

| 10 | Indian Bank |

| 21 | Bhartiya Mahila Bank |

| 11 | Indian Overseas Bank |

| 12 | Oriental Bank of |

| Commerce | |

| 13 | Punjab and Sind Bank |

| 14 | Punjab National Bank |

| 15 | Syndicate Bank |

| 16 | UCO Bank |

| 17 | Union Bank of India |

| 18 | United Bank of India |

| 19 | Vijaya Bank |

| 20 | IDBI Bank Limited |

On 15th April, 1980, six more

State Bank of India

- State Bank of India (SBI) was previously called Imperial Bank of India in 1921, which was created by amalgamation of 3 Presidency Banks viz., Bank of Bengal, Bank of Bombay and Bank of Madras. It was nationalized in 1955.

- banks having demand and time liabilities of not less than ` 200 crores were nationalized. The undertakings of these banks are taken over and vest in six corresponding new banks under the banking companies (Acquisition and Transfer of Undertakings) Act, 1980.

- Later on, in the year 1993, government merged New Bank of India with Punjab National Bank. It was the only merger between Nationalised Banks and resulted in the reduction of the number of Nationalised Banks from 20 to 19.

- In the group wise classification, since 31th December, 2007 IDBI Bank Limited has been included in Nationalised Banks.

State Bank of India

- State Bank of India (SBI) was previously called Imperial Bank of India in 1921, which was created by amalgamation of 3 Presidency Banks viz., Bank of Bengal, Bank of Bombay and Bank of Madras. It was nationalized in 1955.

State Bank Group

- State Bank of Bikaner and jaipur

- State Bank of Hyderabad

- State Bank of India

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

Bharatiya Mahila Bank

- Former Prime Minister Dr. Manmohan Singh and UPA

Chairperson, Sonia Gandhi jointly inaugurated India’s first all women bank, Bharatiya Mahila Bank in Mumbai on 19th November, 2013, on the birth anniversary of former Prime Minister Indira Gandhi. The main objective of the bank is to focus on the banking needs of women and to promote their economic empowerment. The bank will commence operations with an initial capital of `. 1000 crore. The Union Government on 12th November, 2013 - appointed Usha Anantha Subramanian as the first Chairperson and Managing Director of public sector Bharatiya Mahila Bank (BMB). The BMB is based on the principle of: Women empowerment is India’s empowerment’.

- An only for women bank first time in India and to be fully operated by women.

This is the only and first public sector bank incorporated through an Act of the Parliament. - Branches of BMB become operational-Mumbai, Kolkata, Chennai, Ahmedabad Guwahati, Bengaluru and Lucknow.

Private Banks

- All those banks where creator parts of stake or equity are held by the private shareholders are called as private sector banks. In India, private sector banks are known with two names; old Private sector banks and new private sector banks.

- The banks which were not nationalized at the time of nationalization of banks that took place during 1969 and 1980 are known as the old private sector banks. These were not nationalized, because of their small size and regional focus.

- The banks, which came in operation after 1991, with the introduction of economic reforms and financial sector reforms are known as new private sector banks. Banking Regulation Act was then amended in 1993, which permitted the entry of new

- private sector banks in the Indian banking sector.

Foreign Banks

- Foreign Banks are allowed to operate in India through branches and representative offices. A new Foreign Bank desirous of opening a branch in India is required to apply to Reserve Bank of India giving relevant information about its shareholders, financial position and the dealings with Indian parties.

- The request is examined keeping in view the financial soundness of the bank, international and home country ranking, international presence, economic and trade relations between the two countries and supervisory standards in the home country etc.

- Regional Rural Banks

In 1976, the Parliament enacted the Regional Rural Banks Act, 1976 to provide for the incorporation, regulation and winding up of Regional Rural

Banks. The Act has been made effective from the 26th September, 1975. - The equity of the RRBs is contributed by the Central Government, concerned State Government and the sponsor bank in the proportion of 50:15:35.

- The objective of the RRBs is to develop the rural economy by providing; for the purpose of development of agriculture, trade, commerce, industry and other productive activities in the rural areas, credit and other facilities, particularly to the small and marginal farmers, agricultural labourers, artisans and small entrepreneurs and for matters connected therewith and incidental thereto.

- Besides the Reserve Bank which is the regulatory authority for the RRBs in accordance with the provisions of the Banking Regulations Act, 1949, the Banking Regulations Act empowers NABARD (National Bank for Agriculture and Rural

Development) to undertake the inspection of RRBs.

- A Regional Rural Bank seeking permission of the Reserve Bank for opening branches has to obtain the recommendation of NABARD.

- RRB (Amendment) Bill, 2014 This amendment to raise the authorized capital of the RRBs from Rs. 5 crore to Rs. 2000 crore. The bill also provides that the authorized capital of any RRB shall not be reduced below Rs. 1 crore.

Scheduled Co-operative Banks

- Co-operative Banks have also played a limited, but important role in the banking system of the country. Scheduled Co-operative Banks consist of Scheduled State Co-operative Banks and Scheduled Urban Co-operative Banks.

State Co-operative Banks

- State Co-operative Bank means the Principal co-operative society

in a state, the primary object of which is the financing of other co-operative societies in the state. - The Banking Ombudsman Scheme, 1995 notified by RBI on 14th June, 1995 was in terms of powers conferred on the bank by Section 35A of the Banking Regulation Act, 1949 (10 of 1949) to provide for a system of redressal of grievances against banks.

Urban Co-operative Banks

- UCBs are registered under the Co-operative Societies Acts of the respective State Governments. UCBs having a multi-state presence are registered under the Multi-state Co-operative Societies Act and regulated by the Central Government.

- Besides, the Reserve Bank also has regulatory and supervisory authority for bank related operations under certain provisions of the Banking Regulation Act, 1949 (asapplicable to Co-operative Societies).

Reserve Bank of India (RBI)

- RBI was set-up on the basis of Hilton Young Commission recommendation in April, 1935, with the enactment of RBI Act, 1934.

- RBI continued to serve as the Central Bank to Burma (Myanmar), until Japanese occupation of Myanmar in April, 1947.

- RBI also continued to serve as Central Bank to Pakistan, until June, 1948.

- RBI was nationalized in 1949 and its First Indian Governor was CD Deshmukh.

- Main functions of RBI are

Maintaining monetary stability so that business and economic life can deliver welfare gains of a properly functioning mixed economy. - Maintaining financial stability and ensuring sound financial institutions so that monetary

- policy can be safely pursued and economic units can conduct their business with confidence.

- Maintaining a stable payments system so that financial transaction can be safely and efficiently executed.

- Promoting the development of financial infrastructure in terms of markets and systems and to enable it to operate efficiently. i.e., playing a leading role in developing a sound financial system so that it can discharge its regulatory function efficiently.

- Ensuring that credit allocation by the financial system broadly reflect the national economic priorities and societal concerns.

- Regulating the overall volume of money and credit in the economy with a view to ensuring a reasonable degree of price stability.

- Role of the RBI

- RBI Plays the following roles in the Indian banking and Financial System

Note Issuing Authority - RBI has had the sole authoring to issue currency notes other than one rupee notes/coins and coins of smaller denominations since, its inception. One rupee notes/coins and coins of smaller denomination are issued by the Central Government, but are put into circulation through the RBI.

- RBI can issue notes against the securing of coins/bullion, foreign securities, rupee coins,

Government of India securities as such bills of exchange (promissory notes as are eligible for purchase by it. The Reserve Bank has adopted Minimum Reserve System for the note issue. Since 1957, it maintains gold and foreign exchange reserves of Rs. 200 crore of which atleast Rs. 115 crore should by in gold

| Security Press | Station | Related by |

|---|---|---|

| Currency Notes Press-1928 | Nasik | Bank notes from Rs. 1 to 100 |

| Security Paper (Established 1967-68) | Hoshangabad | Banks and currency notes paper |

| Bank Notes Press (1974) | Dewas | Bank notes of Rs. 20,50,100 and 500 |

| Security Notes Printing Press (Established 1982) | Hyderabad | Union excise duty stamps |

| India Security Press Nasik (1992) | Postal material postal stamps etc |

|

| Modernised Currency Notes Press (1995) | Mysore (Karnataka) Sarbani (West Bengal) | |

| Coins are minted at four places viz, Mumbai, Kolkata, Hyderabad and Noida | ||

- 1 note released after 20 years

- In November 1994, printing of ` 1 note was stopped mainly due to highest cost and for freeing capacity to print currency notes of higher denomination.

- Printing of ` 2 and 5 notes were discontinued in 1995

- Notes of ` 1 to be issued would be legal tender as provided in The Coinage Act 2011.

Banker to the Government

- RBI has the obligation to transact the banking business of the Union and State Governments. In this capacity, it accepts, money on account of these governments makes payments on their behalf and carries out their exchange and remittance operations. It does not get any remuneration for these functions. It also manages public debt of these governments for which it charges a commission.

Banker to Banks

- RBI has a special relationship with the banks. It controls the amount of their reserves (SLR

and CRR) and holds all or part of their reserves. Banks borrow from the RBI in times of need and RBI is in effect the lender of last resort. RBI is the ultimate source of money and credit in India.

Regulator and Supervisor

- In this role, RBI provides the broad parameters within which the banking and financial system of India functions. Its regulatory powers are provided by the RBI Act and the Banking Regulation Act. RBI also regulates many types of Non-Banking Financial Companies (NBFCs).

Some of the regulatory powers of RBI are as follows

- Issuing licenses for new banks.

- Prescribing minimum requirements related to paid- up capital, reserves, etc.

- Inspecting the working of banks with regard to organizational set-up, branch expansion etc.

- Conducting investigations into complaints of fraud

irregularities etc. in respect of banks.

- Approving or forcing amalgamations/reconstruction

/liquidation of banks.

- Controlling appointments/termination of chairman and chief executive officers of private sector

Custodian of Foreign Reserves

- As the custodian of foreign reserves, RBI is responsible for managing the investment and utilization of the country’s foreign reserves in the best possible manner. With the introduction of floating exchange rate system and convertibility of the rupee, RBI also has to act to stabilize the foreign exchange market.

- RBI’s function in this role is to develop and regulate the foreign exchange market and to facilitate external trade and

Credit Control

- Credit control is an important tool used by RBI, a major weapon of the monetary policy used to control the demand and supply ofmoney (liquidity) in the economy. Central Bank administers control over the credit that the Commercial Banks grant. Such a method is used by RBI to bring economic development with stability.

Need for Credit Control

- To encourage the overall growth of the priority

- To keep a check over the channelization of

- To achieve the objective of controlling inflation as well as deflation.

- To boost the economy by facilitating the flow of adequate volume of bank credit to different sectors.

- Stability in exchange rate and money market of the

Methods of Credit Control

- There are two types of methods of credit control

Quantitative/Credit Control

- Quantitative credit control is used to control the volume of credit and indirectly to control theinflationary and deflationary pressures caused by expansion and contraction of credit.

- The quantitative credit control consists of

- Bank Rate It is also called the rediscount rate. It is the rate, at which the RBI allows finance to commercial banks. It is currently at 9%.

- Cash Reserve Requirement (CRR) Since, 1962, the RBI has been empowered to vary the CRR requirement between 3% and 15% of the total demand and time deposits. The RBI (Amendment) Bill, 2006, empowers RBI to prescribe CRR cash that banks deposit with the RBI without any floor rate or ceiling

- Statutory Liquidity Ratio (SLR) It is the ratio of liquid asset, which all commercial banks have to keep in the form of cash, gold and unencumbered approved securities equal to not more than 40% of their total demand and time deposits

- Open Market Operations(OMOs) It role as a credit control instrument emerged after economic reforms of 1991, when Indian economy was flushed with excessive inflow of foreign funds. Under OMOs, when the RBI sells G-secs in the market. It withdraws money/liquidity from the market and thus, reduces volume of credit leading to control of

- Repo Rate It was introduced in December, 1992, by RBI. It is the rate, at which RBI lends short-term money to the banks against securities. When the repo rate increases (Dearer Money Policy) borrowing from the RBI becomes more expansive and when the repo rate decreases, (Cheaper Money Policy) borrowing becomes cheaper. Repo rate injects liquidity in the

- Reverse Repo Rate It was introduced in November, 1996. It is the rate, at which banks park short-term excess liquidity with the RBI. Anincrease in the reverse repo rate means that the RBI is ready to borrow money from the banks at higher rate of interest. As a result, banks would prefer to keep more and more surplus funds with the RBI. Reverse repo rate withdraws liquidity from the market.

- Other banking operation activities are Marginal Standing Facility Rate (MSFR), Net Demand and Time Liabilities

- Repo rate and reverse repo rate are the parts of Liquidity Adjustment Facility (LAF) of RBI.

- LAF allows the RBI to manage market liquiding on a daily basis and to send interest rate signals to the

- LAF operates through repo and reverse repo auctions. It has now becomes the principal operating instrument of monetary

Qualitative Credit Control

- Qualitative credit control is used by RBI for the selective purposes, some of which are

- Margin Requirements This refers to difference between the securities offered and amount borrowed by the banks.

- Consumer Credit Regulations This refers to issuing rules regarding down payments and maximum maturities of installment credit for purchase of

- RBI Guidelines RBI issues oral/written statements, appeals, guidelines, warnings etc to the

- Rationing of Credit The RBI controls the credit

granted/allocated by commercial banks.

- Moral Suasion An application of pressure, but not force to get members to adhere to a policy RBI gives advices and suggestions to the bankers to follow the instructions given by

- The quantitative credit control consists of

4.6.1 Banking Sector Reforms Narsimham Committee Recommendation

- Deregulation of interest

- Reduction in reserve

- Prudential

- Supervision of Commercial Banks.

- Measures to improve the competitive efficiency in banking sector.

Narasimham-I

- The purpose of the Narasimham- I Committee was to study all aspects relating to the structure, organization, functions and procedures of the financial systems and to recommend improvements in their efficiency and productivity. The committee submitted its report to the Finance Minister in November, 1991.

Narasimham-II

- The Narasimham-II Committee was tasked with the progress review of the implementation of the banking reforms since, 1992

with the aim of further strengthening the financial institutions of India. It focused on issues like size of banks and capital adequacy ratio among other things. M. Narasimham, Chairman, submitted the report of the committee in April, 1998.

Damodaran Committee

- The committee, headed by former SEBI Chairman M Damodaran, was-set up by the Central Bank to look into the issues of customer services and evaluate the existing system of grievance redressal mechanism prevalent in banks, its structure and efficacy and recommend measures for expeditious resolution of

Recommendations

- Bank should offer no-frill savings accounts with certain basic facilities such as cheque book and ATM card without prescribing any minimum balance.

- All fixed deposit receipts should prominently indicate the

- annualized interest rate to help customers take more informed decisions. The Indian Banks Association should standardize the account opening form for all banks, similar to the one used for loans. Title deeds of property should be returned to customers within 15 days of the full settlement of home loans.

Swabhiman (Campaign)

- A major financial inclusion initiative was formally launched as

remittances using the services of Business Correspondents. - The initiative enables government subsidies and social security benefits to be directly credited to the accounts of the beneficiaries, enabling them to draw the money from the business correspondents

their village itself.

Khandelwal Committee Report

- Government constituted a Committee on Human Resources issues of Public Sector Banks (PSBs) under the Chairmanship of Dr. AK Khandelwal, who has submitted its report.

- The committee made 105 recommendations on matters related to Manpower and Recruitment Planning, Training, Career Planning, Performance Management,Reward Management, Succession Planning and Leadership Development,Motivation Perfessionalisation of HR, Wages, Service Conditions and Welfare etc.

- As 49 recommendations required further deliberations, the remaining 56 recommendations were forwarded to PSBs with the request that an HR Plan for each bank be prepared and got approved by the respective Board of Directors.

Basel Norms

- It was in 1988 that the central banking bodies of the developed

- economies agreed upon the provision of Capital Adequacy Ratio (CAR), also known as the Basel Accord. The accord was agreed upon at Basel, Switzerland, at a meeting of the Bank of International Settlements (BIS). This accord provides recommendations on banking, regulations with regard to capital risk, market risk and operational risk. It’s objective was to ensure that financial institutions have enough capital to meet obligations and absorb unexpected losses.

Basel I

- The Basel Committee on Bank Supervision (BCBS) published a set of minimal capital requirements for banks, to maintain a certain amount of free capital (ratio) to their assets, as a cushion against probabe losses in investment and loans. Basel-I primarily, focus on credit risk. In 1988, this ratio capital was decided to be 8%. The CAR is the percentage of the total capital to the total weighted assets.

- CAR = (Total of Tier-I and Tier-II capital) / Risk weighted assets.

- Thus, CAR is also known as Capital to Risk-Weighted Assets

- Ratio (CRAR). It is used to protect the depositors and promote the stability and efficiency of the financial system.

- Assets of the banks are classified and grouped into 5 categories according to credit risk-0, 10, 20, 50 and 100%. Some critics have criticized the Bass I accord as the norm treated all borrowers alike, no weight age was given to a variability of security for a credit facility and it treated loans of varying maturity in the same manner.

Basel II

- It attempts to integrate Basel I capital standards with national regulations, by setting the minimum capital requirement of financial institutions with the goal of ensuring institution liquidity. It aims at securing international convergence on regulations governing the CAR.

- Minimum capital requirements.

- Supervisory review – Market discipline

- The supervisory review process on the banks internal process and

system, while the market discipline focuses on market disclosures being made by the banks. These two pillars reinforce the pillars of minimum capital requirement. - CAR is held in the form of shareholders equity and certain other defined classes of capital.

Banking Ombudsman

- Banking Ombudsman Scheme was introduced by the RBI in 1995 under the Banking Regulation Act, 1949. It is a senior official appointed by the RBI to redress customer complaints against deficiency in certain banking services.

- Decision of Banking Ombudsman can be appealed against to the appellate authority (vested in a Deputy Governor of RBI).

- Banking ombudsman can award compensation to the complainant. In this, it takes into account the loss of the complainant’s time, expenses incurred and the harassment and mental anguish suffered.

- It has jurisdiction over all commercial banks, RRBs, Scheduled primary co-operative banks, NBFCs etc. It deals with

matters less than or equal to

` 10 lakhs.

Development Financial Institutions

- Financial institutions are an important part of the Indian financial system as they provide medium to long-term finance to different sectors of the economy.

- The institutions have been set-up meet the growing demands of particular segments, such as export, rural housing and small industries.

- These institutions have been playing a crucial role in channelizing credit to the needy sectors and addressing the challenges/issues faced by them.

- The four financial institutions – Exim Bank, National Bank for Agriculture and Rural Development (NABARD), National Housing Bank (NHB) and Small Industries Development Bank of India (SIDBI) are under full- fledged regulation and supervision of the Reserve Bank.

- As in the case of commercial banks, prudential norms relating to income recognition, asset

classification and provisioning and capital adequacy ratio are applicable to these financial institutions as well. These institutions also are subject to on- site inspection as well as off-site surveillance. - Since, all the banks are directly or indirectly contributing to the development works in the country, thus, all are development financial institutions.

Development Financial Institutions of the Capital Market –

National Level Development Banks

| Institution | Year of Establishment | Main Functions |

|---|---|---|

| Industrial Development Bank of India | 1964 | Apex institution in field of industrial development Provides term finance, development services Refinance to eligible banks |

| Industrial Finance Corporation of India (IFCI) | 1948 | 50% subsidiary of IDBI and 50% held by banks and insurance limited companies Assistance in the form of loans Conduct techno economic surveys and technical consultancy etc., |

| Industrial Credit and Investment Corporation of India (ICICI) | 1955 | Private sector development bank Share capital even from World Bank Development of underwriting facilities Provision of foreign currency loans |

| Small industries Development bank of India (SIDBI) | 1990 | Wholly owned subsidiary of IDBI Promotion, financing and development of small scale industries |

| Industrial Investment bank of India (Industrial Reconstruction Corporation of India IRCI) | 1971 | To help sick units for speedy reconstruction and rehabilitation Undertake management of sick units and develop infrastructure for them |

| Industrial Reconstruction Bank of India (IRBI) | 1985 | IRBI was established in 1985 to take over IRCI |

National Housing Bank (NHB)

- National Housing Bank was set- up on 9th, July, 1988 under the National Housing Bank Act, 1987 as a wholly-owned subsidiary of the Reserve Bank to act as an apex level institution for housing.

- NHB has been established to achieve, among other things, the following objectives.

- To provide a sound, healthy, viable and cost effective housing finance system to all segments of the population and to integrate the housing finance system with the overall financial system.

- To promote a network of dedicated housing finance institutions to adequately serve various regions and different income groups.

- To Augment resources for the sector and channelize them for housing.

- To make housing credit more affordable.

- To regulate the activities of housing finance companies based on regulatory and

supervisory authority derived under the Act. - To encourage augmentation of supply of buildable land and also building materials for housing and to upgrade the housing stock in the country.

- To encourage public agencies to emerge as facilitators and suppliers of serviced land for housing.

National Bank for Agriculture and Rural Development (NABARD)

- National Bank of Agriculture and Rural Development (NABARD) is one of the subsidiaries where the majority stake is held by the Reserve Bank. NABARD is an Apex Development Bank with a mandate for facilitating credit flow for promotion and development of agriculture, small scale industries, cottage and village industries, handicrafts and other rural crafts. It also has the mandate to support all other allied economic activities in rural areas, promote integrated and sustainable rural development

and secure prosperity of rural areas.

Industrial Finance Corporation of India Limited (IFCI)

- It was the first development finance institution set-up in 1948 under the IFCI Act in order to provide long-term institutional credit to medium and large industries. It aims to provide financial assistance to industry by way of rupee and foreign currency loans.

- Underwrites/subscribes the issue of stocks, share, bonds and debentures of industrial concern, etc.

- It has also diversified its activities in the field of merchant banking, syndication of loans, formulation of rehabilitation programmes, assignments relating to amalgamations and mergers, etc.

Industrial Development Bank of India (IDBI)

- It was established in July, 1964, as an apex financial institution for industrial development in the country. It caters to the diversified needs of medium and large scale industries in the form

of financial assistance, both direct and indirect. Direct assistance is provided by way of project loans, underwriting of and direct subscription to industrial securities, soft loans, technical refund loans, etc. While, indirect assistance is in the form of refinance facilities to industrial concerns.

Small Industries Development Bank of India (SIDBI)

- It was set-up by the Government of India in April, 1990, as a wholly owned subsidiary of IDBI. It is the principal financial institution for promotion, financing and development of small scale industries in the economy aims to empower the Micro, Small and Medium Enterprises (MSME) sector with a view to contributing to the process of economic growth, employment generation and balanced regional development.

Industrial Investment Bank of India Limited (IIBI)

- It was set-up in 1985 under the Industrial Reconstruction Bank of India Act, 1984, as the principalcredit and reconstruction agency for sick industrial units. It was converted into IIBI on 17th March, 1997, as a full-fledged development financial institution. It assists industry mainly in medium and large sector through wide ranging products and services. Besides project finance, IIBI also provides short duration non-project asset-backed financing in the form of underwriting/direct subscription, deferred payment guarantees and working capital/other short-term loans to companies to meet their fund requirements.

Industrial Credit and Investment Corporation of India (ICICI)

- ICICI is a financial institution set-up in 1955 as a result of international co-operative effort to foster private investment in India. It was sponsored by a mission from the World Bank for the purpose of developing small and medium industries in the private sector. It was registered in January, 1955, under the Indian Companies Act. It provides risk and loan capital for creation, expansion and

modernization of productive facilities, encourages others to invest and thereby promotes the widespread distribution of industrial securities and furnishes managerial, technical and administrative advice to Indian industry. - In all the development financial institutions set-up by the Indian Government after Independence, ICICI registered the most spectacular success. In fact, the financial assistance sanctioned and disbursed by ICICI rose tremendously during the 1990’s and had exceeded the assistance extended by IDBI which was the apex institution in the field of development finance.

- In March 2002, the ICICI merged with the ICICI Bank and there was a creation of Universal Bank in India. With this ICICI as a development financial institution does not exist anymore.

- It was established in 1956 as a wholly-owned corporation of the Government of India. It was formed by the Life Insurance Corporation Act, 1956, with the objective of spreading life insurance much more

Export-Import (EXIM) Bank

- Recognising the important role of exports in maintaining the viability of external sector and in generating employment, the Reserve Bank had sought to ensure adequate availability of Concessional Bank credit to exporters. It took the lead role in setting up the Export Import Bank of India (EXIM Bank) in January, 1982.

- In recent years, with the liberalisation of real and financial sectors of the economy, interest rates on export credit have been rationalised within the overall monetary and credit policy framework.

- In order to provide adequate credit to exporters on a priority basis, the Reserve Bank has also prescribed a minimum proportion of bank’s adjusted net bank credit to be lent to exporters by Foreign Banks

widely and in particular to the rural area. - Commercial paper is one of the instrument through which corporate raise debts from the financial markets.

- Micro finance is a provision of financial services to the people of low income groups.

Banks Board Bureau

- The government to be set-up an autonomous banks board bureau within month of August 2015, a super authority for public sector unit lenders to recommend board level appointments and advise on strategies for raising

funds as well as mergers and acquisitions. - BBB is likely to be a six-member board comprising former CMDs of banks and financial services sector experts. It will be headed by Secretary, Department of Financial Services. There are 22 state-owned banks in India including SBI, IDBI Bank and Bharitya Mahila Bank.

- BBB will search and select heads of public sector banks and help them develop differentiated strategies of capital raising plans to innovative financial methods and instruments.

- It would also be responsible for selection of non-executive chairman and non-official directors on the boards. The government decided to permit public sector banks to raise up to

- ` 1600000 crore (`1600 billion) from capital markets by diluting government holding to 52% in phases so as to meet Basel III capital adequacy norms. Public sector banks alone required

- ` 2.40 lakh crore (` 2.40 trillion) by 2018 to meet global Basel III norms.

Non-Banking Financial Companies (NBFCs)

- NBFCs are essentially banks, since they perform the basic twin functions of attracting deposit from the public and making loans. However, unlike commercial banks, they are not incorporated as a bank and are not governed by the provision of the Banking Regulation Act, 1949.

- With the Enactment of RBI (Amendment) Act, 1997, the

RBI now control the functioning of NBFCs. - NBFCs as a whole account for 11.2% of assets of the total financial system.

- Two broad categories of NBFCs are

- (i) Deposit taking NBFCs (NBFCs – ND).

- (ii) Non-deposit taking NBFCs (NBFCs-ND).

- Capital to Risk-weighted Assets Ratio (CRAR) norms were made applicable to NBFCs-D in 1998. The CRAR norm for NBFC-D is 12% (15% in case of unrated NBFCs-D).

- NBFCs-ND-SI are non-deposit taking systemically important NBFCs as they have asset size of `100 crore and above.

- Mutual funds are the most important among the newer capital market institutions. MFs function is to 9 mobilise the savings of the general public and invest them in stock market securities.

NBFCs

- NBFCs are classified into the following categories based on their principal business: Equipment leasing Company (ELC), Hire purchase Financing Company (HPFC), Loan Company (LC), Investment Company (IC), Mutual Benefit Financial Company (Nidhi), Mutual Benefit Company (Un-notified Nidhi), Miscellaneous Non-Banking Company (Chit Fund Company), Residuary Non-Banking Company (RNBC) and Housing Finance Company (HFC). In the present regulatory framework, the entire gamut of regulation and supervision of the activities of the NBFCs has been redefined, in terms of both the thrust as well as the focus.

- Consequently, the NBFCs are classified into three categories for the purposes of regulation, namely, namely:

- 1. those accepting public deposits (non-demand),

- 2. those which do not accept public deposits and

- 3. core investment companies which hold at least 90 percent of their assets as investments in the securities of their group, holding or subsidiary companies and are not trading in such securities.

- The companies which accept public deposits are required to comply with all the prudential norms of income recognition, asset classification, accounting standards, provisioning for bad and doubtful debts, capital adequacy and credit or investment concentration norms, etc. The NBFCs not accepting public deposits are regulated in a limited manner. Prudential norms like income recognition, asset classification, uniform accounting year and accounting standards that disclose the status of their financial health have been made applicable to them. The core investment companies have been exempted from all the provisions of directions.

Insurance regulatory and Development Authority of India (IRDAI)

- The Insurance Regulatory and Development Authority of India was established in the year 1999 by the government of India.

- The reason for the establishment was to safeguard the interest of the policy holders and for the upgradation of the entire insurance sector.

- The Insurance Regulatory and Development Authority of India has been authorized to register the new insurance companies in India.

Insurance Companies

- Insurance industry includes two sectors; Life Insurance and General Insurance. Life Insurance in India was Introduced by Britishers. A British firm in 1818 established the Oriental Life Insurance Company at Calcutta now Kolkata.

- Since, the opening up, the number of participants in the insurance industry has gone up from 7 insurers (including LIC, four public sector general insurers, one specialized insurer and the GIC as the national re-insurer) in 2000 to 49 insurers as on 30th, September, 2011.

- Insurance Companies in India the insurance companies offer protection against losses. They deal in life insurance, marine insurance, vehicle insurance and so on.

- The insurance companies collect the little savings of the investors and then reinvest those savings in the market. The indigenous insurance companies are collaborating with different foreign insurance companies after the liberalization process. This step has been incorporated to expand the Indian insurance market and make it competitive

UPSC Previous Year Questions:

- There has been a persistent deficit budget year after year. Which of the following actions can be taken by the government to reduce the deficit? (CSE 2015)

- Reducing revenue expenditure

- Introducing new welfare schemes

- Rationalizing subsidies

- Expending industries

1.Select the correct answer using the code given below.

- a) 1 and 3 only

- b) 2 and 3 only

- c) 1 only

- d) 1, 2, 3 and 4

2. With reference to Indian economy, consider the following: (CSE 2015)

- 1. Bank rate

- 2. open market operations

- 3. Public debt

- 4. Public revenue

Which of the above is/are component/components of Monetary Policy?

- a) 1 only

- b) 2, 3 and 4

- c) 1 and 2

- d) 1, 3 and 4

3. When the Reserve Bank of India reduces the Statutory Liquidity Ratio by 50 basis points, Which of

the following is likely to happen? (CSE 2015)

- a) India’s GDP growth rate

increases drastically - b) Foreign Institutional Investors may bring more capital into our country

- c) Scheduled Commercial Banks may cut their lending rates

- d) It may drastically reduce the liquidity to the banking system

4. ‘Pradhan Mantri Jan-Dhan Yojana’

has been launched for (CSE 2015)

- a) Providing housing loan to poor people at cheaper interest rates

- b) Promoting women’s Self-Help Groups I backward areas

- c) Promoting financial inclusion in the country

- d) Providing financial help to the marginalized communities

5. If the interest rate is decreased in an economy, it will (CSE 2014)

- a) decrease the consumption expenditure in the economy

- b) increase the tax collection of the Government

- c) increase the investment expenditure in the economy

- d) increase the total savings in the economy

6. Which of the following are with

‘Planning’ in India? (CSE 2014)

- 1. The Finance Commission

- 2. The National Development Council

- 3. The Union Ministry of Rural Development

- 4. The Union Ministry of Urban Development

- 5. The Parliament

Select the correct answer using the codes given below:

- a) 1, 2 and 5 only

- b) 1, 3 and 4 only

- c) 2 and 5 only

- d) 1, 2, 3, 4 and 5

7. What does venture capital mean? (CSE 2014)

- a) A short-term capital provided to industries

- b) A long-term start-up capital provided to new entrepreneurs

- c) Funds provided to industries at times of incurring losses

- d) Founds provided for replacement and renovation of industries

8. The terms ‘Marginal Standing Facility Rate’ and ‘Net Demand and Time Liabilities’, sometimes appearing in news, are used in relation to (CSE 2014)

-

- a) banking operations

- b) communication networking

c) military strategies

d) supply and demand of agricultural products

9. What is/are the facility/ facilities the beneficiaries can get from the services of Business Correspondent (Bank Saathi) in branchless areas? (CSE 2014)

- 1. It enables the beneficiaries to draw their subsidies and social security benefiters’ in their villages.

- 2. It enables the beneficiaries in the rural areas to make deposits and withdrawals.

Select the correct answer using the code given below:

- a) 1 only

- b) 2 only

- c) Both 1 and 2

- d) Neither 1 nor 2

10. In the context of Indian economy, which of the following is/are the purpose/purposes of ‘Statutory Reserve Requirements’? (CSE 2014)

- 1. To enable the Central Bank to control the amount of advances the banks can create

- 2. To make the people’s deposits

with banks safe and liquid - 3. To prevent the commercial banks from making excessive profits

- 4. To force the banks to have sufficient vault cash to meet their day-to-day requirements

Select the correct answer using the code given below:

- a) 1 only

- b) 1 and 2 only

- c) 2 and 3 only

- d) 1, 2, 3 and 4

11. Priority Sector Lending by banks in India constitutes the lending to : (CSE 2013)

- a) Agriculture:

- b) Micro And Small Enterprises

- c) Weaker Sections

- d) All of the above

12. A rise in general level of prices may be caused by : (CSE 2013)

- 1. An increase in the money supply

- 2. A decrease in the aggregate level of output

- 3. An increase in the effective demand

Select the correct answer using the codes given below:

- a) 1 only

- b) 1 and 2 only

- c) 2 and 3 only

- d) 1, 2 and 3

13. The Reserve bank of India regulates the commercial banks in matters of : (CSE 2013)

- 1. Liquidity of assets

- 2. Branch expansion

- 3. Merger of banks

- 4. Winding-up of banks

Select the correct answer using the codes given below.

- a) 1 and 4 only

- b) 2, 3 and 4 only

- c) 1, 2 and 3 only

- d) 1, 2, 3 and 4

14. An increase in the bank rate generally indicates that the?

(CSE 2013)

- a) Market rate of interest is likely to fall

- b) Central bank is no longer making loans to commercial banks

- c) Central bank is following an easy money policy

- d) Central bank is following a tight money policy

15. Which of the following grants/ grant direct credit assistance to rural households? (CSE 2013)

- 1. Regional rural banks

- 2. National bank for agriculture and rural development

- 3. Land development Banks Select the correct answer using the codes given below.

- a) 1 and 2 only

- b) 2 only

- c) 1 and 3 only

- d) 1, 2 and 3

16. Consider the following liquid assets : (CSE 2013)

- 1. Demand deposits with the banks

- 2. Time deposits with the banks

- 3. Savings deposits with the banks

- 4. Currency

The correct sequence of these assets in the decreasing order of liquidity is

- a) 1-4-3-2

- b) 4-3-2-1

- c) 2-3-1-4

- d) 4-1-3-2

17. In the context of Indian economy, ‘open market operations’ refers to? (CSE 2013)

- a) Borrowing by scheduled banks from the RBI

- b) Lending by commercial banks to industry and trade

- c) Purchase and sale of government securities by the RBI

- d) None of the above

18. Supply of money remaining the same when there is an increase in demand for money, there will be: (CSE 2013)

- a) A fall in the level of prices

- b) An increase in the rate of interest

- c) A decrease in the rate of interest

- d) An increase in the level of income and employment

19. Which of the following can be said to be essentially the parts of ‘Inclusive Governance’? (CSE 2012)

- 1. Permitting the Non-Banking Financial Companies to do banking

- 2. Establishing effective District Planning Committees in all the districts

- 3. Increasing the government spending on public health

- 4. Strengthening the Mid-day Meal Scheme

Select the correct answer using the codes given below:

- a) 1 and 2 only

- b) 3 and 4 only

- c) 2, 3 and 4 only

- d) 1, 2, 3 and 4

20. The Reserve Bank of India (RBI) acts as a bankers’ bank. This would imply which of the following? (CSE 2012)

- 1. Other bank retains their deposits with the RBI.

- 2. The RBI lends funds to the commercial banks in times of need.

- 3. The RBI advises the commercial banks on monetary matters.

Correct

- a) 2 and 3 only

- b) 1 and 2 only

- c) 1 and 3 only

- d) 1, 2 and 3

21. The basic aim of Lead Bank Scheme is that (CSE 2012)

- a) big banks should try to open offices in each district

- b) there should be stiff competition among the various nationalized banks

- c) individual banks should adopt particular districts for intensive development

- d) all the banks should make intensive efforts to mobilize deposits.

22. Why is the offering of ‘teaser loans’ by commercial banks a cause of economic concern? (CSE 2011)

- 1. The ‘teaser loans’ are considered to be an aspect of sub-prime lending and banks may be exposed to the risk of defaulters in future.

- 2. In India, the ‘teaser loans’ are

mostly given to inexperienced

entrepreneurs to set up manufacturing or export units.

Which of the statements given above is/are correct?

- a) 1 only

- b) 2 only

- c) Both 1 and 2

- d) neither 1 nor 2

23. In India, which of the following have the highest share in the disbursement of credit to agriculture and allied activities? (CSE 2011)

- a) Commercial Banks

- b) Cooperative Banks

- c) Regional Rural Banks

- d) Micro-finance Institutions

24. The lowering of Bank Rate by the Reserve Bank of India leads to(CSE 2011)

- a) more liquidity in the market

- b) less liquidity in the market

- c) no change in the liquidity in the market

- d) mobilization of more deposits by Commercial Banks

25. Which of the following terms indicates a mechanism used by commercial banks for providing credit to the government? (CSE 2010)

- a) Cash Credit Ratio

- b) Debt Service Obligation

- c) Liquidity Adjustment Facility

- d) Statutory Liquidity Ratio

26. With the reference of the Non Banking Financial Companies (NBFCs) in India Consider the following statements: (CSE 2010)

- 1. They cannot engage in the acquisition of Securities issued by the government.

2. They cannot accept demand deposit like Saving Account.

Which of the statements given above is /are correct?

- a) 1 only

- b) 2 only

- c) Both 1 and 2

- d) Neither 1 nor 2

27. In the parlance of financial investments, the term ‘bear’ denotes: (CSE 2010)

- a) An investor who feels that the price of a particular security is going to fall.

- b) An investor who expects the price of particular share to rise.

- c) A shareholders or a bondholder who has an interest in a company.

- d) Any lender whether by making a loan or buying a bond.

28. In India, the interest rate on savings account in all the nationalized commercial banks is fixed by (CSE 2010)

- a) Union Ministry of Finance

- b) Union Finance Commission

- c) Indian Banks’ Association

- d) None of the above.

29. With reference to the institution of Banking Ombudsman in India, which one of the statements is not correct? (CSE 2010)

- a) The Banking Ombudsman is appointed by the Reserve Bank of India.