RBI CUTS RATES, ALLOWS LOAN MORATORIUM

28, Mar 2020

Prelims level : Banking

Mains level : GS-III Indian Economy and Issues Relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Why in News?

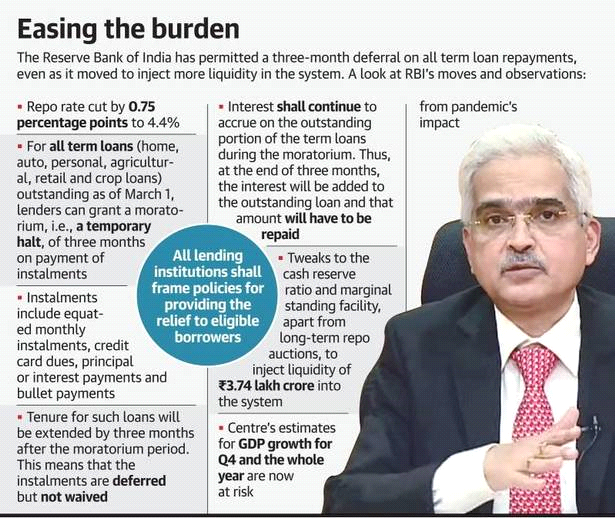

- To ease impact of lockdown, RBI reduced the repo and reverse repo rates and the EMIs deferred for three months.

About the News:

- The Reserve Bank of India (RBI) has opened up the liquidity floodgates for banks even as it reduced the key interest rate sharply by 75 bps and allowed equated monthly instalments (EMIs) to be deferred by three months in a move to fight the economic impact of the countrywide lockdown to check the spread of novel coronavirus.

- The repo rate was reduced to by 75 bps 4.4% while the reverse repo rate was cut by 90 bps point to 4%.

- The higher reduction in the reverse repo rate was aimed at prompting banks to lend more rather than keeping their excess liquidity with the RBI.

- Apart from cutting the repo rate, RBI has also reduced the cash reserve ratio of banks which released ₹37 lakh crore liquidity. This, along with other measures, will see an infusion of ₹3.74 lakh crore into the banking system.

- RBI has also allowed banks to defer payment of EMIs on home, car, personal loans as well as credit card dues for three months. Since non-payment will not lead to non-performing asset classification by banks, there will be no impact on credit score of the borrowers.

- The following decisions were taken after the meeting of the Monetary Policy Committee headed by the RBI Governor.

What is Monetary Policy Committee?

- Strong recommendations to set monetary policy committee in India had come from Urjit Patel panel report.

- Monetary Policy Committee is an executive body of 6 members. Of these, three members are from RBI while three other members are nominated by the Central Government.

- Each member has one vote. In case of a tie, the RBI governor has casting vote to break the tie. MPC is required to meet for two days before deciding on rates. Further, it is needed to meet at least four times a year and make public its decisions following each meeting.

- The core mandate of MPC is to fix the benchmark policy interest rate {Repo Rate} to contain inflation within the target level.

- In that context, RBI is mandated to furnish necessary information to the MPC to facilitate its decision. Government also, if wishes to convey its views, can do so in writing to MPC.

Different Terminologies in Banking Sector:

- Loan moratorium period refers to a particular period of a loan tenure during which the borrower does not have repay anything. It can be described as a waiting period before the borrower will have to start paying the equated monthly instalments (EMIs) for his or her loan. It doesn’t mean that he is completely waived off his loans.

- REPO rate (now 4.4%) denotes Re Purchase Option – the rate by which RBI gives loans to other banks. In other words, it is the rate at which banks buy back the securities they keep with the RBI at a later period.

- Bank gives loan to the public at a higher rate, often 1% higher than REPO rate, at a rate known as Bank Rate.

- RBI at times borrows from banks at a rate lower than REPO rate, and that rate is known as Reverse REPO rate (now 4%).

- CRR or Cash Reserve Ratio corresponds to the percentage of cash each bank have to keep as cash reserve with RBI (in their current accounts) corresponding to the deposits they have. For example, say if State Bank of India (SBI) got a total deposit of Rs. 1 crore with them, they need to keep 4 % of that as cash reserve with RBI (around 4 lakh rupees).

- The banks and other financial institutions in India have to keep a fraction of their total net time and demand liabilities in the form of liquid assets such as G-secs, precious metals, approved securities etc. The Ratio of these liquid assets to the total demand and time liabilities is called Statutory Liquidity Ratio(18.25%).