RBI Reserves Ratio Among the Highest

01, Jan 2019

Prelims level : Economy

Mains level : Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

In News:

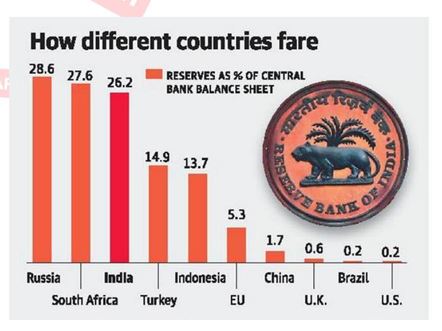

- Analysis of the balance sheets of the central banks of 10 comparable economies shows that the RBI’s reserves as a percentage of its balance sheet is among the highest, a report by consultancy firm found.

Explained:

- The analysis, which looked at the central banks of the BRICS countries, Fragile Five nations and three developed economies, found that the RBI’s reserves which a separate analysis show was about Rs. 10.5 lakh crore form 26.2% its balance sheet. Only two central banks those of South Africa and Russia have a reserve ratio higher than the RBI

- The other two BRICS nations, China and Brazil, have reserve ratios of 1.7% and 0.2%, respectively. But the bulk of those reserves are arising out of the revaluation of its assets, i.e over the years as the rupee depreciated against the U.S. dollar, Great Britain Pound, euro etc, gold and foreign assets held by the RBI when translated into the current rupee value, leads to an increase in its asset value.”

Why does a Central Bank need Capital?

There are five main reasons for a central bank to hold capital.

- First, central banks that have foreign assets need capital to absorb potential losses. The RBI’s foreign assets are worth Rs 26.4 lakh crore, up from 23.7 lakh crore in FY17.

- Second, the RBI needs capital to shield the economy from monetary and financial shocks.

- Third, in case of unstable governments, monetary authorities carry a bigger burden. A Central bank would need more capital in such a situation.

- Fourth, a central bank needs reserves to perform functions such as price and exchange stability.

- Fifth, reserves give independence to a central bank. Low capital will force central bank to turn to government in time of need. This will give government influence over the central bank.