SHADOW BANKING SYSTEM

18, Jun 2019

Prelims level : Economy

Mains level : GS-III: Economic Development

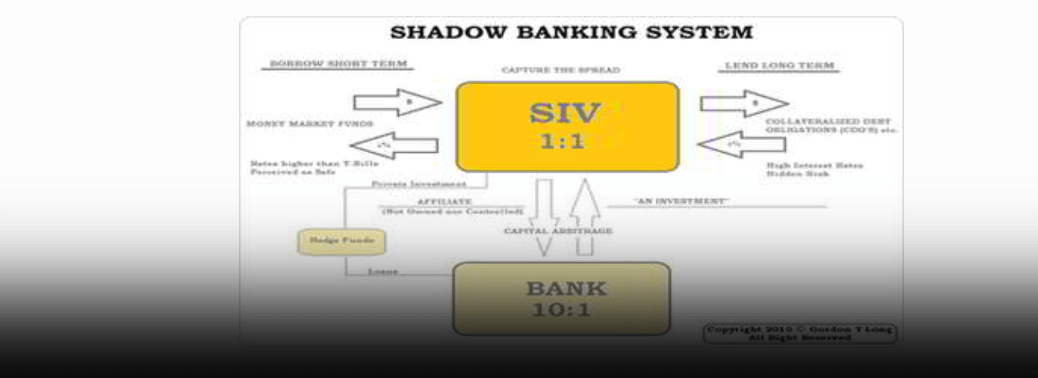

- A shadow banking system is the group of financial intermediaries facilitating the creation of credit across the global financial system but whose members are not subject to regulatory oversight. The shadow banking system also refers to unregulated activities by regulated institutions. The shadow banking system consists of lenders, brokers, and other credit intermediaries who fall outside the realm of traditional regulated banking. These include investment banks, mortgage lenders, money market funds, insurance companies, hedge funds, private equity funds and payday lenders, all of which are a significant and growing source of credit in the economy.

- One of the leading factors that caused the financial crisis of 2007 was the risk taking and failure of shadow banks in the advanced countries.

- In India, the NBFCs are sometimes categorized as the shadow banking sector, though they are well regulated now. In the context of the developing countries, the shadow banking sector plays an important role in promoting financial inclusion. They are very customer friendly, market oriented, innovative and flexible.

- The main advantages of shadow banks lie in their ability to reduce transaction costs, their quick decision-making ability, and customer orientation and prompt delivery of services.

- New Directive under IT Act, 1961. Issued by Central Board of Direct Taxes, under“Compounding of Offences Under Direct Tax Laws, 2019”.

- A person cannot get any sort of relief in an Income Tax evasion offence, if he/she indulges in serious criminal cases of money laundering, terror financing, corruption, possession of benami properties and undisclosed foreign assets.