“TREND AND PROGRESS OF BANKING IN INDIA 2018-19”

27, Dec 2019

Why in News?

- The RBI has recently released “Trend and Progress of Banking in India 2018-19“. This Report presents the performance of the banking sector during 2018-19 and 2019-20 so far.

- Before dwelling into the report, let us have a brief look into the key terminologies used in the report for better understanding.

Basic Terminologies:

1.Non-Performing assets (NPA):

- The assets of the banks which don’t perform (that is – don’t bring any return) are called Non Performing Assets (NPA) or bad loans.

- According to RBI, terms loans on which interest or instalment of principal remain overdue for a period of more than 90 days from the end of a particular quarter is called a Non-performing Asset.

Depending upon the due period, the NPAs are categorized as under:

- Sub-Standard Assets: > 90 days and less than 1 year

- Doubtful Assets: greater than 1 year

- Lost Assets: loss has been identified by the bank or RBI but the amount has not been written off wholly.

2.Gross and Net NPA: Gross NPA refers to the total NPAs of the banks. The Net NPA is calculated as Gross NPA -Provisioning Amount.

3.Provisioning Coverage Ratio (PCR):

- Under the RBI’s provisioning norms, the banks are required to set aside certain percentage of their profits in order to cover risk arising from NPAs.

- It is referred to as “Provisioning Coverage ratio” (PCR). It is defined in terms of percentage of loan amount and depends upon the asset quality. As the asset quality deteriorates, the PCR increases.

The PCR for different categories of assets is as shown below:

- Standard Assets (No Default) : 0.40%

- Sub-standard Assets ( > 90 days and less than 1 year) : 15%

- Doubtful Assets (greater than 1 year): 25%-40%

- Loss Assets (Identified by Bank or RBI) : 100%

4.Special Mention Accounts (SMA):

- Special Mention Account (SMA) Category has been introduced by the RBI in order to identify the incipient stress in the assets of the banks and NBFCs.

- These are the accounts that have not-yet turned NPAs (default on the loan for more than 90 days), but rather these accounts can potentially become NPAs in future if no suitable action is action.

- The SMA has the various sub-categories as shown below:

- SMA-0: Principal or interest payment not overdue for more than 30 days but account showing signs of incipient stress

- SMA-1: Principal or interest payment overdue between 31-60 days

- SMA-2: Principal or interest payment overdue between 61-90 days

- If the Principal or interest payment is overdue for more than 90 days, then the loan is categorized as NPA.

5. Leverage Ratio (LR):

- The Basel Committee on Banking Supervision (BCBS) introduced Leverage ratio (LR) in the 2010 Basel III package of reforms. The Formula for the Leverage Ratio is (Tier 1 Capital/ Total Consolidated Assets) ×100 where Tier 1 capital represents a bank’s equity.

- It is to be noted that the Tier 1 capital adequacy ratio (CAR) is the ratio of a bank’s core tier 1 capital to its total risk-weighted assets. On the other hand, leverage ratio is a measure of the bank’s core capital to its total assets.

- Thus, the Leverage ratio uses tier 1 capital to judge how leveraged a bank is in relation to its consolidated assets whereas the tier 1 capital adequacy ratio measures the bank’s core capital against its risk-weighted assets.

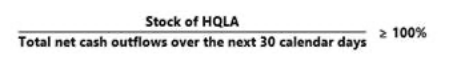

6.Liquidity Coverage Ratio (LCR):

- A failure to adequately monitor and control liquidity risk led to the Great Financial Crisis in 2008. To improve the banks’ short-term resilience to liquidity shocks, the Basel Committee on Banking Supervision (BCBS) introduced the LCR as part of the Basel III post-crisis reforms.

- The LCR is designed to ensure that banks hold a sufficient reserve of high-quality liquid assets (HQLA) to allow them to survive a period of significant liquidity stress lasting 30 calendar days.

- HQLA are cash or assets that can be converted into cash quickly through sales (or by being pledged as collateral) with no significant loss of value.

- Total net cash outflows are defined as the total expected cash outflows minus the total expected cash inflows arising in the stress scenario.

Now we can dive into the Key Highlights of the Report.

Health of the Banking Sector: Important Highlights:

1.Decline in Gross and Net NPA:

- For the first time in the last 7 years, the Gross NPAs of the Scheduled Banks has declined to 9.1% by the end of September 2019. Similarly, the net NPAs has declined to 3.7% in September 2019. The decrease in the Gross NPAs and Net NPAs can be attributed to success of the Insolvency and Bankruptcy Code (IBC).

2.Concentration of NPAs:

- Most of the NPAs are concentrated in the larger borrower accounts (exposure of Rs 5 crore or more) which account for almost 82% of the GNPAs. The report has highlighted that there has been increase in stress of these accounts and hence it may be difficult to reduce NPAs in future.

3.Decline in Special Mention Accounts (SMA): In 2018-19, scheduled Banks recorded decline in all the special mention accounts (SMA-0, SMA-1 and SMA2) which points to the broad-based improvement in asset quality. However, in the first half of 2019-20, there has been increase in the number of SMA accounts.

4.Provisioning Coverage Ratio (PCR): The provision coverage ratio (PCR) of all Scheduled Banks improved to 61 per cent by end of September 2019.

5.Leverage Ratio (LR): The leverage ratio of Scheduled Banks was at 6.6 per cent, above the prescription of 3 per cent by the Basel Committee on Banking Supervision (BCBS).

6.Banking Frauds: The Public sector Banks (PSBs) accounted for the bulk of the banking frauds reported in 2018-19 accounting for almost 55% of the total cases pending.

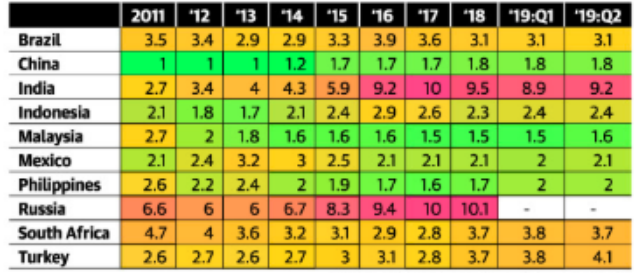

- The following table shows India’s position in the list of countries with emerging economies.

- The table shows India holding 3rdposition among the highest NPA holding economies.