Category: Growth, Development, National

ECONOMIC STIMULUS-II PACKAGE

16, May 2020

Context:

- The Union Finance Minister has recently announced the short term and long-term measures for supporting the poor, including migrants, farmers, tiny businesses and street vendors as part of the second tranche of Atmanirbhar Bharat Abhiyan.

About Free Food Grains:

- The allocation of additional food grain to all the States/UTs (5 kg per migrant labourer and 1 kg chana per family per month) for two months (May and June, 2020) free of cost. It is an extension of the Pradhan Mantri Gharib Kalyan Yojana.

- The Migrant labourers not covered under National Food Security Act (NFSA), 2013 or without a ration card in the State/UT in which they are stranded at present.

- The entire outlay of ₹3500 crores will be borne by the Government of India.

About One Nation One Ration Card:

- It is part of Technology Driven System Reforms and will enable migrant workers and their family members to access PDS benefits from any Fair Price Shop in the country.

- Around 67 crore beneficiaries covering 83% of Public Distribution System (PDS) population will be covered by National portability of Ration cards by August, 2020 and 100% National portability will be achieved by March, 2021.It will ensure that the people in transit, especially migrant workers can also get the PDS benefit across the country.

About Scheme for Affordable Rental Housing Complexes:

- It will be launched soon and under this, the Central Government will provide ease of living at affordable rent for Migrant Workers and Urban Poor.

- It will be converted into Affordable Rental Housing Complexes (ARHC) of government funded houses in the cities under PPP mode (Public Private Partnerships) through Concessionaires.

About Credit Linked Subsidy Scheme:

- This Scheme for Middle Income Group (MIG, annual income between ₹6 and ₹18 lakhs) will be extended up to March 2021. It comes under the Pradhan Mantri Awas Yojana (Urban).

- It will benefit 2.5 lakhs middle income families during 2020-21 and will lead to investment of over ₹70,000 crores in housing sector.

- It will create a significant number of jobs by giving a boost to the Housing sector and will stimulate demand for steel, cement, transport and other construction materials.

Credit Boost for Kisan Credit Card Scheme:

- It is a special drive to provide concessional credit to Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) beneficiaries through Kisan Credit Cards.

- It will inject additional liquidity of ₹2 lakh crore in the farm sector.

- The 2.5 crore farmers will be covered and fisherman and animal husbandry farmers will also be included in this drive.

Shishu MUDRA loanees and their Interest Subvention:

- The Government will provide Interest subvention of 2% for prompt payees for a period of 12 months to MUDRA Shishu loanees, who have loans below ₹50,000.

- The current, MUDRA Shishu loans is around ₹62 Lakh crore. This will provide relief of about ₹1,500 crore to Shishu MUDRA loanees.

Street Vendors and Credit Facility:

- It will be launched to facilitate easy access to credit to Street vendors and enable them to restart their businesses.

- It is expected that 50 lakh street vendors will be benefited under this scheme and credit of ₹5,000 crores would be provided.

- The Bank credit facilities for initial working capital up to ₹10,000 for each enterprise will be extended.

About Employment using CAMPA Funds:

- Around ₹6,000 crore of funds under Compensatory Afforestation Management & Planning Authority (CAMPA) will be used.

- It will be utilised in afforestation and plantation works, artificial regeneration, forest management, soil & moisture conservation works, forest protection, forest and wildlife related infrastructure development, wildlife protection and management etc.

- The Government will grant immediate approval to these plans which will create job opportunities in urban, semi-urban and rural areas and also for Tribals.

Additional Emergency Working Capital:

- The NABARD will extend additional re-finance support of ₹30,000 crore for meeting crop loan requirements of Rural Cooperative Banks (RCBs) and Regional Rural Banks (RRBs).

- It is over and above ₹90,000 crore that will be provided by NABARD to this sector in the normal course.

- It will benefit around 3 crore farmers, mostly small and marginal and will meet their post-harvest Rabi and current Kharif requirements.

Demerits:

- The Economists feel, that this intervention was too little, too late, and that the free food grains provision should have been universalised to deal with widespread distress.

- They have asked the government for a one-time cash transfer to vulnerable sections like migrant labourers.

- Around 50 crore people in the country without ration cards, of which 10 crores are legally entitled to PDS grain under NFSA.

- There are many people who were managing in normal times, vegetable vendors, gig economy workers, auto rickshaw drivers, who are in dire straits now. PDS needed to be extended to all these people at this time.

- There were no steps taken to extend MGNREGA employment guarantee to at least 200 days. It aims to provide at least 100 days of wage employment.

MANUFACTURING HITS RECORD LOW

05, May 2020

Why in News?

- According to a recent IHS Markit India monthly survey, Manufacturing Purchasing Managers’ Index (PMI) fell to 27.4 in April, 2020 from 51.8 in March, 2020.

- The Index (PMI) is compiled by IHS Markit for more than 40 economies worldwide. IHS Markit is a global leader in information, analytics and solutions for the major industries and markets that drive economies worldwide.

Highlights of the Report:

- The PMI slipped into contraction mode, after remaining in the growth territory for 32 consecutive months.

- In PMI’s language, a reading above 50 means expansion, while a score below that denotes contraction.

- According to the 12-month outlook for production the demand will rebound once the Covid-19 threat is diminished and lockdown restrictions are eased.

- The deteriorating demand conditions has led the manufacturers to drastically cut back staff numbers.Export orders have also witnessed a sharp decline.

- There was also evidence of supply-side disruption due to the lockdown.

Reasons Behind the Fall:

- India’s manufacturing sector activity has witnessed contraction in the month of April, 2020 due to national lockdown restrictions.

- The new business orders have collapsed at a record pace severely hampering the demand.

- This is the sharpest deterioration in business conditions across the manufacturing sector since data collection began over 15 years ago.

About Purchasing Managers’ Index:

- Purchasing Managers’ Index (PMI) is an indicator of business activity – both in the manufacturing and services sectors. It is calculated separately for the manufacturing and services sectors and then a composite index is also constructed.

- The PMI summarizes whether market conditions as viewed by purchasing managers are expanding, neutral, or contracting.

- The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

- The PMI is a number from 0 to 100.

- PMI above 50 represents an expansion when compared to the previous month;

- PMI under 50 represents a contraction, and

- A reading at 50 indicates no change.

- The PMI is usually released at the start of every month. It is, therefore, considered a good leading indicator of economic activity.

- It is different from the Index of Industrial Production (IIP), which also gauges the level of activity in the economy.

CORPORATE SOCIAL RESPONSIBILITY (CSR) EXPENDITURE

14, Apr 2020

Why in News?

- The Ministry of Commerce and Industry has clarified that the contributions to the Chief Minister’s Relief Fund or the State relief fund will not qualify as Corporate Social Responsibility (CSR) expenditure, while any donation to the PM CARES Fund will.

What are the Key Points?

- The Chief Minister’s Relief Fund or State Relief Fund for COVID-19 is not included in Schedule VII of the Companies Act, 2013, and therefore any contribution to such funds shall not qualify as admissible CSR expenditure.

- Schedule VII of the Companies Act, 2013 provides the list of activities that can be included in CSR.

- Some political parties criticised this saying it is discriminatory and goes against the constitutional principle of federalism.

- However, donations to the State Disaster ManagementAuthority to combat COVID-19 can be counted as admissible CSR expenditure.

What is Corporate Social Responsibility?

- The term “Corporate Social Responsibility” in general can be referred to as a corporate initiative to assess and take responsibility for the company’s effects on the environment and impact on social welfare.In India, the concept of CSR is governed by clause 135 of the Companies Act, 2013. India is the first country in the world to mandate CSR spending along with a framework to identify potential CSR activities.

- The CSR provisions within the Act is applicable to companies with an annual turnover of 1,000 crore and more, or a net worth of Rs. 500 crore and more, or a net profit of Rs. 5 crore and more.

- The Act requires companies to set up a CSR committee which shall recommend a Corporate Social Responsibility Policy to the Board of Directors and also monitor the same from time to time.

- The Act encourages companies to spend 2% of their average net profit in the previous three years on CSR activities.

- The indicative activities, which can be undertaken by a company under CSR, have been specified under Schedule VII of the Act. The activities include:

- Eradicating extreme hunger and poverty,

- Promotion of education, gender equality and empowering women,

- Combating Human Immunodeficiency Virus, Acquired Immune Deficiency Syndrome and other diseases,

- Ensuring environmental sustainability;

- Contribution to the Prime Minister’s National Relief Fund or any other fund set up by the Central Government for socio-economic development and relief and funds for the welfare of the Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women etc.

Strategic importance of Social Responsibility:

- A healthy business can only succeed in a healthy society. Thus, it is in the best interest of a company to produce only goods and services which strengthen the health of society

- If the company wants to succeed in the long term it needs to have the acceptance—or licence to operate—from social actors affected by the company’s’ operations.

GLOBAL UNEMPLOYMENT AMIDST COVID-19

20, Mar 2020

Why in News?

- The International Labour Organization (ILO) has recently said that the COVID-19 pandemic will drastically increase global unemployment, leaving up to 25 million more people out of work and slashing incomes.

About ILO:

- It is the only tripartite U.N. agency. It brings together governments, employers and workers of 187 member States, to set labour standards, develop policies and devise programmes promoting decent work for all women and men.

- It was established in 1919 by the Treaty of Versailles as an affiliated agency of the League of Nations and also became the first affiliated specialized agency of the United Nations in 1946.

- Headquarters:Geneva, Switzerland.

- India is a founding member of the ILO and it has been a permanent member of the ILO Governing Body since 1922.

- The organization has played a key role in

- Ensuring labour rights during the Great Depression

- Decolonization process

- The creation of Solidarnosc( trade union) in Poland

- The victory over apartheid in South Africa

What are its Key Findings?

- The International Labour Organization (ILO) has warned that the economic and labour crisis sparked by the coronavirus will have far-reaching impacts on labour market outcomes.

- The ILO said that by comparison, the global financial crisis of 2008-09 increased global unemployment by 22 million.

- A study based on the report suggests that the world should prepare to see a significant rise in unemployment and underemployment in the wake of the pandemic.

- In the best-case scenario, 5.3 million more people will be pushed into unemployment.

- In the worst case scenario, 24.7 million more will become jobless, on top of the 188 million registered as unemployed in 2019.

- Underemployment is also expected to increase on a large scale, as the economic consequences of the virus outbreak translate into reductions in working hours and wages.

- Self-employment in developing countries usually serves to cushion the impact of economic shifts but this time due to the severe restrictions on the movement of people and goods, it might not help.

- Reductions in access to work will also mean large income losses for workers.

- The study estimates the income loss between $860 billion and $3.4 trillion by the end of 2020, which will translate into falls in consumption of goods and services, in turn affecting the prospects for businesses and economies.

- The number of people who live in poverty despite holding one or more jobs will also increase significantly.

- The strain on incomes resulting from the decline in economic activity will devastate workers close to or below the poverty line.

- Some groups will be disproportionately impacted by the jobs crisis, including youth, older workers, women and migrants which will only increase the already Prevailing Inequality.

What are its Suggestions?

- The ILO has called for urgent, large-scale and coordinated measures to protect workers in the workplace and stimulate the economy, employment and job support through social protections, paid leave and other subsidies.

- It is suggested to tackle this pandemic in the same way the global financial crisis of 2008 was tackled, by presenting a united front to address the consequences.

THE ECONOMIC IMPACT OF CORONAVIRUS

05, Mar 2020

Why in News?

- The outbreak of Corona virus in China and its spread to neighbouring countries has been having a devastating impact on the various sectors of the economy at both global and national level.

- Thus the impact of this spread on various sectors has been discussed here.

Global Scenario:

1. Slowdown in Global Growth: The world’s economy could grow at its slowest rate since 2009 this year due to the corona virus outbreak, according to OECD. The OECD has forecast growth of just 2.4% in 2020, down from 2.9% in November 2019.

2. Travel Industry: The number of cases diagnosed is increasing around the world every day. Thus, many countries have introduced travel restrictions to try to contain the virus’s spread, impacting the travel industry massively.

3. Fall in Customer Demand: Some people are choosing to avoid activities that might expose them to the risk of infection, such as going out shopping. Restaurants, car dealerships and shops have all reported a fall in customer demand.

4. Beneficiaries: Consumer goods giant Reckitt Benckiser, for example, has seen a boost in sales for its Dettol and Lysol products. The disinfectant is seen as providing protection against the spread of the disease, although its effectiveness has not yet been scientifically proven.

Impact on Indian Economy:

1. GDP Growth Rate:

- OECD has slashed India’s growth forecast for 2020-21 by 110 basis points to 5.1%, warning that the impact of the Covid-19 outbreak on business confidence, financial markets and the travel sector, including disruption to supply chains, could shave 50 bps off global growth in 2020.

2. Automobile Industry:

- China is one of the leading suppliers of auto components in India, accounting for 27% of the total imports.

- The corona virus is expected to have an impact on the Indian automotive industry and therefore also on the automobile component and forging industries, which had already reduced their production rate due to the market conditions and on account of the impending change over to BS-VI emission norms from BS-IV from April 2020.

3. Impact on Pharmaceuticals Sector:

- Given the pharmaceutical industry’s deep linkages to China, the supply chain of raw materials of drugs has taken a hit.

- The production facilities in Himachal Pradesh — largest pharma hub of Asia — have warned of suspension.

- India is heavily import-dependent for APIs from China. India’s API imports stand at around $3.5 billion per year, and around 70%, or $2.5 billion, come from China.

4. Currency

- The month of March is typically good for the Indian currency as remittances, from both overseas citizens and companies, tend to boost the exchange rate.

- In the past decade, the rupee has appreciated seven times against the dollar in March. But March 2020 could be hard on the exchange rate and the rupee’s sharp drop to 73.25 per dollar on 3rd March, 2020 is evidence of this. One of the reasons is an increase in the number of reported cases of coronavirus in India.

Response at Global level:

- Vaccines are being developed.

- The COVID-19 outbreak was declared a Public Health Emergency of International Concern by the WHO.

- According to recommendations by the World Health Organization, the diagnosis of COVID-19 must be confirmed by the Real Time- Polymerase Chain Reaction (PCRT-PCR) or gene sequencing for respiratory or blood specimens, as the key indicator for hospitalisation.

- $15 million dollars has been released from the UN’s Central Emergency Fund to help fund global efforts to contain the spread of the COVID-19 corona virus, particularly vulnerable countries with weak health care systems.

Response at National Level:

- The Indian health minister advised people to approach the government helpline numbers regarding the doubts related to symptoms of the deadly disease. The situation is being monitored at the highest level.

- The government has already introduced travel restrictions and suspended visas from affected countries.

- A detailed containment plan has been shared with states. States have been asked to identify possible isolation areas in hospitals that can accommodate larger numbers.

- PCR Test: If PCR test is positive, the sample is sent to the National Institute of Virology in Pune, which is the only government laboratory currently doing genome sequencing, for final confirmation.

CONSUMER CONFIDENCE SURVEY (CCS)

19, Feb 2020

Why in News?

- Recently, the Reserve Bank has released the results of the January 2020 round of its Consumer Confidence Survey (CCS).

About Consumer Confidence Survey (CCS):

- The Consumer Confidence survey is conducted by the RBI in 13 major cities of India and covers almost over 5,000 respondents.

- The survey measures consumer perception (current and future) on five

-

Economic Variables –

1.Economic situation

2.Employment

3.The Price Level

4.Income

5.Spending

- The Consumer Confidence survey has two main indices – current situation index and future expectations index.

- The current situation index measures the change in consumer perception over an economic issue in the last one year while the future expectations index measures what consumer thinks about the same variables, one year ahead.

- A consumer confidence Index above 100 gives optimistic perception of the consumers while reading below 100 denotes pessimistic perception.

Importance of Consumer Confidence:

- In case of India, the consumption expenditure accounts for almost 60% of India’s GDP and hence it is considered to be the major driver of economic growth and development.

- The main driver of the consumption expenditure is the Consumer Confidence. If the consumers are optimistic about the current and future economic state of country, then they would spend more money leading to increase in the GDP. On the other hand, if the Consumer confidence is low, this can lead to decrease in the consumption expenditure and hence impacts the GDP Growth rate.

- Hence, there is a need to measure the consumer confidence in a country to understand the prospects of economic growth.

TIME TO PRIORITISE EDUCATION AND HEALTH

31, Jan 2020

Why in News?

- In the backdrop of current economic slowdown, few eminent economists have been prescribing investments in human capital formation in order to spur growth and counter the slowdown.

Background Info:

- To counter the economic slowdown the government is attempting to spur demand by increasing the private consumption expenditure.

- Accordingly a number of steps taken by the government include

- Corporate tax rate cut

- Investment in infrastructure inclusion National Infrastructure Pipeline

- Setting up of Alternate Investment Fund in the Housing Sector.

- Higher spending in MGNREGA etc.

- The policy currently being pursued by the government is intended primarily to incentivise potential investors by facilitating ease-of-doing-business and making large-scale concessions to the corporate sector including tax cut.

- Despite of these efforts, there is little evidence of any significant increase in investment by the private sector to boost consumption expenditure.

- There are few who argue that the government must implement labour market reforms, remove constraints on land acquisition, accelerate investments in physical infrastructure mainly transport and energy to boost consumption expenditure.

The Way Around:

- Alternatively few of the eminent economists prescribe increased social sector spending particularly on education and health in order to counter slowdown.

- They suggest this as it have 2-fold Effect Including:

1.Human Capital Formation

2.Increased Demand as a result of improved employment in education and health in the form of new recruitments of healthcare professionals, teachers, improved infrastructure etc. (Counters Economic Slowdown)

Importance of Investments in Education and Health:

- Investments in social sector are grossly underfunded as the target to invest in education is 6 per cent of GDP whereas in Health the target as per the National Health Policy is to invest upto 2.5 per cent of GDP.

- Thus the increased public expenditure in social sectors in the magnitudes required for meeting the constitutionally mandated objectives can have short- and medium-term effect of enhancing employment, generating demand and attracting investment.

- Investments in health and education will serve two main objectives:

- 1.It will boost human capital – efforts of humans

- 2.It can counter economic slowdown

- In the field of education, primarily by investing in teacher recruitment and building school infrastructure. Thus, recruitment of 5.7 million additional teachers over a period of five years, can create huge scale demand. And, this is only one factor essential for universalising quality school education.

- There is also a large gap between requirement of infrastructure in the schools and that available and built recently.

- According to government data, only 12.5% of the schools covered by the RTE Act were compliant with RTE norms, most of which are related to infrastructure. Meeting these norms has the potential of creating employment on a large scale.

- Education has a crucial role to play for an individual in Gaining Employment and Retaining Employability.

- In the field of health, there is a huge deficit of paramedical workers, middle-level health workers, nurses and trained doctors.

Conclusion:

- Health and education are of instrumental value in driving growth, creating employment and improving people’s well-being is widely recognised but often forgotten when it comes to making investment in these sectors.

- The government has a well-entrenched policy of Encouraging Privatisation in both health and education. But, privatisation in these sectors has not led to efficiency or improvement of quality.

- It has only destroyed public sector institutions, promoted greater inequality and pushed the poor out. The gestation period of projects in social sectors is not as long as it is considered.

- It is therefore time for reprioritising education and health in the scheme of development strategy and the allocation of budgetary resources so as to counter current economic slowdown and also build strong infrastructure necessary in the fields of health and education.

ANNUAL STATUS OF EDUCATION REPORT (ASER) 2019

18, Jan 2020

Why in News?

- Recently, the Non-Governmental Organization (NGO) Pratham’s Annual Status of Education Report 2019 has flagged poor learning outcomes in schools.

About ASER 2019:

- ASER 2019 reported on the pre-schooling or schooling status of children in the age group 4 to 8 years in 26 rural districts (districts with rural population >70%) across 24 States.

- It focuses on the “early years” and lays emphasis on “developing problem-solving faculties and building memory of children, and not content knowledge”.

- It is defined globally as age 0-8, is known to be the most important stage of cognitive, motor, social and emotional development in the human life cycle.

- It explores children’s performance on four competencies that are identified as important predictors of future success, viz.

1. Cognitive Development,

2. Early Language,

3. Early Numeracy, and

4. Social and Emotional Development

About the Key Findings of the ASSE:

- ASER Report 2019 argues that a focus on cognitive skills rather than subject learning in the early years can make a big difference to basic literacy and numeracy abilities.

- It tests the cognitive skills of children. Tests included sorting images by colour and size, recognising patterns, fitting together a four-piece animal puzzle — as well as simple literacy and numeracy tests.

- However, of those children who could correctly do all three cognitive tasks, 52% could read words, and 63% could solve the addition problem.

- It shows that children’s performance on tasks requiring cognitive skills is strongly related to their ability to do early language and Numeracy Tasks.

- This suggests that focusing on play-based activities that build memory, reasoning and problem-solving abilities is more productive than an early focus on content knowledge.

Reading and Early Childhood Education:

- Only 16% of children in Class 1 can read the text at the prescribed level, while almost 40% cannot even recognise letters.

- Early childhood education has the potential to be the “greatest and most powerful equaliser”.

- Global research shows that 90% of brain growth occurs by age 5, which meaning that the quality of early childhood education has a crucial impact on the development and long-term schooling of a child.

- More than a quarter of Class 1 students in government schools are only 4 or 5 years old, younger than the recommended age. These younger children struggle more than others in all skills.

- At the same time, 36% in Class 1 are older than the Right to Education (RTE) Act (2009) -mandated age of 6.

- It can be noted that the draft New Education Policy (NEP), 2019 also links the “severe learning crisis” to what goes on with young children in India.

About the Draft New Education Policy (NEP), 2019:

- Draft NEP points out that close to 5 crore children currently in elementary schools do not have foundational literacy and numeracy skills.

- Several possible reasons for this:

- Many children enter school before age 6. This is partly due to the lack of affordable and accessible options for pre-schooling. Therefore, too many children go to Std I with limited exposure to early childhood education.

- Children from poor families have a double disadvantage – lack of healthcare and nutrition on one side and the absence of a supportive learning environment on the other.

- School readiness or early childhood development and education activities have not had a high priority in the Integrated Child Development Scheme (ICDS) system

Annual Status of Education Report (ASER):

- It uses Census 2011 as the sampling frame. It continues to be an important national source of information about children’s foundational skills across the Country.

- In 2016, ASER switched to an alternate-year cycle where this ‘basic’ ASER is conducted every other year (2016, 2018, and next in 2020); and in alternate years ASER focuses on a different aspect of children’s schooling and learning.

- In 2017, ASER ‘Beyond Basics’ focused on the abilities, experiences, and aspirations of youth in the 14-18 age group. In 2018 ASER had data on enrolment patterns in age group 4 to 8.

Way Forward:

- Strengthen the early childhood components in the Integrated Child Development Scheme (ICDS) system for raising school readiness among young children. There is considerable scope for expanding Anganwadi outreach for 3- and 4-year-old children.

- A reworking of curriculum and activities is urgently needed for the entire age band from 4 to 8, cutting across all types of preschools and early grades regardless of whether the provision is by government institutions or by private agencies.

- The year 2020 marks the 10th anniversary of the RTE Act. This is the best moment to focus on the youngest cohorts before and during their entry to formal schooling and ensure that 10 years later they complete secondary school as well-equipped and well-rounded citizens of India.

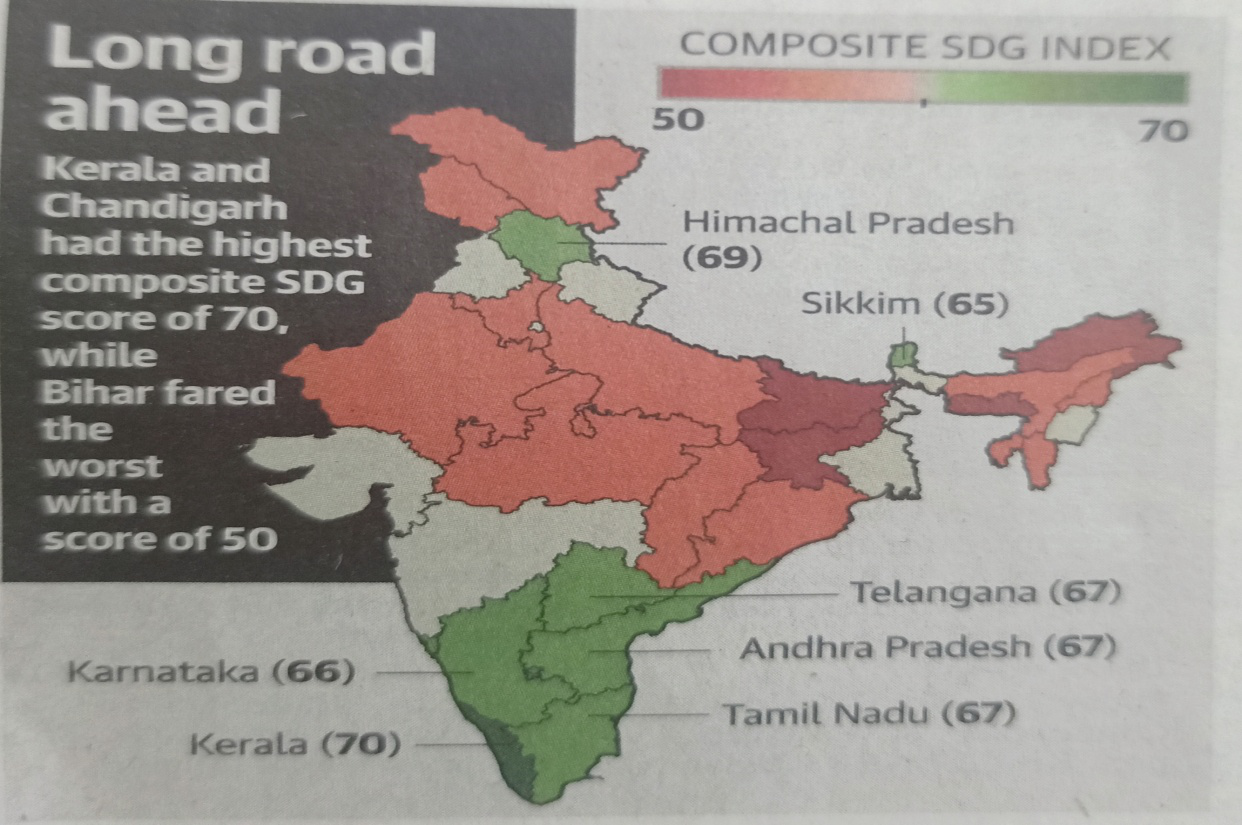

KERALA TOPS NITI AAYOG’S SDG INDEX

31, Dec 2019

Why in News?

- Kerala tops states in progress towards UN Sustainable Development Goals, while Bihar is at the bottom of recently released NITI Aayog’s SDG Index.

About Sustainable Development Goals:

- The Sustainable Development Goals (SDGs) are officially known as Transforming our world: the 2030 Agenda for Sustainable Development.

- There are 17 Sustainable Development Goals, associated 169 targets and 304 indicators.

- They are universal call by United Nations Development Programme (UNDP) for action towards ending poverty, improving health and education, protecting planet, and ensuring that all people enjoy peace and prosperity by 2030.

- India has been closely monitoring its progress on SDGs through its National Indicator Framework and India SDG Index released in 2018.

About the Report:

- The SDG India Index was developed in collaboration with the Ministry of Statistics & Programme Implementation (MoSPI), Global Green Growth Institute and United Nations in India.

- The index comprises a composite score for each State and Union Territory based on their aggregate performance across 13 of the 17 SDGs (leaving out Goals 12, 13, 14 and 17).

- The score, ranging between 0 and 100, denotes the average performance of the State/UT towards achieving the 13 SDGs and their respective targets.

- The states were classified under 4 categories based on their scores. The states with scores between 0 and 49 were categorized ‘Aspirant’, between 50 and 64 were ‘Performers’, between 65 and 99 were ‘Front Runner’ and with a score of 100 were categorized ‘Achiever’.

- The aim of the index is to instill competition among States to improve their performance across social indices as the States’ progress will determine India’s progress towards achieving the set goals by 2030. Using the index, States will be monitored on a real-time basis.

Key Findings of the Report:

- Kerala ranked first in composite SDG index with score of 70. Kerala was followed by Himachal Pradesh, Andhra Pradesh, Telangana and Tamil Nadu.

- The biggest improvement was seen in states such as Uttar Pradesh, Odisha and Sikkim. The score of UP improved from 29 in 2018 to 23 in 2019. Also, the rank of Odisha improved from 23 in 2018 to 15 in 2019.

- The least performing states were Bihar, Jharkhand and Arunachal Pradesh.

- In terms of poverty reduction, states such as Tamil Nadu, Andhra Pradesh, Tripura, Mizoram, Meghalaya and Sikkim performed well.

- The states Uttar Pradesh, Assam and Bihar that were in Aspirant category moved to performers in 2019.

- The states that were in performer category in 2018 and moved to front runner include Andhra Pradesh, Karnataka, Telangana, Sikkim and Goa.

What is the Concern?

- Ending hunger and achieving gender equality are the areas where most states fall far short, with the all-India scores for these goals at 35 and 42 points respectively.

- The second SDG – zero hunger – shows sharp divergence in the performance of states, with little middle ground.

- Kerala, Goa and parts of the north-east — including Mizoram, Nagaland, Arunachal Pradesh and Sikkim – have scored above 65, with Goa at 75 points.

- However, 22 of the states and union territories have scored below 50, with the central Indian states of Jharkhand, Madhya Pradesh, Bihar and Chhattisgarh scoring below 30, showing abysmal levels of hunger and malnutrition.

- The chosen indicators are related to child stunting, obesity and anaemia, as well as agricultural production and subsidised food distribution.

- On the fifth SDG – gender equality – almost all states fare poorly. Only Jammu and Kashmir, Himachal Pradesh and Kerala have managed to cross 50 points.

- The indicators considered include crimes against women, eradicating sex selection and discrimination against daughters, and access to reproductive health schemes, as well as indicators showing women’s economic and political empowerment and leadership.

- A sex ratio of 896 females per 1000 males, a 17.5% female labour participation rate, and the fact that one in three women experience spousal violence all contribute to a low score countrywide.

- The Swachh Bharat Mission has contributed largely to the high scores on the sixth SDG – clean water and sanitation – although that was helped by the fact that four out of seven indicators dealt with toilets and sanitation, while only one indicator was related to safe and affordable drinking water.

- All states and union territories except for Delhi have scored above 65, with the national capital scoring poorly on the percentage of urban households with individual household toilets (less than one percent) and, oddly, providing no data on districts verified to be open defecation free.

- Delhi also has 81% of blocks with overexploited groundwater, vastly higher than any other state.

Way Forward:

- Unless development becomes a mass movement, India can’t achieve what it is essential as of now.

- India’s progress in achieving these goals are crucial for the world as it is home to about 17% of the world population, said a statement from NITI Aayog.

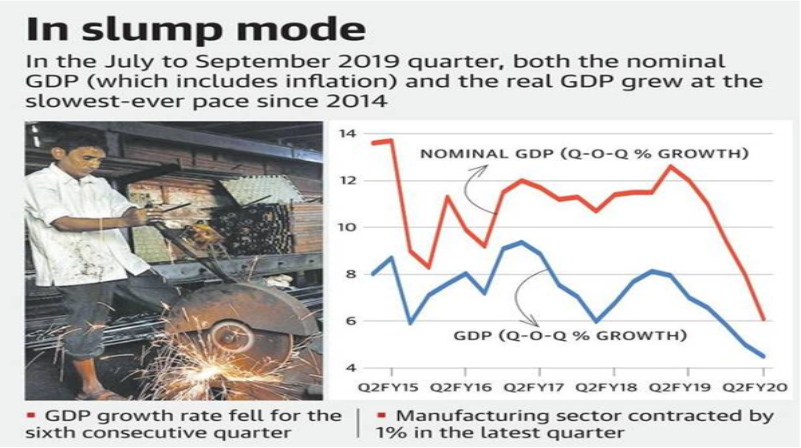

GDP GROWTH PLUNGES TO 4.5%

30, Nov 2019

Why in News?

- The government has announced that Growth in the gross domestic product (GDP) in the July-September quarter hit a 25-quarter low of 4.5%.

Agriculture Sector:

- Growth in gross value added (GVA) also dipped to 4.3% in Q2 of 2019-20 from 4.9% in Q1, and 6.9% in the Q2 of last year.

- The agriculture sector saw growth coming in at 2.1% in second quarter of this year compared with 4.9% in Q2 of last year.

- The sector grew just 2.1% over the first six months of the year compared with 5% in the first half of the previous year.

Manufacturing Sector:

- According to the data released, the manufacturing sector contracted 1% in the second quarter of the current financial year, compared with a robust growth of 6.9% in the same quarter of the previous year.

- The manufacturing sector saw an overall contraction of 0.2% in the first half (April to September) of the current financial year compared to a growth of 9.4% in the first half of last year.

- The International Monetary Fund has projected India’s GDP growth at 6.1% in financial year 2019-20 and 7% in 2020-21 in its October 2019 report.

Service Sector:

- Among the services sectors measured, only the ‘Public Administration, Defence & Other Services’ category saw growth quicken in the second quarter of this year, to 11.6%, compared with 8.6% in the same quarter of the previous year.

- The ‘Financial, Real Estate & Professional Services’ category saw growth slow to 5.8% in Q2 of 2019-20, compared with 7% in Q2 of the previous year.

Gross Fixed Capital formation:

- Gross fixed capital formation, which is a measure of the level of investment in the country by both the government and the private sector, grew only 1.02% in the second quarter of this financial year, compared with a growth of 4.04% in the first quarter, and drastically lower than the growth of 11.8% seen in the Q2 of last year.

Consumption:

- Private final consumption expenditure, the closest proxy in the data to a measure of consumption demand, grew 5.06% in the second quarter of this financial year, compared with a growth of 3.14% in the first quarter.

- However, the growth in the second quarter this year is still significantly lower than the growth of 9.79% recorded in the second quarter of the previous year.

HELPING 10-YEAR-OLDS TO READ BY 2030

26, Nov 2019

Context:

- India has been successful in increasing access to school, but now the focus must shift to quality.

Global Learning Crisis:

- For most children, turning 10 is an exciting moment. They are learning more about the world and expanding their horizons.

- But too many children — more than half of all 10 year olds in low- and middle-income countries — cannot read and understand a simple story.

- We are in the middle of a global learning crisis that stifles opportunities and aspirations of hundreds of millions of children. That is unacceptable.

- In October, we released data to support a new learning target: by 2030, we want to cut, by at least half, the global level of learning poverty.

Eliminating Learning Poverty:

- Learning to read is an especially critical skill: it opens a world of possibilities, and it is the foundation on which other essential learning is built — including numeracy and science.

- Wiping out learning poverty (defined as the percentage of children who cannot read and understand a simple story by age 10) is an urgent matter.

- It is a key to eliminating poverty in general and boosting shared prosperity. It is a key to helping children achieve their potential.

- But over the last several years, progress in reducing learning poverty has been stagnant.

- Globally between 2000 and 2017, there has only been a 10% improvement in learning outcomes for primary school-aged children.

- If this pace continues, 43% of 10-year-olds will not be able to read in 2030.

- The good news is, the children who will turn 10 in 2030 will be born next year. If we work urgently, there is an opportunity to reverse this trend.

- The target we have set is ambitious but achievable — and should galvanize action toward achieving Sustainable Development Goal (SDG4) — ensuring quality education for all.

- It will require nearly tripling the rate of progress worldwide, which can be done if every country can match the performance of the countries that made the most progress between 2000 and 2015.

Global Challenges:

- The challenges of reducing learning poverty will differ between countries and regions. In some countries, access to school remains an enormous problem — 258 million young people were out of school globally, in 2018.

- In other countries, children are in classrooms but are not learning.

- By setting a global target, the World Bank can work with countries to define their own national learning targets. Cutting learning poverty in half by 2030 is only an intermediate goal. Global ambition is to work with governments and development partners to bring that number to zero.As the largest financier of education in low-and middle-income countries, the World Bank will work with countries to promote reading proficiency in primary schools. Policies include providing detailed guidance and practical training for teachers, ensuring access to more and better age-appropriate texts, and teaching children in the language they use at home.

Setting India as an example:

- In India, the Right-to-Education Act has been successful in increasing coverage and access to school education but now there is an urgent need to shift the focus to quality.

- The decision of India to join the Programme for International Student Assessment and the merger of schemes under Samagra Shiksha are encouraging signs that India is moving in this direction.

- In Kenya, the government’s national reading programme has more than tripled the percentage of grade two students reading at an appropriate level.

- This was accomplished through technology-enabled teacher coaching, teacher guides, and delivering one book per child.

- In Vietnam, a lean, effective curriculum ensures that the basics are covered, there is deep learning of fundamental skills, and all children have reading materials.

- Learning outcomes of Vietnamese students in the bottom 40% of the income ladder are as high, or higher, than the average student in high-income countries.

What can be Done?

- The World Bank is also working with governments and development partners to improve entire education systems, so advancements in literacy can be sustained and scaled up.

- That means making sure children come to school prepared and motivated to learn; teachers are effective and valued and have access to technology; classrooms provide a well-equipped space for learning; schools are safe and inclusive; and education systems are well-managed.

- An ambitious measurement and research agenda supports these efforts and includes measurement of learning outcomes and their drivers, continued research and innovation, and the smart use of new technologies on how to build foundation skills.

- The learning crisis not only wastes the children’s potential, it hurts entire economies.

- It will negatively impact future workforces and economic competitiveness — as the World Bank’s Human Capital Index shows that, globally, the productivity of the average child born today is expected to be only 56% of what it would be if countries invested enough in health and education.

- Eliminating learning poverty must be a priority, just like ending hunger and extreme poverty.

- Even though it is not easy, we cannot back down from the challenge.

GDP SLUMP WILL HIT $5-TRILLION ECONOMY TARGET

23, Nov 2019

Why in News?

- NITI Aayog has warned the Government that GDP slump will hit $5-trillion economy target.

What did NITI Aayog said?

- The nominal GDP growth — a measure of growth without accounting for inflation — has to be at least 12.4% on an average if that target has to be reached but the current rate was a mere 8% in the first quarter of the current financial year.

- Experts estimate that growth will dip in Q2 compared to Q1 in both real and nominal terms.

- For example, while GDP growth in real terms in Q1 stood at 5%, state-run lender State Bank of India recently estimated that this could dip to 4.2% in Q2, with a corresponding dip in nominal growth as well.

- “Domestic investment and consumption” are the only dependable drivers for sustainable re-acceleration of the economy.

- However a deceleration in investment is visible, primarily in the household sector, due almost entirely to real estate.

- Gross fixed capital formation in the sub-sector of ‘dwellings, other buildings and structures’ fell from 12.8% of GDP in 2011-12 to 6.9% in 2017-18.

- The slowdown in the domestic market is also because of limited availability of capital with the banks which are tied down due to high non-performing assets in heavy industry and infrastructure.

- In the power sector, there is a high cross-subsidization in favour of residential tariff leading to very high industrial tariffs.

- The electric power transmission and distribution (T&D) losses in India stand at 19%, higher than that of Bangladesh and Vietnam.

What are the implications?

- The presentation flagged the urgent need to focus on export of high-value technology and manufacturing goods instead of primary goods currently exported.

- Citing an example, the NITI Aayog chief said 98% of phones exported by India are in the low-value category, to the Middle East and Africa.

- There has been a sharp decline in exports in the textiles from 2017 onwards, according to the presentation.

- Several financial experts have blamed the decline on the November 2016 decision to demonetize high value currency that drained vital liquidity out of the cash-dependent textile market.

MOODY DOWNGRADES INDIA’S RATING

09, Nov 2019

Why in News?

- Global ratings agency Moody’s Investors Service has recently cut India’s ratings outlook to ‘negative’ from ‘stable’ but affirmed the Baa2 foreign-currency and local-currency long-term issuer ratings.

Reason behind Moody’s Rate Cut:

- A crunch that started out in the non-banking financial institutions (NBFIs) spreading to retail businesses, car makers, home sales and heavy industries has made India’s growth outlook deteriorated this year,

- Government’s policy ineffectiveness in addressing economic weakness has led to an increase in debt burden which is already at high levels.

- A breach of the government’s target of 3.3 per cent, as slower growth and a surprise corporate-tax cut affects revenue.

Impact:

- Reduction in outlook is the first step towards an investment downgrade, as India is now just a notch above the investment grade country rating.

- An actual downgrade in country ratings can lead to massive foreign fund outflows.

- However, if the government is able to address fiscal deficit concerns through higher fund raising from stake sales, the rating agencies tend to revise up their outlook.

About Moody’s Investor Service:

- Moody’s Investors Service, often referred to as Moody’s, is the bond credit rating business of Moody’s Corporation.

- They provide international financial research on bonds issued by commercial and government entities.

- Moody’s, along with Standard & Poor’s and Fitch Group, is considered one of the Big Three credit rating agencies.

Credit Rating Categories:

| S.No | CREDIT RATING | DESCRIPTION |

|---|---|---|

| 1. | AAA | Highest credit quality that denotes the lowest expectations of default risk. |

| 2. | AA+/AA/AA- | Very high credit quality. AA ratings denote expectations of very low default risk. They indicate very strong capacity for payment of financial commitments. |

| 3. | A+/A/A- | High credit quality that denotes expectations of low default risk. The capacity for payment of financial commitments is considered strong, however, vulnerability to adverse business or economic conditions exists. |

| 4. | BBB+/BBB/BBB- | Good credit quality that indicates that expectations of default risk are currently low. The capacity for payment of financial commitments is considered adequate, but adverse business or economic conditions are more likely to impair this capacity. |

| 5. | BB+/BB/BB- | This rating indicates an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time; however, business or financial flexibility exists that supports the servicing of financial commitments. |

| 6. | B+/B/B- | This rating indicates that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment. |

| 7. | CCC+/CCC/CCC- | Substantial credit risk exists in this rating, where the default is a real possibility. |

| 8. | CC | This rating shows a very high level of credit risk with a possibility of defaults. |

| 9. | C | This rating shows that a default or default-like process has begun, or the issuer is in a standstill. |

| 10. | DDD/RD/SD/DD/D | This indicates that the issuer has entered into bankruptcy filings, administration, receivership, liquidation or other formal winding-up procedure or has ceased business. |

WORRY FOR ECONOMY: LABOUR’S CONTRIBUTION TO INCOME KEEPS DIPPING

29, Sep 2019

Why in News?

- Labour’s share to national incomes has been declining in both developing and developed countries for around four decades now, highlighted the latest United Nations Conference on Trade and Development (UNCTAD) report.

Key Stats of the Report:

1.Decline in the Labour’s share to national incomes:

- The report stated that Labour’s share to national incomes has reduced to around 54 per cent in 2018 from 61.5 per cent in 1980 in developed countries.

- In developing economies, the labour share dipped to 50 per cent in 2018 from 52.5 per cent in 1990.

- In the same period, more than 10 per cent of GDP was transferred from workers to capitalists.

- The report also showed that labour wages did not grow at the same pace as the cost of living, but the profit share of corporations increased.

Effect of the decline:

- Affecting living conditions can decrease productivity and further cause erosion of social security, growing market concentration and spread of outsourcing through global value chains, highlighted the UNCTAD report.

- In developing countries, labour market liberalisation weakened the prospects of full-time and regulated employment. This made workers lose bargaining power and borrow money for household expenditure. All this finally slowed down demand and led to a recession-like situation.

2.Decline in Public spending:

- Public spending has been on a declining trend in both developed and developing countries since the 1970s. But public spending is more important for social protection system and long-term asset creation.

- The spending, which included stimulus packages and corporate and banking bailouts, increased inequalities, according to the UNCTAD report.

3.Weak Investment Growth

- Globally, both developed and developing economies tried to increase profit share and cut down corporate taxes to promote productive investment but it didn’t work out.

- Credit has been expanding since 1980s without productive investment. The global financial system is going in the wrong direction, which neither encourages productive investment nor creates an environment of productive investment.

4.Growing stock of Carbon Dioxide

- The current financial mechanism is also at odds with the growing stock of atmospheric carbon dioxide that increases temperature. The prevailing economic pattern where big corporations have a say over carbon-free technology is making it costlier to adopt a solution.The report added that in the last one decade, production of carbon dioxide from developing economies has accelerated, but per capita production of CO2 is less. Developing countries produce around 80 per cent less CO2 when compared with per capita production, read the report.

- The report also established a link between rising inequality and rising temperatures. The threat of rising temperatures from high levels of atmospheric carbon is in large part due to emissions from the richest 10 per cent of people in the world.

Conclusion of the Report:

- Impact on SDGs: Reducing labour share, erosion of public spending, weakening of productive investment and rise in stock of carbon dioxide are factors that stand in the way of countries achieving Sustainable Development Goals (SDGs), according to the UNCTAD findings.

- Misplaced Structural Reforms: The report highlighted the fact that there are underlying structural challenges that stand in the way of revival of global economy.

- The global market, instead of pondering over challenges, brought some misplaced structural reform that further targets liberalisation in labour, products and financial markets, found the UNCTAD.

About UNCTAD:

- United Nations Conference on Trade and Development (UNCTAD) was established in 1964 as a permanent intergovernmental body.

- UNCTAD is the principal organ of the United Nations General Assembly dealing with trade, investment, and development issues.

- The organization’s goals are to: maximize the trade, investment and development opportunities of developing countries and assist them in their efforts to integrate into the world economy on an equitable basis.

- Permanent secretariat — Geneva.

- Other Reports: World Investment Report, Trade and Development Report, Technology and Innovation Report, Commodities and Development Report

ADDRESSING THE DEMAND DROUGHT IN OUR ECONOMY

29, Sep 2019

Background:

- A persistent slowdown has dragged economic growth in India down to 5% in the fiscal first quarter, weakest in more than six years.

- Recent weeks have seen the possible reasons for the slowdown, as well as the government’s policy measures to ostensibly help revive the economy being put under the spotlight, the missing demand is yet to be addressed in a direct and concerted manner.

- As data from the National Statistical Office show, private consumption expenditure, which contributes more than half the gross domestic product and is the mainstay of demand, has decelerated so sharply that at 3.1%, the expansion is at an 18-quarter low.

- Automobile sales continued to plunge in August, posting their worst drop since the Society of Indian Automobile Manufacturers (SIAM) started collating wholesale vehicle sales data in 1997-98.The absence of demand pervades almost every key sector: from consumer durables to biscuits and housing.

What Has Caused This Demand Drought?

- Multiple factors have contributed to the demand drought.

- Lack of jobs, or even where jobs are available — like in the new or digitally enabled “gig” economy — a tenuousness about the incomes from such work, the abiding rural distress, widening inequality and, interestingly, in the opinion of some economists, even the Reserve Bank of India’s successful targeting of inflation are all cited as contributors.

- For an economy such as India’s, the central bank’s remit of containing consumer price index-based inflation within a 2-6% band may be proving less than ideal, especially if monetary policy makers fix their sights on trying to peg inflation at or less than 4% — even it means retarding growth as a fallout.

- Low inflation extracts costs in the form of lower nominal growth (growth measured in current prices) that could crimp tax receipts and in turn lead to cuts in government spending.

- With wage/salary increases most often linked to inflation, slower price gains result in smaller annual increments that leave the earners more wary of spending on discretionary or non-essential purchases.

- The crisis of demand in the rural hinterland has snowballed to the point where sellers of consumer goods including Hindustan Unilever (HUL) and ITC have seen appreciable slowing in sales growth in recent quarters.

- Rural growth rates — which were almost double those in urban areas earlier — have eased to the point where they are now almost at par with those in urban areas, according to HUL’s first-quarter results statement.

What Can Be Done to Revive Demand?

- Consumer sentiment is a key ingredient affecting consumption and it is vital for policy makers to address weakness in consumer sentiment through a mix of measures in the economic realm, both monetary and fiscal, as well as ensuring a congenial socio-political climate that enhances the ‘feel-good’ factor.

- On the monetary side, ensuring lower borrowing costs as well as adequate availability of credit are crucial to helping create an enabling environment for consumers to consider taking out loans to fund their purchases.

- However, fiscal measures are in many ways far more crucial. Targeted tax breaks or non-tax sops that incentivise consumption is one option.

- The government’s latest decision to cut baseline corporate tax rates is certainly a good move, aimed at incentivising and spurring sluggish capital investment by businesses.

- However, companies may balk at adding capacity when demand for their manufactured goods is still weak and it is therefore imperative that the revival of demand stays front and centre of any new policy measures.

- As far as rural demand goes, the government must go beyond the Pradhan Mantri KIsan SAmman Nidhi, or PM-KISAN income supplementing scheme and tackle the crisis of low real farm incomes by radically recalibrating its approach to the agrarian economy.

- As an immediate and necessary measure, the Mahatma Gandhi National Rural Employment Guarantee Scheme needs to be reinvigorated by ensuring timely and adequate funding and the fixing of appropriate wage levels.

- As studies have shown, in its first five years, the scheme gave a big fillip to rural incomes and consumption in the hinterland.

What, if any, are the Risks?

- Any economic stimulus package that the government may come up with would necessarily assume a short-term loosening of the fiscal deficit goals, whether from enhanced spending or from reduced tax revenues as the corporate tax cut may engender.

- If the stimulus also entails a large expenditure component, there could also be second-order inflationary consequences.

- However, the risks of failing to revive demand, at a juncture when the economy is heading for a stall, are far greater in the long run.

- Once, the economy has been reflated and demand revives, revenue buoyancy is bound to return and prudent management can ensure a gradual return to normal service on long-run fiscal goals.

FINANCIAL STABILITY AND DEVELOPMENT COUNCIL (FSDC)

20, Jun 2019

Why in News:

- Union Minister of Finance and Corporate Affairs chaired the 20th Meeting of the Financial Stability and Development Council.

FSDC:

- Financial Stability and Development Council (FSDC), an autonomous body dealing with macroprudential and financial regularities in the entire financial sector of India. Financial Stability and Development Council is an apex-level body constituted by the Government of India.The apex-level FSDC is not a statutory body.

20th Meeting:

- The Meeting reviewed the current global and domestic economic situation and financial stability issues including, inter-alia, those concerning Banking and NBFCs.

- The Council was also apprised of the progress made towards setting-up of the Financial Data Management Centre (FDMC) to facilitate integrated data aggregation and analysis as also a Computer Emergency Response Team (CERT-Fin) towards strengthening the cyber security framework for the financial sector.

- The Council also held consultations to obtain inputs/ suggestions of the financial sector regulators for the Budget.

- The Council also took note of the activities undertaken by the FSDC Sub-Committee Chaired by Governor, RBI and the action taken by Members on the decisions taken in earlier Meetings of the Council.

HOPE MODI WILL CARRY OUT DISCUSSED REFORMS: U.S

14, Jun 2019

Why in news:

- U.S. Commerce Secretary had told Prime Minister Narendra Modi in that the U.S. Trade Representative (USTR) would hold off on making a final decision on India’s eligibility for the Generalized System of Preferences (GSP) programme until after the general election.

Details:

- comparisons between the U.S. and India’s levels of trade protection are made saying the U.S. was the least protectionist among major countries and had a trade deficit to prove it.

- The U.S. has zero tariffs on 61% of the total value of our total import. India’s average applied tariff rate at 13.8% remains the highest of any major world economy. Examples of high Indian tariff rates, including in autos, alcoholic beverages and motorcycles, reiterating some of the public messaging are also pointed out. The U.S. is India’s largest export destination, while India remained the U.S.’s 13th largest export market despite its large population and this imbalance is due importantly to overly restrictive market access barriers.

Generalised System of Preferences (GSP)

- It is a preferential arrangement in the sense that it allows concessional low/zero tariff imports from developing countries to developed countries (also known as preference receiving countries or beneficiary countries).

- It involves reduced/zero tariffs of eligible products exported by beneficiary countries to the markets of GSP providing countries.

- The US has a strong GSP regime for developing countries since its launch in 1976, by the Trade Act of 1974.

- The GSP program has effective dates which are specified in relevant legislation, thereby requiring periodical reauthorization in order to remain in effect.

GSP at Global Level

- GSP instituted in 1971 under the aegis of UNCTAD, has contributed over the years to creating an enabling trading environment for developing countries.

- The following 13 countries grant GSP preferences: Australia, Belarus, Canada, the European Union, Iceland, Japan, Kazakhstan, New Zealand, Norway, the Russian Federation, Switzerland, Turkey and the United States of America.

- Following the WTO Hong Kong Ministerial Decision of UNCTAD in 2005 the members agreed that developed countries and developing countries in a position to do so would grant duty-free and quota-free market access for exports of Least Developed Countries (LDC). Subsequent ministerial decisions also reaffirmed the continued importance of this issue for LDCs’ trade and development prospects.

- The provision and utilization of trade preferences is a key goal the Istanbul Program of Actions adopted at the UN LDC IV in 2013, as further reaffirmed in SDGs Goal 17.

FINANCIAL MARKETS SEEK TAX INCENTIVES, BETTER LIQUIDITY

14, Jun 2019

Why in News:

- Finance Minister Nirmala Sitharaman met representatives from the financial and capital market and they discussed creation of a dedicated liquidity window for the NBFC sector. Bankers have also asked the government to review interest rates on Small Savings Scheme.

Details:

- The Indian Banks Association said a system must be evolved to ensure accountability and responsibility on the part of senior management of state-run banks who are involved in credit sanctions and of the loans became NPAs within one year.

- It is requested the government to enact strong recovery laws with a provision to confiscate personal assets of directors of defaulting companies.

- The capital market representative suggested setting-up of Debt Exchange Traded Fund and rationalisation of various taxes like Security Transaction Tax.

- Insurance Regulatory and Development Authority of India chairman Subhash Chandra Khuntia suggested additional tax incentives for term plans to encourage investments, like in the case of the National Pension Scheme.

Non-Banking Financial Companies

- A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property.

- A non-banking institution which is a company and has a principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner is also a non-banking financial company (Residuary non-banking company).

Difference between banks & NBFCs:

- NBFCs lend and make investments, and hence their activities are akin to that of banks; however, there are a few differences as given below:

- NBFC cannot accept demand deposits;

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself.

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

- Unlike Banks which are regulated by the RBI, the NBFCs are regulated by multiple regulators; Insurance Companies- IRDA, Merchant Banks- SEBI, Micro Finance Institutions- State Government, RBI and NABARD.

- The norm of Public Sector Lending does not apply to NBFCs.

- The Cash Reserve Requirement also does not apply to NBFCs.

Indian Banks’ Association

- Indian Banks’ Association (IBA), formed on 26 September 1946 as a representative body of management of banking in India operating in India – an association of Indian banks and financial institutions based in Mumbai

- With an initial membership representing 22 banks in India in 1946, IBA currently represents 237 banking companies operating in India

- IBA was formed for development, coordination and strengthening of Indian banking, and assist the member banks in various ways including implementation of new systems and adoption of standards among the members

- Indian Banks’ Association is managed by a managing committee, and the current managing committee consists of one chairman, 3 deputy chairmen, 1 honorary secretary and 26 members

Debt Exchange Traded Funds (ETFs)

- Debt Exchange Traded Funds (ETFs) are simple investment products that allow the investors to take an exposure to the fixed income securities.

- These debt ETFs combine the benefits of debt investments with the flexibility of stock investment and the simplicity of mutual funds. These Debt ETFs trade on the cash market of the National Stock Exchange, like any other company stock, and can be bought and sold continuously at live market prices.

- Debt ETFs are passive investment instruments that are based on indices and invest in securities in same proportion as the underlying index. Because of its index mirroring property, there is a complete transparency on the holdings of an ETF.

- Further due to its unique structure and creation mechanism, the ETFs have much lower expense ratios as compared to mutual funds.

INDIAN BANK TO FOCUS ON STRONG GROWTH, PROFITABILITY IN FY20

13, Jun 2019

Why in News:

- Increasing CASA deposits, fee income to improve growth and profits in banks

Background:

- Indian Bank will strive for strong growth this fiscal with focus on profitability.

- The prime focus this year will be on increasing the current and savings deposits (CASA) and fee income, accelerating recovery in respect of impaired assets and containing the level of non-performing assets (NPA). The growth in business should culminate in improving the bottom line of the bank. During the current fiscal, the bank would strive for an healthy growth across corporate and retail, agriculture and MSME (RAM) segments.

- In FY19, the RAM sector constituted 58% and corporate 42%.

- Plans were on to set up corporate branches for handling exclusive large borrower accounts with exposure of ₹50 crore or more at select metro centres to improve quality credit dispensation and bottom line.

Way Forward:

- Focus would be on forging partnerships viz. co-origination of loans in collaboration with NBFCs. Tying up with builders/vehicle dealers and tractor manufacturers and exploring cross-sell options through tie-ups with insurance companies for sale of Bancassurance products in life and non-life.

GLOBAL GROWTH TO SLOW IN 2019, SAYS WORLD BANK

05, Jun 2019

Why in News:

- The World Bank Group has downgraded global real GDP growth to 2.6% for 2019, down by 0.3%age points from its previous forecast.

Details:

- Growth is expected to be increase marginally to 2.7% in 2020.

- India’s growth forecasts are projected to be 7.5% per annum in 2019, 2020 and 2021 — not having been downgraded from their January estimates.

A growth rate of 7.2% is estimated for 2018. - The multilateral development bank’s June 2019 Global Economic Prospects (GEP) report, titled, ‘Heightened Tensions, Subdued Investment’ says the global economy “has continued to soften and momentum remains weak” and investment, sluggish.

- “Stronger economic growth is essential to reducing poverty and improving living standards,” said World Bank Group President David Malpass, via a statement.

- “Current economic momentum remains weak, while heightened debt levels and subdued investment growth in developing economies are holding countries back from achieving their potential. It’s urgent that countries make significant structural reforms that improve the business climate and attract investment.

- They also need to make debt management and transparency a high priority so that new

debt adds to growth and investment.”

Slowdown in U.S. and advanced economies

Advanced economies as a group are expected to slow down in 2019, particularly the Euro Area, due to weaker investments and exports.

U.S. growth is expected to slow to 2.5% this year, down from an estimated 2.9% in 2018, and then down to 1.7% and 1.6% in 2020 and 2021 respectively.

India and South Asia

- South Asia’s growth remained “robust” in the face of global economic headwinds and weakening trade and manufacturing, as per the report.

- In India, where growth was 7.2% in FY2018/2019, investment — both, private and in public infrastructure – offset a slowdown in government consumption.

- Soft agricultural prices dampened rural consumption but urban consumption was bolstered by credit growth. With regard to production — robust growth was broad-based the report says, with the industrial sector accelerating on the back of manufacturing and construction, and agriculture and services sectors moderating, due to a “subdued harvest” and slowing trade, hotel, communications and transport sector, respectively.

U.S.-China trade tensions could hurt global growth in 2020

- The report’s prognosis for the impact of U.S.-China trade tensions is grim. “While some countries could benefit from trade diversion in the short run, adverse effects from weakening growth and rising policy uncertainties involving the world’s two largest economies would have predominantly negative repercussions,” it says. `

- U.S. policy uncertainty is expected to “significantly erode” growth and investment across EMDEs, as protectionist measures impact a wide range of downstream industries and trading partners due to the existence of global value chains, the GEP says.

Brexit could impact financial stability

- A no-deal Brexit, the report says, could have a “severe impact” on the U.K. and to a lower extent on its European trading partners in the event of disruptions and delays at the border. Financial stability could also be impacted. “The United Kingdom accounts for a large share of cross-border lending to some EMDEs, which could be negatively impacted by a sudden retrenchment.”

SLOWDOWN CONFIRMED: ON DEEPENING ECONOMIC CRISIS

03, Jun 2019

Why in News:

- The first macro data set released under the new Finance Minister, Nirmala Sitharaman’s showed an under-performing economy with GDP growth falling to 5.8%. The second government takes office amid a clear economic slowdown.

Details:

- The first macro data set released under the new Finance Minister, Nirmala Sitharaman’s showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%.

- Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown.

- The growth in core sector output a set of eight major industrial sectors fell to 2.6% in April, compared to 4.7% in the same month last year.

- Unemployment data, showed that joblessness was at a 45-year high of 6.1% in 2017-18.

- The economy is troubled by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods.

- The rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal. The new Finance Minister has to boost consumption, which means putting more money in the hands of people.

Way forward:

- Finance minister has to take measures to boost private investment even as she opens up public spending again. Major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health had to be taken.

- Recapitalisation of the ailing banks, and consolidation had to be done.

- With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment.

Centre have to go big on privatisation to boost investments.

Economic growth:

- Economic growth means a rise in the real Gross Domestic Product; effectively this means a rise in the national income, national output and total expenditure. Economic growth enables a rise in living standards and greater consumption of goods and services. As a result, economic growth is often seen as the ‘holy grail’ of macroeconomics.

Slowing the economy

- One of the reasons of slowing down of growth can be attributed to shortage of money. While currency in circulation is not a problem, the money that much of the formal economy uses for transactions, and see as bank deposits i.e. M3 or broad money and is eight times the hard currency in circulation, is not finding its way to the market.

- Our Financial system which converts base money to M3 is not functioning smoothly. When banks give new loans, they “create” money. When the financial system is not functioning effectively, this process of money creation slows down, and the ratio of M3 to M0 (also called the money multiplier) falls.

- Measures of Money Supply: M0, M1, M2, M3 and M4

- The total stock of money in circulation among the public at a particular point of time is called money supply.

- The measures of money supply in India are classified into four categories M1, M2, M3 and M4 along with M0. This classification was introduced in April 1977 by Reserve Bank of India.

Reserve Money (M0):

- It is also known as High-Powered Money, monetary base, base money etc.

- M0 = Currency in Circulation + Bankers’ Deposits with RBI + Other deposits with RBI.

- It is the monetary base of the economy.

Narrow Money (M1):

- M1 = Currency with public + Demand deposits with the Banking system (current account, saving account) + Other deposits with RBI.

- M2 = M1 + Savings deposits of post office savings banks.

Broad Money (M3):

- M3 = M1 + Time deposits with the banking system

- M4 = M3 + All deposits with post office savings banks

ECONOMIC PRIORITIES FOR THE NEW GOVERNMENT

25, May 2019

Why in News:

- With a new government taking office after the General Elections 2019, here is a look at the key economic priorities in the coming years.

What is the current economic scenario?

- The economic scenario of the country is considerably weak.

- The GDP growth in the second half of 2018-19 had fallen to around 6.5%, below the trend growth rate of India (7%).

- IIP contracted to a 21-month low of 0.1% in March, 2019 on the backdrop of weak investment and consumption demand.

- For the 2018-19 financial year as a whole, IIP growth stood at 3.6%, much lower than 4.4% recorded in previous financial year.

- The automobile sector has been witnessing a subdued growth and the passenger car segment saw a decline of 16% in April 2019.

- The FMCG (Fast-Moving Consumer Goods) sector has also been seeing a slowdown in volume growth.

- Consumption demand, which was the bulwark of the economy, has weakened and private investment is yet to show signs of a pickup.

- Evidently, the economy is going through a cyclical downturn.

- The slowing consumption and subdued growth in exports could keep India’s growth rate under pressure in the near future.

What should be the focus areas?

- Speeding up the bad loan resolution process under the Insolvency and Bankruptcy Code (IBC) is a key element in the growth revival process.

- In nearly 48% of the cases (or 548 Corporate Insolvency Resolution Processes-CIRPs), resolution could not be achieved within 180 days.

- A total of 362 cases (around 30% of the ongoing CIRPs) surpassed the outer limit of 270 days set out in the IBC.

- Addressing this will boost capital, by freeing up resources for banks to lend further, improve credit availability and support growth.

- Addressing liquidity issues of the Non-Banking Financial Companies sector is expected to be another priority.

- A number of NBFCs has put a stop to fresh loan disbursements while many are on the verge of defaulting on their repayments.

- NBFCs account for a large part of credit disbursal in tier II and tier III towns.

- Notably, the crisis in the NBFC sector threatens to engulf the entire financial sector; its revival is critical for the economy.

- The government is also expected to further step up capital infusion in public sector banks. While infrastructure segment has seen a pick-up in credit demand over the last 1 year, credit growth for the industrial segment continues to remain weak.

- Private sector investment needs to revive as it may provide the necessary boost to the economy.