Category: Economics

WTO panel rules against India

20, Apr 2023

Why in News?

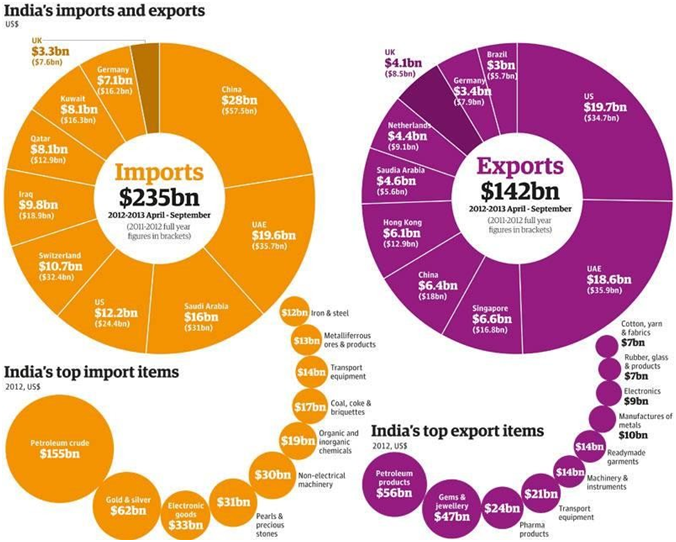

- World Trade Organization (WTO) panel has ruled that India has violated global trading rules by imposing import duties on IT products, such as mobile phones and components, and integrated circuits.

What was the case?

- The case involved a dispute over India’s introduction of import duties ranging from 7.5% to 20% on a wide range of IT products, including mobile phones, components, and integrated circuits.

- The EU, Japan, and Taiwan challenged these import duties in 2019, arguing that they exceeded the maximum rate allowed under global trading rules.

- The recent ruling by the WTO panel found that India had violated these rules and recommended that India bring its measures into conformity with its obligations.

WTO Panel’s Ruling:

- The WTO panel has ruled that India violated global trading rules by imposing these import duties.

- The panel recommended that India bring these measures into conformity with its obligations.

- While the panel broadly backed the complaints against India, it rejected one of Japan’s claims that India’s customs notification lacked “predictability”.

Implications of the ruling:

- The EU is India’s third-largest trading partner, accounting for 10.8% of total Indian trade in 2021, according to the European Commission.

- The ruling could have implications for trade relations between India and the EU, as well as Japan and Taiwan.

- India may be required to lower or eliminate the challenged import duties.

- It remains to be seen whether India will appeal against the ruling.

- If it does, the case will sit in legal purgatory since the WTO’s top appeals bench is no longer functioning due to US opposition to judge appointments.

About the World Trade Organization:

- The WTO started functioning on 1 January 1995, but its trading system is half a century older. Since 1948, the General Agreement on Tariffs and Trade (GATT) had given the rules for the system. (The second WTO ministerial meeting, held in Geneva in May 1998, included a celebration of the 50th anniversary of the system.)

- It did not take long for the General Agreement to give birth to an unofficial, extant international organization, also known informally as GATT.

- Over the years, GATT evolved through several rounds of negotiations.

- The General Agreement on Tariffs and Trade (GATT) had its last round in 1986 and it lasted till 1994.

- This was known as the Uruguay Round and it led to the formulation of the World Trade Organization (WTO).

- While GATT mostly dealt with trade in goods, the WTO and its agreements could not only cover goods but also trade in services and other intellectual properties like trade creations, designs, and inventions.

- The WTO has 164 members and 23 observer governments. Afghanistan became the 164th member in July 2016. In addition to states, the European Union, and each EU country in its own right is a member.India is the original member of the World Trade Organization.

Purpose of WTO:

- To establish rule of law in international trade.

- To ensure free and fair trade.

- To maintain transparency and predictability in international trade.

- To contribute to the development of developing countries.

WTO and developing countries:

- The WTO classifies nations into developed, developing, and least developed countries (LDCs).

- The terms “developed” and “developing” countries are not defined by the WTO.

- The members declare themselves whether their countries are “developed” or “developing.”

- However, other members have the right to challenge the member’s choice to use a provision that is available to developing nations.

- Like IMF and World Bank where a system of weighted voting exists, in WTO also each country has an equal vote. WTO agreements require consensus.

- The Developing Country status comes with certain rights. The status ensures special and differentiating treatment (S&DT).

GI Tag for Cumbum Grapes

17, Apr 2023

Why in News?

- Tamil Nadu’s famous Cumbum Panneer Thratchai, also known as Cumbum grapes recently earned the Geographical Indication (GI) tag.

About the Cumbum grapes:

- The Cumbum Valley located at the Western Ghats in Tamil Nadu is known as the ‘Grapes City of South India’ and cultivates the Panneer Thratchai.

- This variety, also known as Muscat Hamburg, is popular for its quick growth and early maturity, ensuring that the crop is available in the market almost throughout the year.

- The Panneer grapes were first introduced in Tamil Nadu by a French priest in 1832 and are rich in vitamins, tartaric acid and antioxidants and reduce the risk of some chronic diseases.

- They are also known for a superior taste apart from the purplish brown-colour.

What is GI Tag?

- A GI or Geographical Indication is a name or a sign given to certain products that relate to a specific geographical location or origins like a region, town or country.

- Using Geographical Indications may be regarded as a certification that the particular product is produced as per traditional methods, has certain specific qualities, or has a particular reputation because of its geographical origin.

- Geographical indications are typically used for wine and spirit drinks, foodstuffs, agricultural products, handicrafts, and industrial products.

- GI Tag ensures that none other than those registered as authorized users are allowed to use the popular product name.

- In order to function as a GI, a sign must identify a product as originating in a given place.

Who accords and regulates Geographical Indications?

- Geographical Indications are covered as a component of intellectual property rights (IPRs) under the Paris Convention for the Protection of Industrial Property.

- At the International level, GI is governed by the World Trade Organisation’s (WTO’s) Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In India, Geographical Indications registration is administered by the Geographical Indications of Goods (Registration and Protection) Act, 1999 which came into force with effect from September 2003.

- The first product in India to be accorded with GI tag was Darjeeling tea in the year 2004-05.

What are the Benefits of GI Tags?

- The Geographical Indication registration confers the following benefits:

- Legal protection to the products

- Prevents unauthorised use of GI tag products by others

- It helps consumers to get quality products of desired traits and is assured of authenticity.

- Promotes the economic prosperity of producers of GI tag goods by enhancing their demand in national and international markets.

What are the Significances of GI Tags?

- A geographical indication right facilitates those who have the right to use the indication to prohibit its usage by a third party whose product does not conform to the applicable standards.

- For example, in the purview in which the Darjeeling geographical indication is protected, producers of Darjeeling tea can omit the term “Darjeeling” for tea not grown in their tea gardens or not produced according to the norms set out in the code of practice for the geographical indication.

- However, a protected GI does not permit the holder to forbid someone from making a product using the same approaches as those set out in the standards for that indication.

- Protection for a GI tag is usually procured by acquiring a right over the sign that constitutes the indication.

Challenges in GI Tags:

- The special treatment to wines and spirits in TRIPS Agreement appears to be developed country centric.

- Developing countries, including India, seek the same higher level of protection for all GIs as was given under TRIPS for wines and spirits.

- The battle for GI tag between states.

- False use of geographical indications by unauthorized parties is detrimental to consumers and legitimate producers.

- Cheap Power loom saris are sold as reputed Banarsi handloom saris, harming both the producers and consumers.

- Such unfair business practices result in loss of revenue for the genuine right-holders of the GI and also misleads consumers.

- Protection of GI has, over the years, emerged as one of the most contentious IPR issues.

Way Forward:

- The benefits of GI tag are realised only when these products are effectively marketed and protected against illegal copying.

- Effective marketing and protection require quality assurance, brand creation, post-sale consumer feedback and support, prosecuting unauthorised copiers, etc.

- For internationally recognised products like Darjeeling tea, international protection is of crucial importance.

- Legal protection to GIs also extends to protection of traditional knowledge and traditional cultural expression contained in the products.

- Hence Intellectual Property is a power tool for economic development and wealth creation particularly in the developing world.

- GIs have the potential to be our growth engine. Policy-makers must pay a heed to this and give Indian GI products their true reward.

Competition (Amendment) Bill, 2022

13, Apr 2023

Why in News?

- President Droupadi Murmu has given assent to the bill to amend the competition law and the changes seek to ensure regulatory certainty and foster a trust-based business environment.

What is the Competition Act, 2002?

- The Competition Act, 2002, regulates competition in the Indian market and prohibits anti-competitive practices such as cartels, abuse of dominant market position, and mergers and acquisitions that may have an adverse effect on competition. The Act has been amended by the Competition (Amendment) Act, 2007.

- The Competition Commission of India (CCI) is responsible for implementing and enforcing the Act.

- The Competition Appellate Tribunal is a statutory body created in accordance with the Competition Act, 2002 to hear and regulate on appeals against any rules made, decisions made, or orders made by the Competition Commission of India.

- The government replaced the Competition Appellate Tribunal with the National Company Law Appellate Tribunal (NCLAT) in 2017.

What are the Amendments to the Competition Act Proposed?

Penalties for Competition Law Violations:

- The Bill amends the definition of “turnover” to include global turnover derived from all products and services by a person or an enterprise.

- The amendment allows for the imposition of penalties for competition law violations based on a company’s global turnover, rather than just its turnover in India.

Timelines for Approving Combinations:

- The Bill reduces the time limit for the CCI to form a prima facie opinion on a combination from 30 working days to 30 days.

- The change aims to speed up the process of approving mergers and acquisitions in India.

Review of Regulations:

- The Bill seeks to amend the Competition Act, 2002, to regulate mergers and acquisitions based on the value of transactions. Deals with transaction value of more than Rs 2,000 crore will require CCI’s approval.

- The Bill proposes to reduce the timeline for the CCI to pass an order on such transactions from 210 days to 150 days.

- The Bill decriminalizes certain offences under the Act by changing the nature of punishment from imposition of fine to civil penalties.

- These offences include failure to comply with orders of the CCI and directions of the Director General related to anti-competitive agreements and abuse of dominant position.

What are the Benefits of the Competition (Amendment) Bill?

- Promoting Ease of Doing Business: The amendments to the Competition Act aim to reduce regulatory hurdles and promote ease of doing business in India. The amendments are expected to provide greater clarity to businesses operating in India and reduce the compliance burden for companies.

- Enhancing Transparency: The inclusion of global turnover in the definition of “turnover” aims to enhance transparency and accountability in the Indian market. The amendment ensures that companies cannot escape penalties for competition law violations by shifting their revenue to other countries.

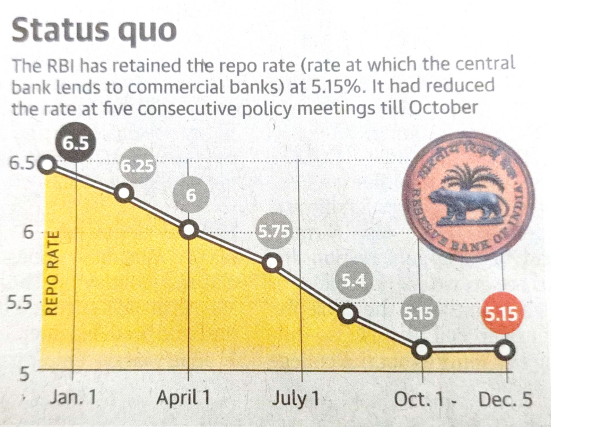

RBI’s Pause On Repo Rate Hike: Concerns Over Inflation And Global Pressures Remain

10, Apr 2023

Why in News?

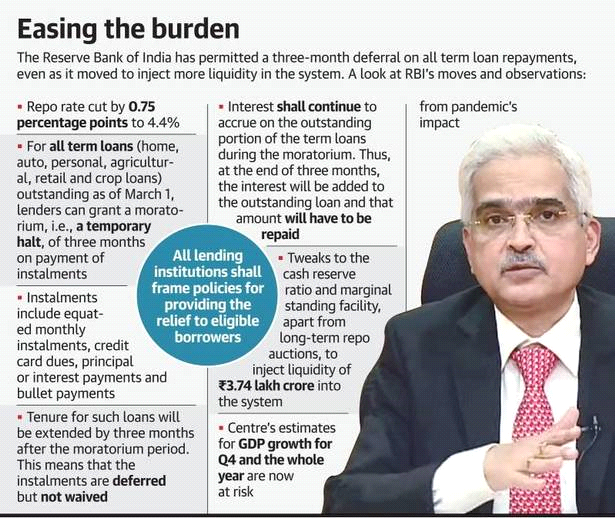

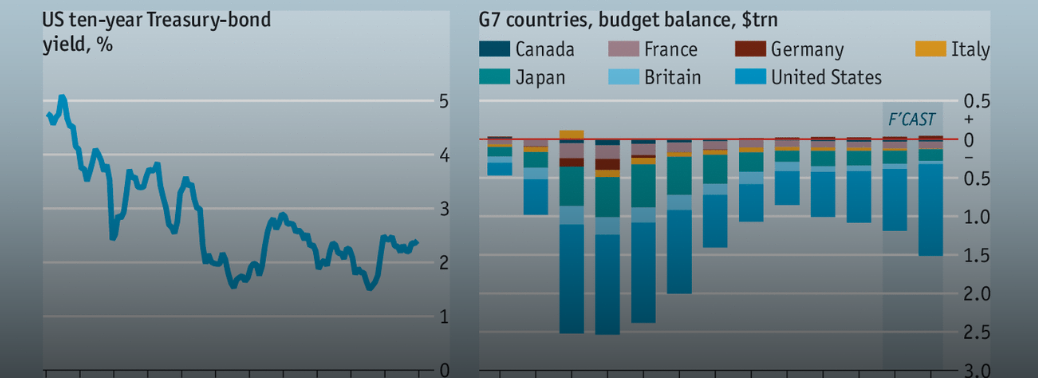

- The RBI has decided to not increase the repo rate amid continuing hikes by important central banks such as the US Federal Reserve (Fed) and European Central Bank (ECB), and domestic inflation concerns. However, if incoming data point to rising inflation risks, this decision could prove to be only a pause in the rate hiking cycle.

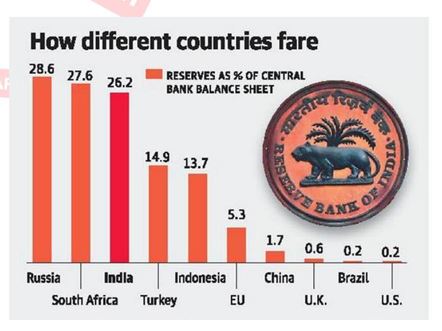

The RBI’s decision to pause on rate hikes

- The RBI feels that money market rates have effectively risen more than the 250-basis-point yank in the repo rate since May 2022, and hence it decided to pause and assess the impact of rate hikes.

- The key reason behind the MPC decision is the expectation of a decline in inflation to 5.2% in the current fiscal, driven by a healthy rabi crop, normal monsoon, moderating international commodity prices, and the impact of rate hikes.The RBI acknowledges the upside risks and stated its readiness to fight any unexpected rise in inflation.

Impact on GDP growth:

- The RBI expects GDP growth to slow to 6% from 7% this fiscal as slowing global growth, domestic interest rates, and messy geopolitics bite.

- Slowing global growth will be net negative for India’s exports, and the growing dependence on commodity exports makes India more vulnerable to global growth volatility.

- Fiscal 2024 will, therefore, test the resilience of India’s domestic demand amid rising interest rates.

Reasons for the expected cooling of consumer inflation:

- Fuel inflation expected to reduce: Fuel inflation is expected to reduce to 3% from a high of over 10% in the current fiscal because some easing of crude oil prices is likely as global growth slows down.

- Decline in core inflation: Slowing domestic growth will ease core inflation from very sticky levels of over 6% last fiscal to 5.5% in the current one. However, the decline in core inflation will be limited as input cost pressures have not dissipated. To protect their margins, firms will continue to pass on input costs to end-consumer. Services inflation will also continue to exert pressure as the rotation of consumption demand from goods to services continues.

- Moderate food inflation: Food inflation, which has a high weightage in the Consumer Price Index and has driven headline inflation in the past, is projected to moderate to slightly below 5%, assuming a normal monsoon. However, food inflation has always been volatile and carries upside risks largely because of climate-related factors affecting agriculture output and prices.

How slowing global growth will have a negative impact on India’s exports?

- The impact of the growth slowdown in the US and Europe is deeper than the recovery in China: The US and Europe have a combined GDP that is twice that of China. Therefore, the impact of the growth slowdown in the US and Europe will be deeper than the recovery in China. This will have a negative impact on India’s exports to the US and Europe.

- India’s exports to the US and Europe are more than to China by a factor of six: India exports more to the US and Europe than to China by a factor of six. Therefore, the negative impact of the growth slowdown in the US and Europe will be felt more by India than by China.

- India’s growing dependence on commodity exports makes it more vulnerable to global growth volatility: India’s exports of petroleum products and steel are growing, and this makes India more vulnerable to global growth volatility. As global growth slows down, demand for commodities is likely to decline, which will have a negative impact on India’s exports.

External vulnerabilities

- India’s external vulnerability is expected to decline with a narrower current account deficit (CAD) and modest short-term external debt.

- The CAD is expected to narrow to 2% of GDP this fiscal from an estimated 2.5% last fiscal.

Conclusion:

- The RBI’s decision to pause on rate hikes is driven by expectations of a decline in inflation. However, inflation risks remain, and the impact of rate hikes on GDP growth is expected to be significant. India’s external vulnerabilities are expected to decline, but the banking turmoil playing out amid interest rate hikes by important central banks and elevated debt levels remains a risk. The RBI’s decision to pause on rate hikes will be closely watched, and further rate hikes may be necessary if inflation risks persist.

The NPCI’s new circular on levy charges

07, Apr 2023

Why in News?

- The National Payments Corporation of India (NPCI), which governs the Unified Payment Interface (UPI), directed the banks that they can now levy charges on merchant transactions made via Prepaid Instrument wallets using UPI.

- As these directions by NPCI got leaked to the media, the NPCI clarified that the usual bank-to-bank UPI transactions would not be charged and that customers will not have to pay for transactions made via Prepaid Payment Instruments (PPI) on UPI.

- NPCI clarified that the new interchange charges are only applicable for PPI merchant transactions.

Prepaid Payment Instruments (PPIs)

- Prepaid Payment Instruments (PPIs) are a type of payment method that is used to purchase various goods and services as well as send or receive money by using the stored value in the wallet.

- Under the PPI mode of transaction, the users must pre-load the digital wallet with a desired amount by using cash, or debit to a bank account, by credit/debit cards, or UPI.

- PPIs can be in the form of mobile wallets, vouchers, secure tokens, physical smart cards, or any other form that allows access to prepaid funds.

- The most prevalent form of PPI used in India at present is the mobile wallet.

- It is to be noted that PPIs can only be used in Indian rupees.

PPI interoperability

- Earlier, in order to use PPI at any merchant, it was mandatory for the respective merchant to be engaged directly by the specific PPI issuer (specific network).

- The PPIs with which the merchant did not have a direct tie-up used to get rejected.

- This provision restricted the customers of one specific mobile wallet to use the money in the wallet only at those merchant locations which had a direct tie-up with the same PPI wallet provider.

- e. if a customer had a Paytm wallet, he/she could only use the money in the wallet for making payments to those merchants who accepted Paytm QR codes.

- The RBI has now mandated interoperability among different PPI wallet providers to address the issues associated with this limitation of PPIs.

- The PPI issuers have now tied up with NPCI for issuing interoperable RuPay PPI cards and for developing interoperable wallets on UPI rails.

- PPIs in the form of mobile wallets can now be linked to UPI which creates interoperable wallets on UPI rails.

The working of PPI interoperability through UPI

- Linking one’s PPI wallet to UPI would enable individuals to transact using the Scan and Pay option on all UPI interoperable QR codes and facilitate the use of PPI wallets at all merchant locations.

- With the help of PPI interoperability, individuals can also send or receive money to any other wallet user.

- Likewise, a merchant with any UPI QR code would be able to accept payments from any PPI issuer or mobile wallet.

- PPI on UPI is expected to increase the incidence of merchant transactions in rural areas and enhance digital financial inclusion by catering to services such as healthcare, education, utility bills, transit, etc.

Charges associated with wallet transactions on UPI

- The PPI-enabled merchants were already paying charges to the PPI issuer for the acceptance of mobile wallets or prepaid cards.

- With the latest changes, the charges are now aligned at a network level with some standardisation.

- From April 1, 2023, an interchange fee of up to 1.1% would be levied on transactions made using PPIs such as gift cards, wallets, etc. for transactions on UPI.

- However, the charges are applicable if the transaction is more than ₹2,000.

- Further, it is clarified no charges are applicable if the merchant is accepting UPI payments from a customer’s bank account as the charges are only applicable if the merchant accepts transactions made using PPI wallet.

- Officially there are no charges to be paid by the customers. However, merchants could pass on the burden to customers in the form of price increases or other such means.

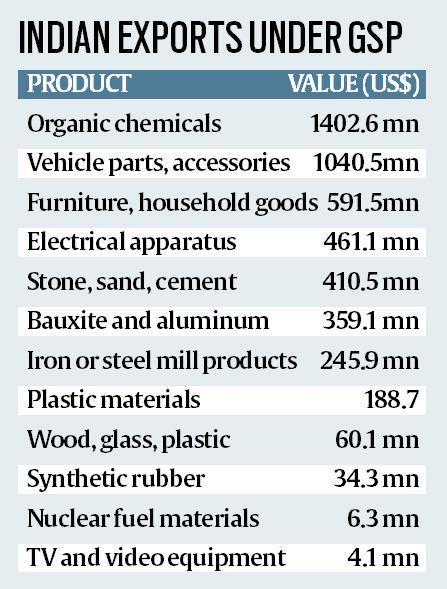

Foreign Trade Policy 2023: India Needs To Adopt 21st-century Trade Policy Instruments

06, Apr 2023

Why in News?

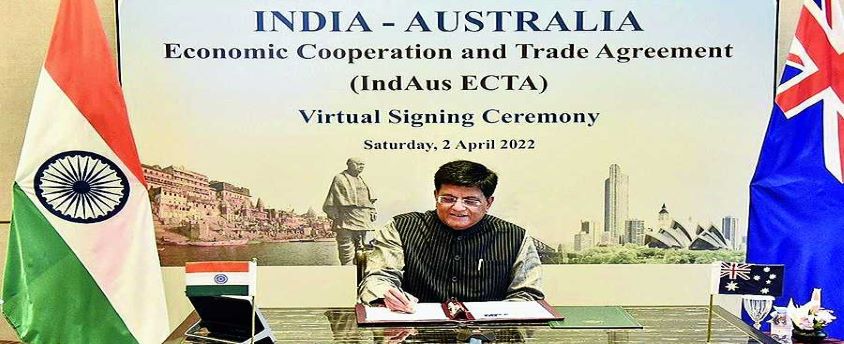

- The Foreign Trade Policy 2023 (FTP 2023) has been recently introduced, but it falls short of addressing the challenges that Indian exporters are likely to face in the global market. India needs to adopt 21st-century trade policy instruments such as product and process standards to improve the quality and efficiency of products.

Foreign Trade Policy, 2023:

- The policy is dynamic and open-ended to accommodate the emerging needs of the time.

- It aims to promote India’s overall exports, which has already crossed US$ 750 Billion.

- The key approach to the policy is based on these 4 pillars:

- Incentive to Remission,

- Export promotion through collaboration – Exporters, States, Districts, Indian Missions,

- Ease of doing business, reduction in transaction cost and e-initiatives and

- Emerging Areas – E-Commerce Developing Districts as Export Hubs and streamlining SCOMET (Special Chemicals, Organisms, Materials, Equipment, and Technologies) Policy

FTP 2023’s inadequate focus on 21st-century trade policy instruments

- 20th-century mindset: The FTP 2023’s primary focus is on regulating, prohibiting, and restricting trade, which is a 20th-century mindset. In contrast, most countries today rely on improving product quality and production efficiencies by rapidly infusing technology to expand their presence in global markets.

- Focus on upgrading the current standards: India needs to focus on upgrading institutions, production facilities, and promoting the development and facilitation of trade to meet the current standards.

Rejigging of export promotion schemes:

- Export promotion schemes: Export promotion schemes were modified after a WTO dispute settlement panel ruled against India in 2019, which found that these schemes provide export subsidies that are not allowed under WTO rules.

- Remission of Duties: The Remission of Duties or Taxes on Export Products (RoDTEP) Scheme was launched in 2021 to neutralize the effect of taxes and duties included in exported goods. The Rajya Sabha’s Standing Committee on Commerce found several weaknesses in the scheme, and FTP 2023 should have responded to the recommendations.

Developing districts as export hubs

- FTP 2023 introduces the novel idea of developing districts as export hubs, which could help achieve the objective of balanced regional development.

- However, the policy only speaks of setting up export promotion committees at the district and state/UT levels, with no mention of supporting efficient infrastructure.

E-commerce and India’s readiness to engage in the WTO:

- E-commerce is a focus area of FTP 2023, but India has opposed discussions on extending the rules of the WTO in this area.

- Moreover, advanced countries have been seeking data portability, which India has refused to accept.

- It remains unclear whether the mention of e-commerce in FTP 2023 implies that India is ready to engage in the WTO on this matter.

Conclusion:

- FTP 2023 falls short of addressing the challenges that Indian exporters are likely to face in the global market.

- It needs to focus on upgrading institutions, production facilities, and promoting the development and facilitation of trade, which requires the Directorate General of Foreign Trade (DGFT) to coordinate with all the standard-setting agencies of the government and relevant institutions in the private sector.

- Developing districts as export hubs could help achieve the objective of balanced regional development, but supporting efficient infrastructure is critical for the programme’s success.

In controlled digital lending, the issue of public interest

06, Apr 2023

Why in News?

- There was a legal tussle in the United States regarding the development of a globally accessible digital library.

Highlights:

- The four major publishers in the USA and Internet Archive (IA), a non-profit organization that is building a globally accessible digital library are engaged in a legal tussle.

- The incident has once again brought to the fore the issue of copyright law and technological advancements.

- It raises the question of “Whether copyright law should protect the public interests or the commercial interests of the copyright holders?”

Internet Archive:

- It is an American digital library to access information, especially for persons with disabilities.

- It is also a non-profit organization that advocates free and open Internet.

- It has archived approximately 735 billion web pages, 41 million books and texts, 14.7 million audio recordings, 8.4 million videos, 4.4 million images, and around 890000 software programs.

Legal Dispute:

- It has been alleged by the publishers that nearly 3.6 million books made available by the IA for borrowing are copyrighted.

- It is argued by the publishers that IA violated the rights provided under copyright law for 127 titles published by them.

- The publishers are especially concerned about the ‘National Emergency Library’, which was established at the peak of the Covid-19 pandemic.

- However, IA rebutted by highlighting that books under copyright protection are lent to the users in a regulated manner through ‘Controlled Digital Lending’ (CDL).

- IA also highlighted that through the CDL route, the sales of print and electronic copies from the publisher’s preferred platforms were not hampered.

- The district court for the Southern District of New York ruled that the activities of IA have violated several rights of publishers under copyright law.

- Furthermore, they do not constitute ‘fair use’ under the same law.

- The court concluded that the benefits provided by IA “cannot outweigh the market harm to the publishers.”

- It is argued that the court ignored the judgment of the U.S. Supreme Court in the Google LLC vs Oracle America, Inc. case (2021).

- It was directed that it is important to consider the public benefits of copying while analyzing potential financial losses for copyright holders.

Controlled Digital Lending:

- Under Controlled Digital Lending (CDL), IA avails one digital copy of each non-circulating print book it has stored. It then lends it like the physical library (i.e. lending one owned copy to one person at a time).

- Moreover, it counts one copy per library (from libraries participating in the digitization process), irrespective of the number of physical copies.

- It is found that lending books from libraries physically is on the decline. This was further hampered by the pandemic.

- However, it should be noted that the number of readers has not gone down, instead, they prefer reading on tablets and mobile phones.

CDL has various advantages:

- It bridges the gap between privileged and unprivileged readers and urban and rural readers.

- It increases the accessibility of books, even to the remotest locations.

- They also provide books that have gone out of print.

- It invokes benefits for education, research, and cultural participation.

India’s Scenario:

- Currently, India has no major CDL initiative. However, it is speculated that there can be CDL in the future as digitization projects in India have also begun (for example, the NLSIU initiative).

Conclusion:

- The case can have serious implications in other countries also.

- It is said that even the current lending process can be threatened if economic interests are prioritized over the public interest.

- It should be realized that the copyright system should not only protect the rights of copyright holders but also the interests of the users of copyrighted works.

NCLAT upholds penalty on Google

01, Apr 2023

Why in News?

- The National Company Law Appellate Tribunal (NCLAT) has recently upheld the ₹1,337 crore fine imposed on Google by the Competition Commission of India (CCI).

- While holding that the CCI investigation did not violate principles of natural justice, the tribunal set aside certain directions issued by the CCI.

About the News:

- The court quashed the directions relating to the non-monetary directives that would have forced the tech giant to allow uninstalling of Google’s pre-installed apps on Android devices.

- The Tribunal also set aside directives that would have forced the company to allow developers of app stores to distribute their app store through Google Play Store.

- Additionally, the Tribunal also set aside orders directing Google to allow app developers to distribute apps through side-loading, and not deny access to its play services Application Programming Interface (APIs) to disadvantage Original Equipment Manufacturers, app developers, and its existing or potential competitors.

What’s the issue?

- CCI found that Google was dominant in the relevant market for licensable smart TV device operating systems in India.

- It also said that prima facie mandatory pre-installation of all the Google applications under Television App Distribution Agreement (TADA) amounts to imposition of unfair conditions on the smart TV device manufacturers.

- This is in contravention of Section 4(2)(a) of the Competition Act.

- So, CCI imposed a penalty on Google for “abusing its dominant position” in markets related to the Android mobile device ecosystem. Google filed an appeal with the NCLAT against the CCI order which was declined by NCLAT.

- Section 4 of the Act pertains to abuse of dominant position.

About Competition Commission Of India:

- The Competition Commission of India (CCI) was established under the Competition Act, 2002 for the administration, implementation and enforcement of the Act, and was duly constituted in March 2009. Chairman and members are appointed by the central government.

Functions of the commission:

- It is the duty of the Commission to eliminate practices having adverse effect on competition, promote and sustain competition, protect the interests of consumers and ensure freedom of trade in the markets of India.

- The Commission is also required to give opinion on competition issues on a reference received from a statutory authority established under any law and to undertake competition advocacy, create public awareness and impart training on competition issues.

About the Competition Act:

- The Monopolies and Restrictive Trade Practices Act, 1969 (MRTP Act) was repealed and replaced by the Competition Act, 2002, on the recommendations of Raghavan committee.

- The Competition Act, 2002, as amended by the Competition (Amendment) Act, 2007, prohibits anti-competitive agreements, abuse of dominant position by enterprises and regulates combinations (acquisition, acquiring of control and M&A), which causes or likely to cause an appreciable adverse effect on competition within India.

Why did India reject J&J’s patent on TB drug?

28, Mar 2023

Why in News?

- An application by Johnson & Johnson (J&J) to extend its patent on the drug Bedaquiline beyond July 2023 was rejected by the Indian Patent office.

- Bedaquiline is used to treat drug-resistant TB.

- This would allow drug manufacturers to produce generic versions of Bedaquiline and make it more affordable.

- It would help in achieving India’s goal of eliminating TB by 2025.

Drug-resistant TB and its treatment:

- India accounts for almost one-fourth of the world’s burden of multi-drug-resistant (MDR) TB and extensively-drug-resistant (XDR) TB (as per 2017 findings).

- MDR TB resists treatment by at least two frontline drugs namely isoniazid and rifampicin.

- XDR TB resists treatment by isoniazid, rifampicin, fluoroquinolones, and any second-line injectable drug. There were approximately 2650 cases of XDR TB in 2017.

- It was found that in 2021, there were about 124000 cases of MDR TB in India.

- Despite the reduction of TB incidence in India, MDR and XDR TB endanger the efforts to locally eradicate the disease.

- Moreover, the COVID-19 pandemic has severely affected the treatment of the disease for two years due to supply chain disruption, inaccessibility of drugs, and shortage of healthcare workers.

- TB can be treated by strictly adhering to the drug doses. Deviation from the drug schedule might result in making the bacteria drug-resistant.

- A drug-resistant TB is harder to treat. The World Health Organization, in 2018, replaced two injectable drugs for MDR TB with an oral regimen comprising Bedaquiline.

BEDAQUILINE:

- It should be noted that second-line treatment options are mostly injected and can have severe side effects such as hearing loss. Bedaquiline is available in tablet form and is less harmful.However, it was found that it might have an impact on the heart and liver and thus it is recommended as a treatment of last resort.

- As per the guidelines prescribed by the Ministry of Health and Family Welfare, Bedaquiline should be used as part of the Programmatic Management of MDR TB under the National TB Elimination Programme.

Details about the rejection of patent treatment:

- The patent application of J&J was for a fumarate salt of a compound to produce Bedaquiline tablets.

- The application was opposed on the ground as the method used to produce a “solid pharmaceutical composition” of Bedaquiline is “obvious” and does not require an “inventive step”.

- The Indian Patent Act 1970 Section 2(1)(ja) describes an ‘inventive step’ to be an invention that is “not obvious to a person skilled in the art”.

- It was also argued that the current application was significantly based on the previous patent(WO 2004/011436). It is similar to the compound discussed in 2002.

- The opposing groups also highlighted the act of ‘evergreening’, which is disallowed in India.Evergreening is a method in which patent-owner continuously extends their rights and/or apply multiple patents for the same product.

- The Patent Office rejected the application on these grounds. It also referred to Sections 3d and 3e of the Act. Check inpatient alcohol rehab.

Consequences of the rejection of patent application:

- J&J’s patent on Bedaquiline resulted in the cost of the drug being $400 per person.

- The rejection of the application will reduce the cost of the drug by 80%.

- After July 2023, other manufacturers of generic drugs can produce generic versions of Bedaquiline.

India’s Foreign Trade Policy set to be revised from April 1

16, Mar 2023

Why in News?

- The revision of India’s Foreign Trade Policy, which has been unchanged since 2015 and due for three years, may finally be announced by the end of this month.

What is a Foreign Trade Policy?

- India’s Foreign Trade Policy (FTP) is a set of guidelines for goods and services imported and exported.

- These are developed by the Directorate General of Foreign Trade (DGFT), the Ministry of Commerce and Industry’s regulating body for the promotion and facilitation of exports and imports.

- FTPs are enforceable under the Foreign Trade Development and Regulation Act 1992.

What is India’s Foreign Trade Policy?

- In line with the ‘Make in India,’ ‘Digital India,’ ‘Skill India,’ ‘Startup India,’ and ‘Ease of Doing Business initiatives, the Foreign Trade Policy (2015-20) was launched on April 1, 2015.

- It provides a framework for increasing exports of goods and services, creating jobs, and increasing value addition in the country.

- The FTP statement outlines the market and product strategy as well as the steps needed to promote trade, expand infrastructure, and improve the entire trade ecosystem.

- It aims to help India respond to external problems while staying on top of fast-changing international trading infrastructure and to make trade a major contributor to the country’s economic growth and development.

Issues with FTP (2015-2020)

- Acting on Washington’s protest, a WTO dispute settlement panel ruled in 2019 that India’s export subsidy measures are in violation of WTO norms and must be repealed.

- Tax incentives under the popular Merchandise Exports from India Scheme (MEIS) (now renamed as RODTEP Scheme)and Service Exports from India Scheme (SEIS) programmes were among them.

- The panel found that because India’s per capita gross national product exceeds $1,000 per year, it may no longer grant subsidies based on export performance.

Why such a delay in Foreign Trade Policy?

- Geopolitical uncertainty: The geo-political situation is not suitable for long-term foreign trade policy, said Union Commerce Minister.

- Global recession: Currently, fears of a recession in major economies like the US and Europe have escalated a panic among investors.

- Decline in USD inflows: Foreign investors have begun to pull back their money from equities.

- Rupee depreciation: The US Dollar is at a 22-year high, while the Rupee hit a new all-time low of $81.6.

- Huge trade deficit: The trade deficit widened by more than 2-folds to $125.22 billion (April – August 2022) compared to $53.78 billion in the same period last year.

Explained: Silicon Valley Bank (SVB) Crisis

15, Mar 2023

Why in News?

- The shutdown and takeover of Silicon Valley Bank (SVB) by US regulators has raised questions on how it impacts India’s startup industry. It was an important partner for the global startup economy.

Silicon Valley Bank (SVB):

- It is a financial institution that provides banking services to the technology industry and venture capital firms.

- Founded in 1983, it has since become the go-to bank for startups and entrepreneurs in Silicon Valley and beyond.

- It is unique in that it understands the specific needs and challenges of the tech industry, and provides a range of services that cater to startups, including loans, deposits, and investment management.

- It has become a critical player in the startup ecosystem, providing funding and financial services to many of the world’s most successful startups, including Tesla, Uber, and LinkedIn.

What is SVB crisis?

- SVB Financial Group runs one of the largest American commercial banks – Silicon Valley Bank.

- Last week, it had announced a $1.75 billion share sale programme to further strengthen its balance sheet.

- This programme triggered a massive sell-off in the group’s shares.

- Thereafter, market went severely bearish and bear rampage wiped out over $80 billion of its market value.

- Alongside, the bond prices of the group collapsed and created a panic in the market.

Reasons for SVB’s downfall

- Downturn of tech stocks: The bank was hit hard by the downturn in technology stocks over the past year as well as the Federal Reserve’s aggressive plan to increase interest rates to combat inflation.

- Lower bond yield due to lower interest rates: SVB bought billions of dollars’ worth of bonds over the past couple of years, using customers’ deposits as a typical bank would normally operate.

- Mostly startups account holders: SVB’s customers were largely startups and other tech-centric companies that started becoming needier for cash over the past year.

- Drying VC funding: Venture capital funding was drying up, companies were not able to get additional rounds of funding for unprofitable businesses.

- Fear over deposit insurance: Since its customers were largely businesses and the wealthy, they likely were more fearful of a bank failure since their deposits were over $250,000, which is the government-imposed limit on deposit insurance.

Immediate effects of SVB’s failure:

- Startups scramble: Many startups and other companies that relied on the bank’s services were suddenly left without access to their funds, which caused financial strain and uncertainty for these businesses.

- Ripple effect: They now fear that they might have to pause projects or lay off or furlough employees until they could access their funds.

Major implications for SVB:

- There are two large problems remaining with Silicon Valley Bank-

- Huge uninsured deposits: The vast majority of these were uninsured due to it’s largely startup and wealthy customer base.

- No scope for asset reconstruction: There is no potential buyer of Silicon Valley Bank.

Could this lead to a repeat of what happened in 2008?

- No probability: At the moment, experts do not expect any issues to spread to the broader banking sector.

- Diversified customer bases: Other banks are far more diversified across multiple industries, customer bases and geographies.

Impact on Indian startups:

- Uncertainty over deposits: The failure of SVB is likely to have a ripple effect on Indian startups, many of which have significant amounts of funds deposited with the bank.

- Hamper the funding: SVB has been a major player in the Indian startup ecosystem, providing banking services and funding to many of the country’s most successful startups, including Flipkart, Ola, and Zomato.

- Ripple effect: This could lead to a cash crunch for many companies, which may be forced to cut costs, delay projects, or lay off employees.

- Reduce global footprints: SVB has also been instrumental in helping Indian startups expand into the US market, by providing them with the necessary infrastructure and support to set up operations in Silicon Valley.

How can Indian startups mitigate the impact of SVB’s failure?

Diversify banking relations: Indian startups that have funds deposited with SVB may want to consider diversifying their banking relationships to reduce their exposure to any one bank.

- Alternative financing: This may involve opening accounts with multiple banks, or exploring alternative banking services such as digital banks or fintech startups.

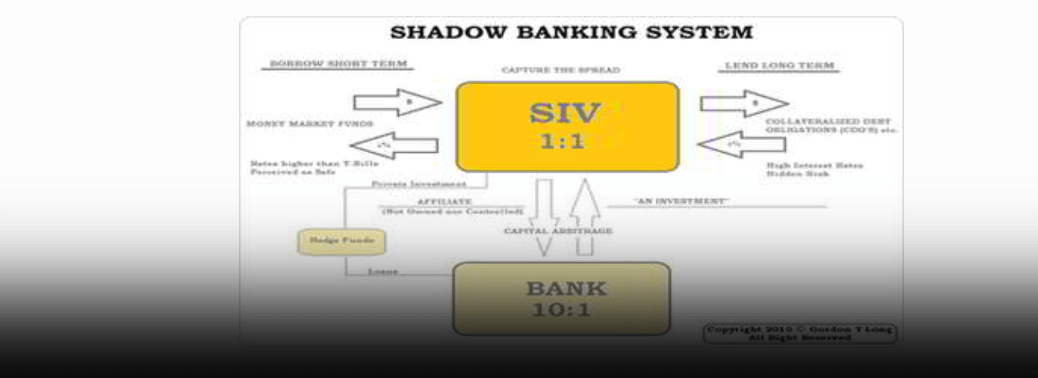

2008 Financial Crisis:

- The bankruptcy of Lehman Brothers was a key event in the 2008 financial crisis.Lehman Brothers was one of the largest investment banks in the world, with assets of around $600 billion. However, the firm had invested heavily in the US housing market, and when the housing market began to decline in 2007, Lehman’s investments began to lose value.

- In addition, the firm had taken on a large amount of debt to finance its investments and operations.As the value of Lehman’s assets declined and its debt levels increased, the firm became insolvent and was unable to meet its obligations to creditors.In September 2008, Lehman Brothers filed for bankruptcy, triggering a financial panic and market turmoil.

Its impact:

- The Lehman crisis had far-reaching consequences, including the collapse of other financial institutions, a global recession, and widespread economic and social hardship.The crisis highlighted the risks of excessive leverage and the interconnectedness of financial institutions, and led to significant reforms in financial regulation and risk management practices.

Failure of Silicon Valley Bank

13, Mar 2023

Why in News?

- On March 10,2023, Silicon Valley Bank became the largest bank to fail since the 2008 financial crisis.

- The California Department of Financial Protection and Innovation shut down Silicon Valley Bank.

- The move put nearly $175 billion in customer deposits under the control of the Federal Deposit Insurance Corp (FDIC).

- The FDIC created a new bank to hold the deposits and other assets of the failed one.

Reasons behind Bank’s Failure:

- SVB’s downfall can be attributed to a bank run, which is when a large number of depositors withdraw their funds from a bank all at once, typically due to fears of the bank’s insolvency.

- In SVB’s case, the bank was largely affected by the downturn in technology stocks over the past year as well as the Federal Reserve’s aggressive plan to increase interest rates to combat inflation.

- SVB bought billions of dollars’ worth of bonds over the past couple of years, using customers’ deposits.

- The value of those investments fell because they paid lower interest rates than what a comparable bond would pay if issued in today’s higher interest rate environment.

- SVB’s customers were largely startups and other tech-centric companies that started becoming more needy for cash over the past year. Venture capital funding was drying up, companies were not able to get additional rounds of funding for unprofitable businesses who then began to withdraw their money.

- To pay those requests, Silicon Valley Bank was forced to sell off some of its investments at a time when their value had declined.

- To fund the redemptions, Silicon Valley Bank on March 08,2023 sold a $21 billion bond portfolio consisting mostly of U.S. Treasuries.

- SVB’s decision to sell $2.25 billion in common equity and preferred convertible stock to fill its funding resulted in decline of share price by 60%, as investors believed that the deposit withdrawals may push it to raise even more capital.

- Several SVB clients pulled their money from the bank which spooked investors such as that SVB had lined up for the stock sale, and the capital raising effort collapsed resulting in the failure of the bank.

Effects of Silicon Valley Bank’s failure on India:

- SVB has been a major player in the Indian startup ecosystem, providing banking services and funding to many of the country’s most successful startups, including Flipkart, Ola, and Zomato.The closure has sent shock waves in the Indian startups’ sector, which was already facing a funding problem.

- It will also dent the fundraising ability of Indian startups as the US-based bank was a key source of funding for tech startups.

- This could lead to a cash crunch for many companies, which may be forced to cut costs, delay projects, or lay off employees.SVB has also been instrumental in helping Indian startups expand into the US market, by providing them with the necessary infrastructure and support to set up operations in Silicon Valley.

Second leg of Budget Session

13, Mar 2023

Why in News?

- The second leg of the Budget session will commence on March 13, 2023 with the government asserting that its priority is to pass the Finance Bill.

What is Budget?

- Annual Financial Statement is a documents presented to the Parliament in every financial year as a part of the Budget Process under Article 112 of the constitution of India.

- This document comprises the receipts and expenditures of the government of current year, previous year and budget year in three separate parts viz.

- Consolidated Fund of India, Contingency Fund of India and Public Account of India. The government has to present a statement of receipts and expenditure for each of these funds.

- Capital receipt comprises of loans raised by the Government, borrowing from the Reserve Bank of India and loans taken from foreign Governments/institutions.

- It also embraces recoveries of loans advanced by the Government and sale proceeds of government assets, including those realized from divestment of Government equity in PSUs.

Difference between Annual Financial Statement and Budget:

- The term budget is used for several documents together including the Annual Financial Statement. The other documents in budget include Demands for Grants (DG); Appropriation Bill; Finance Bill; Memorandum Explaining the Provisions in the Finance Bill; Macro-Economic Framework Statement; Fiscal Policy Strategy Statement; Medium Term Fiscal Policy Statement; Medium Term Expenditure Framework Statement etc.

- However, Annual Financial Statement distinguishes the expenditure on revenue account from the expenditure on other accounts, as is mandated in the Constitution of India. The Revenue and the Capital sections together, therefore make the Union Budget and that is why, Annual Financial Statements is essentially the Budget of the Government.

Budget Pre Independence:

- Budget was introduced on 7 April 1860 by the East India Company to the British Crown. It was presented by a Scottish Economist and politician James Wilson.

- For the first 30 years, the Budget didn’t have the word infrastructure. It was introduced in the Budget in the 1900s.

Budget Post Independence:

- First Union Budget of Independent India: It was introduced on 26 November 1947. It was present by the first Finance Minister R.K. Shanmukham Chetty. However, it was a review of the Indian economy and no new taxes were proposed. It is to be noted that almost 46% of the Budget or Rs. 92.74 crores were allocated for defence services department.

- Printing of Budget: The Budget was leaked in 1950, following which the government shifted the printing of budget from Rashtrapati Bhawan to a press at Minto Road. In 1980, it was shifted to a government press in North Block.

- Introduction of Hindi: Till 1955, the Budget was presented only in the English language. However, from 1955-56, the Budget documents are printed both in English and Hindi.

- First Prime Minister to present the Union Budget: Former Prime Minister Jawaharlal Nehru was the first PM to present the Union Budget for the FY 1958-1959. The Union Budget is usually presented by the Finance Minister. Other than Jawaharlal Nehru, Indira Gandhi and Rajiv Gandhi were the only Prime Ministers to have presented the Budget in their respective administration.

- First Woman to present the Union Budget: Former Prime Minister Indira Gandhi was the first woman to present the Union Budget for the FY 1970-71. On 5 July 2019, Finance Minister Nirmala Sitharaman became the first full-time woman Finance Minister on India.

- Maximum Union Budgets by a Minister: Former Finance Minister Moraji Desai presented the Union Budget a record 10 times, followed by former FM P. Chidambaram (9), former FM Pranab Mukherjee (8), former FM Yashwant Sinha (8), and former FM Manmohan Singh (6)

- Black Budget: For the FY 1973-74, the Budget was presented by the then Finance Minister Yashwantrao B. Chavan and is called as ‘Black Budget’ due to high budget deficit of Rs 550 crores– the maximum until that time. The Budget followed the Indo-Pak war of 1971 and failed the monsoon season.

- The Epochal Budget: The Budget presented by the then Finance Minister Manmohan Singh for the FY 1991-92 is known as ‘The Epochal Budget’– a budget that changed India forever as it marked the economic liberalisation of the nation.

- Dream Budget: The Budget presented by the then Finance Minister P. Chidambaram for the FY 1997-98 is known as ‘Dream Budget’ as it proposed to lower the tax slabs of personal and corporate taxes.

- The Millennium Budget: The Budget presented by the then Finance Minister Yashwant Sinha for the FY 2000-01 is known as ‘The Millennium Budget’– revolutionised India’s IT sector.

- Change in time: In the year 2001, Finance Minister Yashwant Sinha changed the time for the presentation of Union Budget from 5 p.m. to 11 a.m. on the last working day of February.

- Merging of Budgets and Change in date: In the year 2017, the Rail Budget was merged with the Union Budget. Also, since the said year, the Budget has been presented on 1 February following the changes introduced by the then Finance Minister Arun Jaitley.

- Gift Tax: Former Prime Minister Jawaharlal Nehru introduced the Gift Tax in the FY 1958-1959 Budget to make tax evasion more difficult.

- Goods and Services Tax: On 28 February 2006, Goods and Services Tax was introduced by the then Finance Minister P. Chidambaram in the Budget.

- Longest Budget speech: Former Finance Minister Arun Jaitley holds the record for delivering the longest Budget speech in 2014– 2.5 hours.

- Bahi Khata instead of a briefcase: In the year 2019, Finance Minister Nirmala Sitharaman replaced the standard Budget briefcase with the traditional ‘Bahi Khata’ with the National Emblem.

- Paperless Budget: For the first time in Independent India’s history, the Budget for the FY 2021-22 wass paperless.

Budgeting process in India:

- The procedure for presentation of the Budget in and its passing by Lok Sabha is as laid down in articles 112—117 of the Constitution of India, Rules 204—221 and 331-E of the Rules of Procedure and Conduct of Business in Lok Sabha and Direction 19-B of Directions by the Speaker.

- The Budget goes through six stages:

- Presentation of Budget.

- General discussion.

- Scrutiny by Departmental Committees.

- Voting on Demands for Grants.

- Passing of Appropriation Bill.

- Passing of Finance Bill.

Presentation:

- The Budget is presented to Lok Sabha on such day as the President may direct.

- Immediately after the presentation of the Budget, the following three statements under the Fiscal Responsibility and Budget Management Act, 2003 are also laid on the Table of Lok Sabha:

- The Medium-Term Fiscal Policy Statement;

- The Fiscal Policy Strategy Statement; and

- The Macro Economic Framework Statement.

India close to Hindu Rate of Growth: Raghuram Rajan

10, Mar 2023

Why in News?

- Former RBI Governor Raghuram Rajan has warned that India is “dangerously close to the Hindu rate of growth”.

What is Hindu Rate of Growth?

- The “Hindu Rate of Growth” is a term used to describe the slow growth rate of the Indian economy between the 1950s and the 1980s.

- It was coined by the Indian economist Raj Krishna in the 1970s.

- During this period, the Indian economy grew at an average rate of around 3.5% per year, which was much lower than other developing countries like South Korea, Taiwan, and Hong Kong.

- The term is considered controversial as it suggests that the slow growth rate was a result of cultural or religious factors rather than economic policies and structural issues.

- However, the term is still used in academic and policy discussions to refer to the slow growth of the Indian economy during this period.

Features of Hindu Rate of Growth:

- The then features which led to the coining of this term were-

- Low GDP growth rate: The term refers to the period from the 1950s to the 1980s when India’s economy grew at an average rate of around 3.5% per year, which was much lower than other developing countries.

- Slow Industrialization: The industrial sector was dominated by a few public sector companies, and the private sector was heavily regulated.

- Stagnant Agriculture: There was little investment in agriculture, and the sector was not given much priority in government policies.

- License Raj: India had a socialist economic model with heavy government regulation. The License Raj system required permits and licenses for businesses, creating a bureaucratic and corrupt system that hindered innovation and entrepreneurship.

- Import Substitution: India followed a policy of import substitution, where the government tried to develop domestic industries by protecting them from foreign competition.

- This led to a lack of competition, low quality of products, and high prices.

- Inefficient Public Sector: The public sector dominated the economy, but it was inefficient, unproductive, and plagued by corruption. Public sector companies were often overstaffed and poorly managed, resulting in low productivity.

- Lack of Foreign Investment: India was not attractive to foreign investors during this period, and there was little foreign investment in the economy. The government imposed strict controls on foreign investment, and the regulatory environment was not conducive to foreign investment.

Concerns flagged by Rajan:

- Rajan noted that India’s economic growth rate had been declining even before the COVID-19 pandemic hit the country.

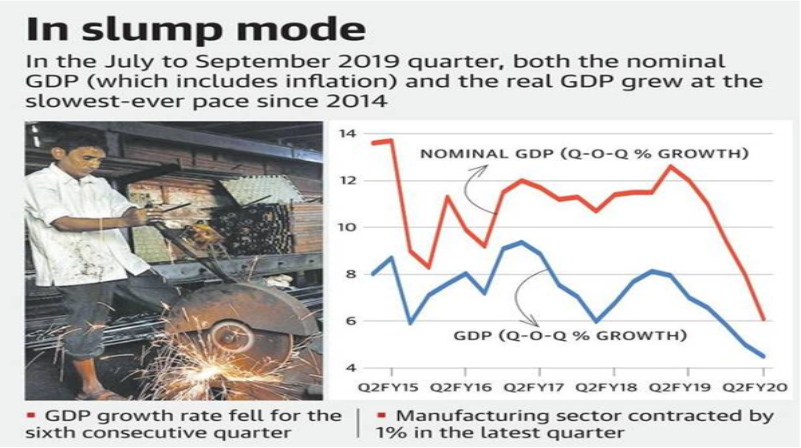

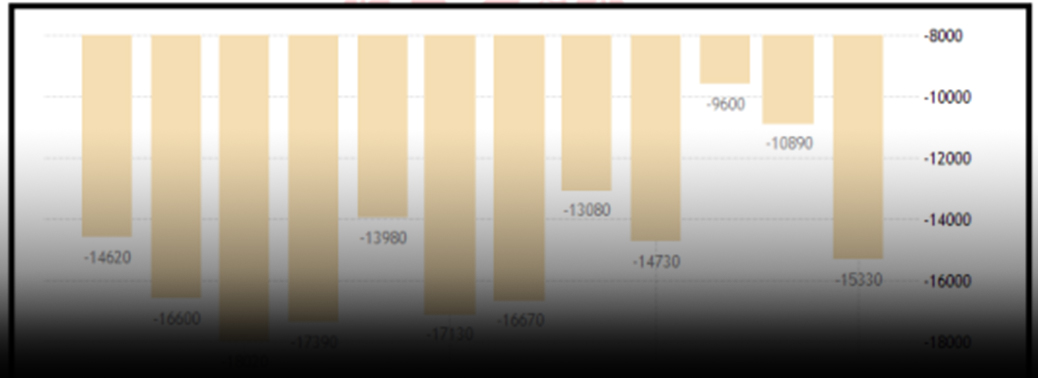

(a) Decline in GDP growth rate

- India’s economic growth rate had fallen to 4.5% in the September quarter of 2019, before the pandemic hit in early 2020.During the pandemic, the Indian economy contracted sharply, with GDP falling by 7.7% in the 2020-21 fiscal year.

- The economy has rebounded somewhat, with the IMF forecasting GDP growth of 9.5% for the current fiscal year.

(b) Lower growth potential than hyped

- However, Rajan noted that India’s potential growth rate is likely to be lower than in the past, due to factors such as an aging population, a decline in the working-age population, and sluggish investment.

- He also cited the country’s poor performance on human development indicators, such as education and health, as a constraint on growth.

Key suggestions:

- Rajan called for measures to address the structural factors that are holding back growth, such as investment in infrastructure and education, and improving the ease of doing business in India.

- He also emphasized the importance of macroeconomic stability and maintaining fiscal discipline, to avoid inflation and currency depreciation.

- He also called for measures to address inequality, such as better targeting of subsidies to those who need them most.

Conclusion:

- Overall, Rajan’s remarks suggest that India faces significant challenges in maintaining high levels of economic growth, and that structural reforms will be needed to address these challenges.

SDGs: India’s Progress Analysis

04, Mar 2023

Why in News?

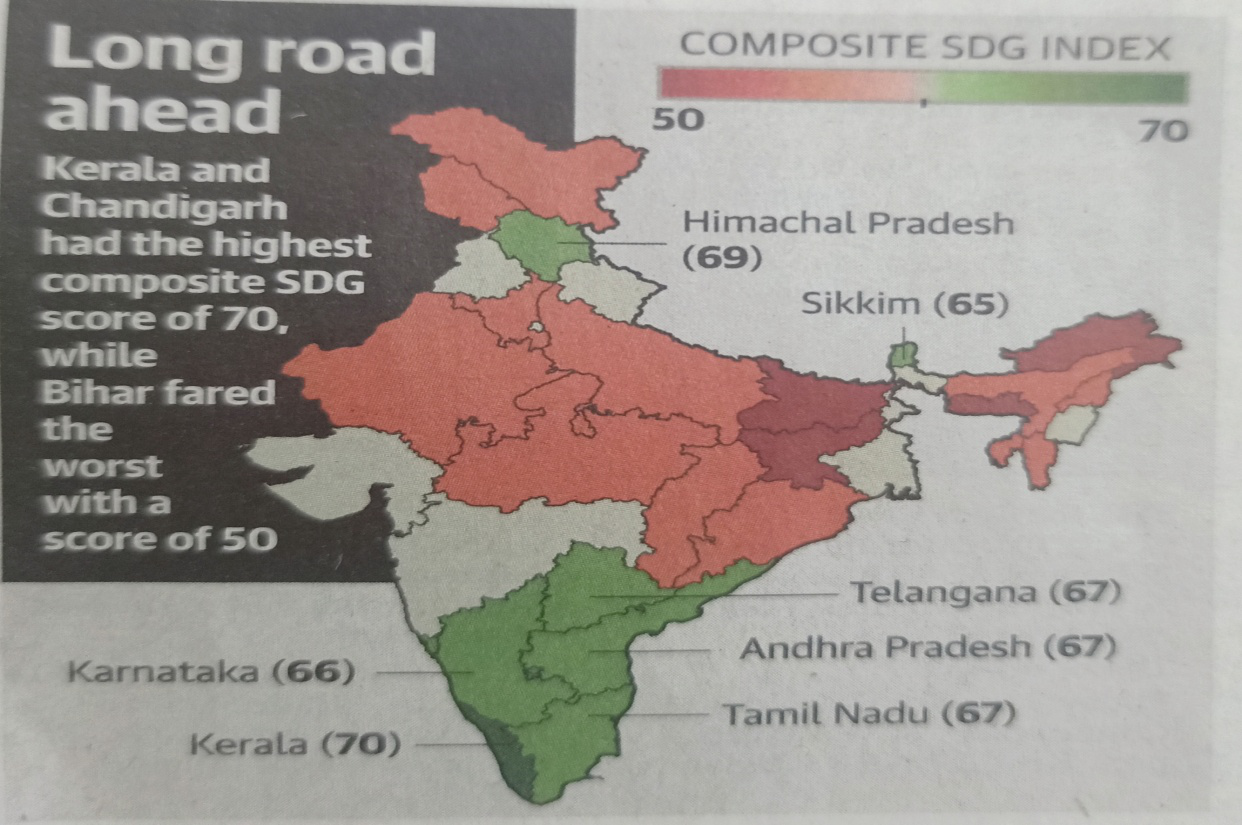

- A recent analysis published in The Lancet has concluded that India is not on-target to achieve 19 of the 33 Sustainable Development Goals (SDGs) indicators. The critical off-target indicators include access to basic services, wasting and overweight children, anaemia, child marriage, partner violence, tobacco use, and modern contraceptive use.

Analysis:

- On-Target: Districts that have not met the SDG target by 2021 and have observed a magnitude of improvement between 2016 and 2021 sufficient to meet the target by 2030.

- Off-Target: Districts that have not met the SDG target by 2021 and either observed worsening between 2016 and 2021 or observed an insufficient magnitude of improvement between 2016 and 2021. If these districts continue with either of these trends, they will not meet their targets by 2030.

- Progress in: Indicators shows the progress in reducing adolescent pregnancy, tobacco use in women, multidimensional poverty, teenage sexual violence, and improving electricity access.

- Areas where more efforts are needed: More efforts are needed for reducing anaemia in women, improving access to basic services, providing health insurance for women, and reducing anaemia in pregnant women.

Sustainable Development Goals (SDGs)

- The SDGs, otherwise known as the Global Goals, are a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity.

- The SDGs were adopted by the United Nations in 2015 with a vision to achieve a better and more sustainable future for all. The 17 SDGs came into force with effect from 1st January 2016 as a part of 2030 Agenda for Sustainable Development.

- India is one of the signatory countries that has committed to achieving these goals by 2030.

- Though not legally binding, the SDGs have become de facto international obligations and have the potential to reorient domestic spending priorities of the countries during the next fifteen years.

- Countries are expected to take ownership and establish a national framework for achieving these goals.

Targets set for each of the SDGs:

- No Poverty: By 2030, eradicate extreme poverty for all people everywhere, currently measured as people living on less than $1.25 a day.

- Zero Hunger: By 2030, end hunger and ensure access by all people, in particular the poor and people in vulnerable situations, including infants, to safe, nutritious and sufficient food all year round.

- Quality Education: By 2030, ensure that all girls and boys complete free, equitable and quality primary and secondary education leading to relevant and effective learning outcomes.

- Gender Equality: End all forms of discrimination, violence, harmful practices against all women and girls everywhere. Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic, and public life.

SDG

India’s progress towards achieving SDGs so far

- SDG 1 (No Poverty): India has made significant progress in reducing poverty, with the poverty rate declining from 21.9% in 2011-12 to 4.4% in 2020. The government’s efforts to provide financial inclusion and social protection schemes have contributed to this progress.

- SDG 2 (Zero Hunger): India has made progress in reducing hunger, with the prevalence of undernourishment declining from 17.3% in 2004-06 to 14% in 2017-19. The government’s initiatives such as the National Food Security Act and the Pradhan Mantri Garib Kalyan Anna Yojana have contributed to this progress.

- SDG 3 (Good Health and Well-being): India has made progress in improving maternal and child health, with maternal mortality ratio declining from 167 per 100,000 live births in 2011-13 to 113 in 2016-18. The government’s efforts to strengthen health systems and increase access to healthcare services have contributed to this progress.

- SDG 4 (Quality Education): India has made progress in improving access to education, with the gross enrolment ratio for primary education increasing from 93.4% in 2014-15 to 94.3% in 2019-20. The government’s initiatives such as the Sarva Shiksha Abhiyan and the Right to Education Act have contributed to this progress.

- SDG 5 (Gender Equality): India has made progress in improving gender equality, with the sex ratio at birth increasing from 918 in 2011 to 934 in 2020. The government’s initiatives such as the Beti Bachao Beti Padhao and the Maternity Benefit Programme have contributed to this progress.

Recent findings by National Family Health Survey

- Multidimensional poverty declined: At a compounded annual average rate of 4.8 per cent per year in 2005-2011 and more than double that pace at 10.3 per cent a year during 2011-2021.

- Declining child mortality: There are some issues with the 2011 child-mortality data, but for each of the 10 components of the MPI index, the rate of decline in 2011-2021 is considerably faster than in 2005-2011.

- Average decline in overall indicators: The average equally weighted decline for nine indicators was 1.9 per cent per annum in 2005-2011 and a rate of 16.6 per cent per annum, more than eight times higher in 2011-2021.

- Consumption inequality decline: Every single household survey or analysis has shown that consumption inequality declined during 2011-2021. This is consistent with the above finding of highly inclusive growth during 2011-2021.

Conclusion:

- The analysis provides a valuable tool for policymakers to address the gaps and focus on the indicators that require more attention, thereby improving the well-being of its citizens and creating a sustainable future for all.

A Budget that signals growth with stability

03, Mar 2023

Why in News?

- Union Finance Minister Nirmala Sitharaman presented the Union Budget 2023-24 in Parliament on February 01.

Highlights:

- The Economic Survey 2022-23 has laid emphasis on India’s remarkable broad-based recovery to reach the level of income that existed before the outbreak of the coronavirus pandemic.

- The pandemic was followed by the Russia-Ukraine conflict and the accompanying sanctions that have been imposed by the West on Russia, the slowdown and the recession in major economies and the rise in inflation leading to sharp increases in interest rates, followed by capital outflow and the pressure on the exchange rate.

- Even though the economy has staged a recovery and surpassed the pre-pandemic income level, it is still 7% below the pre-pandemic GDP trend.

- This budget is termed as the “first Budget in Amrit Kaal” by the Union Finance Minister.

- With an eye on ‘India at 100’, the Budget proposals were aimed at actualising a technology-driven and knowledge-based economy with strong public finances, and a robust financial sector.

Growth and Fiscal Deficit Dilemma:

- The fiscal deficit ratio is to come down from 6.4% in FY23 to 5.9% in FY24, to achieve the fiscal deficit target of 4.5% of GDP by 2025-26. The fiscal deficit target assumes that the economy is on a relatively strong footing, with another year of healthy tax collections.

- However, a third of the global economy is expected to slip into recession in the calendar year 2023, as per the International Monetary Fund which may affect manufacturing and other related sectors and impact revenue collections.

- The fiscal deficit of ₹17.8 lakh crore is to be financed using short-term borrowings and the National Social Security Fund.

- Given the tight liquidity condition of the banking system, this will not exert pressure on the flow of funds.

- Inflation is beyond the upper tolerance limit and aggregate fiscal deficit (Centre and States) is in the range of 9% to 10% of GDP.

- Therefore, ensuring macroeconomic stability requires continued fiscal consolidation.

- Thus the government is faced with the dilemma of accelerating growth by increasing public investment while containing the fiscal deficit.

- With interest payments accounting for 40% of the net revenues of the Centre, there is hardly any room for complacency.

- Despite a significant increase in food and fertiliser subsidies of Rs. 2 lakh crore, the government has managed to keep its goal of the fiscal deficit in the current fiscal to a maximum of 6.4% of GDP mainly due to the increase in the nominal value of GDP and also the increase in tax collections.

A balancing act:

- Union Budget 2023-24 made a greater allocation to infrastructure spending, and the capital expenditure is budgeted to increase from 2.7% of GDP to 3.3% and considering that capital expenditure has a significant ‘crowding in’ effect, it should help to increase private capital expenditures as well.

- This comes after the 25% increase in capital expenditures in the last budget.

- This is also supplemented by the ₹79,000 crore on affordable housing on the revenue expenditure side.

- But the constraint is demand, as reflected in capacity utilisation, which is still around 75%. Hence, capex needs to percolate down to higher disposable incomes and increase demand.

- The Reserve Bank of India has estimated the multiplier effect of capital expenditure at 1.2 which should help revive the sluggish investment climate.

- With deleveraged balance sheets and an increase in commercial lending by banks, the investment climate is expected to further improve and arrest the declining trend in the overall investment-GDP ratio in the country.

- In addition, the continued provision of an interest-free loan to States to supplement their capital expenditures should contribute to an increase in capital spending by States.

- Expenditure on the social sector does not register a quantum jump, though there is an increase in absolute terms with some new initiatives towards skilling in both education and health.

Compression in subsidies:

- Target to achieve fiscal adjustment by mainly containing revenue expenditure will improve the quality of public spending.

- The budgeted increase in revenue expenditures for 2023-24 is just 1.2% higher than the revised estimate for the current year as there is a significant compression in subsidies.

- The fertiliser subsidy is expected to be reduced by ₹90,000 crore from ₹2.87 lakh crore to ₹1.87 lakh crore.

- The fertiliser subsidy is expected to be compressed by ₹50,000 mainly as fertiliser prices have come down.

- In addition, allocation to centrally sponsored schemes is expected to decrease by about ₹20,000 crore, and the overall current transfer to States is kept constant at 3.3%-3.4% of GDP.

- The Budget has provided direct tax sops for individuals and MSMEs which may not translate into higher consumption as it is an indexation of the lower tax brackets with inflation, which has been high in the recent past.

RBI’s new pilot project on Coin Vending Machines

02, Mar 2023

Why in News?

- The RBI in collaboration with banks is set to launch a pilot project to assess the functioning of a QR-code-based coin vending machine.

Coin Vending Machines:

- The vending machines would dispense coins with the requisite amount being debited from the customer’s account using United Payments Interface (UPI) instead of physical tendering of banknotes.

- Customers would be endowed the option of withdrawing coins in required quantities and denominations.

- The central idea here is to ease the accessibility to coins.

- With particular focus on ease and accessibility, the machines are intended to be installed at public places such as railway stations, shopping malls and marketplaces.

Why such a move?

- Prevent hoarding of coins: The situation with respect to coins is peculiar with the supply being very high. It is taking up a lot of storage space and is not getting properly distributed despite high demands.

- Eliminate the physical tendering of banknotes: It was observed that the currency being fed into the machines (for coin exchange) were often found to be fake and could not be checked right at that point of time.

How coins are significant in our economy?

- As per the latest RBI bulletin, the total value of circulation of rupee coins stood at ₹28,857 crore as of December 30 last year. The figure is an increase of 7.2% from the year-ago period.

- Circulation of small coins remained unchanged at ₹743 crore.

- The figures above could be compared to the volume of digital payments until December 2022 which stood at approximately ₹9,557.4 crore, as per the Digidhan Dashboard.

- The number is inclusive of mobile banking, internet banking, IMPS, BHIM-UPI and NEFT, among others.

- Hence the reliance on UPI for dispensing coins is particularly noteworthy.

Is it going against the digital push?

- RBI is in the midst of a pilot for the Central Bank Digital Currency (CBDC).

- But this proposal should not be viewed as a “zero-sum game of digital versus cash.”

- The two can easily supplement each other by re-circulating existing coins in the economy.

Essential Commodities Act

27, Feb 2023

Why in News?

- The Centre has maintained that there is no move to ban the export of onions.

About the Essential Commodities act:

- The Essential Commodities Act, 1955 was enacted to ensure the easy availability of essential commodities to consumers and to protect them from exploitation by unscrupulous traders.

- The Act provides for the regulation and control of production, distribution and pricing of commodities which are declared as essential.

- Essential items under the Act include drugs, fertilisers, pulses and edible oils, and petroleum and petroleum products.

- The Act aim at maintaining/increasing supplies/securing equitable distribution and availability of these commodities at fair prices.

- Centre invokes the ECA Act’s provisions to impose stock limits in case of price/quantity distortions in the market to ensure adequate availability of essential commodities at reasonable prices.

- States are the implementing agencies to implement the EC Act, 1955 and the Prevention of Black marketing & Maintenance of Supplies of Essential Commodities Act, 1980, by exercising powers delegated to them.

- The list of essential commodities is reviewed from time to time with reference to their production and supply and in consultation with concerned Ministries/Departments.

- Currently, the restrictions like licensing requirement, stock limits and movement restrictions have been removed from almost all agricultural commodities.

- Exemptions: Wheat, pulses and edible oils, edible oilseeds and rice are certain exceptions.

- The recent amendment to the Legal Metrology (Packaged Commodities) Rules 2011 is linked to the ECA. The Government can fix the retail price of any packaged commodity that falls under the ECA.

Arguments against ECA:

- An archaic law: Essential Commodities Act has been in existence since 1955, when the economy was very different from what it is today. It was an economy ravaged by famine and food shortages.

- Difference between storage and hoarding: Recently there is evidence of interventions not working. It is because there is a distinction between storage and hoarding.

- As compared to older times, when the economy experiences acute shortages, today many shortage cases are actually that of hoarding.

- Stock limits led to onion price volatility: To control soaring prices of onions over the last few months, centre through ECA imposed stock limits on onions. Instead of decreasing prices, this actually increased price volatility.

- Although the restrictions on both retail and wholesale traders were meant to prevent hoarding and enhance supply in the market, the Survey showed that there was actually an increase in price volatility and a widening wedge between wholesale and retail prices.

- Lower stock limit led traders and wholesalers to immediately offload most of the kharif crop which led to a sharp increase in the volatility.

- Disincentivises storage infrastructure development: With too-frequent stock limits, traders may have no reason to invest in better storage infrastructure in the long run.

- Also, food processing industries need to maintain large stocks to run their operations smoothly. Stock limits curtail their operations. In such a situation, large scale private investments are unlikely to flow into food processing and cold storage facilities.

- Higher prices of medicines: Drug Price Control Order issued under the ECA also distorted the market and actually made medicines less affordable.

- The increase in prices is greater for more expensive formulations than for cheaper ones and for those sold in hospitals rather than retail shops.

- Rent seeking and Low conviction rates: Despite many raids conducted under the ECA in 2019, the conviction rate was abysmally low. The ECA only seems to enable rent-seeking and harassment.

Way Forward:

- Adequate supply: Given that almost all crops are seasonal, ensuring round-the-clock supply requires adequate build-up of stocks during the season.

- Without the ECA the common man would be at the mercy of opportunistic traders and shopkeepers.Genuine shortages: There can be genuine shortages triggered by weather-related disruptions in which case prices will move up.

- So, if prices are always monitored, farmers may have no incentive to farm.

- Difficult to differentiate between hording and shortage: It may not always be possible to differentiate between genuine stock build-up and speculative hoarding.

Four-day workweek: Analysis

25, Feb 2023

Why in News?

- Much is being made about the major breakthrough in one of the largest-ever experiments with a four-day workweek in Britain. Sixty-one companies were part of the six-month trial and 56 of them have opted to continue with the program, while 18 have made it permanent. 4 Day Week Global trial, overseen by Autonomy, aimed to improve work-life balance by allowing workers to work four days instead of five with the same salary and workload.

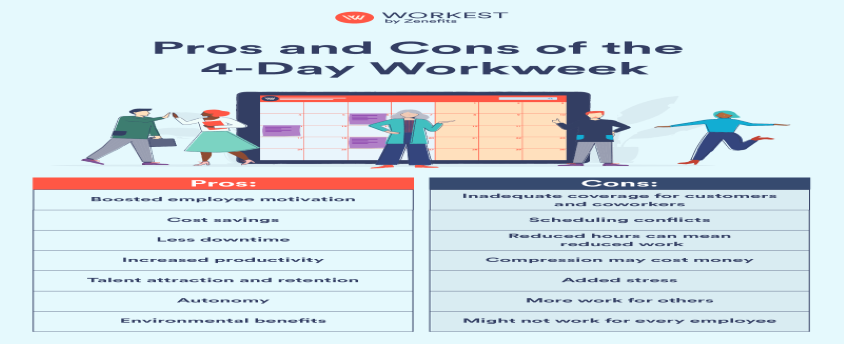

Advantages of implementing a four-day workweek:

- Improved Work-life balance: Having a positive work-life balance can also allow professionals to adopt a better attitude about their work, as they can return to their jobs well-rested. This can help employees remain productive and enthusiastic while working.

- Increased job satisfaction: With more free time, employees may feel more satisfied with their jobs and be more engaged at work.

- Reduced absenteeism and turnover: Offering a four-day workweek could make companies more attractive to potential employees, and employees may be less likely to miss work or leave their jobs if they have a better work-life balance.

- Increased productivity: Some studies have shown that shorter workweeks can actually boost productivity, as employees may be more focused and efficient during their work hours.

- Positive environmental impact: Working four days per week decreases the number of times a professional commute to work. This is helpful to the environment, as most vehicles produce emissions that can harm the environment.

Potential disadvantages:

- Limited impact: The benefits of a four-day workweek may be limited in certain industries or job types, such as those that require shift work or have strict deadlines.

- Increased workload: Employees may feel pressure to complete the same amount of work in fewer hours, resulting in an increased workload and potential burnout.

- Reduced productivity: Some employees may find it difficult to maintain focus and productivity over longer workdays. This could lead to a decrease in overall output and quality of work.

- Impact on customer service: If businesses are closed for an extra day each week, it may be more difficult to provide customer service or maintain consistent operating hours.