Category: Service Sector

CENTRE BRINGS 42 NON-SCHEDULED CANCER DRUGS UNDER PRICE CONTROL

28, Feb 2019

In News:

- The government said it had brought 42 non-scheduled anti-cancer drugs under price control, capping trade margin at 30%, which would reduce their retail prices by up to 85%.

Explained:

- The National Pharmaceutical Pricing Authority (NPPA) has invoked extraordinary powers in public interest, under Para 19 of the Drugs (Prices Control) Order, 2013 to bring 42 non-scheduled anti-cancer drugs under price control through trade margin rationalization. Invoking paragraph 19 of DPCO, 2013, the government hereby puts a cap on trade margin of 30% and directs manufacturers to fix their retail price based on price at first point of sale of product of the non-scheduled formulations containing any of the 42 drugs.

- As per data available with NPPA, the MRP for 105 brands will be reduced up to 85%, entailing minimum savings of Rs. 105 crore to consumers, it added. Currently, 57 anti-cancer drugs are under price control as scheduled formulations. Now, 42 non-scheduled anti-cancer medicines have been selected for price regulation by restricting trade margin on the selling price (MRP) up to 30%

- These would cover 72 formulations and 355 brands as per data available with NPPA. More data is being collected from hospitals and manufacturers to finalize the list.

- The drug manufacturers have been given seven days to recalculate the prices and inform the NPPA, state drug controllers, stockists and retailers, it said. The revised prices shall come into effect from March, 8.

- Non-scheduled drugs are allowed an increase of up to 10% in prices every year, which is monitored by the NPPA.

- The NPPA currently fixes prices of drugs placed in the National List of Essential Medicines (NLEM) under Schedule-I of the DPCO. So far, around 1,000 drugs have been brought under price control under the initiative.

National Pharmaceutical Pricing Authority (NPPA):

- The organization is also entrusted with the task of recovering amounts overcharged by manufacturers for the controlled drugs from the consumers.

- It also monitors the prices of decontrolled drugs in order to keep them at reasonable levels.

- NPPA is an organization of the Government of India which was established, inter alia,to fix/ revise the prices of controlled bulk drugs and formulations and to enforce prices and availability of the medicines in the country, under the Drugs (Prices Control) Order,1995.

- It comes under the ministry of chemical and fertilizers

Functions of National Pharmaceutical Pricing Authority:

1. To implement and enforce the provisions of the Drugs (Prices Control) Order in accordance with the powers delegated to it.

2. To deal with all legal matters arising out of the decisions of the Authority;

3. To monitor the availability of drugs, identify shortages, if any, and to take remedial steps;

4. To collect/ maintain data on production, exports and imports, market share of individual companies, profitability of companies etc, for bulk drugs and formulations;

5. To undertake and/ or sponsor relevant studies in respect of pricing of drugs/ pharmaceuticals;

6. To recruit/ appoint the officers and other staff members of the Authority, as per rules and procedures laid down by the Government;

7. To render advice to the Central Government on changes/ revisions in the drug policy;

8. To render assistance to the Central Government in the parliamentary matters relating to the drug pricing.

Organised retail in India may Double by 2021

27, Feb 2019

In News:

- According to a latest joint report by Deloitte and the Retailers Association of India (RAI), Strong macroeconomic factors coupled with robust demographics and Internet penetration will fuel the growth of the retail market in India, which is third largest in Asia and fourth-largest globally after U.S., China and Japan.

- As Internet penetration increases in the country and more international retailers start operating in India, the share of organized retail market would increase from about 12% in 2017 to about 22-25% by 2021, which would partly also be driven by the growth of e-commerce market from $24 billion in 2017 to $84 billion in 2021.

- The report pegs the growth in e-commerce market to factors like growing Internet penetration and increased usage of smartphones among others.

- The number of online shoppers would increase from the current 15% of the online

- population to 50% by 2026,” stated the report while adding that smartphone users are

- expected to increase from 260 million in 2016 to around 450 million by 2021 that is also

- likely to drive the m-commerce sales from $10.5 billion in 2016 to $38 billion in 2020

- The retail market is expected to grow from $795 billion in 2017 to $1.2 trillion by 2021, as per the report.

- India’s consumption has grown at 13% in the last decade and is likely to continue to grow at 12% over the next 10 years — from Rs. 33 trillion in 2008 to Rs. 330 trillion in 2028.

GST cut may boost Realty demand

25, Feb 2019

In News:

- The 33rd reconvened meeting of the Goods and Services Tax (GST) Council cut the tax rate for under-construction housing to 5 per cent (without input tax credit) from the present effective rate of 12 per cent (after one-third abatement of land). For affordable housing, the GST rate was reduced to 1 per cent from effective 8 per cent. The new rates will take effect on 1 April.

Explained:

- The reduction in the GST rates for under-construction projects is the most decisive move by the GST Council with a clear focus on demand stimulation.

- This move will give the necessary fillip to the demand in under-construction segment, which has been suffering from low sales levels for last many quarters.

- The elimination of input credit tax benefit may hit profitability for the supply side; however, the potential demand generation as a result of this move will far outweigh any negative aspects leading to greater sales numbers and revenues

- The reduction in GST can potentially reduce the buyers’ payout by 6%-7% on the overall purchase, depending on the category. The increase in sales will bring down the unsold inventory which has been afflicting the real estate sector.

- Under-construction properties priced up to ₹45 lakh and measuring 60 sq metre in metros and 90 sq metre in non-metro cities would qualify as affordable housing projects for the purpose of GST relief in metro cities as well as non-metro cities.

Ministry Revises Rules for Chartering of Ships

19, Feb 2019

In News:

- To Incentivise ship-building activity in the country, the Ministry of Shipping has revised its guidelines for chartering of ships by providing Right of First Refusal ( RoFR) to ships built in India.

Explained:

- Whenever a tendering process is undertaken to charter a vessel, a bidder offering a ship built in India will be given the first priority to match the L1 quote. The RoFR would be exercised only in case the vessel being offered for charter by the lowest bidder (L1) has been built outside India.Prior to the revision of the guidelines, the RoFR was reserved for Indian flag vessels as per the relevant provisions of Merchant Shipping Act, 1958.

- The existing licensing conditions have been reviewed in consonance with the Government of India’s policy of promoting the ‘Make In India’ initiative and the Public Procurement and Make in India orders dated June 15, 2017 and May 28, 2018 issued by the DIPP.

- It is expected that this priority given to ships built in India will raise the demand for such vessels, providing them with additional market access and business support.

- The review is also in line with the need to give a long-term strategic boost to the domestic shipbuilding industry, the need to encourage the domestic shipping industry to support the domestic shipbuilding industry, and the need to develop self- reliance and a strong synergy between these vital industries for the overall long-term development and economic growth of the country. A policy in this regard will be unveiled by, Minister for Shipping, Road Transport & Highways, Water Resources, River Development and Ganga Rejuvenation in Mumbai, during the inauguration of the two-day Regional Maritime Safety Conference.

Will Try to Lift More banks from PCA: Finance Minister

09, Feb 2019

In News:

- After Reserve Bank of India (RBI) lifted restrictions under prompt corrective action (PCA) on three public sector banks last week of January 2019, Finance Minister said the government will try to help lift the restrictions on other public sector banks too.

Explained:

PCA Framework:

- PCA framework was started in 2002 to regulate activities of the banking sector

- The PCA framework is applicable only to commercial banks and not extended to co-operative banks, non-banking financial companies (NBFCs) and FMIs

- PCA framework is invoked on banks when they breach any of three key regulatory trigger points (or thresholds).

- They are capital to risk weighted assets ratio, net non-performing assets (NPA) and Return on Assets (RoA), Asset Quality, Profitability, Leverage – of the banks

- It also provides opportunity to RBI to pay focused attention on such banks by engaging. With focusing more closely in those areas.

- Depending on risk thresholds set in PCA framework, banks are put in two type of restrictions, mandatory and discretionary depending upon their placement in PCA framework levels. The mandatory restrictions are on dividend, branch expansion, director’s compensation while discretionary restriction include curbs on lending and deposits. At present, 8 weak PSBs out of the 21 State-owned banks are under the PCA, recently 3 (Bank of India, Bank of Maharashtra and Oriental Bank of Commerce) PSB got out of PCA framework making it to a total of 8

Its objective is to facilitate banks to take corrective measures including those prescribed by RBI, in timely manner to restore their financial health. PCA framework is supervisory tool of RBI, which involves monitoring of certain performance indicators of banks to check their financial health as early warning exercise and to ensure that banks don’t go bankrupted. The PCA framework would apply without exception to all banks operating in India including small banks and foreign banks operating through branches or subsidiaries based on breach of risk thresholds of identified indicators.

NEED For PCA Framework

- Due to the adverse impact on the economy, medium sized or large banks are rarely closed and the governments try to keep them afloat for this PCA kind of framework needed

- If banks are not to be allowed to fail, it is essential that corrective action is taken well in time when the bank still has adequate cushion of capital to minimize the losses. If these asset stressed banks are not properly taken care off then its bankruptcy will create a chain reaction in the economy setting off job losses, share market down and loss of credibility in public sector banks

What are the restrictions faced by banks in this Framework?

- The PCA framework prescribes five levels of trigger points based on capital measures, i.e. total risk-based capital ratio,

The five PCA categories are

- Well capitalized

- Adequately capitalized

- Undercapitalized

- Significantly undercapitalized, and

- Critically undercapitalized.

- On bank reaching the levels of undercapitalized, or significantly undercapitalized, or critically undercapitalized, automatic restrictions, as per provisions of Section 38 of FDI Act, are placed on the concerned bank in respect of

- Payment of capital distributions and management fees

- The growth of assets

- Requiring prior approval of certain expansion proposals

- Requiring that the RBI monitor the condition of the bank, and

- Requiring submission of a capital restoration plan.

- In addition to the above restrictions and close monitoring, the significantly undercapitalized and critically undercapitalized banks are restricted to pay compensation to senior executive officers of the institution. The critically undercapitalized bank is, in addition to above, required to take prior approval from RBI in respect of – entering into any material transaction other than in the usual course of business, such as any investment, expansion, acquisition, sale of assets, or other similar action; extending credit for any highly leveraged transaction; amending the institution’s charter or bylaws; making any material change in accounting methods; paying excessive compensation or bonuses; paying significantly high interest on new or renewed liabilities; making any principal or interest payment on subordinated debt beginning 60 days after becoming critically undercapitalized; and engaging in any covered transaction. In addition, RBI may further restrict the activities of the critically undercapitalized bank.

GOM Favours GST cut on Houses under Construction

09, Feb 2019

In News:

- A panel of State Ministers favored lowering GST on under-construction residential properties to 5%, from the 12% currently.

Explained:

- The Group of Ministers, (GoM) under Gujarat Deputy Chief Minister, was set up last month to analyse tax rates and issues/challenges being faced by the real estate sector under the Goods and Services Tax (GST) regime.

- In its first meeting, the GoM also favoured slashing GST on affordable housing from 8% to 3%. The GoM favored lowering GST rates on residential houses to 5 per cent without input tax credit and to 3 per cent for those under affordable housing

Current Scenario:

- Currently, GST is levied at 12 per cent with Input tax credit (ITC) on payments made for under-construction property or ready-to-move-in flats where completion certificate has not been issued at the time of sale.

- The effective pre-GST tax incidence on such housing property was 15-18%

- GST, however, is not levied on buyers of real estate properties for which completion certificate has been issued at the time of sale.

- There have been complaints that builders are not passing on the ITC benefit to consumers by way of reduction in price of the property after the roll-out of GST. Because if certificate is issued then they have to pass the ITC benefit

- Some experts say this will lead to reduction of home prices by as much as Rs 3,00,000 for super built-up area of 1,000 sq feet.

- This will boost the demand for the residential houses in the realty sector which will in turn boost the demand for the employment generation in the construction sector.

GST Collection may Grow 18% in FY20: Govt.

04, Feb 2019

In News:

- The Union government has projected over 18% growth in Goods and Services Tax (GST) collections in 2019-20 based on the rising trend in revenue mop-up witnessed during the three-month period ending January 2019.

Explained:

- The central government plans to collect over ₹61 lakh crore in Goods and Services Tax (GST) next fiscal as against the revised estimate of over ₹6.43 lakh crore to be collected in the current financial year ending March. This translates into an 18 per cent growth in mop up.

Reason for optimistic Estimate:

- During the last one-and-half years, a series of measures, both in rate rationalization and processes, have been undertaken. The changes made to the GST system will hopefully lead to consolidation next year, which in turn will result in higher revenue

- GST has resulted in an increased tax base, higher collections, and ease of trade, adding that with the introduction of the GST, inter-state movement of goods has become faster, more efficient, and hassle free with no entry tax, check posts, and truck queues.

- Last fiscal our average collection was ₹89,000 crore. This fiscal it is averaging ₹97,000 crore. So, the revenue trend is on upward scale. If one compares November, December, January of 2017-18 with that of 2018-19, one can see a 14 per cent increase.

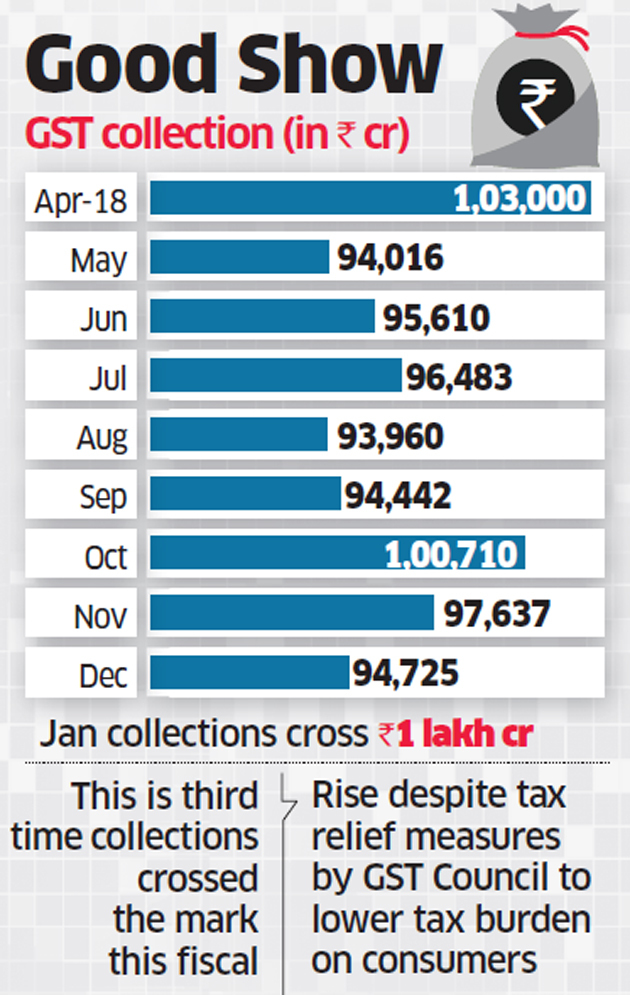

GST Collections Cross Rs.1 Lakh Crore in January

01, Feb 2019

In News:

The government said that Goods and Services Tax (GST) collections crossed the Rs. 1 lakh-crore mark in January, the third month this financial year it would have done so.

Explained:

- The total gross GST revenue collected in the month of January 2019 has crossed Rs. 1 lakh crore. This has been a significant improvement over collection of Rs. 94,725 crores during last month and Rs. 89,825 crores during the same month last year

- This increase has been achieved despite various tax relief measures implemented by the GST Council to lower the tax burden on the consumers,” the Ministry added. “Final figures and details of collections for the entire month will be intimated on 2nd February, 2019. This again underlines that collections are increasing steadily as compliances are getting simplified, rates are getting reduced and administration is getting sharper.

- GST collection stood at Rs 1.03 lakh crore in April, Rs 94,016 crore in May, Rs 95,610 crore in June, Rs 96,483 crore in July, Rs 93,960 crore in August, Rs 94,442 crore in September, Rs 1,00,710 crore in October and Rs 97,637 crore in November. If the same pace is maintained, the revenue targets would be close to being achieved.

- These numbers indicate that rate reductions result in increased revenues and compliance. The government has set a budgetary target of over Rs 1 lakh crore monthly average collection in FY 2019.

Health Sector Seeks Tax breaks for middle class in Budget

01, Feb 2019

- The healthcare sector wants the government’s interim Budget to include tax measures to help the middle class better mitigate health risks.

- “Ayushman Bharat for the financially weaker section took centre stage in healthcare last year; however, the middle class is still at risk!,”

- A first step to universal health coverage would be to increase deduction for medical insurance premium under section 80D for self, family and dependant parents. An enhancement in the medical allowance for salaried employees in line with inflation and a separate deduction in respect of preventive health checks would be desirable.

- We look forward to zero-rating of GST for the sector, or for normalisation of the GST rates for services consumed by the healthcare service providers at 5%,’’ Ms. Reddy added.

- A reduction in the cost of medical equipment that will help in increasing the outreach of telemedicine and home healthcare facilities. This, in turn, will help in the preventive and timely treatment of non-communicable diseases that are expected to account for 75% of the country’s diseases by 2025.

- The last year had been a challenging one for India’s private healthcare providers, with multiple headwinds impacting growth and profitability. The overall sector had become less attractive for investments, the absence of which had hindered growth significantly.

- However, given that more than two-thirds of the sector was driven by private operators, the government had to increase its willingness to partner with the private sector players.

Commerce Ministry not to extend Feb.1 Deadline for E-Tailers

25, Jan 2019

In News:

- The Commerce and Industry ministry is not in favour of extending the deadline of February 1 for implementing the revised guidelines for e-commerce companies having foreign direct investment.

Explained:

- On December 26, 2018, the government tightened norms for e-commerce firms and barred online retailers like Flipkart and Amazon from selling products of the companies in which they have stakes.

- The government also prohibited e-commerce companies from entering into an agreement for exclusive sale of products.

- As per the revised guidelines, a vendor cannot procure more than 25% of products from group companies of the same marketplace where they intend to sell them.

- Both Amazon and Walmart-owned Flipkart had sought extension of the February 1 deadline for complying with the revised norms, stating that they needed more time to understand the details of the framework.

- The ministry has received representations from Amazon and Flipkart for more time. Internal discussions are on. But the ministry is not in favour of extending the deadline

Background on Rules:

- FDI is not permitted in inventory-based model of e-commerce. 100% FDI under automatic route is permitted in marketplace model of e-commerce

What Is Marketplace E- Commerce Model?

- The inventory-based model of e-commerce is when the inventory of goods and services is owned by the e-commerce entity and sold to consumers directly.

- The marketplace model is when an e-commerce company simply provides an information technology platform in order to act as a facilitator between the buyer and the seller.

- E-commerce entity providing a marketplace will not exercise ownership or control over goods purported to be sold. Such an ownership or control over the inventory will render the business into inventory-based model.

What the notification says?

- In addition to the restrictions prescribed under the existing FDI policy, the DIPP clarification now states that inventoryof a vendor will be deemed to be controlled by e-commerce marketplace entity if more than 25% of purchases of such vendor are from the marketplace entity or its group companies

- An entity with equity stake owned by an e-commerce marketplace entity or its group companies, or having control on its inventory by e-commerce marketplace entity or its group companies, will not be permitted to sell its products on the platform run by such marketplace entity.

- It also said an e-commerce marketplace will not force any seller to sell any product exclusively on its platform

Accountability:

E-commerce marketplace entity will be required to furnish a certificate along with a report of statutory auditor to Reserve Bank of India, confirming compliance of the guidelines, by September 30 every year for the preceding financial year.

Cabinet Gives NOD to set up GST Appellate Tribunal

24, Jan 2019

In News:

- The Union Cabinet has approved the creation of a National Bench of the Goods and Services Tax Appellate Tribunal (GSTAT), which would serve as the forum of second appeals to do with the applicability of GST, and will also be the first common forum of dispute resolution between the Centre and the States.

Explained:

- The National Bench of the Appellate Tribunal, to be situated in New Delhi, will be presided over by its president. It will consist of a technical member from the Centre and a representative of the States. “This is part and parcel of the GST provisions

- Chapter XVIII of the CGST Act provides for an appeal and review mechanism for dispute resolution under the GST regime. Section 109 of this chapter empowers the Centre to constitute, on the recommendation of the GST Council, an appellate tribunal for hearing appeals against the orders passed by the Appellate Authority. The government, it is learnt, was initially planning an appellate tribunal in each State.

- However, the idea was discarded in favour of one at the national level following the experience with the various state-level advance ruling authorities, which often gave conflicting judgments. “The disputes they would be looking at would be appeals under GST law wherein the taxpayer is contesting the tax demand put by the tax department, the formation of an appellate authority has come eighteen months after the rollout of the GST regime. The appellate authority is being seen crucial for being a forum for higher appeal for disputes under the indirect tax regime and will also help in resolving the confusion created by contradictory rulings given by Appellate Authority for Advance Rulings (AAAR) on the same or similar issues in different states. The industry has been demanding a centralised appellate authority that could reconcile the contradictory verdicts of different AAARs.

- The creation of the national Bench would amount to one-time expenditure of Rs.92.5 lakh while the recurring expenditure would be Rs 6.86 crore per annum, a government statement said. The national bench of the GST Appellate Tribunal will expedite resolution of disputes under GST laws.

- The national bench of the GSTAT is the forum of second appeal in GST laws and the first common forum of dispute resolution between Centre and states, the statement said. The first appeal against the orders of adjudicating authority shall lie before the appellate authority of the states.

- Being a common forum, GST Appellate Tribunal (national bench) will ensure that there is uniformity in redressal of disputes arising under GST, and therefore, in implementation of GST across the country.

No E – way bills for Non-Filers of GST Returns

21, Jan 2019

In News:

- Non-filers of GST return for six consecutive months will soon be barred from generating e-way bills for movement of goods.

Explained:

- The Goods and Services Tax Network is developing an IT system such that businesses that have not filed returns for two straight returns filing cycles, which is six months, would be barred from generating e-way bills

- CBIC have detected 3,626 cases of GST evasion or violations cases, involving Rs. 15,278.18 crore in the April-December period.

What Is E-WAY Bill?

- The e-way bill system was rolled out on April 1, 2018, for moving goods worth over Rs. 50,000 from one State to another. The system for within the State movement was rolled out in a phased manner from April 15.

- Transporters of goods worth over Rs. 50,000 would be required to present e-way bills during transit to a GST inspector, if asked.

Why this Move Needed?

- The move has been initiated after recording lower-than-expected revenue collection under GST. Against the budgeted monthly revenue target of Rs 1 lakh crore, GST collections have so far averaged Rs 96,800 crore a month this fiscal.

- According to the government’s own admission, GST compliance has steadily declined over the past year with 28.75 per cent of regular taxpayers not filing returns in November 2018, against 10.56 per cent in November 2017, an almost three-fold increase in non-filers. Among taxpayers under the composite scheme, non-filers increased to 25.37 per cent in the July-Sept period of 2018-2019 from 15.03 per cent in the same period the previous year.

Significance of the Move:

- The move would help check Goods and Services Tax evasion. To shore up revenue and raise compliance, strict anti-evasion measures must be adopted.

- The revenue department is working towards integrating the e-way bill system with NHAI’s FASTag mechanism beginning April to help track movement of goods.

- Fake invoices to claim input tax credit also increased from only four cases involving Rs 9.75 crore to 499 involving Rs 3894.94 crore.

- There have been reports that some transporters are doing multiple trips by generating a single e-way bill. Integration of e-way bill with FASTag would help find the location of vehicles, and when and how many times they cross NHAI’s toll plazas.

Removing all Barriers

19, Jan 2019

In News:

- Inaugurating the ninth edition of the Vibrant Gujarat Summit here, prime minister said the country was ready to do business like never before; listing host initiatives his administration had taken to attract investments and improve the ease of doing business ranking.

Explained:

- At 7.3%, the average GDP growth over the entire term of the government, it has been the highest for any government since 1991 and also at the same time, the average rate of inflation at 4.6% is the lowest for any Indian government since 1991.

- Major financial institutions like the World Bank and IMF have expressed confidence in India’s economic journey. We are focused on removing the barriers which were preventing us from achieving our full potential

- The country had moved up the global ranking in the World Bank’s Doing Business report by 65 places since 2014. Doing business in India is not only easier, it’s also cheaper now because of GST, which has reduced taxes and transaction costs. We are among the largest ecosystems in the world for start-ups. Doing business with us is a great opportunity. This is also because we are among the top 10 FDI destinations in the world. India had received FDI worth $260 billion, which was 45% of the FDI received in the last 18 years.

Inflation Volatility is a challenge

19, Jan 2019

In News:

- Amid a growing demand for a reduction in interest rate in the upcoming monetary policy review scheduled for February 7, Reserve Bank of India (RBI) Governor said wide divergences and volatility in inflation pose challenges for its assessment.

Explained:

- The case for a rate cut has been cited by economists and industry lobbies on the back of a sharp fall in retail inflation in recent months with the latest data showing December CPI inflation at 2.2%.

- Although headline inflation has moderated significantly in recent years, its major components — inflation in food, fuel, and inflation excluding food and fuel are exhibiting wide divergences this year.

- While food inflation has turned negative since October 2018 and fuel inflation has been highly volatile, inflation, excluding food and fuel, remains sticky at close to 6% wide divergences and large volatilities’ pose challenges for inflation assessment

- Balancing the objectives of inflation and growth under a flexible inflation targeting framework would warrant careful analysis of every new data,

- In the last policy review meeting in December, RBI kept the repo rate unchanged at 5% and continued with the stance of calibrated tightening.

- Maintaining price stability in the economy was a basic mandate for a central bank, the Governor acknowledged that easing of global crude oil prices augured well for inflation outcomes. On the external front, a close monitoring of external sector was required, given the sharp movements in global crude oil prices and global financial market volatility. Because these are the two global shocks that have implications for our CAD and financial flows.

- The progress on the bankruptcy framework has been ‘encouraging’ and has resulted in better recovery. He said till January 3, 2019 the resolution processes have been approved in 66 cases, involving about ₹80,000 crore as resolution value to creditors.

- Banks had improved their profitability ratios and capital positions and also the provision coverage ratio which increased to 52.4% in end-September 2018 from 3% in end-March 2018.

Women bought a Third of Life Policies sold in 2017-18

12, Jan 2019

In News:

- Almost a third of the 2.82 crore life insurance policies sold during 2017-18 in the country has been bought by women, according to insurance regulator IRDAI.

Explained:

- Apart from purchasing 90 lakh policies, women contributed ₹29,801 crore by way of first-year premium (FYP). The total FYP collected during the year was ₹92,135 crore.

- Both, in terms of the number of policies or the FYP, their contribution was 32%,

- Of the 90 lakh policies bought by women, almost one-third came from three States — Maharashtra (12%); West Bengal (10.3%); and UP (9.4%). Out of ₹29,801 crore FYP contributed by women, a little over one-third came from three States — Maharashtra (18.1%); West Bengal (10%) and Tamil Nadu (7.8%). Women comprise roughly 48% of the population. Their contribution to the economic activity of the country is significant and increasing every year, said a study on the share of women in life insurance business forming part of IRDAI 2017-18 annual report.

Top five States:

- The top five States/UTs with highest share in number of policies bought by women were

- Lakshadweep (55%);

- Puducherry (43%);

- Kerala (43%);

- Mizoram (41%); and

- Sikkim (40%).

- The States with the least share in the number of polices bought by women are — Jammu & Kashmir (24%); Haryana (27%); Gujarat (27%); Uttar Pradesh (28%); and Jharkhand (28%).

An Analysis:

- Men bought 1.91 crore policies and paid ₹62,334 crore premium during the year. In other words, two in three life insurance policies sold were to men.

- At all-India level, 210 persons purchased a life insurance policy, during the year, for every 10,000 population. A further analysis showed that 277 men for every 10,000 male population purchased the policies, while the number for women was 139 for every 10000-female population.

- There is a need to involve more women as, by their very nature, women are protective towards their children and family and insurance is a form of financial protection and financial independence. With a rise in women employment and increasing participation of women in decision-making at various levels it will be a good start towards igniting the traditionally and culturally oppressed gender to their full potential.

GST Burden on Small Business eased

11, Jan 2019

In News:

- The GST Council in its 32nd meeting the last before the Budget took a slew of decisions aimed at reducing the tax and compliance burden on small and medium enterprises, including increasing the threshold limit below which companies are exempt from GST, extending the Composition Scheme to small service providers, and allowing small companies to file annual returns.

Explained:

- It also raised the annual turnover limit under which companies would be exempt from GST to Rs. 40 lakhs for most States and Rs. 20 lakhs for the North Eastern and hill states, from the earlier limit of Rs. 20 lakh and Rs. 10 lakhs, respectively.

- The limit for eligibility for the Composition Scheme would be raised to an annual turnover of Rs. 1.5 crore from April 1, 2019. He added that companies opting for the Composition Scheme would be allowed to file annual returns and pay taxes quarterly from April 1.

- The Composition Scheme currently allows companies with an annual turnover of up to Rs. 1 crore to opt for it, and file returns on a quarterly basis at a nominal rate of 1%. So far, only manufacturers and traders were eligible for this scheme

- The Council had decided to extend the Composition Scheme to small service providers with an annual turnover of up to Rs. 50 lakhs, at a tax rate of 6%.

- The Confederation of All India Traders, in a statement, said that increasing the GST threshold limit would allow about 10 lakh traders to be exempt from the compliance burden of GST, and added that increasing the Composition Scheme limit would benefit about 20 lakh small businesses that fall between the annual turnover brackets of Rs. 1 crore and Rs. 1.5 crore.

- The GST Council also decided to allow Kerala to levy a cess of up to 1% for up to two years on intra-State supplies to help finance the disaster relief efforts following the recent floods in the state.

- As there were diverse and differing opinions on the issues of taxing real estate and lotteries, the GST Council decided to set up to separate Groups of Ministers to look into the issue and present their assessments to the Council. If you’re looking to cancel your Wyndham timeshare, there are steps you can take as outlined at https://howtocancelmytimeshare.com/learn/how-to-cancel-wyndham-timeshare/. This includes contacting Wyndham directly to express your cancellation intent, checking if you’re within the rescission period for a full refund, exploring options to sell, give back or transfer ownership if outside the rescission window, and potentially working with a reputable timeshare exit company or attorney specializing in timeshare law if needed. Being proactive and persistent is key when seeking to cancel a Wyndham timeshare contract.

Benefits of these moves:

- Allowing a quarterly payment and annual return should bring quite a lot of relief and ease of doing business for small service providers.

- Also, increasing the threshold to Rs. 40 lakhs is better because it provides relief to small taxpayers, and also it is equally important to expand the tax base

GST Council:

- Goods & Services Tax Council is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax. The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States shall consist of the following members:

- The Union Finance Minister-Chairperson

- The Union Minister of State in charge of Revenue or Finance-Member

- The Minister in charge of Finance or Taxation or any other Minister nominated by each State Government-

- As per Article 279A (4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain States, etc.

Waive off Road Tax for Electric Vehicles, Centre urges states

11, Jan 2019

Context:

- The Centre urged states and Union Territories to waive off the road tax for all electric vehicles (EVs) and to give their feedback for the proposed scrapping policy for old vehicles, which the transport ministry has shared with them.

Details:

- Currently, barely half a dozen states including Maharashtra, Karnataka, Rajasthan and Goa don’t levy any road tax while registering electric vehicles. In other states, the road tax for EVs is between 4% to 10%.

- Absence of road tax might help in faster adoption of electric vehicles.

- The Centre has zeroed down on these as a part of the non-fiscal incentives for promoting EVs.

- The Centre has also suggested that the state transport corporations should go for more electric buses model from private players and link the payment to kilometres run rather than buying new buses.

- The finance ministry officials have been directed to bring the proposal for reducing the GST on EV components across the value chain to 12% from the present rate of up to 28%

- The government proposal also includes provide funding for setting up charging infrastructure up to 100% of the cost depending up the project.

- The government also decided to spend about Rs 200 crore for developing indigenous technology in areas such as power electronics and battery development.

Government Initiatives:

- The government aims to see 6 million electric and hybrid vehicles on the roads by 2020 under the National Electric Mobility Mission Plan 2020.

- Faster Adoption and Manufacturing of Electric Vehicles in India (FAME India Scheme) for improving electric mobility in India.

- The Union power ministry categorized charging of batteries as a service, which will help charging stations operate without licences.

- Implementation of smart cities would also boost the growth of electric vehicles.

Concerns / Challenges

- The Indian electric vehicle (EV) market currently has one of the lowest penetration rates in the Capital costs are high and the payoff is uncertain. The Faster Adoption and Manufacturing of (Hybrid) and Electric Vehicles (Fame) framework has been extended repeatedly and an uncertain policy environment and the lack of supporting infrastructure are major roadblocks.

- India’s limited ability to manufacture cost effective batteries.

- India does not have any known reserves of lithium and cobalt, which makes it dependent on imports of lithium-ion batteries from Japan and China

- High rate of GST on EVs when government is trying to promote EVs.

- Lack of attention on building charging infrastructure.

GST can boost direct, Indirect Tax Collections

07, Jan 2019

In News:

- The fact that the government is increasingly dependent on tax revenue, especially indirect taxes, to meet its fiscal requirements is not a cause for worry, according to tax analysts, who say that the real benefits of the Goods and Services Tax (GST) have not yet taken effect.

- Once they do, government revenue from both direct and indirect taxes will grow significantly.

Explained:

- An analysis of the budget documents of the last five years has shown that the government’s dependence on tax revenue has steadily increased, with tax revenue making up a little more than 70% of its total receipts in 2018-19, up from 65% in 2014-15.

- Correspondingly, the share of revenue from non-tax sources (such as dividends from PSUs and the RBI) and capital receipts (such as disinvestment proceeds) has been declining. Within tax revenue, the analysis shows that the share of indirect tax has been growing over the years, increasing to nearly 50% in 2018-19 from a little less than 45% in 2014-15.

- This increased dependence on tax revenue to meet its fiscal needs has meant that the government has had to push quite hard to increase its tax base at both the direct and indirect tax levels.

- The view among tax analysts is that the government cannot take the risk of increasing tax rates, whether direct or indirect, for fear of a backlash from the public.

- So, the only option it has to boost tax revenues is to increase the tax base and stop evasion, both of which the government has been trying to do with measures like e-way bill, uniform taxation, analysing the business-wise monthly GST payments and ascertaining trends in State-wise movement of goods using the e-waybill data, operation clean money.

- The other trend the government would be banking on is that increased economic activity and a higher GDP growth rate will boost consumption and hence, indirect tax collections

- The indirect tax rate is fixed, so if there is price inflation, then the government receives a tax on that as well because product prices go up and so the tax component also goes up

- The second aspect is that when the GDP grows, consumption also grows, and so you get more indirect taxes from that.

- The worry for the government should be the fact that an increasing proportion of its indirect tax collections are coming from a single source — oil.

Non-Tax Revenue:

- The government has also been trying to improve its collections from other sources such as dividends from public sector companies and the Reserve Bank of India, and also through disinvestments.

- The analysis of budget data shows that PSU dividends as a proportion of non-tax revenue have been growing over the years, from 16% in 2014-15 to 21.4% in 2018-19. The government has reportedly been pressurizing the state-run oil companies to transfer larger dividends to the Centre every year.

- It is also reportedly asking the state-run oil companies to buy back shares, and is also pushing more PSUs to list on the stock exchanges.

- However, this is an untenable source of revenue for the government because they are based on finite resources.

- Notably, dividends from the RBI, as a proportion of non-tax revenue, have been falling.

- Non-tax revenues, if you look at the majority, they have come from auctioning spectrum licences and royalties from oil, etc., and also disinvestment.