INSUFFICIENT GST REVENUES FOR STATES COMPENSATION, SAYS CENTRE

04, Dec 2019

Prelims level : Polity

Mains level : GS-II Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and Challenges Therein.

Why in News?

- The Centre has concerned that the GST shares to the states would be insufficient due to losses arising out of the Tax System.

About Goods and Services Tax:

- Goods and Services Tax (GST) is a comprehensive indirect tax on manufacture, sale, and consumption of goods and services throughout India. GST would replace respective taxes levied by the central and state governments.

- It is a destination-based taxation system.

- It has been established by the 101st Constitutional Amendment Act.

- It is an indirect tax for the whole country on the lines of “One Nation One Tax” to make India a unified market.

- It is a single tax on supply of Goods and Services in its entire product cycle or life cycle i.e. from manufacturer to the consumer.

- It is calculated only in the “Value addition” at any stage of a goods or services.

- The final consumer will pay only his part of the tax and not the entire supply chain which was the case earlier.

- There is a provision of GST Council to decide upon any matter related to GST whose chairman in the finance minister of India.

About GST Council:

- Its Chairman is Finance Minister.

- It will approve all decision related to taxation in the country.

- It consists of Centre, 28 states, Delhi, Puducherry and Jammu and Kashmir.

- Centre has 1/3rd voting rights and states have 2/3rd voting rights.

- Decisions are taken after a majority in the council.

- Article 279A (4) specifies that the Council will make recommendations to the Union and the States on the important issues related to GST, such as, the goods and services will be subject or exempted from the Goods and Services Tax.

How GST works?

- The Centre will levy and collect the Central GST.

- States will levy and collect the State GST on the supply of goods and services within a state.

- The Centre will levy the Integrated GST (IGST) on the interstate supply of goods and services, and apportion the state’s share of tax to the state where the good or service is consumed.

- The 2016 Act requires Parliament to compensate states for any revenue loss owing to the implementation of GST.

What is the Issue?

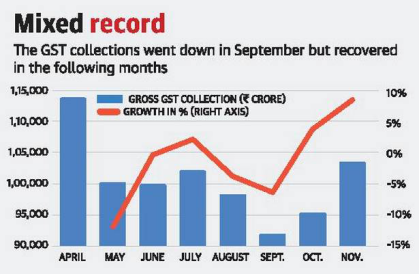

- The Centre has written to all the States voicing concern that due to the lower Goods and Services Tax (GST) collections, the compensation cess might not be enough to pay for losses arising out of the tax system.

- The compensation requirements have increased significantly and are unlikely to be met from the compensation cess being collected.

- This situation assumes significance because it was the promise of compensation to the States for losses arising out of GST implementation that convinced a large number of reluctant States to sign on to the new indirect tax regime.

- The Centre had promised compensation for any shortfall in tax revenue due to GST implementation for a period of five years.

- The government had budgeted for ₹6,63,343 crore in GST collections for the current financial year 2019-20, out of which it has collected only about 50% in the first eight months.

- It had targeted ₹1, 09,343 crore of compensation cess collections, of which it has so far collected ₹64,528 crore.