NO MORE LEEWAY: ON RBI’S RELUCTANCE TO FURNISH LIST OF WILFUL DEFAULTERS

29, Apr 2019

Prelims level : Economics

Mains level : GS-III (Conservation, environmental pollution and degradation, environmental impact assessment)

Why in News

- The RBI must set an example on transparency, and serve the national economic interest

Details:

- The Reserve Bank of India has been given a “last opportunity” by the Supreme Court to stop being in “contempt” of the court’s clear and unambiguous order of December 2015

- Ruling on a batch of contempt petitions against the RBI, a two-judge bench directed it to furnish all information relating to inspection reports and other material sought by Right to Information (RTI) petitioners.

- The bench made it clear that “any further violation shall be viewed seriously”.

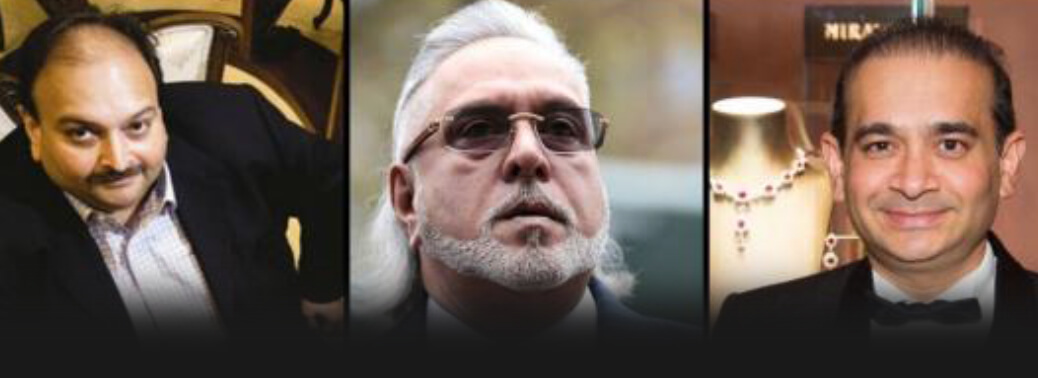

- The banking regulator has repeatedly tried to stonewall multiple requests seeking information ranging from the names of wilful defaulters on bank loans worth hundreds of crores of rupees, to the bank-wise breakup of mark-to-market (MTM) losses and the losses in foreign currency derivatives contract cases.

- The RBI was ticked off by the CIC for failing to uphold the interest of the public and not fulfilling its statutory duty to depositors, the economy and the banking sector, by privileging individual banks’ interests over its obligation to ensure transparency.

- At a time when the level of bad loans at commercial banks continues to remain worryingly high, worsening their combined capital to risk-weighted assets ratio(CRAR), it is inexcusable that the RBI continues to keep the largest lenders to banks, the depositors, and the public in the dark on the specific loan accounts that are endangering the banking system’s health and viability. The RBI’s latest Financial Stability Report shows that the industry-wide CRAR slid to 13.7% in September 2018, from 13.8% in March 2018, with the ratio at the crucial public sector banks declining more sharply to 11.3%, from 11.7%

- As the CIC aptly observed last year, the central bank’s intransigence and repeated failure to honour the court’s orders ultimately undermines the very rule of law it seeks to enforce as a banking sector regulator empowered by Parliament.

Capital Adequacy Ratio (CAR)

- Capital Adequacy Ratio (CAR) is also known as Capital to Risk (Weighted) Assets Ratio (CRAR).It is the ratio of a banks capital to its risk National regulators track a bank’s CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. It is a measure of a bank’s capital. It is expressed as a percentage of a bank’s risk weighted credit exposures.