One Year Of GST

What is GST?

- It is an indirect tax which has replaced many indirect taxes in India there by eliminating the cascading effect.

- GST Law in India is comprehensive, multi – staged, destination – based tax that is levied on every value addition.

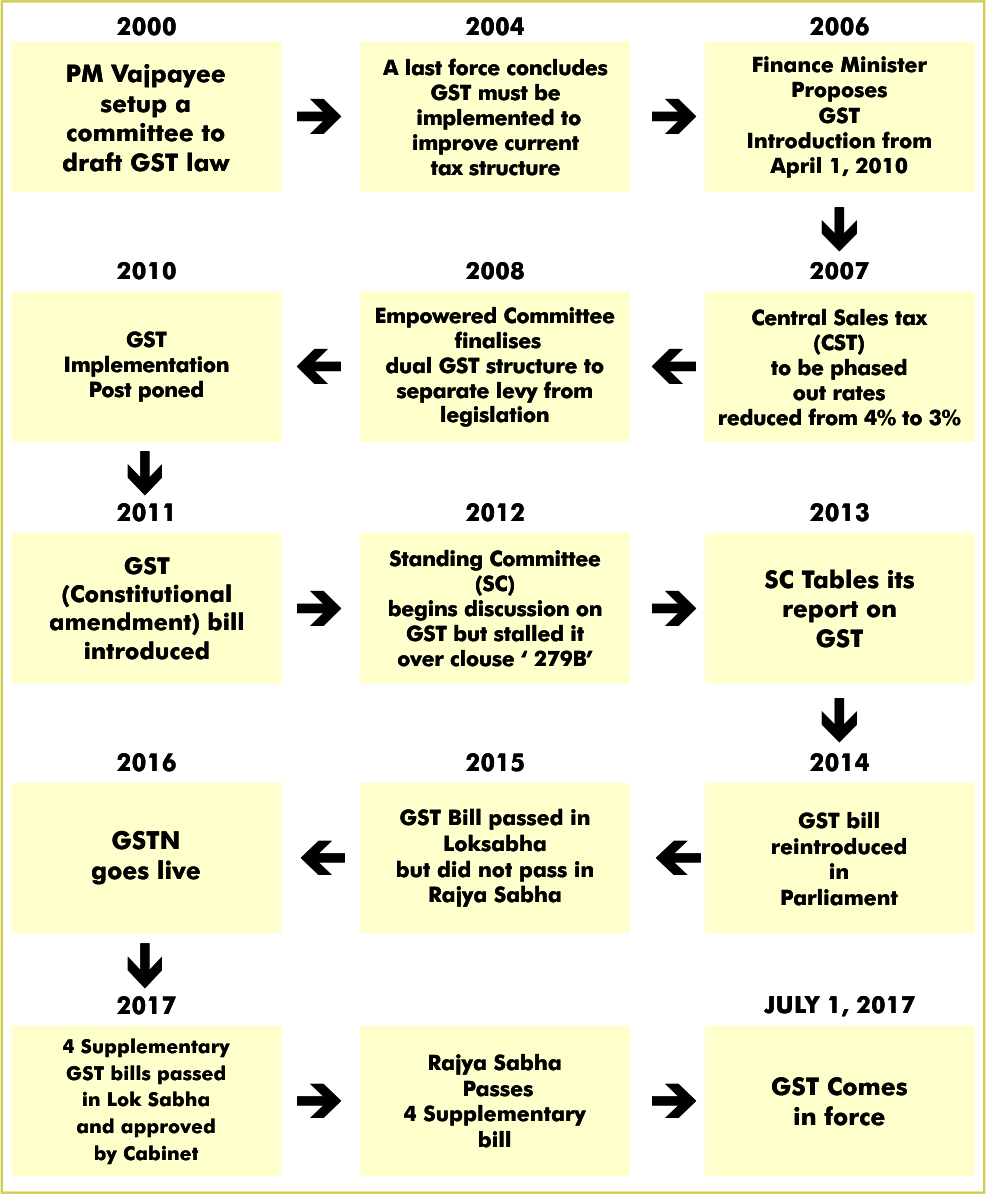

History of GST?

Components of GST:

| GST | COLLECTED BY | TRADE BETWEEN |

|---|---|---|

One Year of her contribution

- It has eliminated the cascading effect on sale of goods and services.

- It is the right steps towards expanding tax – GDP ratio

- Has brought even more transparency in our system, by introducing e -way bill, which makes tax evasion impossible.

Concerns:

The Multiple – tax rates for different products needs to be re-vamp because the services are even costlier.

Conclusion:

In Other countries, implementation of such high scale magnitude reform has caused inflation, but there is no such issue in India. India is capable of handling such high magnitude reforms.