Category: Capital Market

Current Account Deficit

18, Feb 2023

Why in News?

- Recently, the government released data showing that India’s exports and imports decreased by 6.59% and 3.63%, respectively, in January 2023, there are indications that the country’s current account deficit (CAD) will moderate despite the global slowdown triggered by the rising inflation and interest rates.

About the News:

- The moderation in CAD is expected to be aided by the fall in commodity prices, rising workers remittances and services exports, and abatement of selling pressure by foreign investors.

What is the Current Account Deficit?

- Current account deficit (CAD) is when the value of a country’s imports of goods and services is greater than its exports.

- CAD and fiscal deficit together make up twin deficits that can impact the stock market and investors.

- Fiscal Deficit is the gap between the government’s expenditure requirements and its receipts. This equals the money the government needs to borrow during the year.

Implication:

- The CAD is significant because it affects the economy, stock markets, and people’s investments.

- A lower CAD can boost investor sentiment and make the country’s currency more attractive to investors.

- A surplus in the current account indicates that money is flowing into the country, which can boost foreign exchange reserves and the value of the local currency.

Recent Status of India’s CAD:

- The CAD for the first half of 2022-23 was 3.3% of GDP, but the situation improved in Quarter 3:2022-23 due to lower commodity prices and moderated imports.

Negative Effects of CAD on Economy:

- Weaker Currency: When a country’s imports exceed its exports, it can cause a decrease in demand for its currency, leading to a weaker currency value (depreciation).

- This can make imports more expensive, leading to higher inflation and a reduction in purchasing power.

- Debt Accumulation: If a country is unable to finance its current account deficit with foreign investment, it may need to borrow to cover the gap.

- This can lead to an increase in debt levels, which can further harm the economy.

How India can Moderate Current Account Deficit?

- Encourage Exports: Increasing exports is one of the most effective ways to reduce CAD.

- The government can provide incentives for export-oriented industries, streamline export procedures and regulations, and negotiate better trade agreements with other countries.

- Promote Import Substitution: Encouraging domestic production of goods that are currently being imported can help to reduce the trade deficit.

- This can be achieved by providing incentives for domestic manufacturers and by imposing tariffs or import duties on certain goods.

- Improve Productivity and Competitiveness: Improving the productivity and competitiveness of the domestic economy can help to increase exports and reduce the trade deficit.

- This can be achieved through various measures such as investments in infrastructure, technology, and education.

Forex Reserves

03, Feb 2022

Why in News?

- According to recent data from Reserve bank of India (RBI), India’s Foreign Exchange (Forex) reserves posted a decline of USD 678 million during the week ended 21st January 2022 to reach USD 634.287 billion.

About the News:

- The slip in the reserves was on account of a drop in the Foreign Currency Assets (FCA), a vital component of the overall reserves. FCA declined by USD 1.155 billion to USD 569.582 billion in the reporting week.

- Gold reserves saw an increase of USD 567 million to USD 40.337 billion in the reported week.

- The Special Drawing Rights (SDRs) with the International Monetary Fund (IMF) fell USD 68 million to USD 19.152 billion.

About Foreign Exchange Reserves:

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- It needs to be noted that most foreign exchange reserves are held in US dollars.

- India’s Forex Reserve include:

- Foreign Currency Assets

- Gold reserves

- Special Drawing Rights

- Reserve position with the International Monetary Fund (IMF).

Objectives of Holding Forex Reserves:

- Supporting and maintaining confidence in the policies for monetary and exchange rate management.

- Provides the capacity to intervene in support of the national or Union Currency.

- Limits external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed.

Significance of Rising Forex Reserves:

- Comfortable Position for the Government: The rising forex reserves give comfort to the government and the RBI in managing India’s external and internal financial issues.

- Managing Crisis: It serves as a cushion in the event of a Balance of Payment (BoP) crisis on the economic front.

- Rupee Appreciation: The rising reserves have also helped the rupee to strengthen against the dollar.

- Confidence in Market: Reserves will provide a level of confidence to markets and investors that a country can meet its external obligations.

Foreign Currency Assets:

- FCAs are assets that are valued based on a currency other than the country’s own currency.

- FCA is the largest component of the forex reserve. It is expressed in dollar terms.

- The FCAs include the effect of appreciation or depreciation of non-US units like the euro, pound and yen held in the foreign exchange reserves.

About Special Drawing Rights:

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- The SDR is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. SDRs can be exchanged for these currencies.

- The value of the SDR is calculated from a weighted basket of major currencies, including the US dollar, the euro, Japanese yen, Chinese yuan, and British pound.

- The interest rate on SDRs or (SDRi) is the interest paid to members on their SDR holdings.

- Recently, the IMF has made an allocation of SDR 12.57 billion (equivalent to around USD 17.86 billion) to India. Now, the total SDR holdings of India stand at SDR 13.66 billion.

Reserve Position in the International Monetary Fund:

- A reserve tranche position implies a portion of the required quota of currency each member country must provide to the IMF that can be utilized for its own purposes.

- The Reserve Tranche is basically an emergency account that IMF members can access at any time without Agreeing to conditions or paying a Service Fee.

HELICOPTER MONEY

09, May 2020

Why in News?

- Telangana Chief Minister has recently suggested that the helicopter money can help states to come out of the economic chaos created by Covid-19 pandemic.

What is meant by Helicopter money?

- It is an unconventional monetary policy tool, which involves printing large sums of money and distributing it to the public, to stimulate the economy during a recession (decline in general economic activity) or when interest rates fall to zero.

- Under such a policy, a central bank “directly increases the money supply and, via the government, distribute the new cash to the population with the aim of boosting demand and inflation”.

- The term was coined by American economist Milton Friedman. It basically denotes a helicopter dropping money from the sky.

Difference between Helicopter Money and Quantitative Easing:

- Helicopter money should not be confused with quantitative easing, because both aim to boost consumer spending and increase inflation.

- In case of helicopter money, currency is distributed to the public and there is no repayment liability.

- Whereas in case of quantitative easing, it involves the use of printed money by central banks to buy government bonds. Here the government has to pay back for the assets that the central bank buys.

Pros of Helicopter Money:

- It boosts spending and Economic Growth more Effectively than quantitative easing because it increases aggregate demand – the demand for goods and services – immediately.

- It does not rely on increased borrowing to fuel the economy, which means that it doesn’t create more debt.

Cons of Helicopter Money:

- It may lead to over-inflation.

- It may devalue the currency in the foreign exchange market.

- It does not involve repayment liability, therefore many people argue that it’s not a feasible solution to revive the economy.

DECLINE IN FPI OUTFLOWS

04, May 2020

Why in News?

- As per the recent data published by Central Depository Services Limited (CDSL), the Foreign Portfolio Investors (FPIs) have significantly reduced the pace of outflows from the equity and debt market in April 2020, after a record net outflow in the month of March 2020.

Highlights of the Report:

- FPIs sold a net of Rs 6,883 crore from the equities market and net holdings worth Rs 12,551 crore from the debt market in April..

- However, they invested a net of Rs 4,032 crore in debt Voluntary Retention Route (VRR) scheme.

- VRR scheme allows FPIs to participate in repo transactions and also invest in exchange traded funds that invest in debt instruments.

- Outflows have continued due to uncertainty surrounding economic conditions caused by Covid-19 lockdown and investors are cautious. However, the pessimism also continues to grip the markets.

- So far, India has been able to contain the Covid-19 pandemic from spreading aggressively. The measures announced by the government and the Reserve Bank of India (RBI) periodically to revitalize the sagging economy have also resonated well with investors.

- With selective relaxation in the lockdown and gradual opening up of economic activity in the country, foreign investors will be closely watching the developments on this front.

- A success on developing medicine and vaccines will lead to a V-shaped recovery in the economy and markets.

Voluntary Retention Route (VRR) Scheme:

- The VRR scheme is aimed at attracting long-term and stable FPI investments into debt markets.Investments through the route will be free of the regulatory norms applicable to FPI investments in debt markets, provided investors maintain a minimum share of their investments for a fixed period.

- VRR Scheme has a minimum retention period of three years and investors need to maintain a minimum of 75% of their investments in India.

- FPIs registered with Securities and Exchange Board of India (SEBI) are eligible to voluntarily invest through the route in government and corporate bonds.

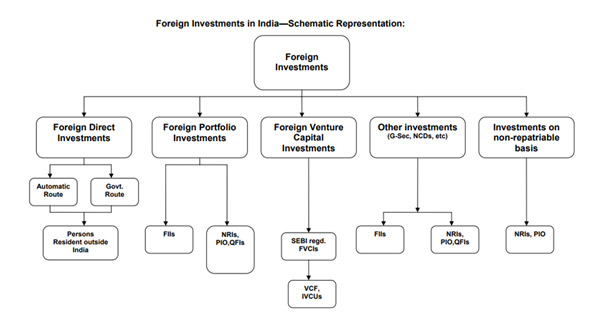

What is meant by Foreign Portfolio Investment?

- Foreign portfolio investment (FPI) consists of securities and other financial assets passively held by foreign investors. It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market.

- Foreign portfolio investment is part of a country’s capital account and is shown on its Balance of Payments (BOP).

- The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- The investor does not actively manage the investments through FPIs, he does not have control over the securities or the business.

- The investor’s goal is to create a quick return on his money.

- FPI is more liquid and less risky than Foreign Direct Investment (FDI).

- A Foreign Direct Investment (FDI) is an investment made by a firm or individual in one country into business interests located in another country. FDI lets an investor purchase a direct business interest in a foreign country.

- FPI is often referred to as “hot money” because of its tendency to flee at the first signs of trouble in an economy.

- FPI and FDI are both important sources of funding for most Economies. Foreign capital can be used to develop infrastructure, set up manufacturing facilities and service hubs, and invest in other Productive assets such as Machinery and Equipment, which contributes to Economic Growth and Stimulates Employment.

COVID-19: GLOBAL MARKETS AND ECONOMY

15, Apr 2020

Context:

- The COVID-19 pandemic has caused an unprecedented human and health crisis. The measures necessary to contain the virus have triggered an economic downturn. The latest Global Financial Stability Report shows that the financial system has already felt a dramatic impact, and a further intensification of the crisis could affect global financial stability.

- Volatility has spiked –

- The uncertainty about the economic impact of the pandemic, had increased the volatility in the market.

- With the spike in volatility, market liquidity has deteriorated significantly.

- The First Line of Defense –

- To preserve the stability of the global financial system and support the global economy, central banks across the globe have been the first line of defense.

- 1. First,they have significantly eased monetary policy by cutting policy rates.

- 2. Second,central banks have provided additional liquidity to the financial system, including through open market operations.

- 3. Third,a number of central banks have agreed to enhance the provision of U.S. dollar liquidity through swap line arrangements.

- 4. And finally, central banks have reactivated programs used during the global financial crisis, including to purchase riskier assets such as corporate bonds.

- By effectively stepping in as “buyers of last resort” in these markets and helping contain upward pressures on the cost of credit, central banks are ensuring that households and firms continue to have access to credit at an Affordable Price.

- The Vulnerability of Emerging Markets –

- As so often happens at times of financial distress, emerging markets risk bearing the heaviest burden.

- In fact, emerging markets have experienced the sharpest portfolio flow reversal on record (FPIs cashing out all they can) posing stark challenges to more vulnerable countries.

- The Spiralling Effect –

- Tougher & lasting containment measures = further tightening of global financial conditions = more severe and prolonged downturn.

- Such a tightening may, in turn, expose financial vulnerabilities that have built in recent years in the environment of extremely low interest rates. This would further exacerbate the COVID-19 shock.

- As firms become distressed and default rates climb higher, credit markets may come to a sudden stop.

- Looking Ahead –

- Central banks will remain crucial to safeguarding the stability of global financial markets and maintaining the flow of credit to the economy.

- But this crisis is not simply about liquidity.

- It is primarily about solvency—at a time when large segments of the global economy have come to a complete stop.

- As a result, both monetary and fiscal policy have a vital role to Play.

- The Troubled Path of India –

- The immediate economic and market impacts of the coronavirus have been on India’s financial markets as well as the rupee, which hit a new low.

- For firms laden with dollar-denominated debts, a continuous weakening of the rupee is likely to intensify their struggles to repay their obligations.

- Beyond the financial shocks, India has to urgently find a way to cushion the demand-side shocks induced by ongoing containment measures.

- Although the recent drop in oil prices offers some reprieve, it is inevitable that India will have to undertake more aggressive counter-cyclical fiscal measures at some stage to buffer against acute negative shocks arising from the spread of Covid-19.

- Together, monetary, fiscal, and financial policies should aim to cushion the impact of the COVID-19 shock and to ensure a steady, sustainable recovery once the pandemic is under control. Close, continuous international coordination will be essential to support vulnerable countries, to restore market confidence, and to contain Financial Stability Risks.

RBI INTRODUCES “FULLY ACCESSIBLE ROUTE (FAR)”

01, Apr 2020

Why in News?

- In the Union Budget, it has been announced that certain specified categories of government securities would be opened fully for non-resident investors without any restrictions.

- As a follow up of the announcement, the Reserve Bank of India (RBI) has introduced a separate channel called “Fully Accessible Route (FAR)” to enable non-residents to invest in specified Government of India dated securities.

- ‘Specified securities’ shall mean Government Securities as periodically notified by the Reserve Bank for investment under the FAR route.

Key Points:

- FPI consists of securities and other financial assets passively held by foreign investors.

- The RBI has said that all new issuances of Government securities (G-secs) of 5-year, 10-year, and 30-year tenors will be eligible for investment as specified securities.

- Non Resident investors can invest in specified government securities without being subject to any investment ceilings.

- This scheme shall operate along with the two existing routes: The Medium Term Framework (MTF) for Foreign Portfolio Investment (FPI) in Central Government Securities (G-secs) and State Government Securities (SDLs), which was introduced in October 2015.

- The Voluntary Retention Route (VRR) encourages Foreign Portfolio Investors to undertake long-term investments in Indian debt markets.

Benefits of the Scheme:

- This would facilitate inflow of stable foreign investment in government bonds.

- This would facilitate inclusion in global bond indices.

- Being part of the global bond indices would help Indian G-secs attract large funds from major global investors, including Pension Funds.

- This will ease the access of non-residents to Indian Government Securities Markets.

What is meant by Government Security (G-Sec)

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments.

- It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year- presently issued in three tenors, namely, 91 day, 182 day and 364 day) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

- In India, the Central Government issues both treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

AT-1 BONDS

14, Mar 2020

Why in News?

- Recently, the Reserve Bank of India (RBI) has made a proposal to write-down Additional Tier-1 (AT-1) bonds as part of the SBI-led restructuring package for Yes Bank.

What are AT-1 Bonds?

- AT-1 bonds are a type of unsecured, perpetual bonds that banks issue to shore up their core capital base to meet the Basel-III norms.

- AT-1 bonds are like any other bonds issued by banks and companies, but pay a slightly higher rate of interest compared to other bonds.

There are Two Routes through which these bonds can be Acquired:

- Initial private placement offers of AT-1 bonds by banks seeking to raise money.

- Secondary market buys of already-traded AT-1 bonds.

Key points about AT-1 Bonds:

- These bonds are also listed and traded on the exchanges. So, if an AT-1 bondholder needs money, he can sell it in the secondary market.

- Investors cannot return these bonds to the issuing bank and get the money. i.e there is no put optionavailable to its holders.

- However, the issuing banks have the option to recall AT-1 bonds issued by them (termed call options that allow banks to redeem them after 5 or 10 years).

- Banks issuing AT-1 bonds can skip interest payouts for a particular year or even reduce the bonds’ face value.

- AT-1 bonds are regulated by RBI. If the RBI feels that a bank needs a rescue, it can simply ask the bank to write off its outstanding AT-1 bonds without consulting its investors.

Basel-III Norms:

- It is an international regulatory accord that introduced a set of reforms designed to improve the regulation, supervision and risk management within the banking sector, post 2008 financial crisis.

- Under the Basel-III norms, banks were asked to maintain a certain minimum level of capital and not lend all the money they receive from deposits.

RBI’s Regulations over Banks:

- In a situation where a bank faces severe losses leading to erosion of regulatory capital, the RBI can decide if the bank has reached a situation wherein it is no longer viable.

- The RBI can then activate a Point of Non-Viability Trigger (PONV) and assume executive powers of the bank.

- By doing so, the RBI can do whatever is required to get the bank on track, including superseding the existing management, forcing the bank to raise additional capital and so on.

- However, activating PONV is followed by a write down of the AT-1 bonds, as determined by the RBI through the Banking Regulation Act, 1949.

NEW FPI NORMS

24, Aug 2019

Context:

- SEBI has relaxed the FPI norms to check the outflows of FPIs from India.

- SEBI relaxes Foreign Portfolio Investors (FPI) norms by easing the regulatory framework for FPI with simplifies KYC requirements for them and allow FPIs to carry out an off-market transfer of securities.

- Apart from this SEBI classified FPIs into two categories instead of three. SEBI relaxes the norms on the basis of a committee headed by H R Khan (Former RBI Deputy Governor).

What are Foreign Portfolio Investors (FPI)?

- FPI are those investors who hold a short-term view of a company, unlike Foreign Direct Investors who invest with a long-term view. They participate in the stock markets in the economy. FPI doesn’t have direct control over the businesses. FPIs are easier to sell than the FDIs due to high liquidity. Generally, the FPI route is preferred for laundering black money. In India, FPIs are regulated by SEBI.

Need of Committee:

- Both the FPIs and the investors had serious concern over the SEBI norms and want to review the norms by SEBI. FPIs shows concern over that the FPIs norms will result in restrictions on investments however SEBI dismissed any such fears.

- Accordingly, SEBI constitutes H R Khan Committee to review FPI norms and concern raised by the investors.

Recommendation of H R Khan Committee:

- The committee categorized the recommendation into four buckets i.e. FPI Registration process, KYC and documentation, Investment permission and limits and other aspects.

- The committee recommends that OCIs, NRIs, and RIs should be allowed for holding a non-controlling stake in FPIs and no restrictions should be imposed on them for managing non-investing FPIs or SEBI registered offshore funds.

- The committee recommends for easing KYC requirements for beneficial owners in case of government-related FPIs.

- The committee recommended that erstwhile PIOs should not be subjected to any restrictions and clubbing of investment limits should be allowed for well-regulated and publicly held FPIs that have common control.

- The committee also suggests that the time for compliance with the new norms should be extended by six months after the finalization and the non-compliant investors should be given another 180 days to reconcile their existing positions.

- According to the committee, NRI will be allowed to invest as FPIs if the single holding is under 25% and group holding under 50% in a fund.

- The panel also recommends that the new rules should be equally applied to the investors using participatory notes (P-notes).

- The panel also suggested for changes in the norms pertaining to the identification of senior managing officials of FPIs and for beneficial owners of listed entities.

New FPI norms by SEBI:

- SEBI rationalizes the requirements for issuance and subscription of offshore derivative instruments (ODIs).

- SEBI said that the offshore funds floated by the mutual funds would be allowed to invest in the country after the registration.

- Those entities which are established under the International Financial Services Centre must meet the criteria for FPIs.

- SEBI permits FPIs for off-market transfer of securities which are unlisted, suspended or illiquid to a domestic or foreign investor.

- Structure for Multiple Investment Manager also has been simplified.

- Those central banks who are not the members of Bank for International Settlements would be eligible for registration as FPIs to attract more overseas funds to the market.

- The FPIs are classified into two categories earlier it was two.

- SEBI said it would rationalize the framework for issuance of participatory notes (P-notes)

- The board also clarified on the debt to equity ratio, companies need to maintain it as 2:1 to be eligible for buybacks however the Non-banking financial companies (NBFC) arms would be exempt from the rule.

- To crack down insider trading a new whistleblower mechanism will be implemented.

- Rewarding informants up to Rs. 1 crore for providing “credible and original information” on insider trading.

- Mutual funds are now allowed to invest in unlisted non-convertible debentures.

Reasons for Outflow of FPIs from India:

- India is the fastest-growing country in the world and there are certain issues which stress the overall economic performance of the country. One of the main challenges recently is the outflow of FPIs from India. Reasons for the outflow of FPIs are:

- Introducing Higher tax surcharge in the Budget 2019 by the government.

- Continue Depreciation of Indian Rupee

- The trade war between the U.S and China

- Reduced rating and default of NBFCs

- Rising of crude oil prices

Conclusion:

- Easing of FPI norms could give a boost to the overseas investment in the country which is an important source of economic growth and development in India. These changed norms will make the regulatory framework more investor-friendly for FPIs and a multidimensional approach is needed to resolve the concerns of FPIs and reasons of outflows.

DEBENTURE REDEMPTION RESERVE

23, Aug 2019

Why in News?

- The Centre has removed Debenture Redemption Reserve (DRR) requirement for listed companies, NBFCs and housing finance companies (HFCs).

Debenture redemption reserve (DRR):

- A debenture redemption reserve (DRR) is a provision stating that any Indian corporation that issues debentures must create a debenture redemption service in an effort to protect investors from the possibility of a company defaulting.

- In 2002, the then government said that for NBFCs registered with the Reserve Bank of India, the reserve had to be at least 50 percent of the value of debentures issued via public issuance.

- A 2013 revision brought this down to 25% of the value of publicly issued debentures

- A debenture redemption reserve is meant to protect the interests of retail bond holders in the event of a company going through financial stress. It was introduced in company law for the first time in 2000.

Highlights:

- The Corporate Affairs Ministry (MCA) has now amended its share capital and debenture rules to remove the requirement for creation of a DRR of 25 per cent of the value of outstanding debentures in respect of listed companies, NBFCs registered with the RBI and for HFCs registered with National Housing Bank (NHB) both for public issue as well as private placements

- For unlisted companies, the DRR has been reduced from the present level of 25 per cent to 10 per cent of the outstanding debentures. Hitherto, listed companies had to create a DRR for both public issue as well as private placement of debentures, while NBFCs and HFCs had to create DRR only when they opted for public issue of debentures.

LINKING FARMERS TO FUTURES MARKET IN INDIA

12, Aug 2019

Why in News?

- The Indian Council for Research on International Economic Relations (ICRIER) study suggests the need to empower the Farmer Producer Organizations (FPOs) to trade in the commodities futures market.

Highlights:

- For futures market to achieve the objectives of price discovery and risk mitigation and have an impact on Indian agriculture, it is necessary that more farmers and farmer-producer organisations (FPOs) participate in it.

- The concept of ‘Farmer Producer Organizations (FPO)’ consists of collectivization of producers, especially small and marginal farmers so as to form an effective alliance to collectively address many challenges of agriculture such as improved access to investment, technology, inputs, and markets.

- The FPO can be a production company, a cooperative society or any other legal form which provides for sharing of benefits among the members. In some forms like producer companies, institutions of primary producers can also become a member of PO.

- The FPOs are generally mobilized by promoting institutions/ resource agencies (RAs). Small Farmers Agribusiness Consortium (SFAC) provides support for the promotion of FPOs.

- The resource agencies leverage the support available from governments and agencies like NABARD to promote and nurture FPOs, but attempting an assembly line for mass production of FPOs has not given the desired results.

Future Market:

- Futures contracts are used as hedging instruments in agricultural commodities. Hedging is a common practice that insures the farmer against a poor harvest by purchasing futures contracts in the same commodity.

- Forward Markets Commission (FMC) was a regulatory authority for commodity futures market in India. Forward Markets Commission (FMC) has been merged with Securities and Exchange Board of India (SEBI) with effect from September 28, 2015.

GREEN BONDS AND CLIMATE CHANGE

31, Jul 2019

Context:

- New study finds firms that have adopted green bonds benefit from both positive financial and environmental outcomes.

What Are Green Bonds:

- A green bond is like any other regular bond but with one key difference: the money raised by the issuer are earmarked towards financing `green’ projects, i.e. assets or business activities that are environment-friendly.

- Such projects could be in the areas of renewable energy, clean transportation and sustainable water management.

What Are Benefits of Green Bonds?

- Green bonds enhance an issuer’s reputation, as it helps in showcasing their commitment to wards sustainable development.

- It also provides issuers access to specific set of global investors who invest only in green ventures.With an increasing focus of foreign investors towards green investments, it could also help in reducing the cost of capital.

- Green bonds present the opportunity for investors to feel as if they’re making a difference for the environment while earning a respectable return in the process.

Green Bond in India

- CLP India, was the first Indian company to tap this route. So far, Rs 7,200 crore has been raised via green bonds.

Key Findings of Study

- Green bonds offer financial benefits to companies in the long run in terms of better returns on assets and equity.

- Green bonds fulfil their intended goal of better environmental outcomes: companies issuing green bonds saw a significant reduction in their CO2 emissions and a boost in their environmental ratings.

- Though green bonds are only a small share of the larger bond market, they have grown rapidly over the last decade.

- Most of these green bonds were issued by governments, financial and utility companies.

- The green bond market is dominated by three countries – China ($83 billion worth of green bonds issued over the last decade), United States ($58 billion) and France ($57 billion) have been the largest issuers of green bonds.

- India still lags behind these countries ($5.2 billion in 2018), it is one of the fastest-growing green bond markets in Asia.

Way Forward:

- There are neither uniform standards to classify a green bond nor a governing body to regulate the market.

- There is need to address this is critical issue for green bond markets to flourish which has good amount of potential.

U.K SINHA COMMITTEE

26, Jun 2019

- The Reserve Bank of India (RBI) on January, 2019 set up an expert committee under former SEBI chairman U.K. Sinha to Suggest Long-Term Solutions for the economic and Financial Sustainability of the MSME sector.

Key Recommendations of the Committee:

- ₹5,000 crore stressed asset fund for domestic micro, small and medium enterprises (MSMEs) in a relief to small businesses hurt by demonetization, the goods and services tax and an ongoing liquidity crunch.

- Such a fund could work in tandem with RBI-mandated restructuring schemes or bank-led NPA revival solutions for MSMEs.

- The onus of creating this fund would lie with the government

- The committee also suggested forming a government-sponsored Fund of Funds of ₹10,000 crore to support venture capital and private equity firms investing in MSMEs.

- The RBI should increase the limit for non-collateralized loans to 20 lakhs.

- Revision in loan limit sanctioned under the MUDRA by the Finance Ministry to 20 lakhs from 10 lakhs.

- Banks that wish to specialize in MSME lending, their sub-targets for farm loans under the priority sector lender could be waived off, and instead can be given a target for loans to the SME sector.

- The targets, committee said, could be of 50% of the net bank credit for universal banks and 80% for small finance banks.

- Commercial banks have been suggested that they should develop customised products to assess the financing requirements based on expected cash flows moving away from traditional forms of assessment.

- Banks need to build their ability to capture cash flows of MSME borrowers on a regular basis, for which tie-ups with industry majors / aggregators / online platforms will have to be done by the banks

- In order to provide loan portability in a seamless manner to MSMEs, the committee recommended that the RBI should come out with measures on portability of MSME loans with a lock-in-period of one year.

AMAZON CLINCHES TOP SPOT IN THE WORLD’S MOST VALUABLE BRAND RANKING

12, Jun 2019

Why in News:

- Amazon clinched the world’s most valuable brand in cloud computing, consumer tech and movie production.

Background:

- It is founded by the world’s richest man Jeff Bezos.

- According to the 2019 BrandZ Top 100 Most Valuable Global Brands rankings, Amazon online retailer set its brand value quintuple in the past five years to reach $315.5billion.

- It is undertaken annually by advertising holding company WPP.

- The detailed study of Brand Z reveals firms financial data and draws on an extensive consumer survey to reach its conclusions.

- Amazon expanded into grocery, healthcare, food delivery and, with its Alexa devices, even voice recognition. Amazon jumped from third to first place to eclipse Google. The brand of Amazon from 52 percent to $315 billion.

- The company jumped from third place to first place and got the third position to topmost by replacing Google.

About Financial Market:

- There are two online shopping namely Alibaba and JD.com Chinese website which are down its Chinese e-commerce operation. Huawei company got a sudden break down of telecom network equipment and smartphone maker poses security and spying risks. Huawei added 8 percent to its brand value in the past year to reach $26.9bn.

- Netflix was third among the global market and they obtained 65% to obtain its brand value of 34.3 billion.

About Amazon:

- Founder: Jeff Bezos

- Headquarters: Seattle, Washington, U.S.

- Services: Amazon.com, Amazon Alexa, Amazon Appstore, Amazon Music Amazon Prime Amazon Video

- Revenue: US$232.887 Billion – 2018

A THREEFOLD RISE IN THE OUTFLOWS FROM CREDIT FUNDS

12, Jun 2019

Why in News:

- Net outflows from credit risk funds jumped over threefold in the month of May as investors remained wary of the segment in the light of recent downgrades and defaults.

Details:

- According to data from the Association of Mutual Funds in India (AMFI), credit risk funds saw net outflows of ₹4,156 crore in May, as against ₹1,253 crore in April.

- Further, the net inflows into the overall debt funds segment fell significantly from ₹1.21 lakh crore in April to ₹70,119 crore in May.

- Industry experts believe that while investors are likely to be sceptical of investing in credit funds, the income and gilt categories could see a jump in inflows on the back of favourable macro-economic factors and also with the central bank cutting rates while changing its stance from neutral to accommodative.

- Macro-economic factors appear to be favourable with low inflation, high reserves and balance of payments under control.The flows into equity schemes are likely to revive going forward as uncertainty related to election results are over and the recent market movement also points towards increased investor confidence.

STRUCTURAL REFORMS FOR TACKLING ECONOMIC SLOWDOWN

10, Jun 2019

Why in News:

- GDP growth slowed to a five-year low of 6.8% in 2018-19, even as the unemployment rate rose to a 45-year high of 6.1% in 2017-18.

Background: / Economic slowdown:

- Official estimates released recently show GDP growth slowed to a five-year low of 6.8% in 2018-19, even as the unemployment rate rose to a 45-year high of 6.1% in 2017-18.

- Agriculture gross value added (GVA) growth is estimated at negative 0.1% and manufacturing GVA growth at 3.1% in the January-March quarter.

- The economy is struggling with an investment and a manufacturing slowdown, rural distress, unremunerative farm incomes, stagnating exports, a banking and financial mess and a jobs crisis.

- Sales figures from fast moving goods makers and continuing production cuts at car manufacturers confirm that consumption spending have slowed.

- The economic priority for the new government ought to be credible course correction in policy — its formulation, articulation and the setting of goals.

Reforms taken in past:

- Structural reforms — spanning an overhaul of labour and land policies and a much-needed manufacturing push, ‘Make In India’, for absorbing the slack from the farms — had been abandoned by the end of 2015.

- The initial energy and enthusiasm gave way to misadventures such as demonetisation and the poorly designed rollout of the Goods and Services Tax (GST) regime.

- The decrepit public banking system and the problems of the financial sector received little policy attention.

- Even the insolvency and bankruptcy reform, a sound economic reform, that got rolled out rather gradually and tentatively is already in danger of getting diluted.

- The Constitution was hurriedly amended for rolling out reservations based on economic criteria and that fiscal giveaways for middle class Indians and farmers dominated the Interim Budget presented in February without considering the magnitude of the challenge on the economic front.

Way ahead: / Generating sustainable Livelihoods:

- Public provision of toilets, cooking gas connections and dwellings or Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) wage jobs and income supplement schemes are temporary sources of relief. They are not an economic growth model or strategies for reducing poverty. They can help the poor survive by providing meagre resources for subsistence.

- Reducing poverty needs economic growth to generate sustainable livelihoods for the poor.

- And this cannot be remedied by redistributive taxation policies alone.

- The government’s ‘Make In India’ strategy was a step in the right direction, and needs to

- be revived. Done right, it can absorb the slack from the farms.

- Few organised sector jobs get generated in India because industries prefer capital-

- intensive production despite the economy’s relative abundance of low-wage labour.

- If production were less capital-intensive, more organised sector jobs would be created.

- Plus, labour’s bargaining power would improve.

- The government needs to take up the backlog of economic reforms pending since the first burst in the 1990s.

- For the role they play in jobs creation, smaller firms ought to be incentivised with easy credit and taxation norms.

Data Collection:

- Lastly, no evolution of the policy paradigm will be possible if the crisis of credibility in the collection, estimation and presentation of official statistics is not addressed appropriately.

Conclusion:

- The new government must leverage the public trust voters have placed in it to get the economy on track. Structural reforms with meticulous planning and proper implementation will help.

SEBI, MCA SIGN PACT FOR MORE DATA SCRUTINY

09, Jun 2019

Why in News:

- The Securities and Exchange Board of India (SEBI) and the Ministry of Corporate Affairs (MCA) signed a memorandum of understanding (MoU) to facilitate seamless sharing of data and information.

Background:

- The MoU comes in the wake of the increasing need for surveillance in the context of corporate frauds affecting important sectors of the economy.

- MoU will enable sharing of specific information such as details of suspended companies, delisted companies, shareholding pattern from SEBI and financial statements filed with the registrar by corporates, returns of allotment of shares, audit reports relating to corporates. This assumes significance as the MCA has the database of all registered firms while SEBI only regulates listed entities that may have unlisted subsidiaries, with the MCA having access to all the data of such unlisted entities.

- The MoU will ensure that both the MCA and the SEBI have seamless linkage for regulatory purposes and in addition to regular exchange of data, the two will also exchange with each other, on request, any available information for scrutiny, inspection, investigation and prosecution.

- A Data Exchange Steering Group has been constituted for the initiative, which will meet periodically to review the data exchange status and take steps to further improve the effectiveness of the data sharing mechanism.

SEBI TIGHTENS DISCLOSURE NORMS FOR LISTED DEBT SECURITIES

28, May 2019

Why in News:

- To further safeguard the interest of investors in listed debt securities, the Securities and Exchange Board of India (SEBI) has tightened the disclosure norms for entities that have issued such securities.

Details:

- The capital market watchdog made it mandatory for such companies to disclose on their websites the schedule of interest and redemption obligations for the complete financial year.

Within a day of due date

- Further, the status of payments has to be updated within one day of the due date, which effectively means that any default or delay will be disclosed within a day of the due date.

- The enhanced disclosure norms have been issued to “further secure the interests of investors in listed debt securities, enhance transparency and to enable Debenture Trustees (DTs) to perform their duties effectively and promptly.” DTs shall display on their website details of interest/ redemption due to the debenture holders in respect of all issues during a financial year within 5 working days of start of financial year. For privately-placed debt securities, SEBI has made it mandatory for the inclusion of a clause stating that at least 2% per annum interest would be paid over the coupon rate in case of a default in meeting the payment obligations.

SEBI

- SEBI is the statutory regulator for the securities market in India.

- It was established in 1988 and given statutory powers through the SEBI Act, 1992.

- HQ: Mumbai

- Purpose: Protect the interests of investors in securities, promote the development of securities market and to regulate the securities market.

- SEBI is responsive to needs of three groups, which constitute the market i.e.

- Issuers of securities, Investors and

- Market intermediaries.

EXTERNAL WOES: ON INDIA’S FOREIGN TRADE

18, May 2019

Why in News:

- The estimates for foreign trade showed a sharp slowdown in merchandise export growth in April, 2019 to 0.64% from a year earlier.

Background: / what is the exports scenario?

- There was a 31% surge in petroleum products shipments to overseas markets in April.

- If this is removed, India’s goods export actually contracted by over 3% in dollar terms.

- [In contrast, overall merchandise exports had expanded 11% year-on-year in March, 2019 with the growth in shipments excluding petroleum products.]

- The slump in exports was fairly widespread, with 16 of the 30 major product groups reflecting contractions.

- This is in contrast with the 10 categories that had shrunk in March.

- Worryingly, shipments of engineering goods declined by over 7% after having expanded by 16.3% in March.

- The traditionally strong export sectors all weakened in April.

- These include the gems and jewellery, leather and leather products, textiles and garments, and drugs and pharmaceuticals sectors.

- E.g. contraction in gem and jewellery exports widened to 13.4% in April, from 0.4% in March; it was 15.3% from 6.4% respectively for the leather segment

- Likewise, the pace of growth of garment exports decelerated to 4.4% from 15.1% in March.

What is the case with imports?

BALANCE OF TRADE

- Imports grew by 4.5% to $41.4 billion in April, accelerating from March’s 1.4%.

- This was primarily because the purchases of crude oil and gold continued to increase.

- The 9.3% jump in the oil import bill, from March’s 5.6%, can partly be explained by the rise in international crude prices. However, the 54% surge in gold imports reflects India’s unappeasable appetite for gold, calling for policymakers’ attention and action.

- Excluding oil and gold, however, imports shrank by more than 2% in April.

- This signals that import demand in the real productive sectors is largely balanced.

What are the Implications?

- Jobs and demand – The traditionally strong export sectors are all key providers of jobs.

- So any prolonged slump across these industries will impact jobs, wages and overall consumption demand in the domestic market.

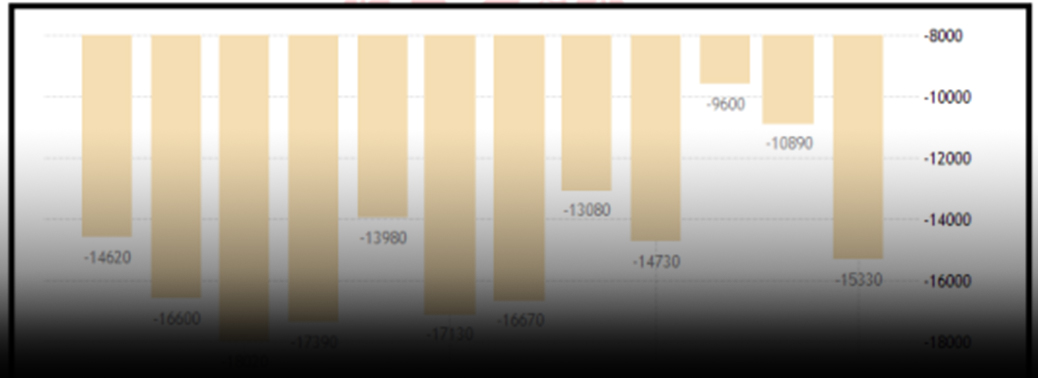

- Trade deficit – With merchandise imports outpacing exports, the trade deficit widened to a five-month high of $15.3 billion.

- The widening trade shortfall will add pressure on India’s widening current account deficit (CAD).

- Being at around $51.9 billion in the first 9 months of fiscal 2018-19, CAD had already surpassed the preceding financial year’s 12-month shortfall of $48.7 billion.

- More challenges and limitations to trade and exports are ahead with the escalating trade war between the U.S. and China.

- The impacts of this could be widespread on global growth.

- Moreover, the rising military tensions in West Asia could potentially further push up oil prices, further increasing India’s import burden.

- Given these, containing the trade and current account deficits seems significantly challenging and urgent measures are needed to boost exports.

A fraught moment: U.S.-China Trade War

11, May 2019

Why in News:

- The U.S. and China need to take sustained steps to de-escalate tensions over tariffs

Details:

- The U.S.-China trade war has flared up again after a deceptive lull over the last few months, when both sides were trying to negotiate a

- Trump tweeted that he would raise the 10% tariff

- imposed on $200-billion worth of Chinese goods to 25%. The latest revival in tensions between the world’s two largest economies elevates the risk of a global trade war to its highest level since the first signs emerged in 2018. The increase in tariffs imposed on goods crossing international borders essentially represents a new tax on a global economy already facing a slowdown

- The International Monetary Fund trimmed its projection for global growth in 2019 to 3%, from a 3.5% forecast made in January, citing slowing momentum in “70% of the world economy”.

- Were tensions in trade policy to flare up again, it could result in large disruptions to global supply chains and pose downside risks to global growth, the IMF warned

- world economy faces the very real risk of an escalation in this trade war where other countries, including India

- it could result in U.S. job losses too as the import of Chinese parts become uneconomical for smaller businesses

- Indian policymakers would do well to closely monitor the latest escalation in trade tensions pans out for global demand and international energy prices, given that the RBI has flagged oil price volatility as a factor that would have a bearing on India’s inflation

Impact on India:

- The trade war may impact Indian economy more adversely.

- A trade war would slowdown global growth overall, worsening India’s already dismal export numbers. The biggest impact could be on the rupee which is already battling historic lows against the US The rising price of oil threatens to widen India’s current account deficit, impacting India’s macroeconomic stability. Reducing investment flows into India. However, India which runs a $51.08 billion trade deficit with China may stand to benefit. China imports 100 million metric tons of soybean which serves as protein source and feeds its food processing industry, this presents a huge opportunity for India.

- India may also seek the opportunity to reduce its own trade deficit against India may be able to gain some traction in textile, garments and gems and jewellery if Chinese exports to the US slow down.

INDIA’S GOLD RESERVES INCREASE MARGINALLY IN FEBRUARY: WGC

10, Apr 2019

Why in News?

- Globally, gold reserves with central banks rise 51 tonnes, highest since Oct. 2018.

Details:

- India has marginally increased its gold holding in February while maintaining the tenth position among countries in terms of yellow metal reserves, as per latest data from the World Gold Council (WGC).

- India added 1.7 tonnes in February while most other countries, barring Russia and China, saw their reserves unchanged in the recent past

- As per WGC, India had total gold reserves of 608.7 tonnes in February, marginally up from the previous month’s holding of 607 tonnes.

- Apart from India, only two other countries among the top 10 in terms of gold reserves increased their holdings in the month of February. Central bank gold reserves increased by a net 51 tonnes in February 2019, with gross sales minimal at only 0.2 tonnes,” said Alistair Hewitt, director of market intelligence, WGC. Collectively,

- central banks — mostly from the emerging markets — continue to accumulate gold at a healthy pace.

Other countries

- Some of the other countries that also have a significant gold reserve include Taiwan (423.6 tonnes), Portugal (382.5 tonnes), Kazakhstan (356.3 tonnes), Uzbekistan (342.1 tonnes) and Saudi Arabia (323.1 tonnes). Pakistan has 64.6 tonnes and is ranked 45 while Sri Lanka (19.9 tonnes) and Bangladesh (14 tonnes) are at 63rd and 66th positions.

- Nepal with 6.4 tonnes is at 82nd position.

World gold council:

- The World Gold Council is the market development organisation for the gold industry. It works across all parts of the industry, from gold mining to investment, and their aim is to stimulate and sustain demand for gold. Headquartered in London United Kingdom.

In Q3, current account deficit narrows to 2.5%

30, Mar 2019

India’s current account deficit (CAD) for the third quarter narrowed to 2.5% of the GDP compared with 2.9% in the preceding quarter, latest data released by the Reserve Bank of India (RBI) showed. In absolute terms, CAD was $16.9 billion in Q3 compared with $19.1 billion in the second quarter.

However, on a year-on-year basis, CAD in October-December period widened from 2.1% or $13.7 billion.

The widening of the CAD on a year-on-year (y-o-y) basis was primarily on account of a higher trade deficit at $49.5 billioncompared with $44 billion a year ago.

What is Current Account Deficit?

- It means the value of imports of goods/services/investment incomes is greater than the value of exports.

- It is sometimes informally referred to as a trade deficit.

- The major contributor to India‘s Current Account Deficit (CAD) has been imports of Gold and Crude Oil.

Impact of CAD

- Sustained period of CAD has led to currency depreciation, high rates of inflation which further effects the incoming foreign investment.

- Fall in gold imports and lower oil import bill in recent time led to shrinkage in the deficit.

- A current account surplus means an economy is exporting a greater value of goods and services than it is importing.

- There is no hard and fast rule about what will happen if a country has a current account surplus. It depends on the size of the current account and the reasons for the current account surplus.

- In the case of India, slow growth in imports, reflecting the persisting weakness in the investment sentiment, is the prominent reason behind this.

- The current account was in surplus last in the January-March quarter in the year 2007.

INDICES GAIN OVER 1% MIRRORING GLOBAL TREND

27, Mar 2019

- The Indian benchmark equity indices staged a smart recovery to gain more than 1% to reverse a two-day losing streak that saw indices fall below psychological levels.

What is an ‘Equity’/Share?

- Total equity capital of a company is divided into equal units of small denominations, each called a share. (Equity capital is the invested money that, in contrast to debt capital, is not repaid to the investors in the normal course of business.) For example, in a company

- the total equity capital of Rs 5,00,00,000 is divided into 50,00,000 units of Rs 10 each. Each such unit of Rs 10 is called a Share. Thus, the company then is said to have 50,00,000 equity shares of Rs 10 each.

What is meant by a Stock Exchange?

- The Securities Contract (Regulation) Act, 1956 [SCRA] defines ‘Stock Exchange’ as any body of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities. Stock exchange could be a regional stock exchange or national exchanges.

Why do companies need to issue shares to the public?

- Most companies are usually started privately by their promoter(s). However, the promoters’ capital and the borrowings from banks and financial institutions may not be sufficient for setting up or running the business over a long term. So companies invite the public to contribute towards the equity and issue shares to individual investors. The way to invite share capital from the public is through a ‘Public Issue’. Simply stated, a public issue is an offer to the public to subscribe to the share capital of a company. Once this is done, the company allots shares to the applicants as per the prescribed rules and regulations laid down by SEBI.

Bull Market vs Bear Market

- A bull market is a financial market of a group of securities in which prices are rising or are expected to rise. Bull markets are characterized by optimism, investor confidence and expectations that strong results will continue.

- Bear market refers to a market condition in which the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. As investors anticipate losses in a bear market and selling continues, pessimism only grows. A bear market should not be confused with a correction, which is a short-term trend that has a duration of less than two months.

Bombay Stock Exchange:

- BSE is the oldest stock exchange in Asia formed by eight native stock brokers association in 1875 located at Dala street, Mumbai.

- It had received temporary approval from Bombay government in 1927 and permanent approval by Indian Government on 31 Aug 1957.

- Today it is 10th largest stock market in the world by market capitalization at $1.7 trillion and has more than 5,000 companies listed in it.

- Its iconic building named Phiroze Jeejeebhoy Towers, Dalal Street in Mumbai, Maharashtra has received image trademark under Trade Marks Act, 1999.

National Stock Exchange of India (NSE)

- NSE is an All india level stock exchange. It was incorporated in November 1992. It offers online trading system matching to international standards.

- The main features of National Stock Exchange are as follows

- It has nationwide coverage. The investor can make dealing through NSEI dealer.

- NSE is the first stock exchange in the world which uses communication technology for trading its securities. It is fully computerised, screen based and ringless system.

- It allows the investors to trade their securities from their offices or homes through the network with direct satellite link up.

- There are transparency dealings. The investor can check the exact price at which their transactions took place.

- National Stock Exchange is a company promoted BY IDBI, ICCI, LIC and GIC and its subsidiaries, commercial banks. SBI capital market limited.

- The establishment of the NSE is a major step in upgrading trading facilities for investors and bringing Indian Financial markets in line with international markets.

- The index of the NSE is called as the Broader 50 share – Nifty.

Foreign Institutional Investor (FII)

13, Dec 2018

Introduction:

- Foreign Institutional Investor (FII) means an institution established or incorporated outside India which proposes to make investment in securities in India. They are registered as FIIs in accordance with Section 2 (f) of the SEBI (FII) Regulations 1995.

- FIIs are allowed to subscribe to new securities or trade in already issued securities. This is just one form of foreign investments in India.

FII Vs FDI: International standards and Indian definition:

- According to IMF and OECD definitions, the acquisition of at least ten percent of the ordinary shares or voting power in a public or private enterprise by non-resident investors makes it eligible to be categorized as foreign direct investment (FDI).In India, a particular FII is allowed to invest upto 10% of the paid up capital of a company, which implies that any investment above 10% will be construed as FDI, though officially such a definition did not exist.

- It may be noted that there is no minimum amount of capital to be brought in by the foreign direct investor to get the same categorized as FDI.

Who can get registered as FII?

Following Foreign Entities / Funds are eligible to get Registered as FII:

1. Pension Funds

2. Mutual Funds

3. Investment Trusts

4. Banks

5. Insurance Companies / Reinsurance Company

6. Foreign Central Banks

7. Foreign Governmental Agencies

8. Sovereign Wealth Funds

9. International/ Multilateral organization/ agency

10. University Funds (Serving public interests)

11. Endowments (Serving public interests)

12. Foundations (Serving public interests)

13. Charitable Trusts / Charitable Societies (Serving public interests)

- Thus, it may be seen that sovereign wealth funds (SWFs) are also regulated under FII regulations only, and no separate regulation exists for SWFs. Further, following entities proposing to invest on behalf of broad-based funds, are also eligible to be registered as FIIs:

- Asset Management Companies

- Investment Manager/Advisor

- Institutional Portfolio Managers

- Trustee of a Trust

- Bank

What FIIs can do?

A Foreign Institutional Investor may invest only in the following:

1. securities in the primary and secondary markets including shares, debentures and warrants of companies listed or to be listed on a recognised stock exchange in India; and

2. units of schemes floated by domestic mutual funds including Unit Trust of India, whether listed on a recognised stock exchange or not

3. units of scheme floated by a collective investment scheme

4. dated Government Securities

5. derivatives traded on a recognized stock exchange

6. commercial papers of Indian companies

7. Rupee denominated credit enhanced bonds

8. Security receipts

9. Indian Depository Receipt

10. Listed and unlisted non-convertible debentures/bonds issued by an Indian company in the infrastructure sector, where ‘infrastructure’ is defined in terms of the extant External Commercial Borrowings (ECB) guidelines

11. Non-convertible debentures or bonds issued by Non-Banking Financial Companies categorized as ‘Infrastructure Finance Companies’(IFCs) by the Reserve Bank of India

12. Rupee denominated bonds or units issued by infrastructure debt funds

13. Indian depository receipts

Myths About FIIS:

- There are certain myths / beliefs about FIIs which are not necessarily true.

- Myth -1:FIIs do not invest in unlisted entities. They participate only through stock exchanges.

- Myth -2:FIIs cannot invest at the time of initial allotment. Foreign investors investing in initial allotment of shares (say IPOs or when a group of entities come together to float a company) are categorized as FDIs.

- Truth on 1 and 2:As per Section 15 (1) (a) of the SEBI FII Regulations, 1995, a Foreign Institutional Investor (FII) could invest in the securities in the primary and secondary markets including shares, debentures and warrants of companies unlisted, listed or to be listed on a recognized stock exchange in India. In fact FIIs are very active in the over the counter (OTC) markets and in the IPO market in India. However, subsequent to SEBI (FPI) regulations, FIIs are allowed to invest only in listed or to-be listed entities and only through stock exchanges.

- Myth 3:FDI has more direct involvement in technology, management etc while FIIs are interested in capital gain and momentary price differences. Generally direct investment involves a lasting interest in the management of an enterprise and includes reinvestment of profits. In contrast, FIIs do not generally influence the management of the enterprise.

- Truth on 3:To some extant this notion is true and is emphasized in policy documents. For instance, consolidated FDI Policy of Department of Industrial Policy and Promotion (DIPP) states that “foreign Direct Investment, as distinguished from portfolio investment (FII), has the connotation of establishing a ‘lasting interest’ in an enterprise that is resident in an economy other than that of the investor”.

- However, of late, there have been occasions where FIIs come together to influence decisions in companies where they hold shares. The difference between FDI and FII, except for the fact that the latter necessarily has to be an institution (FDI can come from an individual also), rather lies in the registration or approval process and to some extent in the individual investment limits or lock-in conditions specified for each category.

- Globally also, the acquisition of at least ten percent of the ordinary shares or voting power in a public or private enterprise by non-resident investors makes it eligible to be categorized as FDI, rather than the purpose of the investments, as intimated or stated by the investing foreigner due to difficulty in assessing it and also for statistical consistency.

SEBI to relax listing norms for start-ups, rename it innovators growth platform

11, Dec 2018

In News:

- In a major push to kickstart listing of start-ups in India in a big way, capital markets regulator Sebi has lined up a slew of relaxations for new-age ventures in sectors like e-commerce, data analytics and bio-technology to raise funds and get their shares traded on stock exchanges.

- The proposed changes include renaming the Institutional Trading Platform that the regulator had created for such listings as Innovators Growth Platform.

The Need for Relaxation of Norms:

- The relaxation came in the wake of demands from various stakeholders to make the norms easier and the platform more accessible considering the expanding activities in the Indian start-up space.

- While there has been a growing interest among the start-ups to get listed, their intention has failed to convert into actual listing due to difficulties in meeting the compliance requirements.

Committee to review the start-up Platform:

- The Securities and Exchange Board of India (Sebi) had set up an expert group in June this year to review the start-up platform.

- The Group held extensive consultations with other stakeholders including start-ups, investors, bankers and wealth management firms and submitted its report to Sebi on the proposed changes.

Proposed Changes of the Expert Committee:

- The group proposed to get rid of the requirement of at least 50 percent of pre-issue capital held by qualified institutional investors.

- It proposed that 25 percent of pre-issue capital for at least two years should be with qualified institutional investors, a family trust with net worth of at least Rs 500 crore, well-regulated foreign investors and a new class of ‘Accredited Investors’ (AIs).

- The AIs are individuals with a total gross income of Rs 50 lakh per annum and minimum liquid net worth of Rs 5 crore, or anybody corporate with a net worth of Rs 25 crore. The AIs can hold up to 10 percent stake before listing.

- The group agreed to do away with a cap of 25 percent holding for any person, individually or collectively, in the company’s post-issue capital. The removal of this cap will ensure that investors are able to invest more than 25 percent in a start-up, thus providing the much-needed boost.

- SEBI also proposed to reduce the minimum application size for share offers to Rs 2 lakh from Rs 10 lakh earlier to attract more investors to the new platform.

- It proposed to do away the allocation of 75 percent of the net offer to institutional investors and the remaining 25 percent to non-institutional investors. There should be no minimum reservation for any specific category of investors.

- It also drops the requirement to limit allocation to a single institutional investor at 10 percent.

- SEBI group retains the existing provisions for lock-in to lend confidence to the entities investing in such a company. The regulations require minimum six-month lock-in of the entire pre-issue capital of the shareholders, excluding the shares arising out of ESOPs and shares held by venture capital funds.

- SEBI proposed to reduce the time period from 3 years to 1 year for the company listed on the start-up platform to the main board of the stock exchange, subject to compliance with the exchange requirements.

- Another key proposal is to fix the minimum offer size at Rs 10 crore.

- These changes are being examined by a sub-group within SEBI’s Primary Market Advisory Committee.

ECB Norms Relaxed oil Companies

15, Oct 2018

In News:

- With the rupee under pressure following rise in global crude oil prices, the Reserve Bank of India liberalized the norms for oil marketing companies (OMCs) to raise funds through external commercial borrowings (ECB).

About:

- The move came on a day when the rupee closed at a new low of 73.34 against the dollar, after Brent oil breached the $ 84 a barrel.

- India’s central bank said that it will relax external commercial borrowings (ECB) policy to allow state-run oil marketing companies to raise external debt for working capital

- The Reserve Bank of India will permit oil marketing firms to raise overseas funds with minimum average maturity period of 3 or 5 years under the automatic route, it said in a statement.

- It lifted the individual borrowing limit set at $750 million under the ECB framework.

- The overall ceiling for such ECBs shall be $10 billion, hereafter.

- With regards to hedging, earlier it was mandatory to hedge all kind of borrowings but now there is relaxation given by the RBI and so the OMCs can decide if they want to hedge immediately or not.

- If OMC hedge it immediately it will be costlier than the domestic loans and so this waiver on hedging is important to OMC as it makes borrowing cost lower.

Oil Bond

14, Oct 2018

What is oil bond?

- Oil bonds are issued by the government to compensate oil marketing companies (OMCs), fertilizer companies and the Food Corporation of India (FCI) for losses borne by them in the process of regulating prices in the domestic market. It was introduced in 2005 to defer the payment of money to the oil marketing companies

- They are akin to government securities. These usually have a long maturity period extending over 15-20 years. Interest payments will be due at fixed intervals during the tenure of the bond.

- These debts are not accounted in the fiscal deficit number of the issuing year. Unlike cash subsidies, there is no direct cash flow. Moreover, oil bonds do not qualify as statutory liquidity ratio (SLR) securities, making them less liquid when compared to other government securities.

- Oil bonds can be traded for liquid cash by sale in the secondary market to insurance companies, banks, and other financial institutions.

Background:

- The then government in 2005 took to issuing oil bonds as a substitute for subsidies between 2005 and 2010. High crude prices and the blowback from the recession of 2008 increased fiduciary pressure on the government.

- By raising capital through bonds, these payments could be made in a deferred manner without causing a major escalation in prices, thus insulating customers.

- Between 2005 and 2009, the government issued bonds worth Rs 4 lakh crore. This was done to partially compensate OMCs for recoveries amounting to Rs 2.9 lakh crore.

- Under-recoveries are the difference between the cost of purchasing crude oil in the international market and the price at which petroleum products are sold in the domestic market. In the aftermath of the recession, OMCs were facing large under-recoveries. This presented the government with the dilemma of ensuring financial stability of OMCS, many of which are government-owned, while taking into account political repercussions of allowing fuel prices to rise.

- Oil bonds were chosen as the vehicle to dampen the pressure on OMCs while keeping prices in check. On November, 2010, the Minister of State for Petroleum and Natural informed Rajya Sabha that the debt burden was to be shared by public sector oil companies, the government, banks, and other stakeholders.

Remedy:

- Petroleum and diesel prices were heavily subsidized to keep the consumers insulated from the global oil price rise during 2005 to 2012 but at the cost of the increased subsidized cost which the future generations have to pay.

- The first step towards deregulation was taken in 2010 with the announcement that oil bonds will be discontinued, and OMCs will be paid in cash.

- In June 2010, petrol prices were deregulated, mirroring the market price of crude. Diesel went the same way in October 2014. In June 2017, the government adopted the system of dynamic fuel pricing whereby the retail price of petrol and diesel fluctuate on a daily basis.

Conclusion:

- The outstanding oil bonds (as on April 1, 2018) which will be discharged only between 2022-2026 is Rs. 13, 0923 crore while Majority of bonds are yet to mature in 2022 the fuel taxes (imposed on petrol/diesel like central excise and state VAT) can’t be reduced in future also so that these bonds may be paid in cash raised through this tax. Deregulation of prices will be one of the remedy to solve this energy triggered resource constraint, should also incentivize the use of bio fuels, solar energy to reduce the dependency on crude oil.

BSE, NSE GET SEBI NOD FOR COMMODITY SEGMENT

06, Sep 2018

Why in news?

- The Securities and Exchange Board of India has given the regulatory go-ahead to BSE and NSE to start their respective commodity derivatives segments. Both bourses plan to start the new segment from October

Background:

- Commodities exchange is a legal entity that determines and enforces rules and procedures for the trading standardized commodity contracts and related investment products. Commodities exchange also refers to the physical center where trading takes

- Interestingly, both the equity exchanges NSE and BSE plan to start with non-agriculture commodities like metals and bullion, and subsequently launch contracts in agriculture commodities.

- Currently, Multi Commodity Exchange of India (MCX)is the largest commodity bourse with over 90% market

- The commodity market in India is regulated by market board SEBI since September 2015. Prior to that Forward Market commission, Overseen by Ministry of Consumer Affairs regulated Commodities market in

SEBI:

- The Securities and Exchange Board of India was established as a non-statutory regulatory body in the year 1988, but it was not given statutory powers until January 30, 1992, when the Securities and Exchange Board of India Act was passed by the Parliament of India. Its headquarters is at the business district at the Bandra Kurla Complex in

- Objective is to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental

MOV on Masala Bond

05, Sep 2018

- The Memorandum of Understanding (MoU) was signed by NSE London Stock Exchange Group on dual listing of masala bonds

About:

- Under the pact, together LSEG (London Stock Exchange Group) and NSE (National Stock Exchange) will look to provide a route for masala bonds (rupee-denominated bonds) and foreign currency bonds of Indian issuers listed on London Stock Exchange to be dual listed on NSE’s International Exchange, NSE IFSC Ltd, in Gujarat International Finance Tech (GIFT)

- The pact also outlines the parties’ commitment to engage with growing companies, leading financial institutions and the broader SME community across the country to integrate them with the global ELITE community (London Stock Exchange Group’s international business support and capital raising programme for ambitious and fast- growing companies)

- Both also agreed to explore the launch of ELITE LSEG’s business support and capital raising initiative for small and medium enterprises in India in

Significances:

- Through the approval of a single listing document, an issuer will be able to obtain a dual listing on London Stock Exchange’s International Securities Market and GIFT City, gaining access to an enhanced investor base of global institutions based in London, as well as domestic and regional investors registered on NSE

- Dual listing of masala bonds and foreign currency bonds of Indian issuers would enhance visibility, increase liquidity in secondary markets and enhance efficiency of price discovery for the bond issuers. It would also reduce the cost of raising capital for all issuers and encourage the participation of a wider variety of issuers in the masala bond market. It also underlines the strength of the economic and financial partnership between the UK and India, reinforcing London’s position as a complimentary and valued funding partner to India.

- Still now LSEG has listed 46 Masala bonds, which have raised an equivalent of more than $5 billion.

- The MoU signings demonstrate LSEG’s and NSE’s commitment to promoting the inter- connectedness between the UK and Indian capital markets, supporting global awareness of the opportunities that exist in India’s first international financial services centre, GIFT City, and championing the development of the country’s

- The ELITE global community is made up of over 900 private, ambitious companies from 32 countries and over 30 sectors. ELITE will bring a more in-depth and formalised process to help SMEs scale up their businesses and integrate them with the global ELITE community.

Masala bonds:

- Masala Bonds are rupee-denominated borrowings issued by Indian entities in overseas markets.

- Masala means spices and the term was used by International Finance Corporation (IFC) to popularise the culture and cuisine of India on foreign

- The objective of Masala Bonds is to fund infrastructure projects in India, fuel internal growth via borrowings and internationalise the Indian

- Masala bonds should have a minimum maturity of five years, and there is a $750 million per year limit for borrowers which can be exceeded with the RBI

Significance:

- The bonds are directly pegged to the Indian currency. So, investors will directly take the currency risk or exchange rate

- If the value of Indian currency falls, the foreign investor will have to bear the losses, not the issuer which is an Indian entity or a corporate. If foreign investors eagerly invest in Masala Bonds or bring money into India, this would help in supporting the

- The issuer of these bonds is shielded against the risk of currency fluctuation, typically associated with borrowing in foreign Besides helping in diversifying funding sources, the costs of borrowing via masala bonds could also turn out to be lower than domestic markets.

- Currently, these bonds are listed on the London Stock

STT for derivatives

16, Aug 2018

- Central Board of Direct Taxes (CBDT) clarified that physical settlement in the equity derivatives segment will attract securities transaction tax (STT) of 0.1 per cent.