Category: Indian Economy and issues relating to planning – GS3A

U.K SINHA COMMITTEE

26, Jun 2019

- The Reserve Bank of India (RBI) on January, 2019 set up an expert committee under former SEBI chairman U.K. Sinha to Suggest Long-Term Solutions for the economic and Financial Sustainability of the MSME sector.

Key Recommendations of the Committee:

- ₹5,000 crore stressed asset fund for domestic micro, small and medium enterprises (MSMEs) in a relief to small businesses hurt by demonetization, the goods and services tax and an ongoing liquidity crunch.

- Such a fund could work in tandem with RBI-mandated restructuring schemes or bank-led NPA revival solutions for MSMEs.

- The onus of creating this fund would lie with the government

- The committee also suggested forming a government-sponsored Fund of Funds of ₹10,000 crore to support venture capital and private equity firms investing in MSMEs.

- The RBI should increase the limit for non-collateralized loans to 20 lakhs.

- Revision in loan limit sanctioned under the MUDRA by the Finance Ministry to 20 lakhs from 10 lakhs.

- Banks that wish to specialize in MSME lending, their sub-targets for farm loans under the priority sector lender could be waived off, and instead can be given a target for loans to the SME sector.

- The targets, committee said, could be of 50% of the net bank credit for universal banks and 80% for small finance banks.

- Commercial banks have been suggested that they should develop customised products to assess the financing requirements based on expected cash flows moving away from traditional forms of assessment.

- Banks need to build their ability to capture cash flows of MSME borrowers on a regular basis, for which tie-ups with industry majors / aggregators / online platforms will have to be done by the banks

- In order to provide loan portability in a seamless manner to MSMEs, the committee recommended that the RBI should come out with measures on portability of MSME loans with a lock-in-period of one year.

CASH IN CIRCULATION HAS FALLEN

26, Jun 2019

- Demonetisation, coupled with increased digital transactions and the reduced cash usage in the informal economy, led to a Reduction in Currency in Circulation by ₹3.4 lakh crore.

- The notes in circulation had been growing at an average annual growth rate of 14.51% since October 2014.

- Reserve Bank of India data shows that the number of counterfeit bank notes detected decreased from 762,072 pieces in 2016-17, to 522,783 in 2017-18 and 317,389 pieces in 2018-19 and hence “demonetisation resulted in curbing of the counterfeit currency”

- “Growth of digital transactions in terms of value has increased to ₹188.07 lakh crore in September 2018 from ₹112.27 lakh crore in November 2016. Digital transactions in terms of volume have increased to 241.88 crore in September 2018 from 91.83 crore.”

- Demonetisation led to a “significant positive impact on most theatres of violence” in the country since illegally held cash formed a major chunk of terror funding, and that the note ban rendered the cash held with terrorists worthless.

- “Demonetisation also resulted in better tax compliance, greater tax revenues, more formalization of economy and higher digital transactions.”

PROJECT MONITORING GROUP (PMG)

26, Jun 2019

- Projects worth 11 lakh crore remain stalled or have issues under consideration. Railways, roads and Power sector accounting to more than half of these stalled projects.

- Project Monitoring Invest India Cell has resolved the issues surrounding 740 projects worth 30.5 lakh crore. However, 298 projects worth 10.98 lakh crore still have problems that are yet to be resolved.

- What is PMIC?

- The Project Monitoring Group (PMG) was set up in 2013 under Cabinet Secretariat.

- It is an institutional mechanism for resolving a variety of issues including fast tracking the approvals for setting up and expeditious commissioning of large Public, Private and Public–Private Partnership (PPP) Projects.

- PMG is now functioning under Prime Minister’s Office (PMO) since 14.09.2015.

- The projects considered by PMG mainly pertain to sectors such as:

- National Highways and Railways

- Civil Aviation and Shipping

- Petroleum & Natural Gas

- Chemicals & Fertilizers

- Coal, Power and Mines

- Cement, Construction and Steel

- PMG in association with ‘Invest India’, the agency dedicated to promotion of foreign Investment in India, also helps foreign investors intending to make large investments in India by facilitating approvals/clearances and providing them necessary support during implementation of projects

- PMG monitors digitization of Union and State level clearance processes including reengineering of such processes, wherever required for simplification and investment promotion.

ONLINE PORTAL FOR FILING COMPLAINTS

25, Jun 2019

- The Reserve Bank of India, launched a ‘Complaint Management System (CMS)’, which will enable members of the public to lodge their complaints on its website against any of the regulated entities with public interface such as commercial banks, urban co-operative banks, and non-banking financial companies, among others.

- The system will be accessible on desktop as well as on mobile devices.

- Provides features such as acknowledgement through SMS/e-mail notification(s), status tracking through unique registration number, receipt of closure advises, and filing of appeals, where applicable.

- It also solicits voluntary feedback on the customer’s experience.

- Insights from the data available from CMS can, for example, be used by banks/FSPs for designing products, which meet the expectations of their customers.

- Data from CMS can be leveraged by the RBI for analytics, which can be used for regulatory and supervisory interventions, if required.

- Various dashboards provided in the application will help the central bank effectively track the progress in redressal of complaints.

- With the launch of the CMS, the processing of complaints received at the offices of the Ombudsman and Consumer Education and Protection Cells (CEPCs) of the RBI has been digitalised.

INTERIM RESOLUTION PROFESSIONALS

25, Jun 2019

- Section 16(1) of the Insolvency and Bankruptcy Code, 2016 requires Adjudicating Authority to appoint an interim resolution professional (IRP) within fourteen days from the insolvency commencement date.

- Section 18 of the Code prescribes Duties of Interim Resolution Professional as under:

- The IRP shall have to collect all information relating to the assets, finances and operations of the corporate debtor for determining the financial position of the corporate debtor

- The IRP shall receive and collate all the claims submitted by creditors to him pursuant to the public announcement made

- IRP shall constitute a committee of creditors

- Further, the IRP shall monitor the assets of the corporate debtor and manage its operations until a resolution professional is appointed by the committee of creditors

- The IRP shall file the information collected with the information utility, if necessary; and The IRP shall take control and custody of any asset over which the corporate debtor has ownership rights as recorded in the balance sheet of the corporate debtor, or with information utility or the depository of securities or any other registry that records the ownership of assets.

Government to extend foreign currency loans to Exporters

23, Jun 2019

- India is a net importer of commodities.

- This impacts India’s balance of payments, hence the country needs to strengthen its exports. In order to boost exports, the government has subsidized several trade related issues. However, such steps have been inadequate. Moreover, they have burdened the exchequer.

- Hence the government now plans to enhance foreign currency loans by working with bankers. The government has decided to enhance the role of Export Credit Guarantee Corporation of India as an agency for exporters.

What is Export Credit Guarantee Corporation of India?

- ECGC Ltd. (Formerly known as Export Credit Guarantee Corporation of India Ltd.) wholly owned by Government of India, was set up in 1957.

- It was set up with the objective of promoting exports from the country by providing credit risk insurance and related services for exports.

- ECGC is essentially an export promotion organization, seeking to improve the competitiveness of the Indian exports by providing them with credit insurance covers.

- The Corporation has introduced various export credit insurance schemes to meet the requirements of commercial banks extending export credit. The insurance covers enable the banks to extend timely and adequate export credit facilities to the exporters.

ECGC Provides:

- A range of insurance covers to Indian exporters against the risk of non – realization of export proceeds due to commercial or political risks

- Different types of credit insurance covers to banks and other financial institutions to enable them to extend credit facilities to exporters and

- Export Factoring facility for MSME sector which is a package of financial products consisting of working capital financing, credit risk protection, maintenance of sales ledger and collection of export receivables from the buyer located in overseas

Data Localisation

19, Jun 2019

Context:

- RBI last year mandated companies to store their payments data “only in India” so that the regulator could have “unfettered supervisory access”.

- The RBI will examine concerns around its strict data localisation rules that require storing of customer data exclusively in India without creating mirror sites overseas.

What is Data Localisation:

- Data localisation laws refer to regulations that dictate how data on a nation’s citizens is collected, processed and stored inside the country.

Significance of Data Localisation:

- Data localisation is critical for law enforcement.

- Access to data by Indian law agencies, in case of a breach or threat, cannot be dependent on the whims and fancies, nor on lengthy legal processes of another nation that hosts data generated in India.

What India can do:

- It may not be wise for India to have the liberal rules as developed nation.

Legislation backup:

- Only Mandatory rule on data localisation in India is by the Reserve Bank of India for payment systems. Justice Sri krishna Committee report – to identify key data protection issues in India and recommend methods of addressing them”.

Libra Facebook Cryptocurrency

19, Jun 2019

Context:

- Facebook has linked with 28 partners in a Geneva-based entity called the Libra Association, which will govern its new digital coin set to launch in the first half of 2020.

- Facebook has also created a subsidiary called Calibra, which will offer digital wallets to save, send and spend Libras.

- Calibra will be connected to Facebook’s messaging platforms Messenger and WhatsApp.

- Calibra will conduct compliance checks on customers who want to use Libra, using verification and anti-fraud processes that are common among banks.

- Libra is a global currency and financial infrastructure.

- it is a digital asset built by Facebook and powered by a new Facebook-created version of blockchain, the encrypted technology used by bitcoin and other cryptocurrencies.

Why Libra?

- Facebook claims it wants to reach the 1.7 billion people around the world who do not have access to a Bank Account.

Authority Incharge:

- The Libra Association is described by Facebook as an independent, not-for-profit organisation based in Switzerland.

- It serves two main functions:

-

- To Validate Transactions on the Libra blockchain and

- To Manage the Reserve Libra is tied to and allocate funds to social

- It functions as what is known as a “Stablecoin”, pegged to existing assets like the dollar or euro, in the aim of making it less subject to the volatility that many Cryptocurrencies Experience.

What is a Cryptocurrency?

- A cryptocurrency is a digital or virtual currency that uses cryptography for security.

Advantages:

- A cryptocurrency is Difficult to Counterfeit because of the security feature of blockchain technology.

- It is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.

- Cryptocurrencies hold the promise of making it easier to transfer funds directly between two parties in a transaction, without the need for a trusted third party such as a bank or credit card company; these transfers are facilitated through the use of public keys and private keys for security purposes.

- Fund transfers are done with minimal processing fees, allowing users to avoid the steep fees charged by most banks and financial institutions for wire transfers.

- At the same time, there is no central authority, government, or corporation that has access to your funds or your personal information.

Disadvantages:

- The Semi-Anonymous Nature of Cryptocurrency Transactions makes them well- suited for a host of nefarious activities, such as money laundering and tax evasion.

- Since prices are based on supply and demand, the rate at which a cryptocurrency can be exchanged for another currency can fluctuate widely.

- The first cryptocurrency to capture the public imagination was Bitcoin, which was launched in 2009 by an individual or group known under the pseudonym, Satoshi Nakamoto.

- Bitcoin’s success has spawned a number of competing cryptocurrencies, known as “Altcoins” such as Litecoin, Namecoin and Peercoin, as well as Ethereum, EOS, and Cardano.

Cryptocurrency in India:

- RBI does not recognize any sort of Cryptocurrency as legal tender.

- The Reserve Bank has explicitly said that “entities regulated by RBI shall not deal with or provide services to any individual or business entities dealing with or settling VCs”.

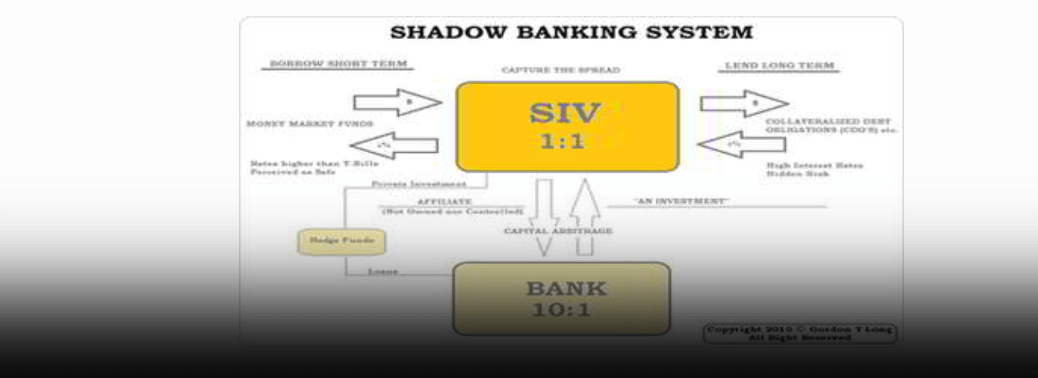

SHADOW BANKING SYSTEM

18, Jun 2019

- A shadow banking system is the group of financial intermediaries facilitating the creation of credit across the global financial system but whose members are not subject to regulatory oversight. The shadow banking system also refers to unregulated activities by regulated institutions. The shadow banking system consists of lenders, brokers, and other credit intermediaries who fall outside the realm of traditional regulated banking. These include investment banks, mortgage lenders, money market funds, insurance companies, hedge funds, private equity funds and payday lenders, all of which are a significant and growing source of credit in the economy.

- One of the leading factors that caused the financial crisis of 2007 was the risk taking and failure of shadow banks in the advanced countries.

- In India, the NBFCs are sometimes categorized as the shadow banking sector, though they are well regulated now. In the context of the developing countries, the shadow banking sector plays an important role in promoting financial inclusion. They are very customer friendly, market oriented, innovative and flexible.

- The main advantages of shadow banks lie in their ability to reduce transaction costs, their quick decision-making ability, and customer orientation and prompt delivery of services.

- New Directive under IT Act, 1961. Issued by Central Board of Direct Taxes, under“Compounding of Offences Under Direct Tax Laws, 2019”.

- A person cannot get any sort of relief in an Income Tax evasion offence, if he/she indulges in serious criminal cases of money laundering, terror financing, corruption, possession of benami properties and undisclosed foreign assets.

NATIONAL SMALL SAVINGS FUND

17, Jun 2019

It has been established under Public Account of India since 1st April 1999. It Comprises of

- Postal Deposits

- Savings Certificates and Kissan Vikas Patra

- Social Security Schemes such as PPF and Senior Citizens Savings

Although it reflects a borrowing mechanism, its transactions are not included in the fiscal deficit of the government. The balance in the fund is invested in Central and State Government securities.

INDIAN ECONOMY

17, Jun 2019

- What are Debt Instruments?

- They are either paper or electronic obligations that allows the issuing party to raise funds by promising to repay the lender in the terms of the contract.

- E.g. Bonds, debentures, certificates etc.

Dwindling automobile sales market in India Since Nov 2018:

- The major reason for such a downfall in the market is the reduction in the private consumption expenditure.

What is Private Consumption Expenditure?

- It is defined as the value of the consumption goods and services acquired and consumed by households.

- It is influenced by the following factors: Inflation or price rise

- Increase in taxes which may reduce personal savings. Unemployment

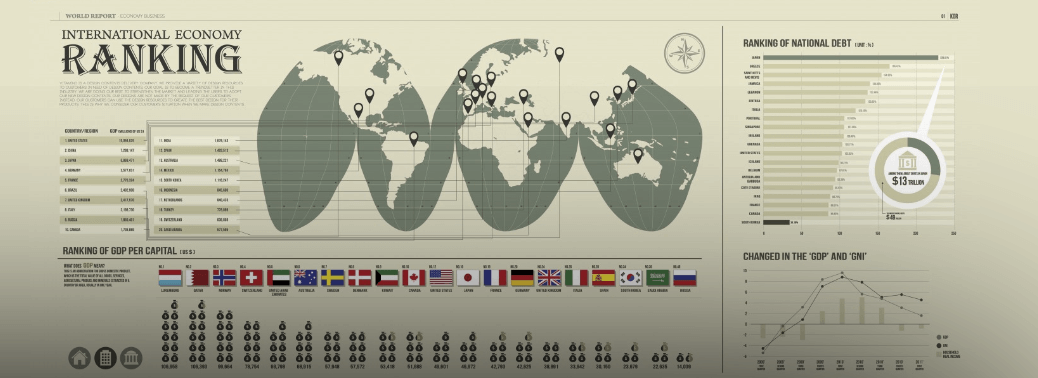

INTERNATIONAL ECONOMY

16, Jun 2019

- India imposed tariffs on 29 goods from the U.S from June 16. This is a retaliatory measure taken by India against the U.S imposing tariffs on steel and aluminium form 2018.

- This is also a part of the ongoing tussle between the nations with regard to the protectionist tendencies in the global economy.

- 301 Probe: It is a law in the U.S that allows the President to impose tariffs and other restrictions on a country to protect U.S companies from unfair trade practices by other countries.

- U.S has imposed 301 probe on China in 2017, and is likely to impose the same on India Very soon

EXTERNAL WOES: ON INDIA’S FOREIGN TRADE

18, May 2019

Why in News:

- The estimates for foreign trade showed a sharp slowdown in merchandise export growth in April, 2019 to 0.64% from a year earlier.

Background: / what is the exports scenario?

- There was a 31% surge in petroleum products shipments to overseas markets in April.

- If this is removed, India’s goods export actually contracted by over 3% in dollar terms.

- [In contrast, overall merchandise exports had expanded 11% year-on-year in March, 2019 with the growth in shipments excluding petroleum products.]

- The slump in exports was fairly widespread, with 16 of the 30 major product groups reflecting contractions.

- This is in contrast with the 10 categories that had shrunk in March.

- Worryingly, shipments of engineering goods declined by over 7% after having expanded by 16.3% in March.

- The traditionally strong export sectors all weakened in April.

- These include the gems and jewellery, leather and leather products, textiles and garments, and drugs and pharmaceuticals sectors.

- E.g. contraction in gem and jewellery exports widened to 13.4% in April, from 0.4% in March; it was 15.3% from 6.4% respectively for the leather segment

- Likewise, the pace of growth of garment exports decelerated to 4.4% from 15.1% in March.

What is the case with imports?

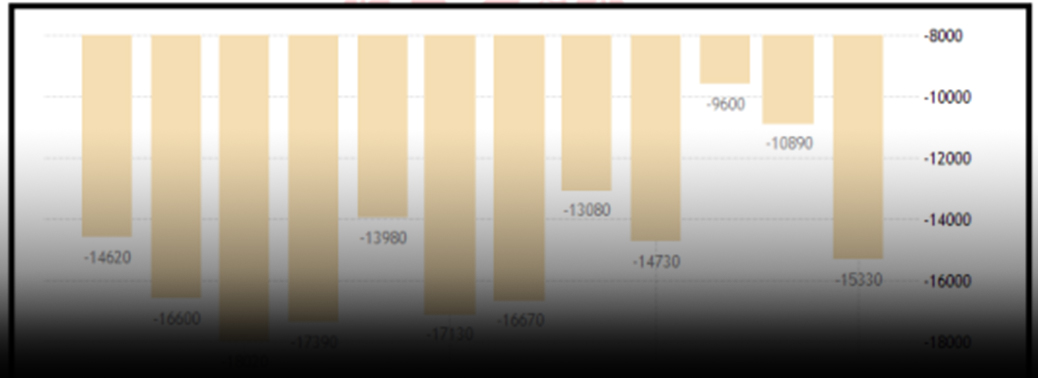

BALANCE OF TRADE

- Imports grew by 4.5% to $41.4 billion in April, accelerating from March’s 1.4%.

- This was primarily because the purchases of crude oil and gold continued to increase.

- The 9.3% jump in the oil import bill, from March’s 5.6%, can partly be explained by the rise in international crude prices. However, the 54% surge in gold imports reflects India’s unappeasable appetite for gold, calling for policymakers’ attention and action.

- Excluding oil and gold, however, imports shrank by more than 2% in April.

- This signals that import demand in the real productive sectors is largely balanced.

What are the Implications?

- Jobs and demand – The traditionally strong export sectors are all key providers of jobs.

- So any prolonged slump across these industries will impact jobs, wages and overall consumption demand in the domestic market.

- Trade deficit – With merchandise imports outpacing exports, the trade deficit widened to a five-month high of $15.3 billion.

- The widening trade shortfall will add pressure on India’s widening current account deficit (CAD).

- Being at around $51.9 billion in the first 9 months of fiscal 2018-19, CAD had already surpassed the preceding financial year’s 12-month shortfall of $48.7 billion.

- More challenges and limitations to trade and exports are ahead with the escalating trade war between the U.S. and China.

- The impacts of this could be widespread on global growth.

- Moreover, the rising military tensions in West Asia could potentially further push up oil prices, further increasing India’s import burden.

- Given these, containing the trade and current account deficits seems significantly challenging and urgent measures are needed to boost exports.