Category: Banking

RBI hikes repo rate by 25 basis points to control inflation

09, Feb 2023

Why in News?

- The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has recently decided to increase the policy repo rate by 25 basis points to 6.50%, with immediate effect.

About the News:

- Taking various factors into consideration, real GDP growth for 2023-24 is projected at 6.4% with Q1 at 7.8%; Q2 at 6.2%; Q3 at 6.0%; and Q4 at 5.8%.

- Taking into account several factors and assuming an average crude oil price (Indian basket) of US$ 95 per barrel, inflation is projected at 6.5% in 2022-23, with Q4 at 5.7%.

- On the assumption of a normal monsoon, CPI inflation is projected at 5.3% for 2023-24, with Q1 at 5.0%, Q2 at 5.4%, Q3 at 5.4% and Q4 at 5.6%.

What is Monetary Policy Committee?

- Strong recommendations to set monetary policy committee in India had come from Urjit Patel panel report.

- Monetary Policy Committee is an executive body of 6 members. Of these, three members are from RBI while three other members are nominated by the Central Government.

- Each member has one vote. In case of a tie, the RBI governor has casting vote to break the tie. MPC is required to meet for two days before deciding on rates. Further, it is needed to meet at least four times a year and make public its decisions following each meeting.

- The core mandate of MPC is to fix the benchmark policy interest rate {Repo Rate} to contain inflation within the target level.

- In that context, RBI is mandated to furnish necessary information to the MPC to facilitate its decision. Government also, if wishes to convey its views, can do so in writing to MPC.

Different Terminologies in Banking Sector:

- Loan moratorium period refers to a particular period of a loan tenure during which the borrower does not have repay anything. It can be described as a waiting period before the borrower will have to start paying the equated monthly instalments (EMIs) for his or her loan. It doesn’t mean that he is completely waived off his loans.

- REPO rate (now 6.5%) denotes Re Purchase Option – the rate by which RBI gives loans to other banks. In other words, it is the rate at which banks buy back the securities they keep with the RBI at a later period.

- Bank gives loan to the public at a higher rate, often 1% higher than REPO rate, at a rate known as Bank Rate (6.75%).

- RBI at times borrows from banks at a rate lower than REPO rate, and that rate is known as Reverse REPO rate (3.35%).

- CRR or Cash Reserve Ratio corresponds to the percentage of cash each bank have to keep as cash reserve with RBI (in their current accounts) corresponding to the deposits they have. For example, say if State Bank of India (SBI) got a total deposit of Rs. 1 crore with them, they need to keep 4.5 % of that as cash reserve with RBI (around 4.5 lakh rupees).

The banks and other financial institutions in India have to keep a fraction of their total net time and demand liabilities in the form of liquid assets such as G-secs, precious metals, approved securities etc. The Ratio of these liquid assets to the total demand and time liabilities is called Statutory Liquidity Ratio (18%).

RBI’s MPC starts deliberations amid expectations of moderate rate hike

06, Dec 2022

Why in News?

- The Reserve Bank of India‘s (RBI’s) rate-setting panel recently started brainstorming for the next round of monetary policy amid expectations of a moderate interest rate hike of 25-35 basis points as inflation has started showing signs of easing and economic growth tapering.

About the News:

- The RBI has hiked key benchmark lending rate by 50 basis points (bps) thrice since June over and above an off-cycle 40 bps increase in repo in May.

- The current policy repo rate is 5.9%.

- Several other experts too expect the rate hike to be in the range of 25-35 basis points on December 7.

- On September 30, the RBI had hiked the key policy rate (repo) by 50 basis points with an aim to check inflation.

- It was the third successive hike of 50 bps. Before the September hike, the central bank had raised the repo rate by 50 bps each in June and August, and 40 bps in May.

What is Monetary Policy Committee?

- Strong recommendations to set monetary policy committee in India had come from Urjit Patel panel report.

- Monetary Policy Committee is an executive body of 6 members. Of these, three members are from RBI while three other members are nominated by the Central Government.

- Each member has one vote. In case of a tie, the RBI governor has casting vote to break the tie. MPC is required to meet for two days before deciding on rates. Further, it is needed to meet at least four times a year and make public its decisions following each meeting.

- The core mandate of MPC is to fix the benchmark policy interest rate {Repo Rate} to contain inflation within the target level.

- In that context, RBI is mandated to furnish necessary information to the MPC to facilitate its decision. Government also, if wishes to convey its views, can do so in writing to MPC.

Different Terminologies in Banking Sector:

- Loan moratorium period refers to a particular period of a loan tenure during which the borrower does not have repay anything. It can be described as a waiting period before the borrower will have to start paying the equated monthly instalments (EMIs) for his or her loan. It doesn’t mean that he is completely waived off his loans.

- REPO rate (now 5.9%) denotes Re Purchase Option – the rate by which RBI gives loans to other banks. In other words, it is the rate at which banks buy back the securities they keep with the RBI at a later period. Bank gives loan to the public at a higher rate, often 1% higher than REPO rate, at a rate known as Bank Rate.

- RBI at times borrows from banks at a rate lower than REPO rate, and that rate is known as Reverse REPO rate.

- CRR or Cash Reserve Ratio corresponds to the percentage of cash each bank have to keep as cash reserve with RBI (in their current accounts) corresponding to the deposits they have. For example, say if State Bank of India (SBI) got a total deposit of Rs. 1 crore with them, they need to keep 4.5 % of that as cash reserve with RBI (around 4.5 lakh rupees).

The banks and other financial institutions in India have to keep a fraction of their total net time and demand liabilities in the form of liquid assets such as G-secs, precious metals, approved securities etc. The Ratio of these liquid assets to the total demand and time liabilities is called Statutory Liquidity Ratio (18%).

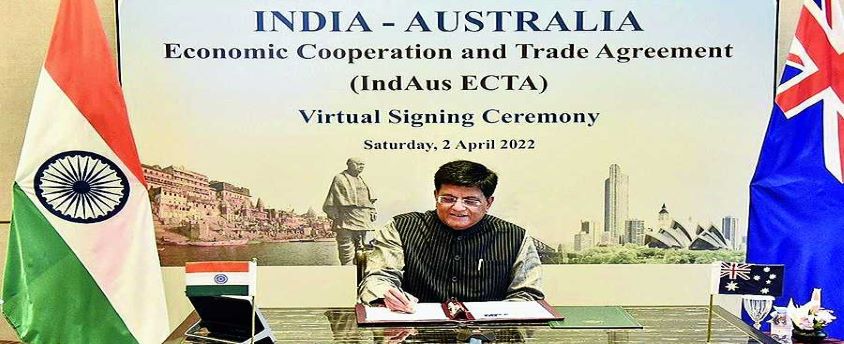

India-Australia Economic Cooperation and Trade Agreement

23, Nov 2022

Why in News?

- Commerce and Industry Minister Piyush Goyal recently said that the trade pact with Australia that was ratified by the Australian Parliament on November 22 will “significantly open up opportunities” for many Indian business sectors.

About the News:

- In February 2022, India and Australia announced that they were going to sign such an agreement.

- The negotiations for India-Australia ECTA were formally re-launched in September 2021 and concluded on a fast-track basis by the end of March 2022.

What is the Economic Cooperation and Trade Agreement?

- It is the first Free Trade Agreement (FTA) that India has signed with a major developed country in over a decade.

- In February, India signed an FTA with the UAE and is currently working on FTAs with Israel, Canada, UK and the European Union.

- The Agreement encompasses cooperation across the entire gamut of bilateral economic and commercial relations between the two friendly countries, and covers areas like:

- Trade in Goods, Rules of Origin.

- Trade in Services.

- Technical Barriers to Trade (TBT).

- Sanitary and Phytosanitary (SPS) measures.

- Dispute Settlement, Movement of Natural Persons.

- Telecom, Customs Procedures.

- Pharmaceutical products, and Cooperation in other Areas.

- ECTA provides for an institutional mechanism to encourage and improve trade between the two countries.

- The ECTA between India and Australia covers almost all the tariff lines dealt in by India and Australia respectively.

- India will benefit from preferential market access provided by Australia on 100% of its tariff lines.

- This includes all the labour-intensive sectors of export interest to India such as Gems and Jewellery, Textiles, leather, footwear, furniture etc.

- On the other hand, India will be offering preferential access to Australia on over 70% of its tariff lines, including lines of export interest to Australia which are primarily raw materials and intermediaries such as coal, mineral ores and wines etc.

- Under the agreement, Indian graduates from STEM (Science, Technology, Engineering and Mathematics) will be granted extended post-study work visas.

- Australia will also set up a programme to grant visas to young Indians looking to pursue working holidays in Australia.

What is the Significance of the Agreement?

- It will provide zero-duty access to 96% of India’s exports to Australia including shipments from key sectors such as engineering goods, gems and jewellery, textiles, apparel and leather.

- It will boost bilateral trade in goods and services to USD 45-50 billion over five years, up from around USD 27 billion, and generate over one million jobs in India, according to a government estimate.

- It will also give about 85% of Australia’s exports zero-duty access to the Indian market, including coal, sheep meat and wool, and lower duty access on Australian wines, almonds, lentils, and certain fruits.

What are Free Trade Agreements?

- It is a pact between two or more nations to reduce barriers to imports and exports among them. Under a free trade policy, goods and services can be bought and sold across international borders with little or no government tariffs, quotas, subsidies, or prohibitions to inhibit their exchange.

- The concept of free trade is the opposite of trade protectionism or economic isolationism.

- FTAs can be categorised as Preferential Trade Agreement, Comprehensive Economic Cooperation Agreement (CECA), Comprehensive Economic Partnership Agreement (CEPA).

How has been the India- Australia Trade Relation so far?

- India and Australia enjoy excellent bilateral relations that have undergone transformational evolution in recent years, developing along a positive track, into a friendly partnership.

- This is a special partnership characterised by shared values of pluralistic, parliamentary democracies, Commonwealth traditions, expanding economic engagement, long standing people-to-people ties and increasing high level interaction.

- The India-Australia Comprehensive Strategic Partnership initiated during the India-Australia Leaders’ Virtual Summit held in June 2020 is the cornerstone of India-Australia multi-faceted bilateral relations.

- Growing India-Australia economic and commercial relations contribute to the stability and strength of a rapidly diversifying and deepening bilateral relationship between the two countries.

- India and Australia have been each other’s important trading partners.

- Australia is the 17th largest trading partner of India and India is Australia’s 9th largest trading partner.

- India-Australia bilateral trade for both merchandise and services is valued at USD 27.5 billion in 2021.

- India’s merchandise exports to Australia grew 135% between 2019 and 2021. India’s exports consist primarily of a broad-based basket largely of finished products and were USD 6.9 billion in 2021.

- India’s merchandise imports from Australia were USD 15.1 billion in 2021, consisting largely of raw materials, minerals and intermediate goods.

- India and Australia are partners in the trilateral Supply Chain Resilience Initiative (SCRI) arrangement along with Japan which seeks to enhance the resilience of supply chains in the Indo-Pacific Region.

- Further, India and Australia are also members of the QUAD grouping (India, the US, Australia and Japan), also comprising the US, and Japan, to further enhance cooperation and develop partnership across several issues of common concern.

Way Forward:

- Shared values, shared interests, shared geography and shared objectives are the bedrock of deepening India-Australia ties and the cooperation and coordination between the two countries have picked up momentum in recent years.

- Both India and Australia share a vision of a free, open, inclusive and rules-based Indo-Pacific region and cooperative use of the seas by adherence to international law including the United Nations Convention on the Law of the Sea (UNCLOS) and peaceful resolution of disputes rather than through unilateral or coercive actions.

- The India-Australia ECTA will further cement the already deep, close and strategic relations between the two countries and will significantly enhance bilateral trade in goods and services, create new employment opportunities, raise living standards, and improve the general welfare of the peoples of the two countries.

RBI extends Liquidity Window for Healthcare

11, Feb 2022

Why in News?

- The Reserve Bank of India (RBI) recently proposed to extend the term-liquidity facility of ₹50,000 crore offered to emergency health services by three months till June 30.

About the News:

- Last year in May, RBI had announced an on-tap liquidity window of ₹50,000 crore, at the repo rate with tenors of up to three years, to boost provision of immediate liquidity for ramping up COVID-19-related healthcare infrastructure and services in the country.

- Banks were incentivised for quick delivery of credit under the scheme through extension of priority-sector classification to such lending up to March 31, 2022.

- “In view of the response to the scheme, it is now proposed to extend this window up to June 30, 2022 from March 31, 2022 as announced earlier,” the RBI said in a statement on development and regulatory policies on Thursday.

- Under the scheme, banks were expected to create a COVID-19 loan book.

What is the Significance?

- Under the scheme, banks can provide fresh lending support to a wide range of entities including vaccine manufacturers, importers and suppliers of vaccines and priority medical devices, hospitals and dispensaries, pathology labs, manufactures and suppliers of oxygen and ventilators, importers of vaccines and Covid-related drugs, logistics firms and also patients for treatment.Banks are being incentivised for quick delivery of credit under the scheme through extension of priority sector classification to such lending.

- These loans will continue to be classified under priority sector till repayment or maturity, whichever is earlier. “Banks may deliver these loans to borrowers directly or through intermediary financial entities regulated by the RBI.

Airtel Payments Bank is now a Scheduled Bank

08, Jan 2022

Why in News?

- The Reserve Bank of India (RBI) has announced the inclusion of Airtel Payments Bank Ltd. in the Second Schedule to the Reserve Bank of India Act, 1934.

Implications:

- With this, the bank can now pitch for Government-issued Requests for Proposals (RFP) and Primary Auctions and undertake both Central and State Government business.

What is a Schedule Bank?

- Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934.

- Every Scheduled bank enjoys two types of principal facilities: It becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of Clearing House.

About Airtel Payments Bank:

- It is among the fastest-growing digital banks in the country, with a base of 115 million users.

- It offers a suite of digital solutions through the Airtel Thanks app and a retail network of over 500,000 Neighbourhood Banking Points.

- The bank Turned Profitable in the Quarter ended September 2021.

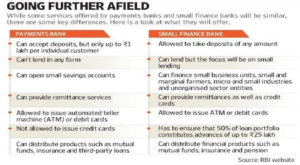

What is Payment’s bank?

- Payment banks were established to promote financial inclusion by offering; ‘modest savings accounts and payments/remittance services to migratory labour workforce, low-income households, small enterprises, other unorganised sector entities, and other users.’

- These banks can accept a restricted deposit, which is now capped at Rs 200,000 per person but could be raised in the future.

- These banks are unable to provide loans or credit cards. Banks of this type can handle both current and savings accounts.

- Payments banks can provide ATM and debit cards, as well as online and mobile banking.

RBI introduces Prompt Corrective Action Framework for NBFCs

28, Dec 2021

Why in News?

- The Reserve Bank of India (RBI) has introduced the prompt corrective action (PCA) Framework for non-banking Financial Companies (NBFCs).

About the News:

- The PCA framework for NBFCs will come into effect on October 1,2022 on the basis of their Financial Position on or after March 31.

What is PCA Framework?

- The objective of the framework is to enable supervisory intervention at the appropriate time and require the supervised entity to initiate and implement remedial measures in a timely manner, to restore its Financial Health.

Applicability:

- The framework will be applicable to all deposit-taking non-banking financial companies (NBFCs), all non-deposit taking NBFCs in the middle, upper and top layers including investment and credit companies, core investment companies, infrastructure debt funds, infrastructure finance companies and microfinance institutions.

- However, it has excluded NBFCs not accepting/not intending to accept public funds, primary dealers and Housing Finance companies along with government-owned ones.

Indicators based on which PCA will be Invoked for NBFC:

- The central bank will track three indicators — capital to risk-weighted assets ratio (CRAR), Tier I ratio and net non-performing assets (NNPAs) including non-performing investments (NPIs).

- In the case of core investment companies (CICs), the RBI will track adjusted net worth/aggregate risk-weighted assets, leverage ratio and NNPAs, including NPIs.

- A breach in any of the three risk thresholds under the above-mentioned indicators could result in invocation of PCA.

Need for:

- The PCA Framework for NBFCs has been brought after four big finance firms — IL&FS, DHFL, SREI and Reliance Capital — which collected public funds through fixed deposits and non-convertible debentures collapsed in the last three years despite the tight monitoring in the financial sector. They collectively owe over Rs 1 lakh crore to investors.

What will happen once the PCA is invoked for an NBFC?

- Based on the risk threshold, the RBI may prescribe mandatory corrective actions such as restriction on dividend distribution/remittance of profits, requiring promoters /shareholders to infuse equity and reducing leverage.

- The RBI can also restrict the issuance of guarantees or take other contingent liabilities on behalf of group companies (only for CICs).

- Further, the central bank may also restrict branch expansion, impose curbs on capital expenditure other than for technological up-gradation within board-approved limits and restrict/ directly reduce variable operating costs.

SBI TO EXTEND LOAN MORATORIUM TO NBFCS

07, May 2020

Why in News?

- The State Bank of India (SBI) has decided to extend loan moratorium to NBFCs that could give a huge relief to the entities facing a Cash Crunch.

What is Loan Moratorium?

- It refers to a particular period of a loan tenure during which the borrower does not have to repay anything.

- It can be described as a waiting period before the borrower will have to start paying the equated monthly instalments (EMIs) for his or her loan.

- It doesn’t mean that he is completely waived off his Loans.

Why this Move?

- At end March, following the nationwide lockdown, the RBI had allowed banks to extend three-month repayment moratorium to their term loan customers without classifying them as non-performing assets.

- While the banks had extended the facility to the retail borrowers, they were reluctant to extend the same to the NBFCs, including housing finance companies and micro-finance institutions.

- Bank funding is a key source of liquidity for the NBFCs. As a result, NBFCs that had extended the benefit to their customers but were not granted one from the banks were facing a severe liquidity crunch.

- Rating agency Crisil had said that the NBFCs rated by the agency would face a ₹75 lakh-crore debt obligation maturing by June end.

- Similarly, micro-finance institutions had informed the RBI during a recent meeting that they had to repay a debt of ₹18,500 crore in the next three months.

- With SBI now deciding to offer the moratorium, NBFCs expect other commercial banks also to follow suit.

What is Non-Banking Financial Company (NBFC)?

- A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature.

- NBFC does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property.

- A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company).

What are the Differences between banks & NBFCs?

- NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:

- NBFC cannot Accept Demand Deposits;

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of Banks.

CO-OPERATIVE BANKS UNDER SARFAESI ACT

06, May 2020

Why in News?

- The Supreme Court held that Co-operative banks established under a State law and multi-State level co-operative societies come within the ambit of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (Sarfaesi) Act of 2002.

Issues Involved:

- The Judgment Came in view of Several Conflicting decisions by high courts on the issues of

- Whether the Co-operative banks can be called as “Banks (financial Institutions)” under the Banking Regulation Act of 1949

- Whether the Parliament has legislative competence to regulate financial assets of cooperative banks formed under state law.

- The argument was that under Lists I and II of the 7th Schedule, the Constitution provides for distinct fields of legislative entries for the state legislature and Parliament and once there is already a valid law made by the state referring to its own field, there should not be a parallel parliamentary law on the same topic.

Verdict of the Supreme Court:

- The court has upheld the central government’s notification which brought co-operative societies within the purview of the Sarfaesi Act.

- The Supreme court said Co-operative banks come within the definition of “Banks” under the Banking Regulation Act, 1949 for the purposes of the Sarfaesi Act. The recovery procedure under the Sarfaesi Act is also applicable to co-operative banks and there is no clash with the Banking Regulation Act, 1949.

- The court also ruled that the Parliament has legislative competence to provide procedures for recovery of loans under the Sarfaesi Act with respect to cooperative banks.

- The court was of the opinion that recovery of dues would be an essential function of any financial institution and co-operative banks cannot carry on any activity without compliance of provisions of the banking Act and any other legislation applicable to such banks and the RBI Act.

About Sarfaesi Act:

- Banks utilize Sarfaesi Act as an effective tool for bad loans (Non Performing Asset) recovery.

- The Sarfaesi Act is effective only against secured loans where banks can enforce the underlying security.

- Major feature of Sarfaesi is that it promotes the setting up of asset reconstruction companies (ARCs) and asset securitization companies (SCs) to deal with NPAs accumulated with the banks and financial institutions.

- Following are the main objectives of the Sarfaesi Act.

- Provides the legal framework for securitization activities in India.

- It gives the procedures for the transfer of NPAs to asset reconstruction companies for the reconstruction of the assets.

- Enforces the security interest without Court’s intervention.

- Gives powers to banks and financial institutions to take over the immovable property that is pledged to enforce the recovery of debt.

DEPOSIT INSURANCE AND CREDIT GUARANTEE CORPORATION (DICGC)

06, May 2020

Why in News?

- RBI has asked the Registrar of Co-operative Societies, Maharashtra to start the process of winding up operations of CKP Co-operative bank and appoint a liquidator.

What’s the Issue?

- Recently, the Reserve Bank of India (RBI) recently cancelled the licence of Mumbai-based CKP Co-operative Bank for the Following Reasons:

- Financial position of the bank was highly adverse and unsustainable.

- The bank is not in a position to pay its present and future depositors.

- The bank failed to meet the regulatory requirement of maintaining a minimum capital adequacy ratio of 9% and reserves.

What is Capital to Risk Weighted Assets Ratio (CRAR)?

- The CRAR, also known as the Capital Adequacy Ratio (CAR), is the ratio of a bank’s capital to its risk. It is a measure of the amount of a bank’s core capital expressed as a percentage of its risk-weighted asset.

- It is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process.

- The Basel III norms stipulated a capital to risk weighted assets of 8%.

- However, as per RBI norms, Indian scheduled commercial banks are required to maintain a CRAR of 9%.

What is Deposit Insurance? How is it Regulated in India?

- Deposit insurance is providing insurance protection to the depositor’s money by receiving a premium.

- The government has set up Deposit Insurance and Credit Guarantee Corporation (DICGC) under RBI to protect depositors if a Bank Fails.

- DICGC charges 10 paise per ₹100 of deposits held by a bank. The premium paid by the insured banks to the Corporation is paid by the banks and is not to be passed on to depositors.

- DICGC last revised the deposit insurance cover to ₹5 lakh in Feb, 2020, raising it from ₹1 lakh since 1993.

What is the Procedure for Depositors to Claim the Money from a Failed Bank?

- The DICGC does not deal directly with depositors.

- The RBI (or the Registrar), on directing that a bank be liquidated, appoints an official liquidator to oversee the winding up process.

- Under the DICGC Act, the liquidator is supposed to hand over a list of all the insured depositors (with their dues) to the DICGC within three months of taking charge.

- The DICGC is supposed to pay these dues within two months of receiving this list.

Who are Insured by the DICGC?

- The corporation covers all commercial and co-operative banks, except in Meghalaya, Chandigarh, Lakshadweep and Dadra and Nagar Haveli.

- Besides, only primary cooperative societies are not insured by the DICGC.

Which type of depositors is not included under the DICGC?

- Deposits of Foreign Governments.

- Deposits of Central/State Governments.

- Inter-bank Deposits.

- Deposits of the State Land Development Banks with the state Co-operative Bank.

- Any amount due on account of Any Deposit received outside India.

- Any amount specifically Exempted by the DICGC with Previous Approval of RBI.

FOREIGN EXCHANGE RESERVES

04, May 2020

Why in News?

- Recently, India’s Foreign Exchange (Forex) reserves declined by $113 million to $479.45 billion in the week to 24 April, 2020 due to a Fall in Foreign Currency Assets.

Highlights:

- The foreign currency assets (FCAs) decreased by $321 million to $441.56 billion. The Gold reserves rose by $221 million to $32.901 billion.

- The country’s reserve position with the IMF also was down by $8 million to $3.57 billion. The special drawing rights with the International Monetary Fund (IMF) fell by $6 million to $1.42 billion.

- Earlier, the reserve had touched a life-time high of $487.23 billion in the week ended by 6 March, 2020. During 2019-20, the country’s foreign exchange reserves rose by almost $62 billion.

About Foreign Exchange Reserves:

- It is an asset, which is held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- It needs to be noted that most foreign exchange reserves are held in U.S. dollars. These assets serve many purposes but are most significantly held to ensure that the central bank has backup funds if the national currency rapidly devalues or becomes altogether insolvent.

- India’s Forex Reserve includes Foreign Currency Assets, Gold reserves, Special Drawing Rights and Reserve position with the International Monetary Fund (IMF).

About Reserve Position in the International Monetary Fund:

- A reserve tranche position implies a portion of the required quota of currency each member country must provide to the International Monetary Fund (IMF) that can be utilized for its own purposes.

- It is basically an emergency account that IMF members can access at any time without Agreeing to Conditions or Paying a Service Fee.

About Foreign Currency Assets (FCA):

- These are assets that are valued based on a currency other than the country’s own currency.

- It is the largest component of the forex reserve, which is expressed in dollar terms.

- It includes the effect of appreciation or depreciation of non-US units like the euro, pound and yen held in the foreign exchange reserves.

About Special Drawing Rights (SDR):

- It is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- It is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. SDRs can be exchanged for these currencies.

- Its value is calculated from a weighted basket of major currencies, including the U.S. dollar, the euro, Japanese yen, Chinese yuan, and British pound. The Interest rate on SDRs or (SDRi) is the interest paid to members on their SDR Holdings.

WAYS AND MEANS ADVANCES

20, Apr 2020

Why in News?

- The Reserve Bank of India (RBI) has announced a 60% increase in the Ways and Means Advances (WMA) limit of state governments over and above the level as on March 31.

What is the Significance of this Move?

- It was done with a view to enabling them “to undertake COVID-19 containment and mitigation efforts” and “to better plan their market borrowings”.

- The increased limit comes at a time when government expenditure is expected to rise as it battles the fallout of a spreading Coronavirus.

- The availability of these funds will give government some room to undertake short term expenditure over and above its long term market borrowings.

What are Ways and Means Advances?

- The WMA scheme for the Central Government was introduced on April 1, 1997, after putting an end to the four-decade old system of adhoc (temporary) Treasury Bills to finance the Central Government deficit.

- They are temporary loan facilities provided by RBI to the government to enable it to meet temporary mismatches between revenue and expenditure.

- The government makes an interest payment to the central bank when it borrows money.

- The rate of interest is the same as the repo rate, while the tenure is three months.

- The limits for WMA are mutually decided by the RBI and the Government of India.

- They aren’t a source of finance per se. Section 17(5) of the RBI Act, 1934 authorises the central bank to lend to the Centre and state governments subject to their being repayable “not later than three months from the date of the making of the advance”.

What if the Government needs Extra Money for Extra Time?

- When the WMA limit is crossed the government takes recourse to overdrafts, which are not allowed beyond 10 consecutive working days.

- The interest rate on overdrafts would be 2 percent more than the repo rate.

Types of WMA:

- There are two types of Ways and Means Advances — normal and special.

- Special WMA or Special Drawing Facility is provided against the collateral of the government securities held by the state. After the state has exhausted the limit of SDF, it gets normal WMA. The interest rate for SDF is one percentage point less than the repo rate.

- The number of loans under normal WMA is based on a three-year average of actual revenue and capital expenditure of the state.

What are the existing WMA limits and Overdraft Conditions?

- For the Centre, the WMA limit during the first half of 2020-21 (April-September) has been fixed at Rs 120,000 crore. This is 60% higher than the Rs 75,000 crore limits for the same period of 2019-20. The limit for the second half of the last fiscal (October-March) was Rs 35,000 crore.

- For the states, the aggregate WMA limit was Rs 32,225 crore till March 31, 2020. On April 1, the RBI announced a 30% hike in this limit, which has now been enhanced to 60%, taking it to Rs 51,560 crore. The higher limit will be valid till September 30.

- The central bank, on April 7, also extended the period for which a state can be in overdraft from 14 to 21 consecutive working days, and from 36 to 50 working days during a quarter.

NBFC’S GETS 50,000 CRORE BOOSTER

18, Apr 2020

Why in News?

- The Reserve Bank of India (RBI) has announced a host of measures to provide liquidity support to non-banking financial companies (NBFCs), apart from giving them certain benefits for loans extended to the commercial Real Estate Sector.

What Measures did RBI took?

- Banks have to invest the funds availed under targeted long-term repo operation (TLTRO), in investment grade bonds, commercial paper, and non-convertible debentures of NBFCs. Small and mid-sized NBFCs and micro-finance institutions (MFIs) should receive at least 50% of these funds.

- Banks can avail Rs. 50,000 crore through the targeted long-term repo operation. The first auction of TLTRO for Rs. 25,000 crore will be conducted on April 23.

- The RBI has also decided to provide special refinance facility of Rs. 50,000 crore to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs.

- The regulator has also allowed non-banking institutions to extend the date for commencement for commercial operations (DCCO) by an additional one year, without treating the same as restructuring, if the project is delayed due to reasons beyond the control of the promoter.

What are the NBFC’s?

- A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature.

- NBFC does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property.

- A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company).

How they are Differed from other Commercial Banks?

- NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:

- 1.NBFC cannot Accept Demand Deposits;

- 2.NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

- 3.Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of Banks.

HELICOPTER MONEY

15, Apr 2020

Why in News?

Telangana Chief Minister K. Chandrashekar Rao has suggested RBI to adopt the concept of Helicopter Money to help state governments tide over the current crisis and kick-start economic activity in India.

What is Helicopter Money?

- This is an unconventional monetary policy tool aimed at bringing a flagging economy back on track.

- It involves printing large sums of money and distributing it to the public. American economist Milton Friedman coined this term.

Why it is Called So?

- It basically denotes a helicopter dropping money from the sky. Friedman used the term to signify “unexpectedly dumping money onto a struggling economy with the intention to shock it out of a deep slump.”

- Under such a policy, a central bank “directly increase the money supply and, via the government, distribute the new cash to the population with the aim of boosting demand and inflation.”

Why is Helicopter Money Needed Now?

- With the coronavirus-hit economy falling deeper and deeper into a chasm with each passing day, Telangana chief minister KC Rao has said helicopter money can help states comes out of this crisis.

- He asked for the release of 5% funds from GDP by way of quantitative easing (QE).

Is Helicopter Money the Same as Quantitative Easing?

- Quantitative easing also involves the use of printed money by central banks to buy government bonds. But not everyone views the money used in QE as helicopter money.

- It sure means printing money to monetise government deficits, but the government has to pay back for the assets that the central bank buys. It’s not the same as bond-buying by central banks “in which bank-owned assets are swapped for new central bank reserves.”

How will Helicopter Money Help Indian Economy?

- Simply put, Helicopter Money means extension of non-repayable money transfer from the central bank to the state and central governments, to infuse liquidity in the system.

- The policy aims at putting more money into the pockets of people to nudge them to spend more money and in turn pick-up economic activity in the country.

- The direct impact of Helicopter Money is rise in disposable incomes of the people, increase in money supply with an intention to boost demand and inflation in the economy.

CORONA BONDS

08, Apr 2020

Context:

- Corona bonds is recently seen in news, which could be a possible resolution to alleviate Eurozone financial struggles amid the coronavirus crisis.

About Corona Bonds:

- It would be a collective debt amongst EU member states, with the aim of providing financial relief to Eurozone countries battered by the coronavirus.

- It would also be mutualised and supplied by the European Investment Bank, with the debt taken collectively by all member states of the European Union.

- The idea of corona bonds has received reinforcement from nine EU countries, all keen to reach a financial solution as soon as possible. Not all countries in the European Union (EU) are in favour of this idea.

- The resistance has come most notably from the ‘Frugal Four’. The Frugal Four consists of Germany, The Netherlands, Finland, Austria

- These countries are of the opinion that finance is an individual nation’s responsibility. They believe that each EU member state should keep their finances in order.

Significance:

- It would allow European countries to gain essential financial support.

- Their States could receive economic aid without expanding their national debt.

- If all the EU member states support this idea, then this would likely strengthen confidence amongst Europe.

Way Forward:

- Its disadvantage is that it would not necessarily enhance debt sustainability.

- Its concept would only aid future debt forgiveness, distinguishing between coronavirus related debt and legacy debt.

- The implementation of a common bond amongst EU member states could also potentially take a lot of time. The delay is not ideal for countries who require access to funds immediately.

RBI PLANS FOR AN FRAUD OVERSIGHT WING

06, Apr 2020

Why in News?

- The Reserve Bank of India (RBI) is in the process of putting together an exclusive wing for banking fraud oversight.

About “Fraud Oversight Wing”:

- This wing will have teams for meta-data processing and analysis, artificial intelligence analysis units, as well as proactive risk assessment cells.

- The banking fraud oversight wing may comprise up to 600 officers along with experts from the private sector. The RBI plans to hire industry veterans to lead the teams.

- Experts from the private sector working in all these domains will be brought in to train the new members in the fraud oversight wing. These training sessions will be repeated every year in the initial years.

- These new teams will also be given training in the latest technologies, so that they can also prevent another Yes Bank kind of event.

Need of such an Institution:

- The RBI had been mulling ways to proactively detect such frauds after various Bank loan fiascos.

- 1.Punjab National Bank Fraud. The bank fraud was of the tune of Rs 11,450 crore involving diamond merchant Nirav Modi.

- 2.Yes Bank Case: Even though there were representatives of RBI on the Yes Bank board, it was found to be difficult for them to flag the risk, as they had never done a credit risk assessment task in their career so far.

Earlier Attempts of RBI:

- The banking regulator in 2019 had moved to create a separate cadre of its own employees who would work in regulation and oversight sections.

- However, the working conditions were very strict and anyone opting for that cadre would not be allowed to leave for three years. To overcome this problem, the RBI sought to create a fraud oversight wing.

RBI CUTS RATES, ALLOWS LOAN MORATORIUM

28, Mar 2020

Why in News?

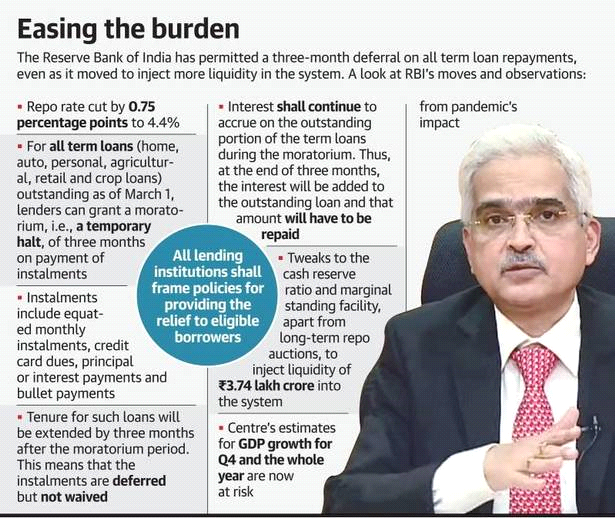

- To ease impact of lockdown, RBI reduced the repo and reverse repo rates and the EMIs deferred for three months.

About the News:

- The Reserve Bank of India (RBI) has opened up the liquidity floodgates for banks even as it reduced the key interest rate sharply by 75 bps and allowed equated monthly instalments (EMIs) to be deferred by three months in a move to fight the economic impact of the countrywide lockdown to check the spread of novel coronavirus.

- The repo rate was reduced to by 75 bps 4.4% while the reverse repo rate was cut by 90 bps point to 4%.

- The higher reduction in the reverse repo rate was aimed at prompting banks to lend more rather than keeping their excess liquidity with the RBI.

- Apart from cutting the repo rate, RBI has also reduced the cash reserve ratio of banks which released ₹37 lakh crore liquidity. This, along with other measures, will see an infusion of ₹3.74 lakh crore into the banking system.

- RBI has also allowed banks to defer payment of EMIs on home, car, personal loans as well as credit card dues for three months. Since non-payment will not lead to non-performing asset classification by banks, there will be no impact on credit score of the borrowers.

- The following decisions were taken after the meeting of the Monetary Policy Committee headed by the RBI Governor.

What is Monetary Policy Committee?

- Strong recommendations to set monetary policy committee in India had come from Urjit Patel panel report.

- Monetary Policy Committee is an executive body of 6 members. Of these, three members are from RBI while three other members are nominated by the Central Government.

- Each member has one vote. In case of a tie, the RBI governor has casting vote to break the tie. MPC is required to meet for two days before deciding on rates. Further, it is needed to meet at least four times a year and make public its decisions following each meeting.

- The core mandate of MPC is to fix the benchmark policy interest rate {Repo Rate} to contain inflation within the target level.

- In that context, RBI is mandated to furnish necessary information to the MPC to facilitate its decision. Government also, if wishes to convey its views, can do so in writing to MPC.

Different Terminologies in Banking Sector:

- Loan moratorium period refers to a particular period of a loan tenure during which the borrower does not have repay anything. It can be described as a waiting period before the borrower will have to start paying the equated monthly instalments (EMIs) for his or her loan. It doesn’t mean that he is completely waived off his loans.

- REPO rate (now 4.4%) denotes Re Purchase Option – the rate by which RBI gives loans to other banks. In other words, it is the rate at which banks buy back the securities they keep with the RBI at a later period.

- Bank gives loan to the public at a higher rate, often 1% higher than REPO rate, at a rate known as Bank Rate.

- RBI at times borrows from banks at a rate lower than REPO rate, and that rate is known as Reverse REPO rate (now 4%).

- CRR or Cash Reserve Ratio corresponds to the percentage of cash each bank have to keep as cash reserve with RBI (in their current accounts) corresponding to the deposits they have. For example, say if State Bank of India (SBI) got a total deposit of Rs. 1 crore with them, they need to keep 4 % of that as cash reserve with RBI (around 4 lakh rupees).

- The banks and other financial institutions in India have to keep a fraction of their total net time and demand liabilities in the form of liquid assets such as G-secs, precious metals, approved securities etc. The Ratio of these liquid assets to the total demand and time liabilities is called Statutory Liquidity Ratio(18.25%).

RBI REGULATION FOR PAYMENT AGGREGATORS AND PAYMENT GATEWAYS

27, Mar 2020

Why in News?

- The Reserve Bank of India recently released guidelines for regulating payment aggregators and Payment Gateways.

About Payment Aggregators and Payment Gateways:

- Payment Aggregators facilitate e-commerce sites and merchants in accepting payment instruments from the customers for completion of their payment obligations without the need for merchants to create a separate payment integration system of their own. Example: Billdesk.

- Payment Gateways are entities that provide technology infrastructure to route and facilitate processing of an online payment transaction without any involvement in handling of funds. PGs in India mainly include banks.

- A Payment Gateway allows the merchants to deal in a specific payment option put on the portal, whereas a Payment Aggregator allows one to have multitudes of options for payment. Thus, a Payment Aggregator covers a payment gateway in its ambit.

What are the various Guidelines?

Authorisation

- Non-bank PAs will require authorisation from the RBI under the Payment and Settlement Systems Act, 2007 (PSSA). A PA should be a company incorporated in India under the Companies Act, 1956 / 2013.

- Banks provide PA services as part of their normal banking relationship and do not therefore require a separate authorisation from RBI.

- E-commerce marketplaces (e.g. flipkart, Paytm) providing PA services should separate PA services from the marketplace business and they should apply for authorisation on or before 30th June, 2021.

- PGs will be considered as ‘Technology Providers’ or ‘Outsourcing Partners’ of banks or non-banks, as the case may be.

Capital Requirement:

- Existing PAs have to achieve a net worth of ₹15 crore by 31st March, 2021 and a net worth of ₹25 crore on or before 31st March, 2023. The net worth of ₹25 crore has to be maintained at all times thereafter.

- New PAs should have a minimum net worth of ₹15 crore at the time of application for authorisation and have to attain a net worth of ₹25 crore by the end of the third financial year of the grant of authorisation. The net worth of ₹25 crore has to be maintained at all times thereafter.

Disclosure Requirements:

- PAs need to disclose comprehensive information regarding merchant policies, customer grievances, privacy policy and other terms and conditions on the website and / or their mobile application.

- They need to undertake background and antecedent checks of the merchants to ensure that such merchants do not have any malafide intention of duping customers, and do not sell fake / counterfeit / prohibited products.

RBI TO INFUSE RS. 10,000 CRORE VIA OMO

19, Mar 2020

Why in News?

- The Reserve Bank of India (RBI) has decided to infuse ₹10,000 crore liquidity in the banking system by buying government securities through open market operations (OMO).

What is Open Market Operations?

- Open Market Operations (OMO) is one of the quantitative (to regulate or control the total volume of money) monetary policy tools which is employed by the central bank of a country to control the money supply in the economy.

- OMOs are conducted by the RBI by way of sale or purchase of government securities (g-secs) to adjust money supply conditions.

- The central bank sells g-secs to remove liquidity from the system and buys back g-secs to infuse liquidity into the system.

- These operations are often conducted on a day-to-day basis in a manner that balances inflation while helping banks continue to lend.

- RBI carries out the OMO through commercial banks and does not directly deal with the public.

- The RBI uses OMO along with other monetary policy tools such as repo rate, cash reserve ratio and statutory liquidity ratio to adjust the quantum and price of money in the system.

How it would be done?

- RBI will conduct simultaneous purchase and sale of government securities under Open Market Operations (OMO) for ₹10,000 crore each.

- It will purchase the longer-term maturities (i.e. government bonds maturing in 2029), and simultaneously sell the shorter duration ones (i.e. short-term bonds maturing in 2020).

- The eligible participants can bid or submit offers in electronic format on RBI’s Core Banking Solution (E-Kuber).

Why such a Decision Taken now?

- With the heightening of COVID-19 pandemic risks, certain financial market segments have been experiencing a tightening of financial conditions as reflected in the hardening of yields and widening of spreads.

- To ensure that all market segments remain liquid and stable, and function normally, the Reserve Bank of India (RBI) has decided to infuse ₹10,000 crore liquidity in the banking system by buying government securities through open market operations.

What are its Benefits?

- This simultaneous purchase and sale will bring down interest on long term loans which can lead to increase in economic spending.

- OMOs are primarily done to maintain ample liquidity in the system, which reflects that the RBI is keen that banks should transmit lower rates to borrowers.

- The action of Operation Twist by the RBI is encouraging for the market. This step may become a driving factor for long-term economic activity and the addition of new investment stock.

- 1.‘Operation Twist’ is when the central bank uses the proceeds from the sale of short-term securities to buy long-term government debt papers, leading to easing of interest rates on the long term papers.

- 2.Operation Twist first appeared in 1961 as a way to strengthen the U.S. dollar and stimulate cash flow into the economy.

- 3.In June 2012, Operation Twist was so effective that the yield on the 10-year U.S. Treasury dropped to a 200-year low.

RBI GUIDELINES TO REGULATE PAYMENT AGGREGATORS AND GATEWAYS

18, Mar 2020

Why in News?

- The Reserve Bank of India has recently released guidelines for regulating activities of Payment Aggregators and Payment Gateways functioning in India.

What is meant by Payment Aggregators and Payment Gateways?

- Payment Aggregators (PA) facilitates e-commerce sites and merchants in accepting payment instruments from the customers for completion of their payment obligations without the need for merchants to create a separate payment integration system of their own.

- Payment Gateways (PG) are entities that provide technology infrastructure to route and facilitate processing of an online payment transaction without any involvement in handling of funds. PGs in India mainly include banks.

Difference between PA and PG:

- A Payment Gateway allows the merchants to deal in a specific payment option put on the portal, whereas a Payment Aggregator allows one to have multitudes of options for payment. Thus, a Payment Aggregator covers a payment gateway in its ambit.

Key Guidelines given by RBI:

1. Mandatory Authorisation:

- A PA should be a company incorporated in India under the Companies Act, 1956 / 2013.

- Non-bank PAs will require authorisation from the RBI under the Payment and Settlement Systems Act, 2007 (PSSA).

- Banks provide PA services as part of their normal banking relationship and do not therefore require a separate authorisation from RBI.

- E-commerce marketplaces (e.g. flipkart, Paytm) providing PA services should separate PA services from the marketplace business and they should apply for authorisation on or before 30th June, 2021.

- PGs will be considered as ‘technology providers’ or ‘outsourcing partners’ of banks or non-banks, as the case may be.

2. Disclosure Requirements:

- As need to disclose comprehensive information regarding merchant policies, customer grievances, privacy policy and other terms and conditions on the website and / or their mobile application.

- They need to undertake background and antecedent checks of the merchants to ensure that such merchants do not have any malafide intention of duping customers, and do not sell fake / counterfeit / prohibited products.

3. Capital Requirement:

- Existing PAs have to achieve a net worth of ₹15 crore by 31st March, 2021 and a net worth of ₹25 crore on or before 31st March, 2023. The net worth of ₹25 crore has to be maintained at all times thereafter.

- New PAs should have a minimum net worth of ₹15 crore at the time of application for authorisation and have to attain a net worth of ₹25 crore by the end of the third financial year of the grant of authorisation. The net worth of ₹25 crore has to be maintained at all times thereafter.

YES BANK CRISIS

07, Mar 2020

Context:

- Recently, the Reserve Bank of India (RBI) on March 5 imposed a moratorium on the private sector lender Yes Bank, limiting withdrawal of deposits to Rs 50,000. The RBI has also superseded the institution’s board of directors and had imposed a 30-day moratorium.RBI has appointed Prashant Kumar, former CFO of State Bank of India as its administrator.

What’s a Moratorium?

- It means the bank’s normal operations including lending and deposit mobilization are restricted.

- Under Section 45 of the Banking Regulation Act 1949, the one-month moratorium imposed on Yes Bank came into effect from March 5 and will be on till April, 6.

- During this period, deposit withdrawals are capped, while the bank cannot give fresh loans or renew existing loans besides others

Why did Yes Bank Collapse?

- Deteriorating Financial Position

- The bank was making losses and inadequate profits for consecutive quarters

- The bank was unable to raise capital to address potential loan losses and resultant downgrades

- In FY’19 alone, it reported a divergence of Rs 3,277 crore in bad loans and Rs 978 crore in NPA provisions.

- Governance Issues:

- The bank has also experienced serious governance issues and practices.

- In 2018, the RBI refused to give Yes Bank’s boss Rana Kapoor an extension as chief executive and managing director due to his highly irregular credit management practices.

- Failure in Raising Capital

- There was no concrete proposal from investors to put the kind of money that the bank required to survive and grow.

- In August 2019, it raised Rs 1,930.46 crore through qualified institutional placement (QIP), but this only scratched the surface of what it needed.

- Outflow of Liquidity

- The bank was facing regular outflow of liquidity due to withdrawal of deposits from customers.

- Although the government has limited withdrawals from Yes bank accounts to a maximum of Rs 50,000 per month, the deposits with Yes Bank are insured for up to Rs 5 lakh by the DICGC.

- Budget 2020 proposed to increase insurance coverage of deposits with scheduled banks from Rs 1 lakh to Rs 5 lakh by Deposit Insurance and Credit Guarantee Corporation (DICGC).

- DICGC came into existence in 1978 after the merger of Deposit Insurance Corporation (DIC) and Credit Guarantee Corporation of India Ltd. (CGCI) after passing of the Deposit Insurance and Credit Guarantee Corporation Act, 1961 by the Parliament.

- It serves as a deposit insurance and credit guarantee for banks in India.

- It is a fully owned subsidiary of and is governed by the Reserve Bank of India.

- What DICGC does?

- DICGC charges 10 paise per ₹ 100 of deposits held by a bank. The premium paid by the insured banks to the Corporation is paid by the banks and is not to be passed on to depositors.

- DICGC last revised the deposit insurance cover to ₹ 1 lakh on May 1, 1993, raising it from ₹ 30,000 since 1980. The protection cover of deposits in Indian banks through insurance is among the lowest in the world.

- The Damodaran Committee on ‘Customer Services in Banks’ (2011) had recommended a five-time increase in the cap to ₹5 lakh due to rising income levels and increasing size of individual bank deposits.

- Budget 2020 proposed to increase insurance coverage of deposits with scheduled banks from Rs 1 lakh to Rs 5 lakh.

- What kind of deposits are covered

- DICGC covers all deposits such as savings, fixed, current, recurring and so on except for the following deposits:

The safety of the Depositors:

Deposit Insurance and Credit Guarantee Corporation (DICGC):

1.Deposits of foreign governments;

2.Deposits of Central/State Governments;

3.Inter-bank deposits;

4.Deposits of the State Land Development Banks with the State co-operative bank;

5.Any amount due on account of and deposit received outside India

6.Any amount, which has been specifically exempted by the corporation with the previous approval of Reserve Bank of India

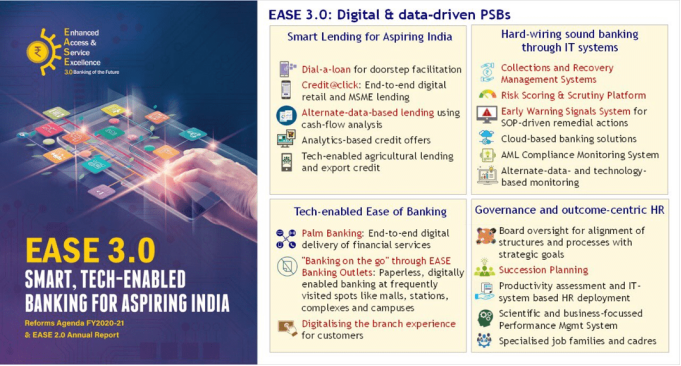

EASE 3.0 FOR TECH-ENABLED BANKING

28, Feb 2020

Why in News?

- Finance Minister Nirmala Sitharaman has recently launched Ease 3.0 for tech-enabled to change the customer’s experience at the Public Sector Banks (PSBs).

About:

- Ease (Enhanced Access and Service Excellence) 3.0 reform agenda aims at providing smart, tech-enabled public sector banking for aspiring India.

- New features that customers of public sector banks may experience under EASE 3.0 reforms agenda include facilities like:

- Palm Banking for “End-to-end digital delivery of financial service”.

- “Banking on Go” via EASE banking outlets at frequently visited spots like malls, stations, complexes, and campuses.

- PSB Reforms EASE Agenda is a common reform agenda for PSBs aimed at institutionalizing clean and smart banking.

- It was launched in January 2018, and the subsequent edition of the program ― EASE 2.0 built on the foundation laid in EASE 1.0 and furthered the progress on reforms.

- In EASE 2.0, the government had proposed pushing liquidity in the public sector banks, reconstituting the management committee and possible mergers among the ideal partners in the Indian banking sector.

Why EASE 3.0 was Launched?

- The Ministry has the idea of establishing paperless and digitally-enabled banking at places where people visit the most.

- The government aims to focus on digitalization in the Public Sector Banks (PSBs) among themes that include responsible banking, PSBs as Udyami Mitra, customer responsiveness, credit take-off, and deep financial inclusions.

INSURANCE COVER ON BANK’S DEPOSIT

03, Feb 2020

Why in News?

- Finance Minister has recently proposed to increase the limit of insurance cover in case of Bank Failure on deposits to ₹5 lakh from ₹1 lakh.

What is Deposit Insurance?

- Deposit insurance is Providing Insurance Protection to the Depositor’s Moneyby receiving a premium.

- The government has set up Deposit Insurance and Credit GuaranteeCorporation (DICGC) under RBI to protect depositors if a bank fails.

- Every insured bank pays premium amounting to 0.001% of its deposits to DICGC every year.

- This scheme insures all types of bank deposits including savings, fixed and recurring with an insured bank.

What happens to Depositors’ Money when a Bank Fails?

- When a bank is liquidated, depositors are entitled to receive an insurance amount of ₹1 lakh per individual from the Deposit Insurance and Credit Guarantee Corporation of India (DICGC).

- The ₹1 lakh insurance limit includes both principal and interest dues across your savings bank accounts, current accounts, fixed deposits and recurring deposits held with the bank.

- Now this 1 lakh amount has been proposed to 5 lakhs recently.

How the Depositors claim the Money from a Failed Bank?

- The DICGC does not deal directly with depositors.

- The RBI (or the Registrar), on directing that a bank be liquidated, appoints an official liquidator to oversee the winding up process.

- Under the DICGC Act, the liquidator is supposed to hand over a list of all the insured depositors (with their dues) to the DICGC within three months of Taking Charge.

- The DICGC is supposed to pay these dues within two months of receiving this list.

- In FY19, it took an average 1,425 days for the DICGC to receive and settle the first claims on a De-Registered Bank.

Who are insured by the DICGC?

- The corporation covers all commercial and co-operative banks, except in Meghalaya, Chandigarh, Lakshadweep and Dadra and Nagar Haveli.

- Besides, only primary cooperative societies are not insured by the DICGC.

- Primary Cooperative Credit Societies are formed at village or town level.

- A primary credit society refers to any cooperative society other than a primary agricultural credit society. It is basically an association of members residing in a particular locality. The members can be borrowers or Non-Borrowers.

What Kind of Depositors is not included in DICGC?

- Deposits of foreign governments. However, foreign banks in India are excluded.

- Deposits of central/State Governments.

- Inter-bank Deposits.

- Deposits of the state land development banks with the state co-operative bank.

- Any amount due on account of any deposit received outside India.

- Any amount specifically exempted by the DICGC with previous approval of RBI.

What are the Benefits of this Move?

- Guaranteed Returns:Investors can rest assured that his investments are safe and he will be getting back a guaranteed amount at the end of the tenure.

- Encourages Saving Habit:This encourages the saving habit of an individual. He will not be tempted to spend the money and find a way to manage his finances more efficiently.

- Increases Bank Accounts:It also increases the banking habits of the people.

INSOLVENCY AND BANKRUPTCY BOARD OF INDIA (LIQUIDATION PROCESS) (AMENDMENT) REGULATIONS, 2020

09, Jan 2020

Why in News?

- The Insolvency and Bankruptcy Board of India (IBBI) amended the Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016.

Amendments:

- The amendment clarifies that a person, who is not eligible under the Insolvency & Bankruptcy Code (IBC) to submit a resolution plan for insolvency resolution of the corporate debtor, shall not be a party in any manner to a compromise or arrangement of the corporate debtor under section 230 of the Companies Act, 2013.

- It also clarifies that a secured creditor cannot sell or transfer an asset, which is subject to security interest, to any person, who is not eligible under the Code to submit a resolution plan for insolvency resolution of the corporate debtor.

- The amendment provides that a secured creditor, who proceeds to realise its security interest, shall contribute its share of the insolvency resolution process cost, liquidation process cost and workmen’s dues, within 90 days of the liquidation commencement date.

- It shall also pay excess of realised value of the asset, which is subject to security interest, over the amount of its claims admitted, within 180 days of the liquidation commencement date.

- Where the secured creditor fails to pay such amounts to the Liquidator within 90 days or 180 days, as the case may be, the asset shall become part of Liquidation Estate.

- The amendment provides that a Liquidator shall deposit the amount of unclaimed dividends, if any, and undistributed proceeds, if any, in a liquidation process along with any income earned thereon into the Corporate Liquidation Account before he submits an application for dissolution of the corporate debtor.

- It also provides a process for a stakeholder to seek withdrawal from the Corporate Liquidation Account.

Insolvency and Bankruptcy Board of India (IBBI):

- The IBBI was formed in 2016 under the IBC.

- It is the regulator responsible for overseeing the insolvency proceedings.

- It is responsible for the implementation of the IBC that consolidates and amends the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals.

- It has regulatory oversight over:

- Insolvency Professionals

- Insolvency Professional Agencies

- Insolvency Professional Entities

- Information Utilities

- It frames and enforces rules for:

- Corporate Insolvency Resolution

- Corporate Liquidation

- Individual Insolvency Resolution

- Individual Bankruptcy

FINANCE MINISTER LAUNCHES EBKRAY FOR ONLINE AUCTION OF ASSETS ATTACHED BY BANKS

30, Dec 2019

Why in News?

- Finance Minister Nirmala Sitharaman discussed banking issues with chiefs of Public Sector Banks (PSBs), chief executive of Indian Banks’ Association and representatives of leading private sector banks.

eBkray:

- It is a common e-auction platform launched today by the Finance Minister.

- It has been launched to enable online auction of attached assets transparently and cleanly for improved realisation of value.

- The platform is equipped with property search features and navigational links to all PSB e-auction sites.

- It provides single-window access to information on properties up for e-auction as well as facility for comparison of similar properties.

- It contains photographs and videos of uploaded properties.

Steps for enhancing Digital Transactions:

- In order to strengthen the digital payment eco-system and move towards less-cash economy, the Finance Minister in her budget speech of 2019-20 had, inter alia, announced that business establishments with annual turnover of more than Rs. 50 crore shall offer low cost digital modes of payment (such as BHIM UPI, UPI QR Code, Aadhaar Pay, Debit Cards, NEFT, RTGS, etc.) to their customers, and no charge or merchant discount rates (MDR) shall be imposed on customers as well as merchants.

- To facilitate Implementation of the announcement, it was decided as under:

- Department of Revenue (DoR) will notify RuPay and Unified Payments Interface (UPI) as the prescribed mode of payment for undertaking digital transactions without any MDR.

- All companies with a turnover of Rs. 50 crore or more shall be mandated by DoR to provide the facility of payment through RuPay Debit card and UPI QR code to their customers.

- All banks will start a campaign to popularise RuPay Debit card and UPI.

“TREND AND PROGRESS OF BANKING IN INDIA 2018-19”

27, Dec 2019

Why in News?

- The RBI has recently released “Trend and Progress of Banking in India 2018-19“. This Report presents the performance of the banking sector during 2018-19 and 2019-20 so far.

- Before dwelling into the report, let us have a brief look into the key terminologies used in the report for better understanding.

Basic Terminologies:

1.Non-Performing assets (NPA):

- The assets of the banks which don’t perform (that is – don’t bring any return) are called Non Performing Assets (NPA) or bad loans.

- According to RBI, terms loans on which interest or instalment of principal remain overdue for a period of more than 90 days from the end of a particular quarter is called a Non-performing Asset.

Depending upon the due period, the NPAs are categorized as under:

- Sub-Standard Assets: > 90 days and less than 1 year

- Doubtful Assets: greater than 1 year

- Lost Assets: loss has been identified by the bank or RBI but the amount has not been written off wholly.

2.Gross and Net NPA: Gross NPA refers to the total NPAs of the banks. The Net NPA is calculated as Gross NPA -Provisioning Amount.

3.Provisioning Coverage Ratio (PCR):

- Under the RBI’s provisioning norms, the banks are required to set aside certain percentage of their profits in order to cover risk arising from NPAs.

- It is referred to as “Provisioning Coverage ratio” (PCR). It is defined in terms of percentage of loan amount and depends upon the asset quality. As the asset quality deteriorates, the PCR increases.

The PCR for different categories of assets is as shown below:

- Standard Assets (No Default) : 0.40%

- Sub-standard Assets ( > 90 days and less than 1 year) : 15%

- Doubtful Assets (greater than 1 year): 25%-40%

- Loss Assets (Identified by Bank or RBI) : 100%

4.Special Mention Accounts (SMA):

- Special Mention Account (SMA) Category has been introduced by the RBI in order to identify the incipient stress in the assets of the banks and NBFCs.

- These are the accounts that have not-yet turned NPAs (default on the loan for more than 90 days), but rather these accounts can potentially become NPAs in future if no suitable action is action.

- The SMA has the various sub-categories as shown below:

- SMA-0: Principal or interest payment not overdue for more than 30 days but account showing signs of incipient stress

- SMA-1: Principal or interest payment overdue between 31-60 days

- SMA-2: Principal or interest payment overdue between 61-90 days

- If the Principal or interest payment is overdue for more than 90 days, then the loan is categorized as NPA.

5. Leverage Ratio (LR):

- The Basel Committee on Banking Supervision (BCBS) introduced Leverage ratio (LR) in the 2010 Basel III package of reforms. The Formula for the Leverage Ratio is (Tier 1 Capital/ Total Consolidated Assets) ×100 where Tier 1 capital represents a bank’s equity.

- It is to be noted that the Tier 1 capital adequacy ratio (CAR) is the ratio of a bank’s core tier 1 capital to its total risk-weighted assets. On the other hand, leverage ratio is a measure of the bank’s core capital to its total assets.

- Thus, the Leverage ratio uses tier 1 capital to judge how leveraged a bank is in relation to its consolidated assets whereas the tier 1 capital adequacy ratio measures the bank’s core capital against its risk-weighted assets.

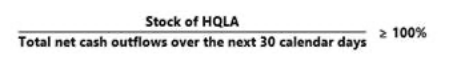

6.Liquidity Coverage Ratio (LCR):

- A failure to adequately monitor and control liquidity risk led to the Great Financial Crisis in 2008. To improve the banks’ short-term resilience to liquidity shocks, the Basel Committee on Banking Supervision (BCBS) introduced the LCR as part of the Basel III post-crisis reforms.

- The LCR is designed to ensure that banks hold a sufficient reserve of high-quality liquid assets (HQLA) to allow them to survive a period of significant liquidity stress lasting 30 calendar days.

- HQLA are cash or assets that can be converted into cash quickly through sales (or by being pledged as collateral) with no significant loss of value.

- Total net cash outflows are defined as the total expected cash outflows minus the total expected cash inflows arising in the stress scenario.

Now we can dive into the Key Highlights of the Report.

Health of the Banking Sector: Important Highlights:

1.Decline in Gross and Net NPA:

- For the first time in the last 7 years, the Gross NPAs of the Scheduled Banks has declined to 9.1% by the end of September 2019. Similarly, the net NPAs has declined to 3.7% in September 2019. The decrease in the Gross NPAs and Net NPAs can be attributed to success of the Insolvency and Bankruptcy Code (IBC).

2.Concentration of NPAs:

- Most of the NPAs are concentrated in the larger borrower accounts (exposure of Rs 5 crore or more) which account for almost 82% of the GNPAs. The report has highlighted that there has been increase in stress of these accounts and hence it may be difficult to reduce NPAs in future.

3.Decline in Special Mention Accounts (SMA): In 2018-19, scheduled Banks recorded decline in all the special mention accounts (SMA-0, SMA-1 and SMA2) which points to the broad-based improvement in asset quality. However, in the first half of 2019-20, there has been increase in the number of SMA accounts.

4.Provisioning Coverage Ratio (PCR): The provision coverage ratio (PCR) of all Scheduled Banks improved to 61 per cent by end of September 2019.

5.Leverage Ratio (LR): The leverage ratio of Scheduled Banks was at 6.6 per cent, above the prescription of 3 per cent by the Basel Committee on Banking Supervision (BCBS).

6.Banking Frauds: The Public sector Banks (PSBs) accounted for the bulk of the banking frauds reported in 2018-19 accounting for almost 55% of the total cases pending.

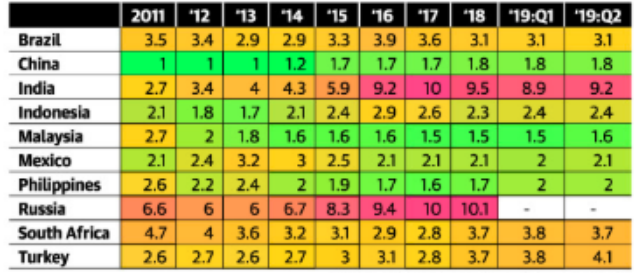

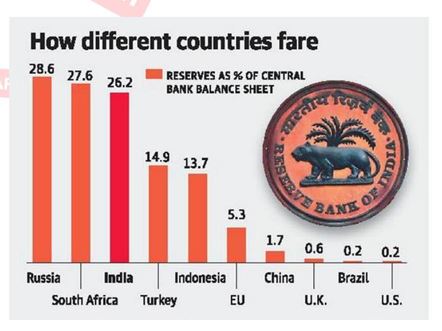

- The following table shows India’s position in the list of countries with emerging economies.

- The table shows India holding 3rdposition among the highest NPA holding economies.

OPERATION TWIST

21, Dec 2019

Why in News?

- Recently, RBI has planned to conduct “Operation Twist”.

About Operation Twist:

- Operation Twist is actually a move that is used by U.S Federal Reserve in past.

- The central bank uses the proceeds from the sale of short-term bonds to buy long term government bonds, leading to easing of interest rates on the long-term bonds.

- It involves simultaneous purchase and sale of government securities under Open Market Operations (OMO) for 10,000 crore each.

- It will purchase the longer (government bonds maturing in 2029), and simultaneously sell the shorter duration ones (short-term bonds maturing in 2020).

- It will be done through electronic platform.

About Open Market Operations:

- Open Market is known as unrestricted, free access market.

- It aims to regulate the money supply in the economy.

- It is used to adjust the liquidity conditions in the market.

- It is the sale and purchase of government securities and T-bills by RBI.

- During increase in liquidity condition then RBI sells G-secs to Open Market.

- During decrease in liquidity condition then RBI buys G-secs from Open Market.

Repurchase or buyback of G-secs:

- It is known as buying back the existing securities that are sold in Open Market.

- Sometimes RBI Prematurely buys G-secs.

- The Reasons are to:

- Reduce the cost of particular G-secs (High coupon G-secs),

- Reduce the number of outstanding G-secs and improve liquidity,

- Infuse liquidity in the system

Government Securities (G-Secs):

- It is a Tradeable Instrument that is issued by the central Government/ state governments.

- It is also called as risk-free gilt-edged instruments. It has two types, short term bonds and long-term bonds.

- Short term bondsare also known as Treasury Bill. Its maturity period is less than 1 year.

- Long Term Bondsare also known as Government Bonds or Dated Securities.

- Central Government issues both Government bonds and Dated Securities.

- In case of State Government either Government bonds or Dated Securities through RBI. It is called as State Development Loan. Its maturity period is greater than or equal to 1 year.

- G-sec is issued through auctions conducted by RBI, by an electronic platform called

E-Kuber. It is the Core banking Solution platform of RBI.

- RBI issues Indicative auction calendar, which contains details of calendar. It also contains information regarding amount of borrowing, maturity time period and time of auction.

PARTIAL CREDIT GUARANTEE SCHEME

13, Dec 2019

Why in News?

- The Union Cabinet has recently approved the Partial Credit Guarantee Scheme for the benefit of the banks and NBFCs.

Background Info:

- Over a period of time, the NBFC sector in India has emerged as major source of loans. However, the sector been facing liquidity crunch due to Asset-Liability Mismatch.

- The poor financial condition of the NBFCs has in turn adversely affected the credit creation in the Indian Economy.